撰文:Yanz,Liam

“一个好的金融人,‘the Robin Hood’ of finance(金融界的罗宾汉)”,一位朋友曾这样形容特内夫(Vladimir Tenev)。

后来,正是这个外号,成为了一家改变金融业的企业名称。只是,这还不是一切故事的开端。

特内夫(Vladimir Tenev)和巴特(Baiju Bhatt),这两位分别拥有斯坦福大学数学和物理学背景的创始人,相识于斯坦福大学本科时的一个暑期研究项目。

两人都未曾预料,未来会与一代散户投资者深度绑定,他们以为是自己选择了散户,实际上,是时代选中了他们。

在斯坦福求学期间,特内夫便对数学研究的前景产生了质疑。他厌倦了那种“花上数年,钻研一个问题,结果可能一无所获”的学术生活,也无法理解博士同学们甘愿为微薄收入埋头苦干的执念。正是这种对传统路径的反思,悄然埋下了他创业的种子。

2011 年秋天,恰逢“占领华尔街”运动的高潮,公众对金融行业的不满达到顶点。纽约祖科蒂公园内,抗议者的帐篷星罗棋布,远在旧金山的特内夫和巴特,站在办公室窗前,也能望见这一幕的余波。

同年,他们在纽约创立了 一家名为 Chronos Research 的公司,为金融机构开发高频交易软件。

然而,很快他们就意识到,传统券商借助高昂的佣金和繁琐的交易规则,把普通投资者挡在了金融市场门外。这让他们开始思考:为机构服务的技术,能不能也服务于散户?

那时正值 Uber、Instagram、Foursquare 等新兴移动互联网公司涌现,专为移动端设计的产品开始引领潮流。反观金融行业,E-Trade 这样的低成本券商仍难以适配移动设备。

特内夫和巴特决定,顺应这场技术与消费浪潮,将 Chronos 转型为面向千禧一代的免费股票交易平台,并申请了经纪交易商牌照。

千禧一代、互联网、免费交易——Robinhood 集齐了这个时代最具颠覆性的三大要素。

那时的他们并未料到,这个决定,开启了属于 Robinhood 不平凡的十年。

围猎千禧一代

Robinhood 将目光投向了一个当时被传统券商忽视的蓝海市场——千禧一代。

传统金融理财公司 Charles Schwab 2018 年进行的一项调查显示:31%的投资者会在选择中介机构时对比手续费的高低。而千禧一代对“零手续费”尤为敏感,超过一半的受访者表示,会因为这一点而转向更具价格优势的平台。

零佣金交易正是在这样的背景下横空出世。当时,传统券商每笔交易通常收取 8 至 10 美元,Robinhood 却彻底免去了这项费用,且不设最低账户资金门槛。只需一美元即可交易的模式,迅速吸引了大批新手投资者,配合简洁直观、甚至带有“游戏感”的界面设计,Robinhood 成功提升了用户的交易活跃度,甚至培养出一批“沉迷交易”的年轻用户。

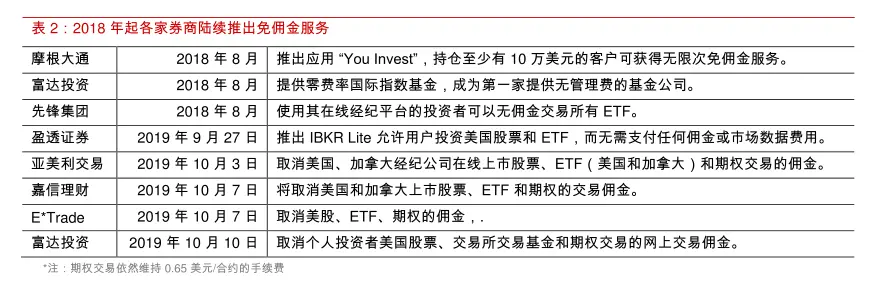

这场收费模式的变革,最终倒逼行业转型。2019 年 10 月,Fidelity、Charles Schwab 和 E-Trade 相继宣布将每笔交易佣金降为零。Robinhood,成为扛起零佣金大旗的“第一人”。

来源:东方证券

采用 Google 于 2014 年推出的 Material design 设计风格,Robinhood 游戏化的界面设计甚至获得了一项苹果设计大奖,成为第一家获奖的金融科技公司。

这是成功的一部分,却不算是最关键的地方。

在一次采访中,特内夫通过转述电影《华尔街》中的角色 Gordon Gekko 的一句话来描述公司的理念:“我拥有的最重要的商品是信息。(“The most important commodity that I have is information.”)

