Author: Ding Dong (@XiaMiPP)

In December 2024, ETH plummeted from $4,000 to $1,400, with almost no significant rebound, a decline of over 65%. This crash was accompanied by a complete capitulation sell-off from traders and early whales, leading to a severe reshuffling of market positions in a state of panic. The ETH/BTC exchange rate also fell back to a low of 0.018, nearly returning to the starting point of the 2019 bull market.

At this same starting point, can ETH replicate the same trend in this round?

Just as most people lost confidence in Ethereum, a structural transformation is quietly brewing. Policy boundaries are becoming clearer, institutional capital is flowing back, EF is self-correcting, on-chain data is showing divergence, and industry narratives are refocusing. ETH may be on the verge of a structural revaluation.

Policy Tailwind: Emerging Crypto Regulatory Framework from Uncertainty

At the macro level, crypto assets are gradually stepping out of the gray area. Key legislative processes such as the "GENIUS Act" and "CLARITY Act" have made breakthroughs, and the SEC is also discussing establishing an exemption framework for DeFi. The regulatory approach to the crypto industry is shifting from exclusion to acceptance, from suppression to "limited encouragement."

As the foundation of DeFi, stablecoins and NFTs serve as the core settlement layer, and Ethereum may become the most direct beneficiary of this policy tailwind, as its compliance process is inherently embedded within the entire industry framework. When the regulatory environment becomes clearer, the first to be reassessed in value by institutions will inevitably be Ethereum, which has a "legitimate infrastructure" background.

Capital Return: A New Narrative for ETH Has Been Ignited

Since SharpLink, a publicly traded company in the U.S., announced the establishment of an ETH strategic reserve, other listed companies such as Siebert Financial, Treasure Global, and Bit Digital have followed suit, incorporating it into their corporate balance sheets. ETH is beginning to write a new narrative as a strategic reserve asset.

SharpLink, dubbed the "ETH version of MicroStrategy," has now announced an additional purchase of 7,689 ETH, increasing its total holdings to 205,634 ETH, which, at the current price of $2,600, values the total holdings at approximately $530 million. Behind this round of capital reallocation is a reassessment of ETH's asset attributes.

Capital's instincts are always sharp, and multiple institutions are poised to act. On July 3, Abraxas Capital withdrew 48,823 ETH (worth $126 million) from Binance and Kraken. A wallet suspected to be associated with Matrixport withdrew 40,734 ETH (worth $104 million) from Binance and OKX.

Nick Tomaino, founder of 1confirmation, stated that Coinbase has been hoarding ETH, currently holding over $335 million worth of ETH on its balance sheet. Robinhood is also set to follow Coinbase, and other companies are likely to do the same. Although still in the early stages, competition for ETH ownership in L2 has already begun.

Foundation Self-Correction: Governance Shift Towards Transparency

The Ethereum Foundation, once criticized for "lack of transparency," has begun a deep adjustment of its governance structure. In the face of centralization dilemmas and transparency crises, the foundation has restructured its research and development team and reduced staff. Meanwhile, the foundation released the latest financial policy document, clarifying its asset management strategy, ETH sale mechanisms, and long-term commitments to the DeFi ecosystem.

This is not only an attempt at self-correction but also a signal to the market: Ethereum will continue to defend its credible neutrality and institutional legitimacy.

Data Support: On-Chain Metrics Speak

On-chain data is telling the story of Ethereum's rising foundation. As of now, the number of weekly active unique users of stablecoins based on Ethereum has surpassed 750,000, setting a historical high. Among them, USDT and USDC still dominate, with circulating volumes on Ethereum of $73 billion and $41 billion, respectively, accounting for about 85% of the current total market value of stablecoins.

CryptoQuant data shows that since June 2025, over 500,000 ETH have been newly staked, pushing the total staked ETH across the network to surpass 35 million for the first time, setting a historical high. Meanwhile, the total holdings of "accumulation addresses" that have never sold ETH have also risen to a historical high of 22.8 million. During the consolidation phase in June, the buying of long-term holders of Ethereum significantly increased, with accumulation volumes showing a clear divergence from price trends, indicating a strong tendency for long-term holders to accumulate.

