Written by: Oliver, Mars Finance

In July in Washington, the heat is rising, but more intense than the weather is the tense atmosphere permeating the political and financial arenas.

"I believe the Federal Reserve must cut interest rates this week."

On the eve of the U.S. Federal Open Market Committee (FOMC) interest rate decision, Donald Trump once again unabashedly pushed his differences with Federal Reserve Chairman Jerome Powell into the global spotlight. This is not the first time he has "fired" at the central bank leader he nominated himself, but this time the wording—"must"—has raised the intensity of his call to an unprecedented level.

This almost commanding posture has turned what should have been a cautious decision based on complex macro data into a showdown of willpower. The nerves of global markets are once again being stirred, leading people to wonder: Will Trump's desired "immediate rate cut" actually happen? If not, what exactly is the resistance standing between this former president's will and current monetary policy?

To answer this question, we cannot merely dwell in the political clamor; we must, like the Federal Reserve officials, step into the decision-making chamber built on cold data and historical lessons.

Visible Resistance: Three Economic "Data Mountains"

The Federal Reserve's decisions, especially adjustments to the "big weapon" of interest rates, are not made whimsically but are strictly anchored to its two core missions: maintaining price stability and promoting maximum employment. Currently, at least three "data mountains" from the macro economy prevent Powell and his colleagues from easily pressing the "rate cut" button, collectively forming a thick "data wall."

The first mountain is the still untamed "inflation tiger." After two years of intense struggle, the Federal Reserve has successfully brought runaway inflation back from decades-high levels through a series of aggressive rate hikes. However, "success" does not equal "victory." The inflation indicator most valued by the Federal Reserve—the core Personal Consumption Expenditures (PCE) price index—still hovers around an annual growth rate of about 2.8%, and the more familiar Consumer Price Index (CPI) is similar. Both figures are significantly above the Federal Reserve's target policy line of 2%.

To use a metaphor, the body's high fever has dropped from 40 degrees to 38 degrees, but it is still far from the healthy temperature of 37 degrees. In this situation, rashly stopping the "rate hikes" or even starting to "nourish" (cut rates) could very likely lead to a resurgence of the high fever. Federal Reserve Governor Michelle Bowman has repeatedly warned that prematurely declaring victory and loosening policy could cause inflation expectations to "de-anchor," and when trying to bring them back on track, society would have to pay a much heavier price. This caution is a painful lesson learned by central banks from the "stagflation" of the 1970s.

The second mountain is a seemingly solid yet cracked "employment wall." On the surface, the U.S. job market remains strong. An unemployment rate below 4% is low by any historical standard, suggesting that the economic engine is running strong and is far from needing a "boost" through rate cuts.