这句话,道出了 Robinhood 商业模式的核心——订单流付费(PFOF)。

与许多互联网平台一样,Robinhood 看似“免费”背后,其实是更昂贵的代价。

它通过将用户的交易订单流量卖给做市商获利,但用户未必能成交到市场最优价格,还以为自己占了零佣金交易的便宜。

通俗解释,当用户在 Robinhood 上下单时,这些订单并不是直接送到公开市场(比如纳斯达克或纽交所)去成交,而是首先被转发给与 Robinhood 合作的做市商(如 Citadel Securities)。这些做市商会以极小的价格差(通常是千分之一美分的差距)来撮合买卖,从中获利。作为回报,做市商会向 Robinhood 支付“引流费”,也就是订单流付费。

换句话说,Robinhood 的免费交易,其实是在用户“看不见的地方”赚钱,

尽管创始人特内夫一再声称 PFOF 并非 Robinhood 的利润来源,现实却是:2020 年,Robinhood 75% 的收入来自与交易相关的业务,到了 2021 年一季度,这一数字升至 80.5%。即便近年来占比略有下降,PFOF 依旧是 Robinhood 收入的重要支柱。

纽约大学市场营销教授亚当·阿尔特(Adam Alter)在采访中直言:“对 Robinhood 这样的公司来说,单纯拥有用户是不够的。你必须让他们不断点击‘买入’或‘卖出’按钮,降低人们在做出财务决策时可能遇到的所有障碍。”

有时候,这种“去门槛”的极致体验,带来的不只是便捷,还有潜在的风险。

2020 年 3 月,20 岁的美国大学生卡恩斯,在 Robinhood 上进行期权交易后,发现账户显示亏损了高达 73 万美元——远超他 1.6 万美元本金的负债。这位年轻人最终选择了自杀,留给家人的纸条里写道:“如果你读到这封信,我已经不在了。为什么一个 20 岁、没有收入的人,可以动用近 100 万美元的杠杆?”

Robinhood 精准击中了年轻散户的心理:低门槛、游戏化、社交属性,也享受到了这份设计带来的回报。直至 2025 年 3 月,Robinhood 用户的平均年龄仍稳定在 35 岁左右。

但命运赠予的一切都标注好了价码,Robinhood 也不例外。

罗宾汉,劫贫济富?

