撰文:NEET

编译:AididiaoJP,Foresight News

我将分享如何通过 meme 在本轮周期实现财务自由,这是一个的具体执行策略,而非想法。是的,我没有开玩笑。

过去一到两年的时间里,我一直在以太坊上积累 meme 币。我逢低买入,并且没有短期卖出的打算。目前 meme 币占投资组合的 80%。

与此同时,我逐步卖出 Solana 上的 meme 持仓。Solana 生态系统的 meme 流动性变得越来越低。除了少数例外,自 1 月 TRUMP 和 MELANIA 推出以来,meme 币的回报率一直在下降。

Solana 上的 meme 币战场永远不会消失,每天都会有新的 meme 币暴涨暴跌。但我们可以在以太坊上找到更安全、回报更高的机会。

从宏观角度看,我的 meme 币策略非常简单:

停止在流动性差的 Solana meme 币上撒网式押注,去追求 100 倍收益。

开始在流动性好的以太坊 meme 币上追求 10-20 倍收益,并投入更多资金。

第一部分:为什么选择以太坊模因币?

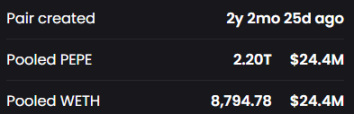

PEPE/ETH 交易对的流动性高达 4900 万美元。当 ETH 价格翻倍或三倍时,PEPE 的价格会发生什么变化?

我的观点很简单:ETH 会上涨,meme 币的涨幅会更大。

过去 1-2 年,我们已经看到 PEPE、MOG 和 SPX 等模因币的超额回报。这些币种的价格表现优于 ETH,未来很可能继续保持这一趋势。

如果一个以太坊模因币满足以下条件,就将其加入观察列表并密切关注:

-

上线至少一年时间

-

锁定或销毁的流动性超过 50 万美元

-

合约所有权已放弃

-

官网和社交媒体仍在运营

-

持有者在 Telegram 或 Twitter 上保持一定活跃度

这些币种在接下来的山寨季中将大幅跑赢 ETH,而这一时刻可能比想象中更近。

此外,以太坊 meme 币还有一个隐藏优势:它们与 DeFi 兼容。这一点稍后会详细说明。

接下来是大家最期待的部分。

第二部分:价格目标

每个人都关心价格目标。

没有人能准确预测价格走势,但可以根据多种指标做出合理推测。记住:无论是否喜欢某个币种或认同其 meme 文化,在牛市中,几乎所有模因币都会上涨。

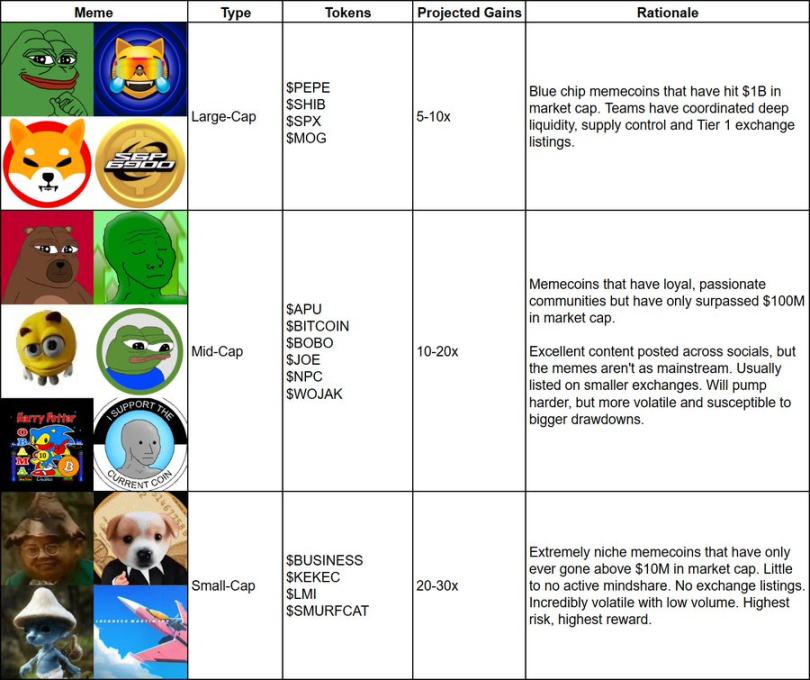

首先从龙头 meme 币开始:

