撰文:BlockSec

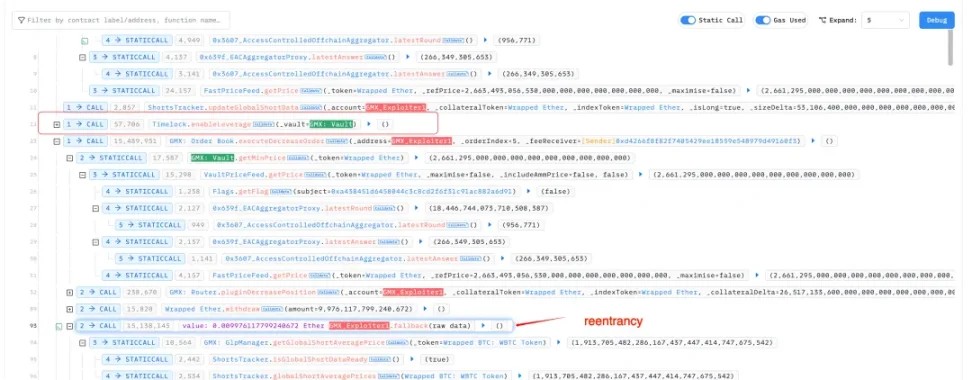

GMX 遭遇黑客攻击,损失超过 4000 万美元。攻击者利用了一个可重入漏洞,并在合约启用杠杆功能的情况下开空头头寸,实施了攻击。

问题的根源在于 executeDecreaseOrder 函数被错误使用。该函数的第一个参数本应是外部账户(EOA),但攻击者传入了一个智能合约地址。这使得攻击者可以在赎回过程中重新进入系统,操纵内部状态,最终赎回的资产远超过其实际持有的 GLP 价值。

GLP 正常赎回机制

在 GMX 中,GLP 是流动性提供者代币,代表对金库资产(如 USDC、ETH、WBTC)的份额。当用户调用 unstakeAndRedeemGlp 时,系统使用以下公式计算应返还的资产数量:

redeem_amount = (user_GLP / total_GLP_supply) * AUM

其中 AUM(管理资产总额)的计算方式为:

AUM = 所有 token 池的总价值 + 全局空头未实现亏损 - 全局空头未实现盈利 - 已预留金额 - 预设扣减(aumDeduction)

该机制保证了 GLP 持有者按比例获得金库的实际资产份额。

杠杆开启后的问题

当 enableLeverage 开启后,用户可以开设杠杆仓位(多头或空头)。攻击者在赎回 GLP 前,开设了大额的 WBTC 空头头寸。

由于空头一开仓便增加了全局空头规模,价格尚未变动的情况下系统默认该空头是亏损的,而这部分未实现亏损会被计为金库的「资产」,导致 AUM 人为上升。尽管金库并未实际获得额外价值,但赎回计算会基于这个虚高的 AUM,从而使攻击者获得了远超其应得的资产。

攻击流程

写在结尾

此次攻击暴露了 GMX 在杠杆机制与可重入保护设计上的严重缺陷。核心问题在于资产赎回逻辑对 AUM 的信任过高,未对其组成部分(如未实现亏损)进行足够审慎的安全校验。同时,关键函数对调用者身份的假设(EOA vs 合约)也缺乏强制性验证。该事件再次提醒开发者,在涉及资金敏感操作时,必须确保系统状态不可被操纵,尤其是在引入复杂金融逻辑(如杠杆、衍生品)时,更需严防重入与状态污染带来的系统性风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。