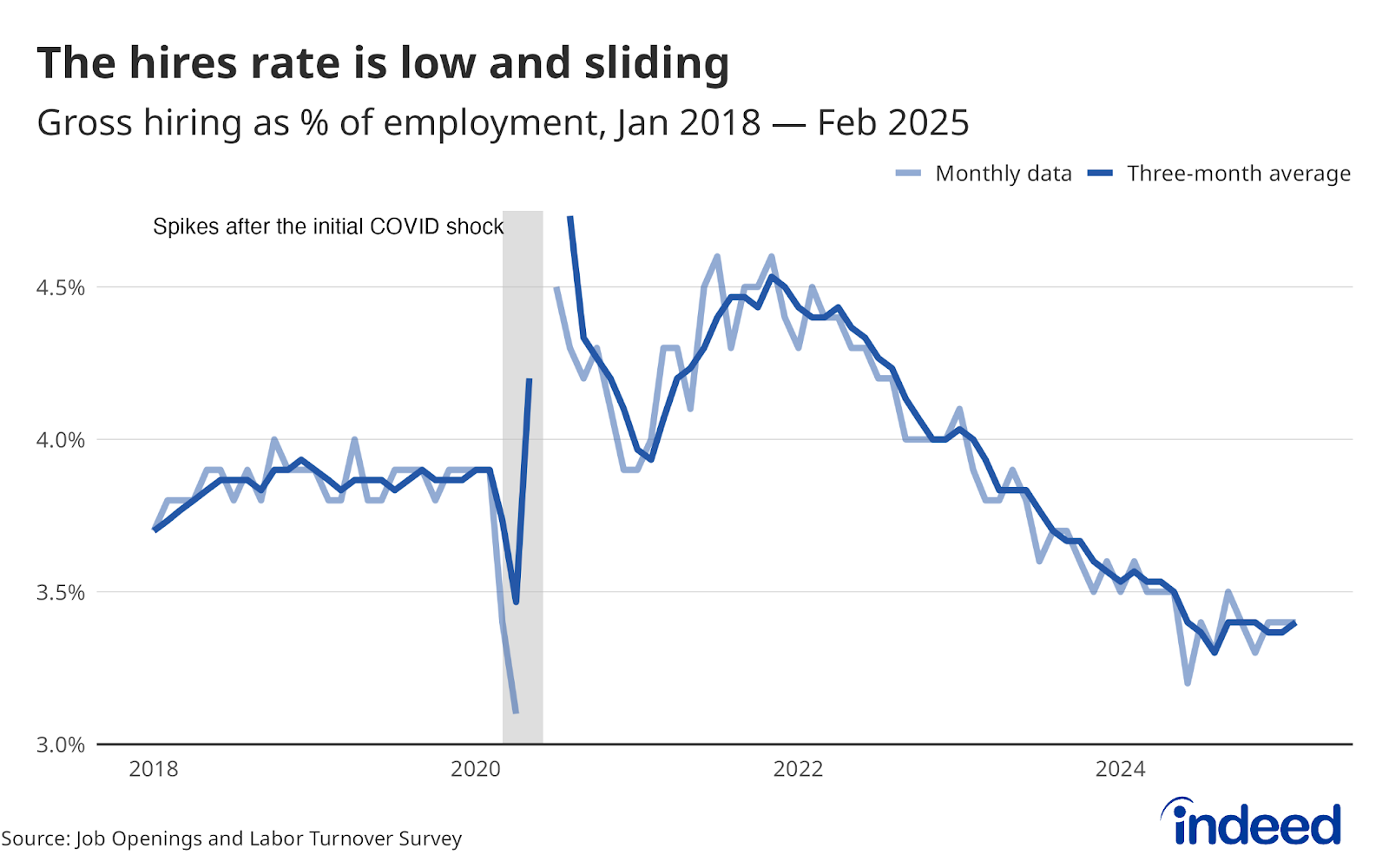

However, a closer inspection of the cracks in the wall reveals some disturbing signs. Recent non-farm payroll reports show that the momentum of new job creation is slowing, increasingly concentrated in government sectors and a few industries, while the private sector's job creation capacity has shown signs of fatigue. At the same time, the ratio of job vacancies to job seekers (JOLTS data) continues to decline. This creates a source of internal disagreement within the Federal Reserve: some officials believe that "preventive" reinforcement should be made before clear gaps appear in the wall, i.e., cutting rates; while others insist that any action is premature until indisputable signs of deterioration are seen. This "seemingly strong, yet actually weakening" contradictory state makes it difficult for the scales of decision-making to tip.

The third mountain is the recently stabilized "economic growth (GDP) ballast." After earlier concerns about a slowdown, the U.S. economy has shown some resilience; recent GDP data, while not stellar, has not plunged into the abyss of recession. As long as the economy is still growing, even at a slow pace, it provides the most direct reason for the Federal Reserve to "hold its ground." Since the ship can still sail smoothly, why rush to change course and risk reigniting inflationary waves?

These three mountains collectively form the decision-making foundation that Powell repeatedly emphasizes—"data dependent." Until the data clearly indicates controlled inflation and a clear risk of economic recession, any decision to cut rates lacks sufficient legitimacy.

Invisible Resistance: The Central Bank's "Independence" Dilemma

If economic data is the visible obstacle, then a deeper, more subtle resistance is rooted in the very soul of the Federal Reserve's institution—its independence.

One of the core cornerstones of the modern central banking system is its independence from the executive branch. This ensures that monetary policy is formulated based on long-term economic welfare rather than serving short-term political election cycles. Trump's public, high-profile, and even threatening pressure touches this most sensitive nerve.