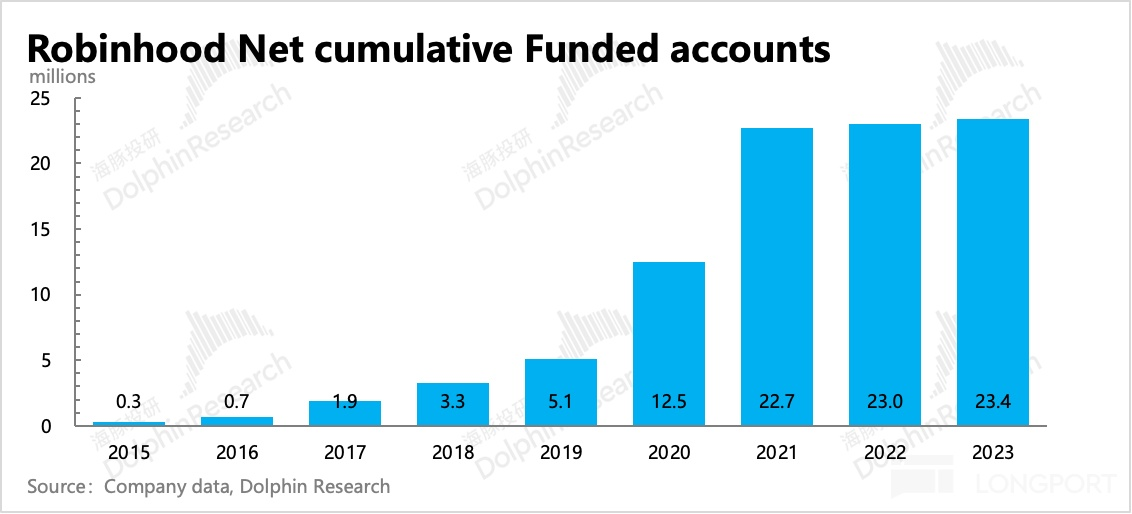

2015 至 2021 年,Robinhood 平台注册用户数量增长达到 75%。

尤其是 2020 年,伴随着新冠疫情、美国政府的刺激政策和全民投资热,平台用户和交易量双双飙升,托管资产一度突破 1350 亿美元。

用户数量激增,争端也接踵而至。

2020 年底,马萨诸塞州证券监管机构指控 Robinhood 以“游戏化”手段吸引缺乏投资经验的用户,却未能在市场波动期间提供必要的风险控制。紧接着,美国证券交易委员会(SEC)也对 Robinhood 展开调查,指控其未能为用户争取最佳交易价格。

最终,Robinhood 选择支付 6500 万美元与 SEC 达成和解。SEC 直言不讳地指出:即便考虑免佣金的优惠,用户总体仍因价格劣势而损失了 3410 万美元。Robinhood 否认了指控,但这场风波注定只是开始。

真正让 Robinhood 卷入舆论漩涡的,是 2021 年初的 GameStop 事件。

这家承载着一代美国人童年回忆的电子游戏零售商,在疫情冲击下陷入困境,成了机构投资者大举做空的目标。然而,成千上万的散户投资者不愿眼睁睁看着 GameStop 被资本压垮。他们在 Reddit 论坛 WallStreetBets 上集结,利用 Robinhood 等交易平台集体买入,掀起了一场“散户逼空”大战。

GameStop 的股价从 1 月 12 日的 19.95 美元,一路暴涨到 1 月 28 日的 483 美元,涨幅超过 2300%。一场“草根反抗华尔街”的金融狂欢,令传统金融体系震动。

然而,这场看似属于散户的胜利,却很快演变成 Robinhood 的“至暗时刻”。

那年的金融基础设施根本无法承受突如其来的交易狂潮。按照当时的结算规则,股票交易需要 T+2 天才能完成清算,经纪商必须提前为用户交易预留风险保证金。交易量暴涨,让 Robinhood 需要向清算机构缴纳的保证金直线上升。

1 月 28 日清晨,特内夫被妻子叫醒,得知 Robinhood 收到全国证券清算公司(NSCC)通知,要求其缴纳高达 37 亿美元 的风险保证金,Robinhood 的资金链被瞬间逼至极限。

他连夜联系风险投资人,四处筹资,以确保平台不被系统性风险拖垮。与此同时,Robinhood 被迫采取极端措施:限制 GameStop、AMC 等“网红股票”的买入,用户仅能卖出。

这一决定立刻引爆了公众愤怒。

数百万散户投资者认为 Robinhood 背叛了“金融民主化”的承诺,批评其向华尔街势力低头,甚至有阴谋论指控 Robinhood 与 Citadel Securities(其最大订单流合作方)暗中勾结,操纵市场以保护对冲基金利益。

网暴、死亡威胁、恶评轰炸接踵而至。Robinhood 突然从“散户朋友”变成了众矢之的,特内夫一家被迫暂避,并雇佣了私人安保。

1 月 29 日,Robinhood 宣布已紧急筹资 10 亿美元维持运营,之后又连续几轮融资,最终累计筹得 34 亿美元。与此同时,国会议员、名人和公众舆论对其穷追不舍。

2 月 18 日,特内夫被传唤出席美国国会听证会,面对众议员的质问,他坚称 Robinhood 的决定是迫于结算压力,与市场操纵无关。

尽管如此,质疑从未平息。金融业监管局(FINRA)对 Robinhood 展开彻查,最终开出史上最大单笔罚款——7000 万美元,其中包括 5700 万罚金和 1300 万客户赔偿。

GameStop 事件成为 Robinhood 历史上的转折点。

这场金融风暴让 Robinhood 的“散户护航者”形象严重受损,品牌信誉与用户信任都遭受重创。一时间,Robinhood 成了既受散户不满、又被监管盯防的“夹缝中生存者”。