-

PEPE

-

MOG

-

SHIB

-

SPX

我将龙头 meme 币定义为曾经达到 10 亿美元市值的币种。在目前这个价位上,它们的预期收益在 5-10 倍。持有这些币种可以让你安心入睡,除非发生灾难性事件,否则 90% 的回撤几乎不可能发生。

接下来是主流 meme 币:

-

APU

-

BITCOIN(HarryPotterObamaSonic10Inu)

-

BOBO

-

JOE

-

NPC

-

WOJAK

这些币种曾突破 1 亿美元市值,通常上线二线交易所,拥有活跃社区和忠实持有者。预计这些主流 meme 币有 10-20 倍的上涨空间。

最后是山寨模因币:

-

BUSINESS

-

KEKEC

-

LMI

-

SMURFCAT

这些是市值仅超过 1000 万美元的小市值模因币,没有交易所上线,流动性和交易量较低,但波动性更大。并非所有小盘模因币都会暴涨,但表现优异的可能会有 20-30 倍的收益。

投资组合应重点配置蓝筹模因币,适度配置中盘模因币,并少量持有小盘模因币作为投机性押注。

第三部分:现货杠杆

别让任何人告诉你 meme 币不值钱。

买入 meme 币后,下一步是什么?将 meme 币用于 DeFi。

IMF@intlmemefund 协议允许你用 meme 币抵押进行借贷。

为什么要用 IMF 以模因币抵押贷款?我用它来为持仓增加现货杠杆。现在 meme 币每上涨 1 美元,我就能赚 1.5 美元。

具体操作如下:

-

买入 1 万美元 PEPE

-

将 PEPE 存入 IMF,并借出 5000 美元 USDS 贷款

-

将 USDS 换成 PEPE

-

将剩余的 5000 美元 PEPE 存入以降低贷款价值比(LTV)

现在你持有的 PEPE 数量增加了 1.5 倍。只有当 PEPE 价格从当前水平下跌 66% 时才会面临清算,而这种情况发生的可能性每天都在降低。

适度的杠杆可以带来巨大收益。1.5 倍的 PEPE 敞口可以让你安心入睡。此外完成这笔交易后,你还能获得 IMF 奖励,可谓一举两得。

起初我并未意识到 IMF 的潜力。但现在像 MOG 和 JOE 社区正在买入更多代币,并通过新增买盘推动价格上涨。

IMF 目前支持 PEPE、MOG 和 JOE,未来将支持更多币种。

那么在 Binance、ByBit 和 Hyperliquid 上进行期货或永续合约交易呢?我建议谨慎行事。以太坊上的 meme 币更成熟,上涨需要更长时间,这是一场耐心的游戏,上涨只是时间问题。

如果你想进行波段交易,请坚持低杠杆、长周期,并且永远不要投入超过你能承受损失的金额。

第四部分:退出策略

最后的步骤是最简单的。

仓位已经建好,接下来不是干等,而是耐心等待。以太坊 meme 币的时机终将到来。市场是周期性的,资金轮动回以太坊 meme 币的时刻即将到来。

无论如何,设定明确的盈利目标至关重要。如果没有计划卖出一定比例或金额的 meme 币,你的仓位就像是过山车一样。

当你的币种开始上涨时,首先偿还 IMF 的贷款并降低现货杠杆。然后使用@1inch 或@CoWSwap 等协议逐步卖出,分多次退出。

不要试图精准逃顶。你需要在币价上涨过程中分批获利了结。以太坊主网的 Gas 费很低,因此可以根据需要多次卖出。

完成这些步骤后,你已成功抓住牛市,并通过模因币实现了财务自由。

结论

我必须承认且执行这个交易策略。

meme 币将长期存在。

尽管我也看好其他加密资产(包括 NFT 和一些 Solanameme 币),但我坚信以太坊模因币就像水下的沙滩球,终将浮出水面。

在熊市环境下,我们已经看到 MOG 和 JOE 的上涨,并从 2 月低点反弹。随着 IMF 等 DeFi 协议引入借贷和现货杠杆功能,新一轮 meme 币季节很可能即将到来。

这一次,我不会激进地交易新币种,而是坚持那些经过时间考验的老牌 meme 币。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。