原创 | Odaily星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

本应是提振行业信心的一周,如今却因立法反复多添一层“不确定性”。

北京时间7 月 16 日,特朗普在社交平台宣布,已与 11 位关键众议员会面并获得支持,力推《GENIUS 法案》进入正式表决环节。

7 月 17 日凌晨,美国众议院以 217:212 的票数通过程序性投票,正式确立了包括《GENIUS》《CLARITY》与《Anti-CBDC》在内三项加密法案的议事流程。尽管本次投票并非最终通过法案内容,但意味着立法已进入最后关口,稳定币法案最快将于本周四进入终审投票。

这场“加密周”,正在从焦灼等待向现实推进靠近,而市场,则在另一头悄然走强。

OKX 实时行情显示,ETH 今晨强势突破 3400 美元关口,最高报 3428 美元,24 小时最高涨幅达 11.91% ,截至发稿前,回落至3380 USDT;BTC 则相对冷静,最高点在 120000 美元一线震荡,24 小时最高涨幅仅为 3.14% ,现价118740 USDT。

其他山寨行情,今晨也出现了普涨,BONK 24 小时最高涨幅 21.2%,现报 0.000037854 USDT;CRV 24 小时最高涨幅 13.31%,现报 0.9226 USDT;JUP 24小时最高涨幅 9.56%,现报 0.53 USDT;BOME 24 小时最高涨幅 18.43%,现报 0.002113 USDT;SOL 24 小时最高涨幅 6.55%,现报 170.81 USDT。

随着美国众议院通过了加密货币相关法案的程序性投票,加密货币概念股普涨,其中:Coinbase(COIN)上涨 4.21%,现报 404.26 美元;Circle(CRCL)涨超 22%,现报 238.58 美元;Strategy(MSTR)上涨 2.29%,现报 452.42%;Mara Holdings(MARA)上涨 5.17%,现报 19.73 美元。

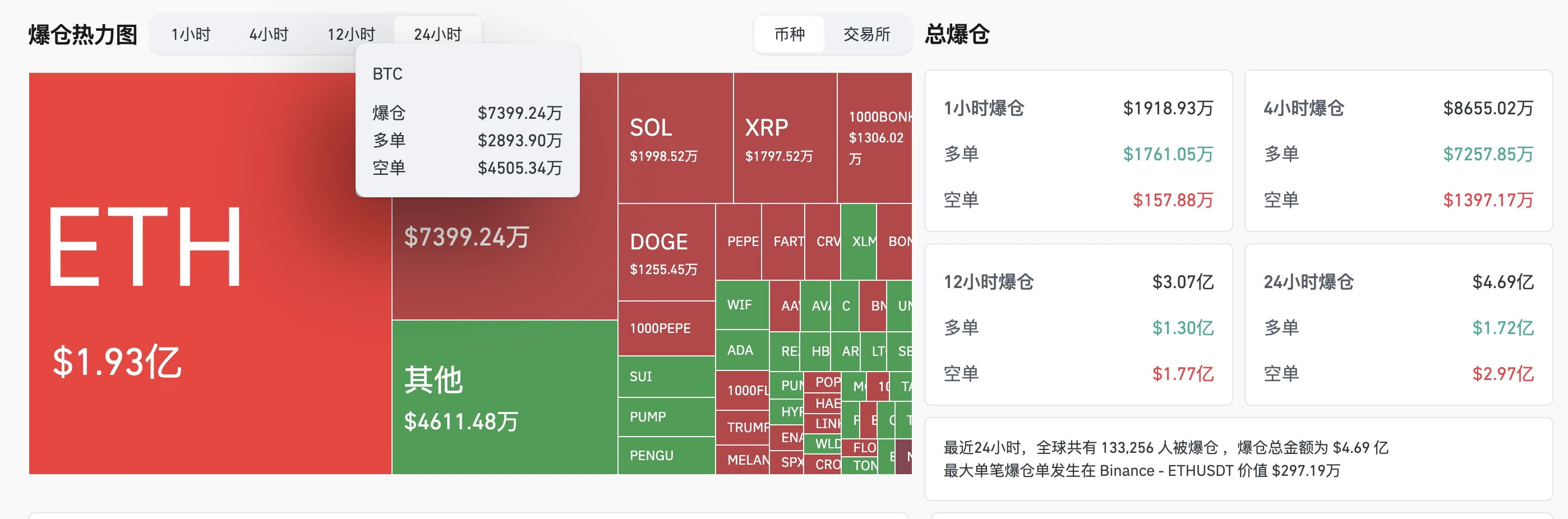

衍生品交易方面,Coinglass数据显示,过去 24 小时全网爆仓 4.69 亿美元,其中多单爆仓 1.72 亿美元,空单爆仓 2.97 亿美元。从币种来看,其中 BTC 爆仓 7399.24 万美元,ETH爆仓 1.93亿美元。