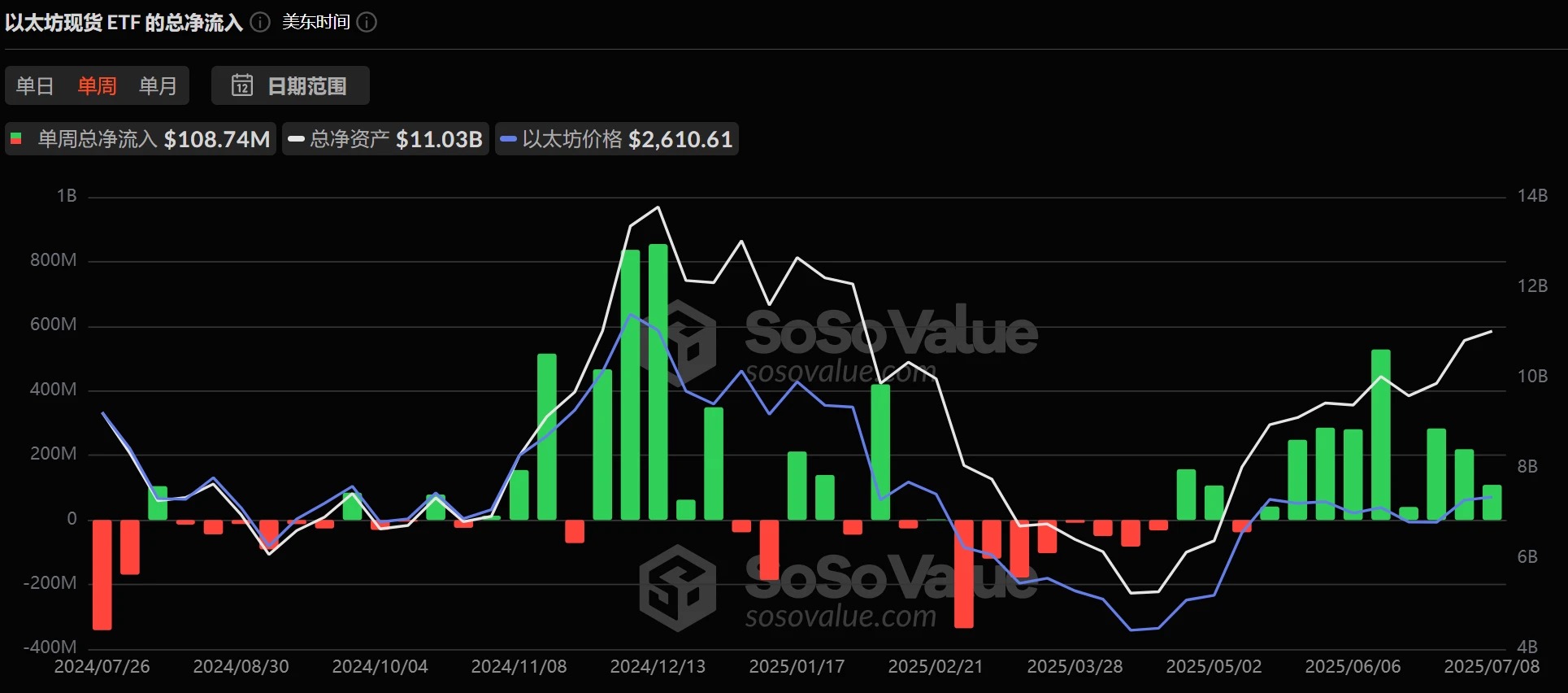

Ethereum Spot ETFs Have Recorded Net Inflows for Nine Consecutive Weeks, with Bitwise Chief Investment Officer Matt Hougan stating that inflows into Ethereum exchange-traded funds will accelerate significantly in the second half of the year, as more stablecoins and stocks begin trading on the Ethereum chain, which is an easily understandable phenomenon for traditional investors. In June, inflows into Ethereum ETFs reached $1.17 billion, and if this trend continues, inflows into Ethereum ETFs in the second half of the year could reach $10 billion.

Industry Perspective: The Return of Believers

Driven by multiple factors, the market seems to have found ample reasons for Ethereum's rise. Industry leaders are also rallying for Ethereum's next round of growth, re-establishing market confidence.

1confirmation Founder: Firmly Support Ethereum as the Cornerstone of Industry Sustainability

Nick Tomaino, founder of 1confirmation, firmly stated that Ethereum is the cornerstone of the entire industry's sustainable development. He emphasized that the values of credible neutrality, open-source, and permissionless innovation must be continuously inherited and disseminated.

Tomaino pointed out that some current trends, such as venture capital chains and corporate adoption of Ethereum treasury strategies, while not directly related to the aforementioned values, do not imply that they are bad. He quoted Hal Finney's perspective from 33 years ago: "Computers can be used to liberate and protect people, not to control them."

Bankless Co-Founder: Ethereum's MEV Minimization Investment May Aid Traditional Financial Adoption

David Hoffman, co-founder of Bankless, stated that Ethereum's ongoing investment in credible neutrality and MEV (Miner Extractable Value) minimization may provide additional advantages for its adoption in traditional finance (TradFi). He noted that blockchains like Robinhood, which use a single sequencer, do not face illegal MEV issues, but Ethereum's investment in fair MEV infrastructure is akin to "compliance" efforts in traditional finance. This investment could become a significant driving factor for traditional financial institutions to choose Ethereum over other blockchains, further enhancing Ethereum's competitiveness in compliance and technical credibility.

ZKsync Founder: Solana Cannot Compete with Ethereum in Decentralization and Anti-Censorship

Previously, Solana co-founder Toly stated that Solana is not "at war" with Ethereum but is fighting against centralized sequencer Layer 2 based on Ethereum.

Alex Gluchowski, founder of ZKsync and CEO of Matter Labs, responded to Solana co-founder Toly by stating that Solana cannot compete with Ethereum in terms of decentralization and anti-censorship, nor can it compete with single-sequencer Layer 2 networks in terms of latency and performance.

Consensys CEO: Ethereum Layer 1 Will Become the Global Ledger

Joseph Lubin, CEO of Consensys and co-founder of Ethereum, stated, "Ethereum Layer 1 will become the global ledger. It allows anyone to view, use, and add data or functionality without permission, possessing credible neutrality and anti-censorship. It has tamper-proof and verifiable tampering characteristics (achieved through a confiscation mechanism and transparency) and continuously advances its decentralization process. It has a large, top-tier community that remains highly vigilant, as there will always be patient and resourceful participants attempting to undermine the system. Fortunately, as Ethereum develops and matures, the difficulty of undermining the system will increase."

Conclusion: ETH, This Time It’s Really Different

Every round of faith reconstruction always begins at the coldest moments in the market. After experiencing the baptism of a crash, its chip structure has become sparse, and any marginal capital entering could trigger a price bounce. Currently, its price may still be fluctuating, but its value is quietly transforming.

ETH may truly be back.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。