不过,这一事件也促使美国监管机构着手改革清算制度,推动结算周期从 T+2 缩短为 T+1,为整个金融行业带来了长远影响。

这场危机之后,Robinhood 推进了早已筹备的 IPO。

2021 年 7 月 29 日,Robinhood 以“HOOD”为代码在纳斯达克上市,发行价定在 38 美元,估值约 320 亿美元。

然而,IPO 并未为 Robinhood 带来预期的资本盛宴。上市首日,股价开盘即跌,最终收报 34.82 美元,较发行价下跌 8%。虽然随后因散户热潮和机构买入(如 ARK Invest)出现短暂回升,但整体走势长期承压。

华尔街与市场的分歧显而易见——是看好其作为“散户时代的金融入口”,还是担忧其饱受争议的商业模式与未来的监管风险。

Robinhood 站在了信任与怀疑的十字路口,也正式步入了资本市场的现实考验。

可就在那时,少有人注意到一个被掩藏在招股书字里行间的信号——在 Robinhood 提交的 S‑1 文件中,“Crypto” 这个词被反复提及了 318 次。

不经意的高频出现,背后却是一次战略转向的宣言。

Crypto,正是 Robinhood 悄然掀开的全新叙事。

撞上加密

早在 2018 年,Robinhood 就已经悄然试水加密货币业务,率先推出比特币与以太坊交易服务。彼时,这一布局更多像是产品线的补充,远未成为核心战略。

但市场的热情很快改变了这一切。

2021 年,《纽约客》曾这样描述 Robinhood:“一个既提供股票,又能交易加密货币的零佣金平台,致力于成为华尔街的开明版本,肩负着‘实现全民金融民主化’的使命。”

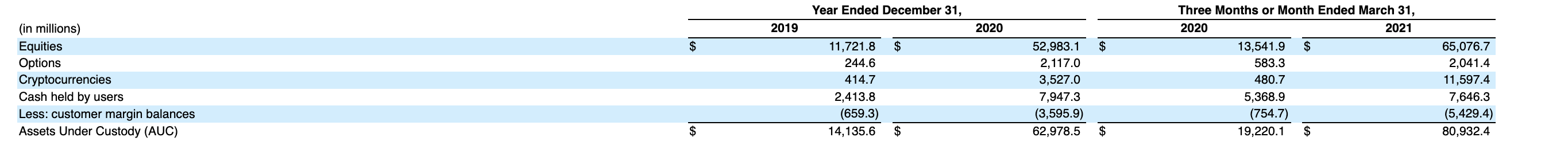

数据的增长也印证了这条赛道的潜力:

-

2020 年第四季度,约有 170 万用户 在 Robinhood 平台交易加密货币,到了 2021 年第一季度,这个数字飙升至 950 万,单季增长超 5 倍。

-

2020 年第一季度,加密交易收入占公司总交易营收的约 4%。到了 2021 年第一季度,这一数据激增至 17%,第二季度更是爆炸式增长至 41%。

-

2019 年起步时,Robinhood 加密货币资产规模仅为 415 万美元。到了 2020 年底,这一数字暴增至 3,527 万美元,增长超 750%。进入 2021 年第一季度,托管规模飙升至 11.6 亿美元,同比增长超过 2,300%。

此刻,加密货币,已经从边缘产品变成了 Robinhood 的收入支柱之一,被明确定位为增长引擎。正如他们在文件中写道:“我们相信,加密货币交易为我们的长期增长打开了新的空间。”

但究竟是发生了什么,让 Robinhood 的加密货币业务在短短一两个季度内,爆炸式增长?

答案也出现在 S-1 招股书中。还记得 2021 年疯狂的狗狗币吗?Robinhood 正是狗狗币浪潮的推动者。

S‑1 文件明确指出:“在截至 2021 年 6 月 30 日的三个月里,62% 的加密交易营收来源于 Dogecoin,而在此前季度为 34%” 。

为迎合用户需求,Robinhood 在 2021 年 8 月宣布计划推出加密货币存取款功能,允许用户将比特币、以太坊、狗狗币等资产自由转入或转出钱包。

半年后,在 LA Blockchain Summit 上,Robinhood 正式发布了支持多链的 Robinhood Wallet 测试版,并于 2022 年 9 月开放给 iOS 用户,2023 年全面上线。