ETH 的上涨,并非单点爆发,而是结构性资金推动的结果。链上数据显示,在过去 48 小时内,多家机构和大额地址完成了对 ETH 的“无声吸筹”。

止盈与抄底交错,链上主力分裂开战

Trend Research 的大幅减持,无疑成为市场关注的焦点。

据 Lookonchain 数据,其在过去 24 小时内累计售出 69946 枚 ETH,套现金额高达 2.183 亿美元,仅昨晚一笔交易就卖出 21000 枚 ETH,价值约 6700 万美元。尽管如此,该机构仍持有逾 11.5 万枚 ETH,账面价值接近 3.8 亿美元。

但另一些力量,正在悄悄接棒。

SharpLink Gaming 今日通过策略账户新增购入 10,614 枚 ETH,价值约 3562 万美元。其总持仓已达 296,508 枚,价值逼近 10 亿美元,成为链上最激进的 ETH 财务配置者之一。

买家与卖家并非对立,而是博弈的两端。主力在分歧,市场在定价。ETH 的涨幅不是空中楼阁,而是一次“筹码交替”后的重估。

法案卡壳,ETH 为何大涨?

表面上看,法案延迟应是利空。但市场并未因此下行,反而出现反身上涨的迹象。

Oppenheimer 分析师 Owen Lau 在接受 CNBC 采访时指出,GENIUS 等法案的通过是“时间问题”,而非“是否通过”的问题。程序性表决的通过,已为正式立法扫清了制度障碍。

但真正推动 ETH 强势走高的,是其背后日益清晰的资产叙事。

一方面,2024 年 5 月,SEC 已批准多家以太坊现货 ETF 上市申请,并于 7 月正式开始交易,标志着 ETH 继比特币后正式进入美国主流投资市场。市场当前关注焦点已转向后续资金流入情况、是否支持质押功能,以及是否允许推出相关期权产品。

另一方面,自以太坊基金会年初开启架构改革后,传统金融市场对 ETH 的接受度不断提升。继 MicroStrategy 效应后,SharpLink Gaming 等美股上市公司也开始将 ETH 纳入资产负债表,用作长期储备。

此外,ETH 在链上金融中的核心地位,也令其天然具备对抗流动性紧缩和美元波动的“数字主权资产”属性。简言之,ETH 不再是“加密平台币”,而是在慢慢变成“链上版国债”。

后市:立法、降息与“山寨季”的三重博弈

ETH 的突破,或许只是这场新周期的开始。

7 月 22 日与 7 月 30 日的 FOMC 会议,被视为本轮宏观博弈的关键窗口。一旦美联储释放降息信号,加密市场将迎来第二层流动性驱动。

立法方面,美国众议院已于今日推进 GENIUS、CLARITY 与 Anti-CBDC 三项关键加密法案进入最终表决阶段。稳定币法案预计最快于周四进行投票,若获通过将送交总统签署。即便最终票数存在变数,光是进入表决流程本身就已提振市场风险偏好。

更重要的是,ETH 的走强也正重新点燃“山寨季”的预期。

链上数据显示,SUI、HBAR 等新兴公链代币 24 小时涨幅超过 12%,SOL、AVAX、LTC、DOGE 等主流山寨同步翻红。BitMEX 联合创始人 Arthur Hayes 昨日发文表示:“以太季已经到了”,并预测 ETH 将跑赢 BTC,DeFi 与 NFT 板块也将迎来回暖。他甚至还将社交平台头像换成 CryptoPunk,以示信心。

结语:FOMO情绪尚未真正蔓延

从特朗普亲自施压推进法案,到 ETH 强势突破 3400,再到链上机构稳步建仓,这场“加密周”的剧本似乎正在被重新书写。

但此刻的大盘并未全面共振,BTC 横盘、山寨币分化,FOMO 情绪尚未真正蔓延。也许,这正是属于冷静者的入场时刻,当你下一次听到全场齐声高喊“山寨起飞”时,ETH 或许早已飞在更前头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。