Bitcoin Price Crash Intensifies After Massive Whale Movement Activity

Bitcoin Price Crash by almost 5% in the last 24 hours, creating panic among crypto investors. This Bitcoin Price Crash was triggered by two major events, huge whale activity and new political tensions over U.S. tariffs.

$2 Billion in BTC Moved by Bitcoin OG

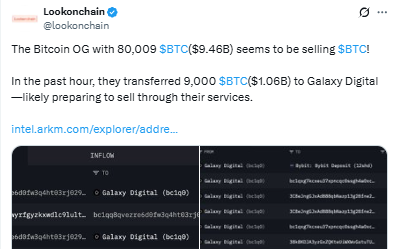

A huge whale wallet, called the “Bitcoin OG ,” from Satoshi’s Era , started to gain attention. This wallet holds 80,009 BTC, worth $9.46 billion.

According to Lookonchain , the whale recently moved 9,000 BTC (about $1.06 billion) to Galaxy Digital.

Source: Lookonchain

Shortly after, another 7,843 BTC ($927 million) was transferred. In total, the whale has sent over 16,843 BTC (about $2 billion) to Galaxy Digital’s wallets.

Source: Lookonchain

Galaxy Digital Sends BTC to Exchanges

Once the cryptocurrency transferred to Galaxy Digital, huge amounts began to flow in crypto exchanges. So far, 2,000 BTC (worth $236 million) has been sent to Bybit and Binance. These platforms are where traders buy and sell, so such large deposits often signal that a sell-off is underway.

This selling pressure created panic within the market and drove prices down rapidly.

Another Whale Flips Short: $228K in Profit

The other large trader, identified through the wallet address 0x960B, also acted quickly. The moment the wallet started transferring, he closed his long position and went short, i.e., he began placing bets that this digital currency would fall. His strategy worked, and that wallet is now holding an unrealized gain of $228,000 as per the Lookonchain .

Source: Lookonchain

This move fueled the Bitcoin Price Crash, as a greater number of traders also followed him.

Technical Charts Show a Correction Was Likely

Even before the wallet movement started, the market showed signs of trouble.

-

The 7-day RSI (Relative Strength Index) hit 86.83, signaling that it was overbought.

-

After the dip, the RSI dropped to 76.08, but it's still too high for comfort.

-

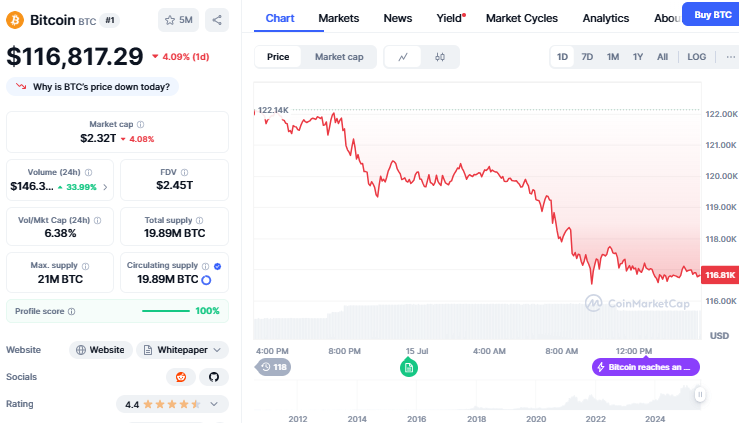

The currency reached a swing high of $123,091 before falling below a key support level of $117,237.

-

If it continues downward, the next support lies at $113,615.

Breaking that could send prices even lower during this Bitcoin Price Crash.

Source: CoinMarketCap

The currency is now trading at $116,817 with a decrease of 4%, while the trading volume increased by 35% within the last 24 hours.

Trump’s Tariff Threat to Russia Adds More Pressure

Just as the market was dealing with the whale moves, U.S. President Donald Trump added to the storm. During a meeting with NATO officials, he announced that the United States may impose 100% secondary tariffs on nations that will continue trading with Russia .

The bold warning shook financial markets, including crypto. The cryptocurrency, which had been rising to new highs, quickly lost momentum. The timing of the news added extra pressure to an already shaky market leads to Bitcoin price crash.

What’s Next?

This Bitcoin Price Crash is the result of both technical and political stress. A giant whale sold billions worth of this crypto, traders rushed to exit, and then global tension from U.S. tariffs made things worse.

As the cryptocurrency tries to find new support, all eyes are now on whether the selling is over, or if more pain is coming. For this digital asset to climb toward $135,000 or more, it needs strong support from big investors and positive global money trends to outweigh short-term price pullbacks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。