此举标志着 Robinhood 正式由“中心化券商”向“数字资产平台”转型的开始。

然而,就在 Robinhood 借助加密热潮加速转型的关键阶段,一个当时颇显传奇的男人盯上了它——Sam Bankman-Fried(SBF)。

这位彼时风头正盛的 FTX 创始人兼 CEO,素以激进的扩张手法和对金融行业的颠覆性野心闻名。

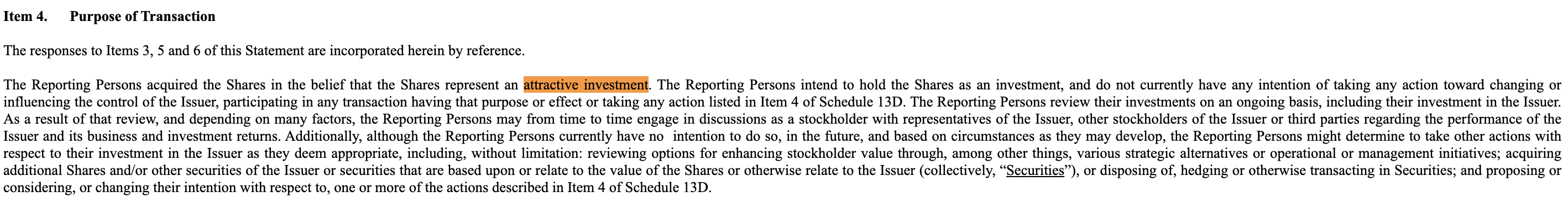

2022 年 5 月,SBF 通过其控股公司 Emergent Fidelity Technologies,低调地买入了约 7.6% 的 Robinhood 股份,价值约 6.48 亿美元。

消息公开后,Robinhood 股价在盘后交易中短线暴涨超 30%。

SBF 在向美国证券交易委员会(SEC)提交的 13D 文件中表示,他之所以买入 Robinhood,是因为“认为其是一项有吸引力的投资”,并承诺目前没有寻求控制权或干预管理的计划。但文件同时保留了“未来可能会根据情况调整持股意图”的表述,留下了充分的操作空间。

实际上,SBF 此举很难被简单解读为财务性投资。

彼时,FTX 正在积极布局美国合规市场,试图摆脱“纯加密交易所”的身份,向传统金融和证券业务渗透。Robinhood,凭借庞大的零售用户基础与合规资质,正是那座理想的桥梁。

市场一度盛传 SBF 有意推动与 Robinhood 更深层次的合作,甚至尝试并购,尽管 SBF 公开否认了这一传闻,但他也从未排除未来的可能性。

然而,SBF 的这场布局,没能等来理想中的“双赢”。

2022 年底,FTX 轰然倒塌,SBF 身陷欺诈、洗钱与金融犯罪的指控,美国司法部在 2023 年 1 月正式查封了 SBF 通过控股公司持有的 约 5,600 万股 Robinhood 股票,当时市值约 4.65 亿美元。

这笔原本象征“加密金融联盟”的股权,最终成了烫手的法律证物。

直到 2023 年 9 月 1 日,Robinhood 以 6.057 亿美元 从美国法警局(USMS)手中回购了这批股份,才彻底化解了潜在的持股风险。

令人唏嘘的是,按 Robinhood 当前 860 亿美元的市值来算,SBF 曾经拥有的 7.6% 股权,若保持至今,其价值已上升至约 65 亿美元,相当于原始成本翻了 10 倍以上。

