Unstaking does not necessarily mean that there will be a sale.

Written by: Deep Tide TechFlow

Whenever the market is good, FUD is inevitable.

Today, a piece of news has once again raised concerns about the price of ETH:

Validators on the Ethereum network are queuing up to unstake ETH.

As a representative of the PoS consensus mechanism, staking ETH is technically used to maintain the security of the entire Ethereum network, and economically, it can generate additional income from staking, locking the liquidity of ETH in the staking pool.

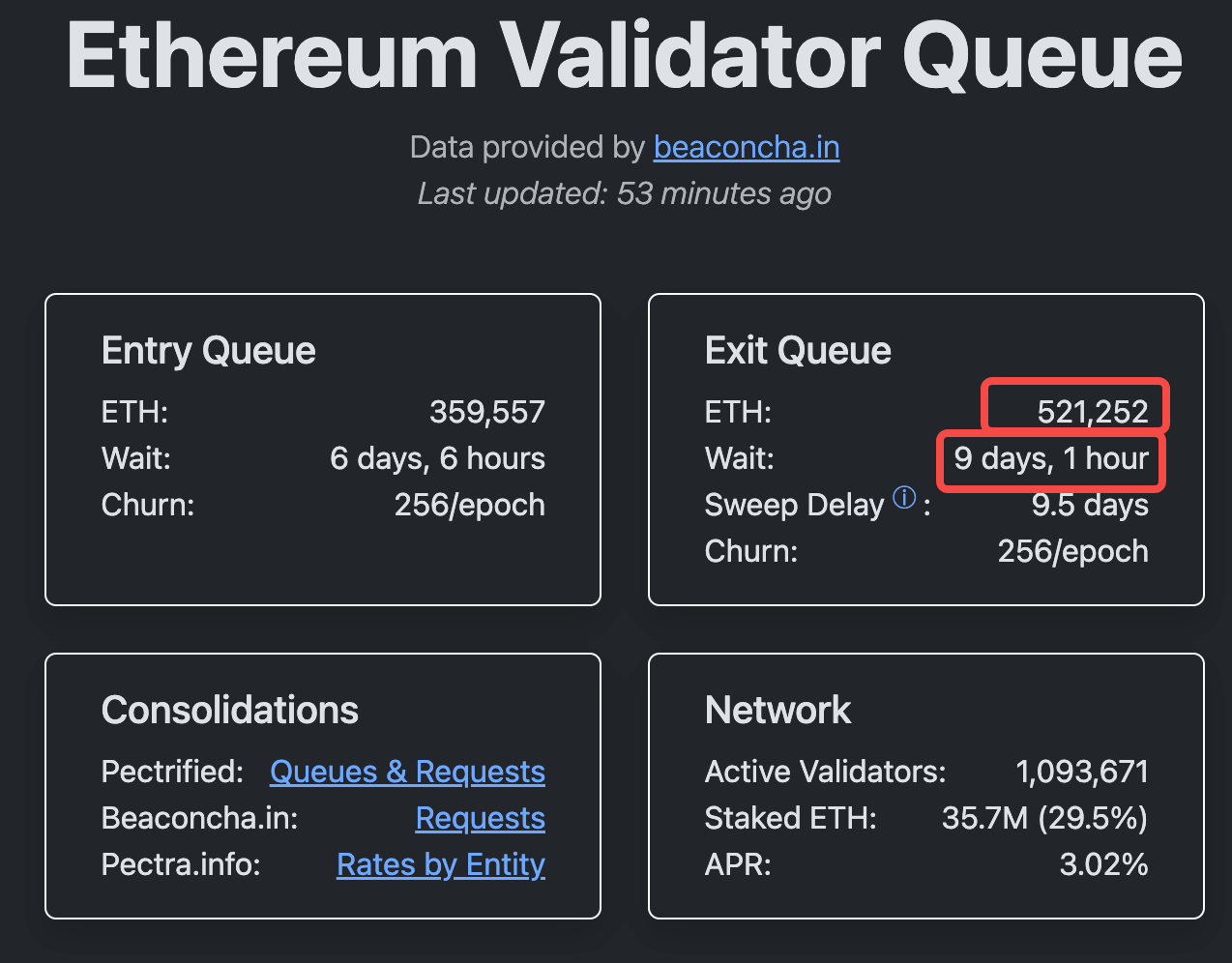

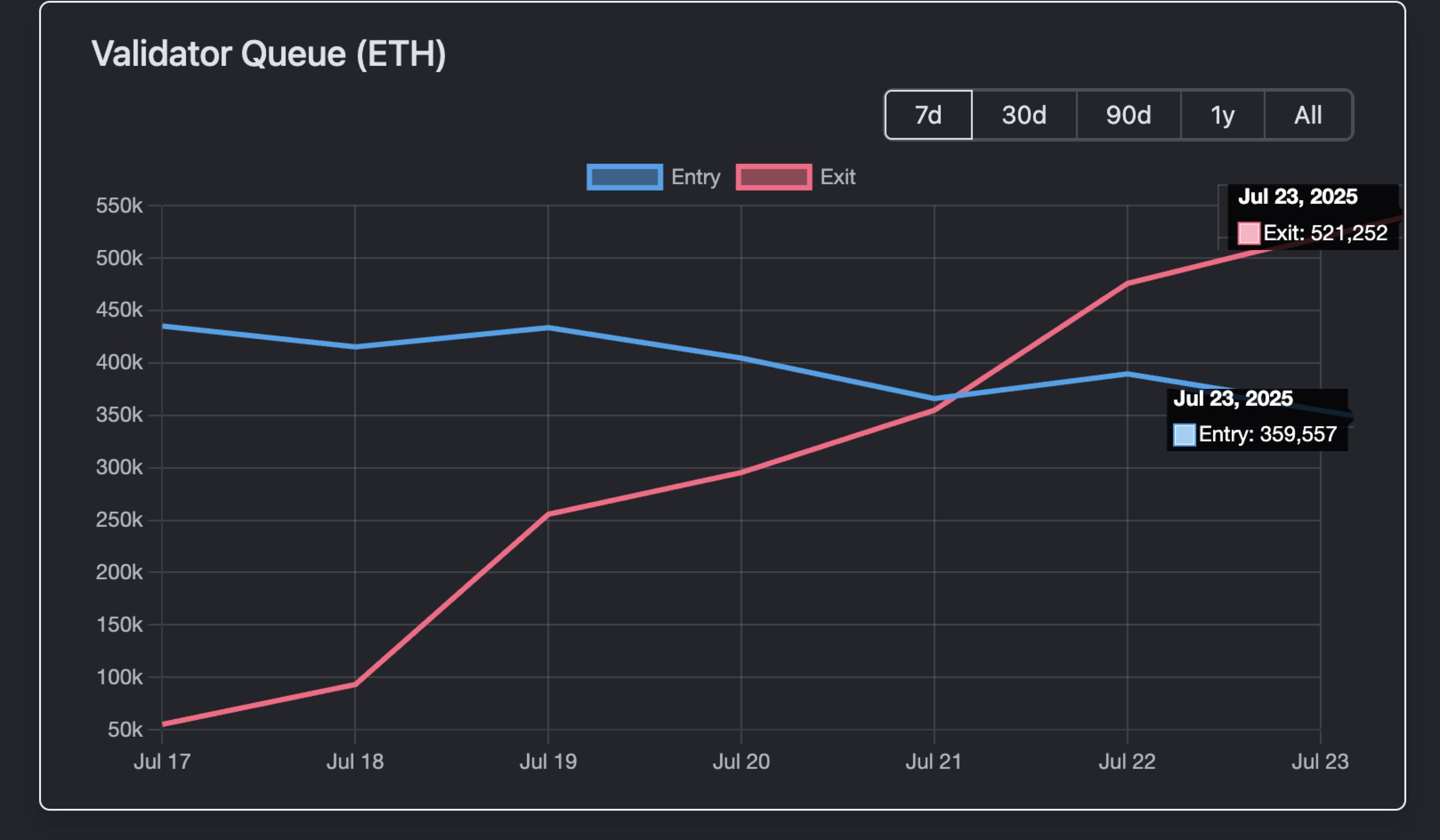

However, according to data from Validator Queue, as of July 23, approximately 521,252 ETH are queued for unstaking, valued at about $1.93 billion at current prices, with a waiting time of over 9 days and 1 hour for unstaking.

