原文作者:Stacy Muur

编译 | Odaily星球日报(@OdailyChina)

译者 | Ethan(@ethanzhang_web3)

新注意力经济的记忆是短暂的。

加密领域一直由叙事驱动。但在2025年,一种生成注意力的新机制占据了中心舞台:@KaitoAI的Earn排行榜。这些激励性活动奖励早期的研究者、评论者和表情包创作者(俗称“yappers”),他们在项目启动前制造热度,以此换取未来的代币分配。

如今,这一玩法已经成为标准流程:

奖励早期的认知份额(mindshare)

编造一个故事

在TGE之前创造需求

它确实有效。排行榜带来了曝光、交易量和社交认同。但关键问题是:这种注意力能持续吗?

一旦代币发行并完成空投领取,同样的“yappers”就已经转向下一个代币发行前的热点。价格下滑,交易量枯竭,参与度消退。

本文批判性地审视了多个与Kaito相关的项目:SKATE、HUMA、QUAI和SOON,探讨:Kaito 模式制造的热度是否能在代币上市后维持下去?趋势显而易见:叙事被设计用于引爆,而非留存。

我们从SKATE开始。

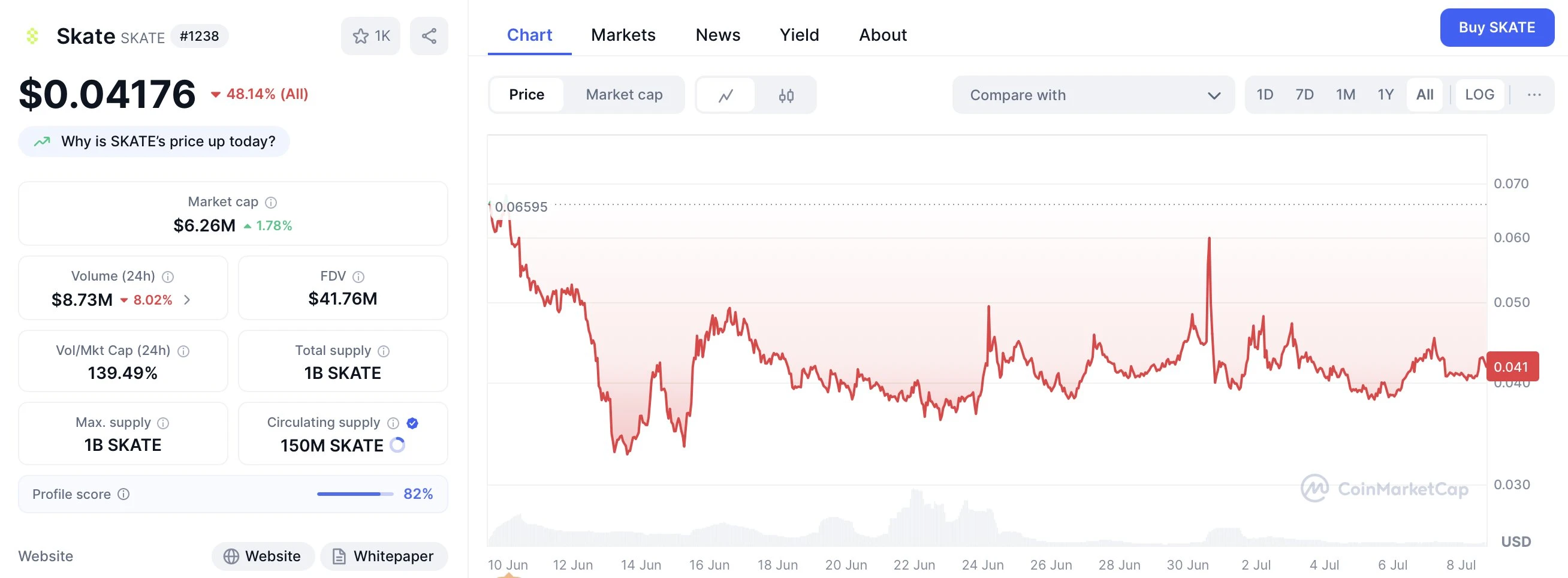

Skate:高交易量,大所上市,以及Kaito热潮后的停滞

@skate_chain的原生代币SKATE是一个基于Solana构建的模块化游戏层的代币,以强劲势头推出。凭借包括币安和Bitget在内的主流交易所上市,以及深度嵌入的Kaito Earn活动,SKATE带着充足的流动性和曝光度进入市场。