事实证明,这项 SBF 所认为的“诱人的投资”(attractive investment),足够诱人。

起飞吧,股价

如果说 GameStop 事件是 Robinhood 危机四伏的洗礼,那么 2025 年的 Robinhood,正式迎来了属于自己的高光时刻。

这一切,早有预兆。

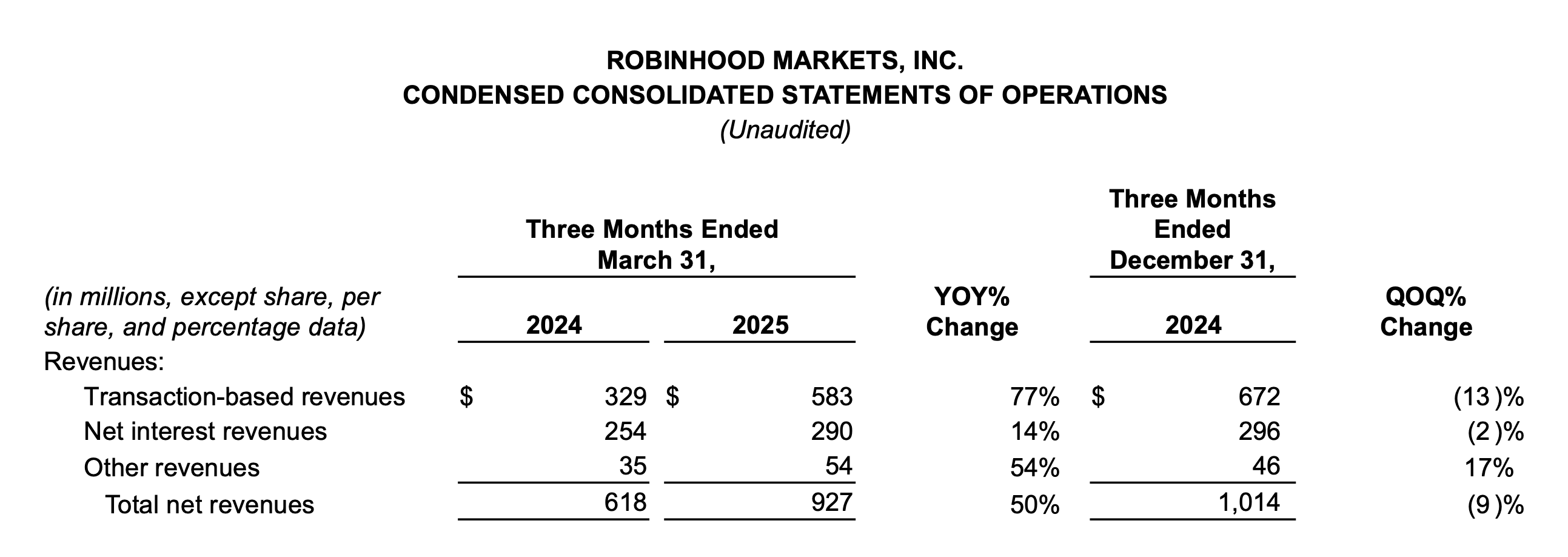

2024 年第四季度,Robinhood 各项关键指标齐创新高:

-

托管资产、净存款、黄金订阅用户数、收入、净利润、调整后 EBITDA 以及每股收益均全面超预期;

-

单季收入突破 10.1 亿美元,净利润达 9.16 亿美元,黄金订阅用户超 260 万,调整后 EBITDA 调整后 EBITDA 达到 6.13 亿美元......

-

加密货币交易量激增至 710 亿美元,加密业务收入同比增长 700%,单季创收高达 3.58 亿美元。

值得注意的是,在四季度财报中,Robinhood 创始人特内夫表示 :“我们看到了摆在我们面前的巨大机会,因为我们正在努力使任何人在任何地方都能通过 Robinhood 购买、出售或持有任何金融资产并进行任何金融交易。”