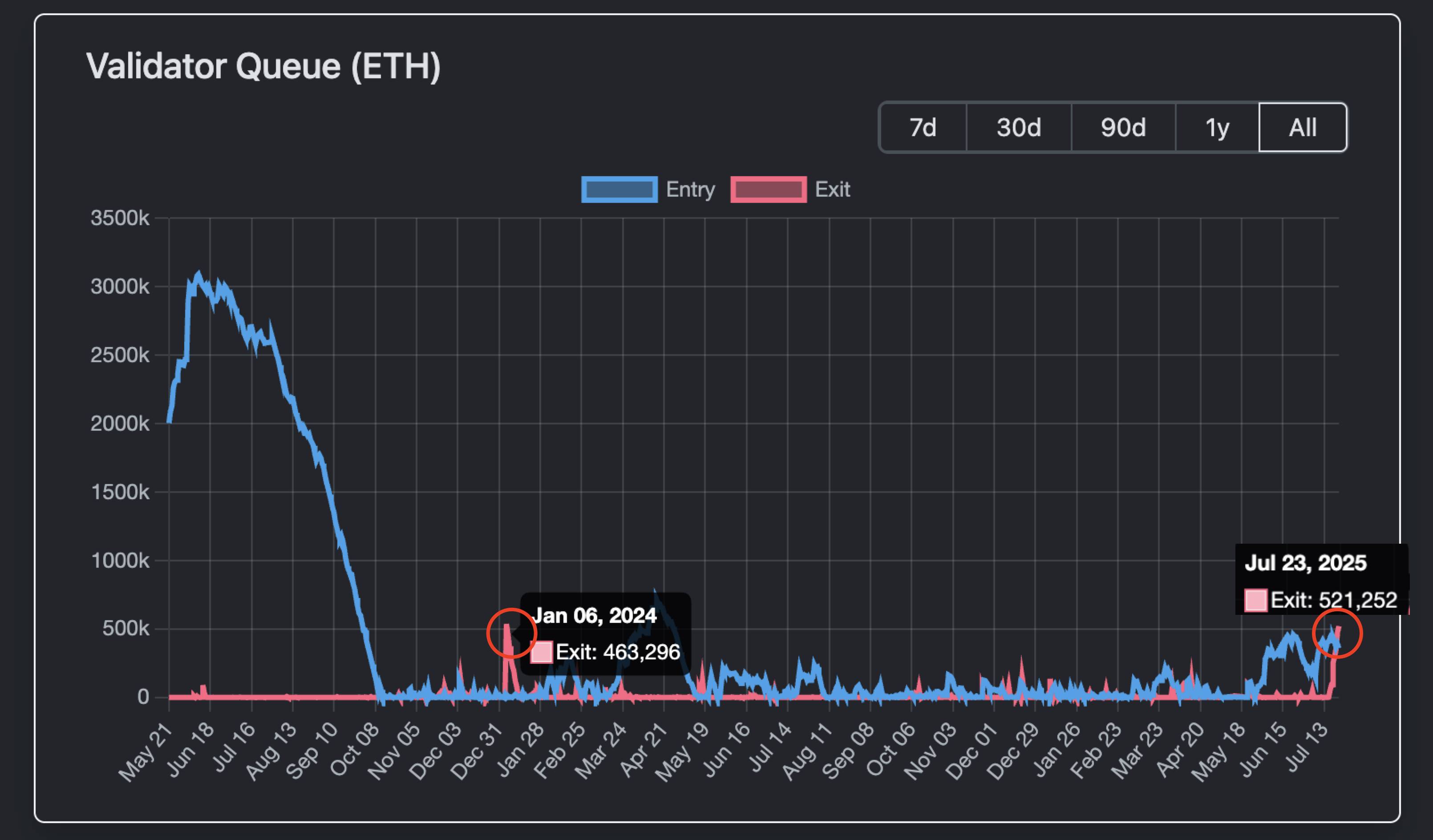

This is also the longest queue for validators choosing to exit in the past year.