TGE: 2025年6月10日

发行价(开盘价):0.06506美元

首日收盘价:0.05094 美元

首日交易量:4146万美元

初始FDV(完全稀释估值):约 6500万美元

当前价格(7月7日):0.04065美元

当前FDV:约4065万美元

自TGE开盘以来的回撤:约 37.5%

当前24小时交易量(7月7日): 846万美元

交易量/市值比率(7月7日): 约 139%

价格走势:从飙升到下滑

SKATE的早期交易反映了一个充满希望的开局。6月10日,该代币的兴趣急剧上升,峰值达到0.06539,但迅速回调,收盘于0.05094附近,仅在首日就回撤了约22%。

随后出现的是在其他Kaito相关项目中常见的轨迹:

6月中旬: 在上市后势头的支撑下反弹至0.051 至 0.048 美元区间(6月11日–16日)

6月21日至 23日: 巨大的交易量轮动(单日超过1.1亿美元以上),但没有强劲的持续性方向

6月30日至 7月4日: 暂时性波动,价格飙升至0.06234 美元,然后快速下跌

7月5日至 7日: 价格被压缩至0.04065 美元,确认了自TGE以来约37%的回撤,以及自其7月4日波段高点下跌约22%。

社交热度同样在早期达到顶峰后迅速恶化。在项目启动后的7到10天内,Kaito贡献者将焦点转向了新的排行榜项目和尚未发币的活动,导致提及率和参与度明显下降。

小结:轮动 > 留存

SKATE拥有所有有利条件:主流CEX的上市、高流动性以及由奖励驱动的Kaito生态系统叙事。但注意力并未持续。尽管相对于市值的日交易量接近140%,SKATE仍然是一个被高度轮动而非持有的资产。

它的故事反映了Kaito Earn领域内的其他代币:

发行前的炒作

立即由上市驱动的交易量

空投领取和快速退出

数周内叙事枯竭

SKATE的市场行为强化了日益显现的对Kaito推动项目发行的批评:高曝光,低粘性。

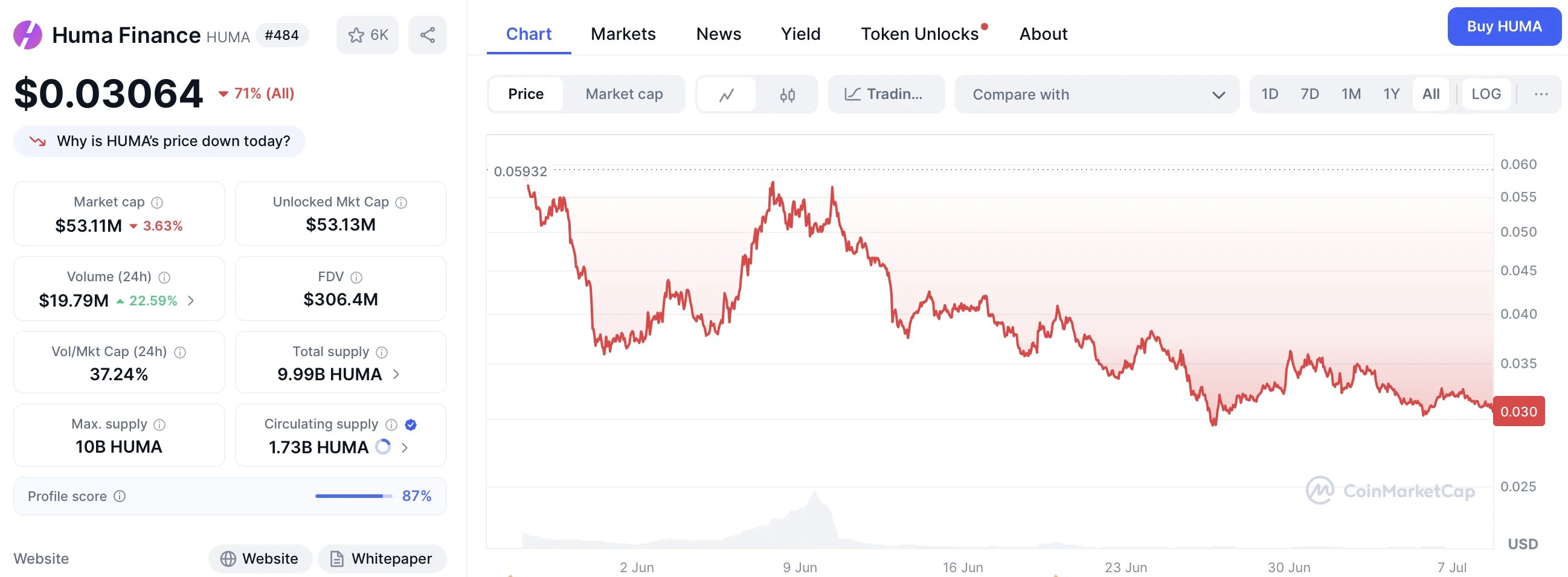

Huma:Launchpool热潮,0.5%的Kaito奖励,以及首日3亿美元轮动

@humafinance,一个去中心化PayFi,凭借币安和Kaito的顶配助力,于2025年5月26日推出了其原生代币HUMA。

币安Launchpool活动让用户在5月23日至26日期间通过质押BNB、FDUSD或USDC来挖矿HUMA。同时,Huma运行了一个Kaito Earn活动,将总供应量的0.5%分配给了三个奖励“赛季”。

第1赛季分配:

0.1% 分配给排名前 500的Kaito yappers(30天、3个月、12个月认知份额);

0.1% 分配给Solana、DeFi和RWA类别的贡献者;

分配通过SOL钱包注册和持有Kaito生态系统代币来限定。

交易于5月26日UTC时间13:00在币安开始。截至5月27日:

TGE(开盘)价格: 0.06683 美元

首日收盘价: 0.05936 美元

自开盘的回撤:约 11.2%

首日交易量: 3.1037亿美元

首日市值: 1.0289亿美元

当前价格(7月7日): 0.03083 美元

当前市值: 5344万美元

FDV(完全稀释估值): 3.086亿美元

交易量/市值比率(7月7日): 约33%

尽管 Launchpool 和 Kaito Earn 带来了热度,HUMA 的交易活动仍然以短期轮动为主。第1赛季的奖励从第1天起即可领取,并且第2赛季已被预告,这鼓励了抛压而非长期持有。

在6月初短暂稳定在~0.05 美元左右后,价格在接下来的一个月里稳步下跌,从6月9日到7月7日下跌了40%。这一趋势不仅反映了获利了结,也反映了缺乏粘性需求的更广泛现象。日交易量较第1天高点下降超过90%,FDV(3.08亿美元)与实际市值(5344万美元)之间不断扩大的差距强化了这样一种认知:HUMA的大部分吸引力是由活动驱动的,而非产品驱动的。

小结

HUMA展示了典型的Kaito Earn模式:声势浩大,流动性充裕,但缺乏持久吸引力。 这次发行是为曝光量而设计的,不一定是为信念而设计的。如果没有发行后的效用或需求钩子,早期的注意力轮动出去的速度和轮动进来的速度一样快。

Quai:大额分配,深度Kaito整合,强劲开局……然后沉寂

@QuaiNetwork,一个去中心化、多线程区块链协议,至今为止发起了一场最为慷慨且深度整合的 Kaito Earn 活动之一。从2025年1月17日到4月17日,该项目总共分配了600万枚QUAI代币作为内容贡献者的奖励:

550万枚 QUAI 用于通用Kaito排行榜;

50万枚 QUAI 用于专门的Quai项目排行榜。

领取期从4月29日到5月12日通过Kipper平台开放。每周快照追踪贡献者,像@0xalank、@basedPavel和@Abhijeetcg这样的顶级yappers获得了高达5.95%的个人认知份额,远高于SKATE或HUMA。

虽然Quai主网于1月29日启动,但代币直到2月22日交易所数据可用时才可自由交易。

QUAI首日表现(2025年2月22日):

开盘价:0.09884 美元;

最高价:0.2263 美元;

收盘价:0.1929 美元;

交易量:1014万美元。

接下来发生了什么:轮动、反转和长期冷却

QUAI创下了所有Kaito相关代币中最爆炸性的首秀之一。它在日内从0.09884 美元飙升至0.2263 美元,涨幅达129%,收盘于 0.1929 美元。

但那就是顶峰了。

在接下来的几周内:

2月23日至 26日:价格跌至0.17至 0.18 美元区间,早期迅速冷却。

3月1日至15日:稳定下跌至0.12 至 0.08 美元区间,呈现出与后续热度衰减相符的回调特征。

4月至5月:尽管有一些小幅反弹尝试,但支撑位逐渐减弱。

6月至7月:代币进入0.06 至 0.07 美元区间,截至7月7日,交易价为 0.05266 美元,较收盘价下跌约 73%,较最高价下跌约 76.7%。

交易量也说明了问题:

从第1天的1000万降至目前的约300万,活动急剧减少。

即使是第2阶段Kaito奖励也未能实质性地提振TGE后的需求。

小结

QUAI拥有所有优势:巨额的Kaito分配、强大的品牌协同效应、被热炒的TGE,以及预示着动能的早期价格走势。 但注意力轮动得很快。即使是拥有>5%个体认知份额的顶级yappers也无法维持二级市场的兴趣。

QUAI现在的交易价格低于发行价,自3月以来没有出现任何有意义的复苏,这是一个研究“早期流动性≠持久信念”的典型案例。

Soon:Kaito协同,币安Alpha Buzz,以及严峻的现实检验

@soon_svm,一个高性能的Solana Optimistic Network(基于SVM的rollup),在2025年初运行了最具结构性和社区协同性的Kaito Earn活动之一。该项目在为期3个月的活动窗口期内,将450,000枚SOON代币(约占总供应量的0.045%)分配给了前100名yappers。

活动日期: 2025年2月19日 至 5月19日;

领取期: 2025年5月23日 至 6月23日;

领取资格: Kaito排行榜贡献者、早期NFT持有者、建设者徽章所有者;

奖励类型: 通过airdrop.soo.network进行的基于代币的空投。

该活动不仅仅是一次奖励分发,它被嵌入了SOON的身份认同中。参与者被授予“Sooner”角色、徽章和社交地位,强化了Kaito yappers是SOON早期布道核心的草根叙事。

TGE与市场启动:从热潮到阴跌

SOON的代币于5月23日发行,币安Alpha上市于5月24日开始交易。代币开盘价为0.4527 美元,短暂触及0.4776 美元,当日收盘于0.4007 美元。首日交易量飙升至1.031亿美元,强烈的投机活动和交易所的放大效应得以显现。

市场指标(截至2025年7月7日):

TGE日期: 5月23日;

首日开盘价: 0.4527 美元;

首日收盘价: 0.4007 美元;

首日交易量: 1.031亿美元;

当前价格: 0.1529 美元;

市值: 约 2690万美元;

自开盘以来的回撤: 约66.2% ;

自最高点的回撤: 约68.0% ;

交易量/市值比率(7月7日): 约 97% 。

首日后发生了什么?

在最初的狂热情绪之后,SOON遵循了如今熟悉的Kaito后轨迹:

5月下旬至6月中旬: SOON维持在0.29至 0.39 美元区间,伴随着温和的换手和缓慢的衰减。

6月下旬: 支撑位跌破 0.25 美元,6月27日至 30日交易量加速下跌。

7月5日至 7日: SOON在48小时内暴跌40%,从0.22 美元到 0.13 美元,然后微弱反弹至 0.15 美元。

这种急剧下跌恰逢领取期结束(6月23日)之后,许多领取者可能在此后抛售,注意力也转向了其他Kaito活动。

小结:越早卖出越好?(The sooner you sell?)

SOON拥有成功发行的所有要素:强大的基础设施宣传、币安Alpha的曝光量以及社区编码的激励机制。但该代币在六周内66%的回撤表明,炒作并未转化为信念。

Kaito Earn模式已变得可预测:

叙事驱动的空投 → 高首日交易量 → 快速空投轮动降仓 → 随着注意力转移价格下跌

尽管 SOON 公司努力融入社区文化,但其市场行为却是注意力脆弱性的一个案例研究。它的Kaito根源给了它一个响亮的开局,但无法阻止随之而来的沉寂。

结论:叙事廉价,信念稀缺

Kaito Earn模式已被证明是发行前曝光度的强大引擎,但在SKATE、HUMA、QUAI和SOON中,出现了一个一致的模式:

注意力在TGE时达到顶峰,但未能转化为长期信念。

尽管在领域(游戏、基础设施、PayFi)、上市平台(币安、Bitget)和奖励结构上存在差异,结果却惊人地相似:

代币在首日上涨;

空投接收者轮动退出;

价格走势在数周内趋于平缓。

这并非Kaito本身的失败,作为内容发现层,它表现出色。但当前模式激励的是叙事创造,而非长期信念。如果缺乏实际用途、留存机制或持续的产品需求,大多数通过这个渠道发行的代币都会陷入注意力或退出的循环。

除非随着代币设计能够打破这一循环,不再仅仅是炒作而是奖励持有,否则 Kaito 的模式可能依然只是:一个强大的发布平台,却很少能成功着陆。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。