这大概是一个小小的伏笔。

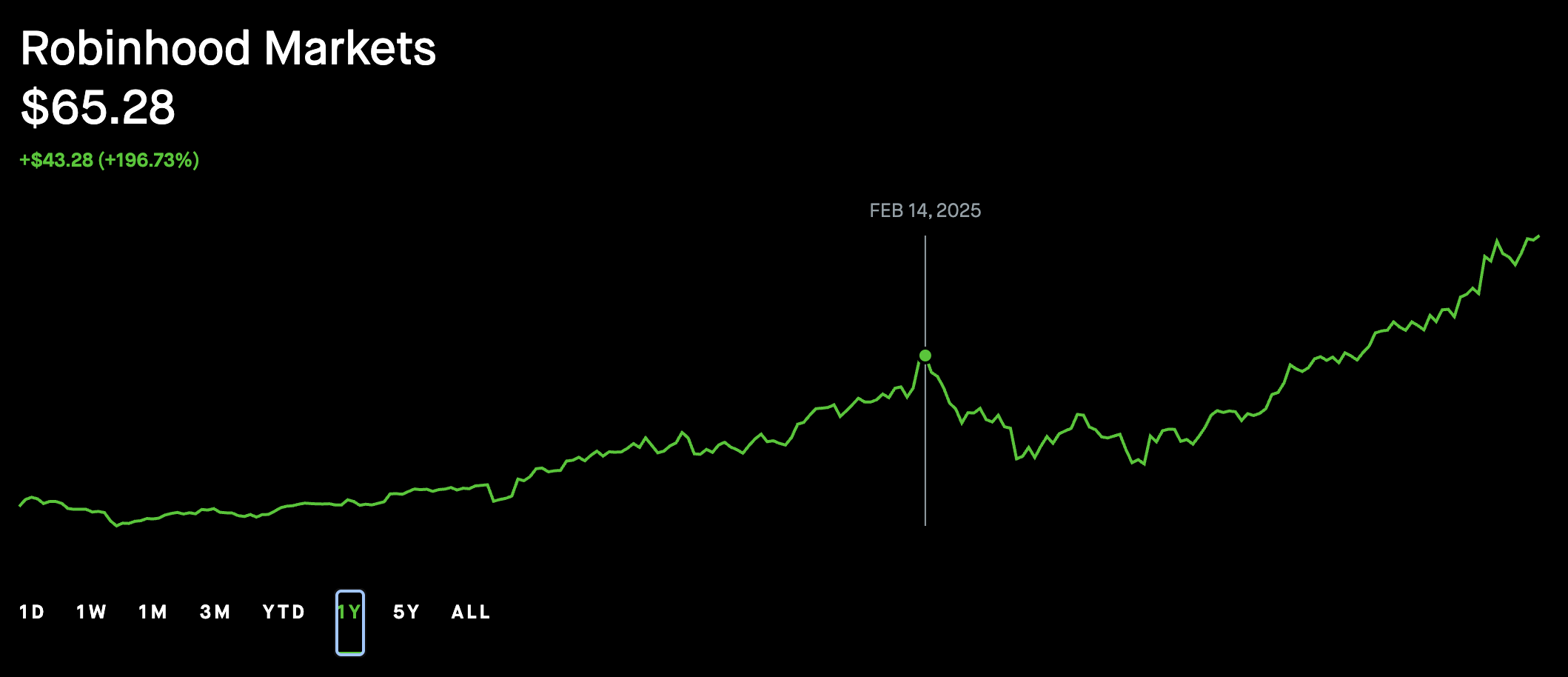

2025 年 2 月 14 日,就在财报发布的两天后,Robinhood 的股价迎来了 2025 年第一个高峰 65.28 美元。

但真正点燃这场股价狂飙的,是全球金融与加密市场的共振。

随着特朗普当选、美国政策转向“加密友好”,Robinhood 在监管端的风险也逐渐解除。

2025 年 2 月 21 日,美国 SEC 执法部门正式通知 Robinhood Crypto,结束长达一年的针对加密业务、托管流程和支付订单流的调查,且决定不采取任何执法行动。这封函件不仅扫清了 Robinhood 未来加密业务扩张的政策障碍,也成为股价突破性反弹的重要催化剂。

紧接着,Robinhood 甩出一记重拳。

2025 年 6 月 2 日,Robinhood 正式宣布以 6,500 万美元 完成对全球历史最悠久的加密交易所之一 Bitstamp 的收购。

Bitstamp 更名为 “Bitstamp by Robinhood”,全面整合入 Robinhood Legend 与 Smart Exchange Routing 系统。这一战略收购不仅为 Robinhood 带来了合规资产与全球市场布局的入场券,更将其从一家零售券商,推向了与 Coinbase、Binance 同台竞争的全球加密交易所行列。

次日,股价突破 70 美元。

如果说 Bitstamp 收购是 Robinhood 出海的重要一步,那么接下来的动作,宣告了 Robinhood 大步进军 Web3 资本市场。

还记得特内夫此前的预告吗?“任何人、任何时间、任何金融资产、任何交易更进一步。”

