Old coins never die; they must be extraordinary.

Written by: Deep Tide TechFlow

In every rise and fall of the cryptocurrency market, there are always some familiar names that repeatedly appear at the top of the gainers' list.

XRP, XLM, ADA… These projects, considered "without a future" in the mainstream crypto circle, are still making a comeback in the new bull market wave.

They are neither newly innovative public chains nor the hot topics of the moment, nor do they boast any strong ecosystems or technological breakthroughs. But at some stage in the bull market cycle,

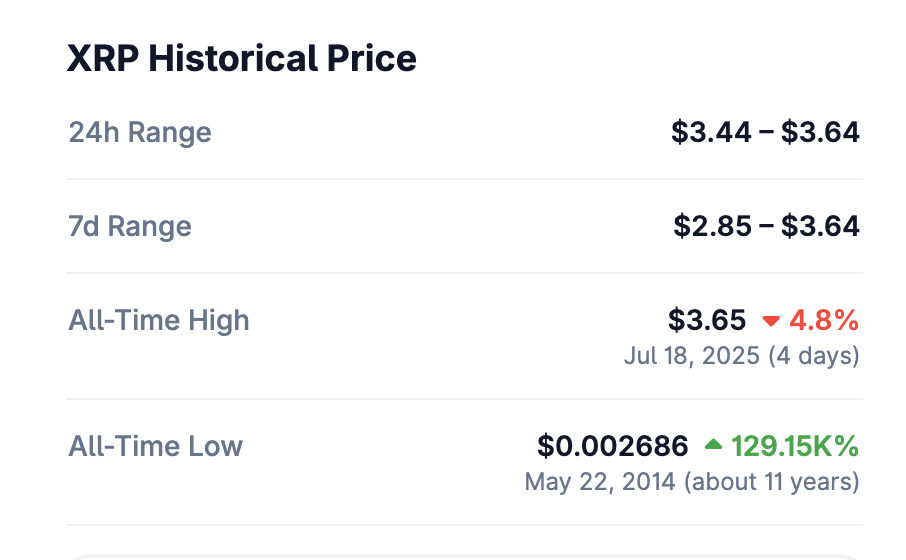

they always manage to rise against the trend in some inexplicable way, returning to the center of attention, and even breaking new highs like XRP.

This is not merely "speculative inertia" in the financial market; it feels more like there exists a hidden parallel world within the crypto industry.

In this parallel world, XRP is the future of cross-border payments, XLM is the hope for global micropayments, and ADA represents a new order in smart contract governance.

Old coins never die; they must be extraordinary.

The Crypto Parallel World

If the crypto market is a stage filled with hot rotations and technological innovations, then the survival soil of old coins often exists behind this stage—a world that is almost parallel to the mainstream crypto community.

We are accustomed to discussing new narratives and projects in Twitter, Discord, Telegram, and WeChat groups, and we are used to the hot switches between Ethereum, Solana ecosystems, or meme coins.

Yet we rarely realize that these assets known as "old coins" also have large and stable communities behind them; it's just that their active space is not in the circles we are familiar with.

XRP, XLM, ADA, HBAR… The users of these old coins have never been active participants in crypto Twitter, nor are they speculators in the community who blindly follow KOLs to buy coins.

They have their own information channels, community networks, and judgment logic—or, more directly, they do not care what is popular in the industry.

The XRP community is active in WhatsApp groups, Line groups, and Facebook communities in Japan, the United States, and even Latin America.

Most of these users are not concerned with the technical logic of crypto and do not chase industry hotspots, but they are familiar with XRP's cross-border payment story, recognize Ripple's cooperation model with banks, and even view XRP as a "long-term asset for financial innovation."

Whether XRP is being sued by the SEC or there are various bearish voices in the market, the beliefs of these users are largely unaffected.

The Stellar (XLM) community is similar.

In some developing countries, Stellar's cooperation with local financial service providers has given it a real user base. They may not know about Staking, DeFi, or even be unaware of the innovative ecosystem on-chain, but Stellar has already become a cutting-edge brand and asset in their cognition.