History is a mirror. In the 1970s, then-President Nixon successfully pressured then-Federal Reserve Chairman Arthur Burns to adopt an accommodative monetary policy before the elections. The result was a short-term appearance of economic prosperity, paving the way for Nixon's re-election, but it also sowed the seeds for a decade-long "stagflation" (high inflation, high unemployment, low growth). This disreputable history hangs like the sword of Damocles over every Federal Reserve chairman.

With such a cautionary tale, the Federal Reserve under Powell's leadership will undoubtedly be particularly vigilant against pressure from the political sphere. If it were to yield to Trump's demands at this moment, it would be tantamount to announcing to global markets that the Federal Reserve's decisions can be hijacked by political interests. This would severely damage its credibility as a neutral, professional institution, and in the long run, the harm to the global status of the dollar and the U.S. economy could far exceed the impact of one or two erroneous interest rate decisions. Therefore, to some extent, the louder Trump's calls are, the more likely the Federal Reserve is to choose to "hold its ground" to defend its remaining credibility.

The Rate Cut Game and the Butterfly Effect in the Crypto World

This macro game taking place in Washington is by no means a distant concern for the seemingly remote crypto world. On the contrary, every hint and dispute regarding interest rates triggers a dramatic butterfly effect in the crypto market.

From the most direct logical perspective, a rate cut cycle is typically seen as a positive for crypto assets. It means that more dollars will flow into the market, financing costs will decrease, and investors will be more willing to shift funds from low-yield traditional financial products to high-risk, high-return asset classes, with Bitcoin and Ethereum undoubtedly at the forefront.

However, the deeper impact lies in the unique structure of the crypto world. Stablecoin issuers, such as Tether (USDT) and Circle (USDC), are major buyers of U.S. Treasury bonds. According to statistics, these two companies alone hold over $150 billion in short-term U.S. Treasury bonds. The interest from these bonds is a significant profit source for their business model. Once the Federal Reserve opens the rate cut channel, the yield on these reserve assets will directly decline, squeezing the profit margins of stablecoin issuers. This seemingly minor change could have profound effects on the yield of underlying assets in the entire DeFi world (Real World Asset, RWA) through transmission.

Moreover, a more audacious and disruptive narrative has been proposed by Arthur Hayes, the founder of BitMEX, a thought leader in the crypto world. He believes that the key issue may not be the Federal Reserve itself, but rather the U.S. Treasury's debt issuance. Against the backdrop of the continuously expanding U.S. government debt, regardless of whether the Federal Reserve cuts rates, the Treasury will need to finance its massive deficits, which in itself is a form of liquidity injection.

In this grand narrative, crypto assets, especially Bitcoin, play the role of hedging against the credit risk of fiat currency systems. When the government stimulates the economy through massive debt issuance, it effectively dilutes the purchasing power of fiat currency, while the fixed supply of Bitcoin becomes a "digital gold" for value storage. From this perspective, regardless of whether there is a rate cut this week, as long as the U.S. government's fiscal discipline cannot be restrained, the "flood" flowing into the crypto world will not cease.

Additionally, an undeniable trend is that the political influence of the crypto industry in the U.S. is rapidly rising. Political donations and lobbying activities from industry participants are unprecedentedly active, and there are increasingly friendly voices towards crypto technology within both parties. Pantera Capital's recent report, "Escape Velocity," also points out that the crypto industry is undergoing a profound political shift. This means that future monetary policy and financial regulation will have to consider the influence of this emerging field more.

Conclusion

Returning to the initial question: The rate cut that Trump desires faces numerous obstacles. In front are the three immovable "data walls" of inflation, employment, and GDP, while behind is the "independence" defense line that the Federal Reserve vows to protect. This week, we are likely to see Trump's political outcry collide with Powell's calm and firm professional barrier.

But for the crypto market, this may just be the prologue to a grand drama. The real variable may not be this interest rate decision itself, but rather the future shaped by political intentions, fiscal deficits, technological innovations, and macro cycles that it reveals. Regardless of the outcome of the Washington game, a larger and more unpredictable macro wave seems to be brewing. For every participant in the crypto space, understanding the causes and directions of this wave is far more important than merely guessing the rise and fall of a single interest rate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。