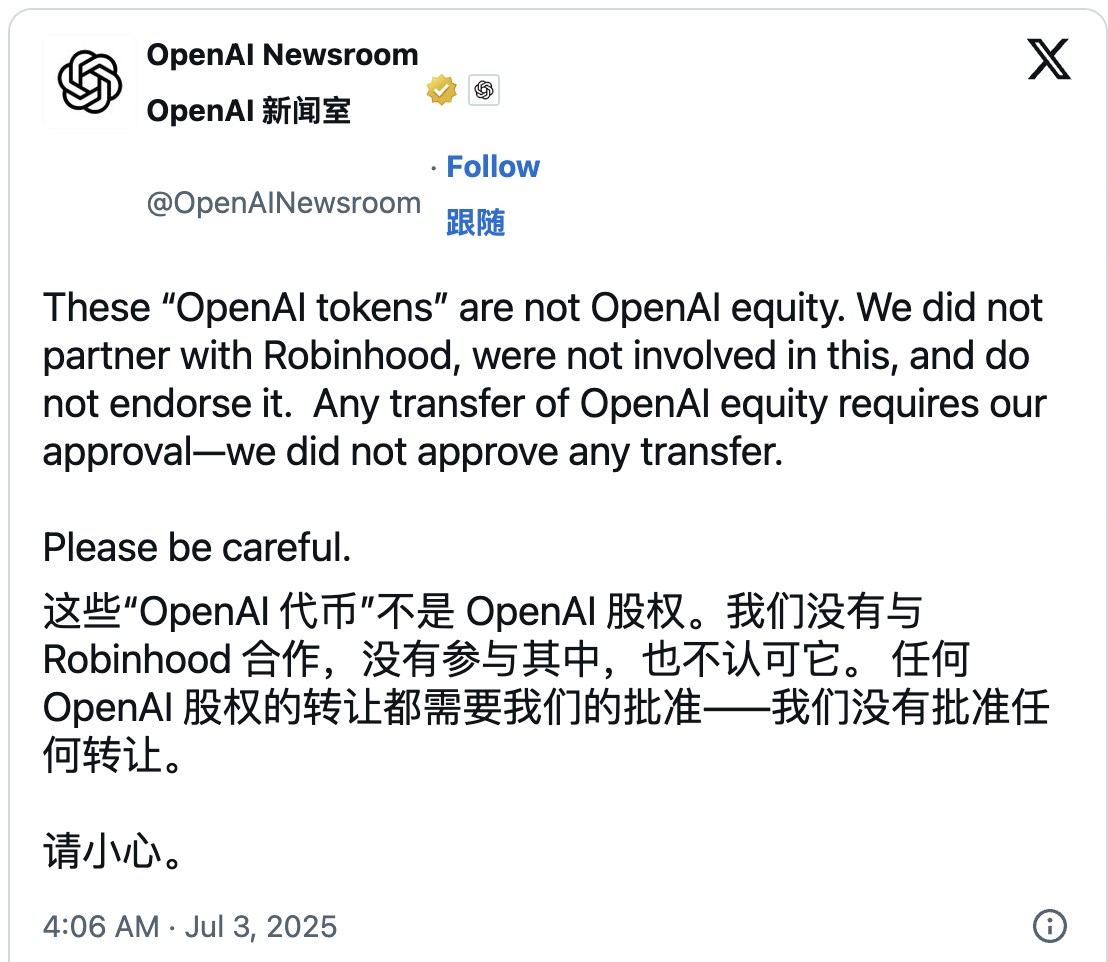

2025 年 6 月 30 日,Robinhood 宣布正式进军区块链证券领域,允许欧洲用户通过基于区块链的代币在 Arbitrum 网络上交易超过 200 种美国股票和 ETF,其中包括英伟达(Nvidia)、苹果(Apple)和微软(Microsoft)等知名企业的股票。

不仅如此,Robinhood 还公布了自研 Layer-2 区块链 “Robinhood Chain” 的开发计划。

市场对此反应明显,Robinhood 股价单日大涨,月内涨幅达到 46%,并在 7 月 2 日盘中突破 100 美元,创下历史新高。

尽管此后市场一度因 OpenAI 股权代币化传闻被辟谣而出现短暂回调,但分析师普遍认为,Robinhood 已从“散户券商”完成向“金融科技平台”的华丽转型,区块链证券将成为其下一个长期增长引擎。

截至目前,Robinhood 股价稳稳站在 100 美元左右,年内涨幅近 150%,市值突破 880 亿美元 (约 6300 亿人民币),远超当年上市时的想象。

从草根到今天,市值 867 亿的罗宾汉已经不复当年。从 2021 年 GameStop 风暴中的“众矢之的”,到 2025 年金融与加密融合浪潮中的弄潮儿,Robinhood 不仅经历了资本市场的极限考验,更用五年时间完成了自己的加速重构。

如果说当年是历史选择了 Robinhood,那么此刻,Robinhood 终于成为了那个能引领历史的玩家。

今天,特内夫大概可以告诉大学时期担忧数学作为职业的自己:“你也花了几年时间探索一个特定的问题,总算不是一无所获”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。