Since each validator typically stakes 32 ETH, this theoretically means that over 16,000 validators are seeking to unstake. The large-scale queue for unstaking raises some alarming signals.

Taking profits?

Are the whales and institutions looking to sell ETH to take profits?

The surge in Ethereum unstaking may be partially related to the recent price increase.

Starting from the low point in early April 2025 (around the $1,500-$2,000 range), ETH has experienced a strong rebound, with a cumulative increase of 160% to date. Specifically, on July 21, ETH reached a high of $3,812, the peak in the past seven months.

Such rapid increases often prompt some investors to take profits, especially those who staked early, who may decide to lock in profits after seeing gains rather than continue holding.

From a historical perspective, this pattern is not new.

From January to February 2024, after the ETH/BTC ratio rose by 25% in a week, a similar scale of unstaking occurred, leading to a short-term price drop of 10%-15%. However, it was also around the same time that Celsius went bankrupt, with 460,000 ETH unstaked in a short period, causing a queue congestion of about a week for validators exiting the entire ETH network.

Not a selling pressure

Unlike before, although the queue for ETH unstaking is long this time and the amount is large, it does not necessarily mean direct selling pressure.

First, looking at the data from Validator Queue, on July 23, there were 520,000 ETH queued for unstaking, but at the same time, 360,000 ETH entered the staking queue.

This offsets the situation, significantly reducing the net ETH exiting the Ethereum network.

Secondly, institutional behavior also plays a buffering role.

Data from July 22 shows that the total inflow of ETH spot ETFs from various institutions in the public market reached $3.1 billion, significantly greater than the 520,000 ETH (worth $1.9 billion) queued for unstaking that day.

Moreover, this is just the net inflow of ETFs for one day, not to mention that the validator exit queue has a 9-day waiting period.

At the same time, unstaking does not necessarily mean that there will be a sale.

In the current bullish environment for ETH, concentrated unstaking may very well be due to institutions adjusting custody services or shifting to crypto treasury strategies, to put it more clearly, changing custodians for ETH to seek more returns rather than taking ETH out to sell.

On-chain, some of the unstaked ETH is more likely to be used for DeFi and NFT-related activities. For example, as collateral to provide liquidity, or recently, a whale swept the floor of Crypto Punks;

Additionally, on-chain LST tokens often experience decoupling, which also provides arbitrage opportunities for ETH—recently, the ratio of stETH to ETH dropped to 0.996 (a discount of about 0.04%), and weETH also showed similar fluctuations. Arbitrageurs buy discounted LSTs and wait for the 1:1 peg to recover for profit, which increases the demand for ETH.

Overall, unstaking seems more like an internal adjustment within the Ethereum ecosystem rather than a direct selling signal.

However, there are various speculations on social media; although concentrated unstaking does not mean selling pressure, it may indicate a phenomenon of "changing the main player."

Some believe that BlackRock, which is committed to pushing crypto assets into the mainstream financial sphere, has effectively become the major player in ETH. As of July data, BlackRock has accumulated over 2 million ETH (worth about $6.9-$8.9 billion), accounting for about 1.5%-2% of the total ETH supply (approximately 120 million ETH).

This is not a secret but rather a public ETF asset management behavior, so it resembles an institutional-level "open main player"—publicly holding and accumulating through ETFs to promote institutional adoption of ETH rather than manipulating the market.

The logic of changing the main player is that as Ethereum transitions from an internal value consensus to a broader consensus as a financial tool, it is already a very obvious trend that Wall Street is preparing to make a big move.

This speculation is not without reason; staking and unstaking may also represent a shift in the structure of chips.

But regardless, Ethereum's growth potential will continue to support its leadership position in the crypto space, and this wave of unstaking may just be the starting point of a new cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。