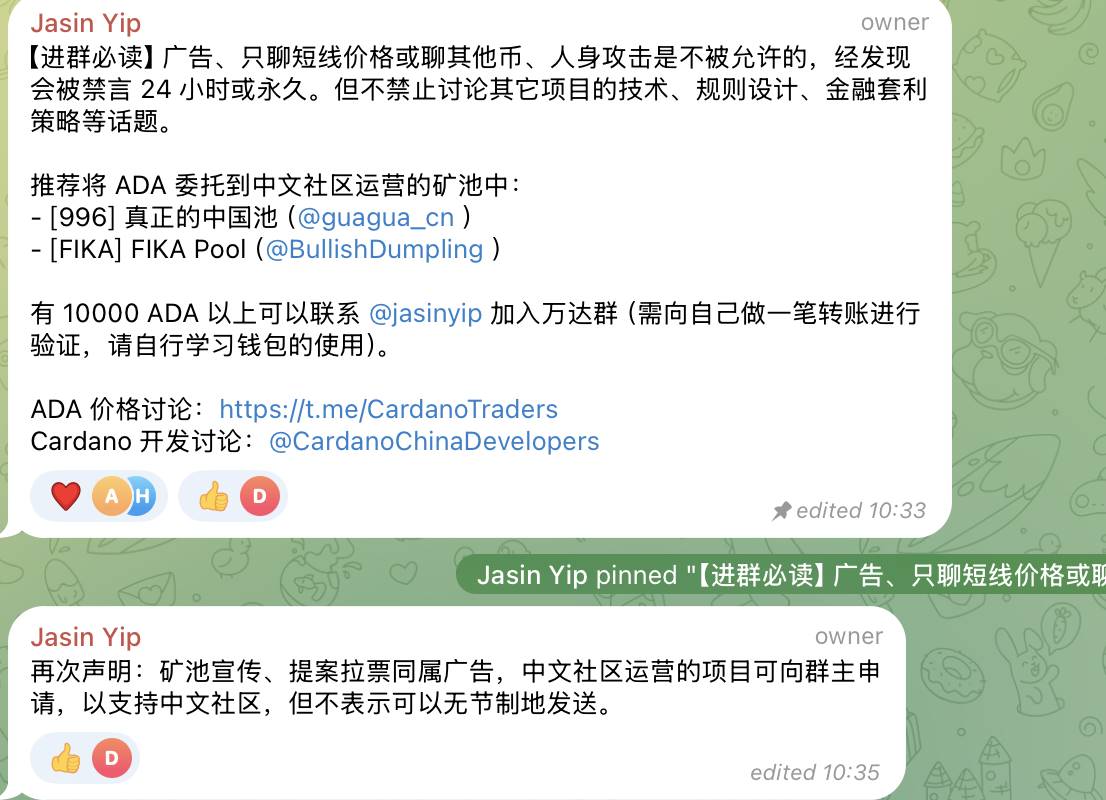

Cardano (ADA) exhibits a more typical "die-hard fan" phenomenon.

In Japan, Africa, Eastern Europe, and some English-speaking countries, Cardano's education, governance, and community projects have accumulated a large number of loyal users. Even in China, there is an ADA community led by programmers from major internet companies.

These individuals are active on Reddit, Telegram, and local forums, well-versed in Cardano's technical roadmap and the speeches of founder Charles Hoskinson. Even if the ecosystem develops slowly and the industry is filled with skepticism, they remain steadfast holders.

To outsiders, these perceptions may seem disconnected from reality, but they form a deeply rooted reason for holding coins.

All of this constitutes an ecosystem that runs parallel to the mainstream crypto world.

Messari analyst Sam stated that crypto Twitter always looks down on those "old coins" because, compared to the new technologies used on their chains, these coins are outdated. Their judgment is not wrong, but ordinary retail investors do not really understand what modern on-chain technology is; they only buy the coins they are familiar with (like XRP, ADA, XLM, DOGE).

They do not survive on popularity, nor do they rise and fall with market narratives. The operational logic of these old coin communities is closer to the user culture of the Web2 era: brand, habit, emotional recognition, and even the psychological inertia of "being used to it."

The survival of old coins has never relied on the mainstream stage of the industry; their vitality is hidden in those "secret corners" overlooked by the mainstream crypto world.

For this reason, no exchange would easily delist XRP, XLM, or ADA.

The trading volume, active users, market depth, and hedging demand they bring are all important components of trading platforms.

Even if the project parties have no technological breakthroughs, old coins still hold a significant position on the trading lists of spot, leverage, and perpetual contracts.

They have become part of the market, a habit of passive capital allocation, and even "old friends" in the minds of speculators—as long as the market starts, funds will always flow back.

Not Just Capital, But Politics

In addition to users and communities, the economic and political power of these project parties far exceeds external imagination.

These crypto projects, seen as "outdated," continue to shine not only because of the presence of old users, but also because they have long secured a place in traditional finance and political capital.

Taking XRP as an example, Ripple is not an isolated technology and business organization but a "veteran player" that has long participated in traditional finance and policy-making.

The founding team and executives of Ripple frequently appear at international payment forums, U.S. congressional hearings, and fintech summits, and they have deep ties with the Trump administration.

In January 2025, Ripple CEO Brad Garlinghouse was invited to a Trump dinner at the Mar-a-Lago resort in Florida and posted a dinner photo on Twitter with the caption "Strong start to 2025!"

On July 19, Trump officially signed the "Genius Act" at the White House, and Ripple's Chief Legal Officer Stuart Alderoty was invited to the event, being one of the few witnesses from the cryptocurrency industry.

In the long-standing lawsuit against Ripple by the SEC, Ripple not only was not defeated but instead achieved favorable results, further solidifying its political position in the discussion of "compliant crypto assets."

Moreover, Ripple has collaborated with hundreds of financial institutions worldwide over the years, including traditional financial giants like Santander, PNC, Standard Chartered, and SBI Holdings. This extensive business network has become an important support for market confidence in XRP.

Cardano is promoting blockchain education and digital identity projects in countries like Ethiopia and Rwanda, aligning with local national policies and governance.

Hedera's governing council consists of globally renowned companies such as Boeing, Google, IBM, and Deloitte, which have participated multiple times in discussions on digital asset and distributed ledger policies in the U.S. Hedera board member Brian Brooks is the former acting Comptroller of the Currency and a close associate of current SEC Chairman Paul Atkins.

These projects do not merely operate within the crypto circle; they are building a solid foundation in the political system, compliance consulting, and business cooperation multidimensional space. They have the ability to influence policies, seek regulatory compromises, and gain "chosen" status through political and capital networks.

Therefore, when people question these old coins from a technological and narrative perspective, they often overlook the moats they have already established at the policy and capital levels.

Within this framework, what these old coins represent is not technological backwardness but rather another strategy of "living long and living steadily"—the real trump card lies in capital, business resources, and political shields.

So, the next time you see XRP, XLM, ADA, HBAR, etc., appearing again on the market rankings, there is no need to be surprised or rush to explain with technology and narratives.

They do not need to be recognized; they just need to survive, and that is enough.

Sometimes, simply "living long enough" is already an underestimated competitive advantage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。