撰文:深潮 TechFlow

最近很明显的一种趋势是,大家又开始重新看多以太坊。

从喊出“以太坊是数字时代的石油”,到 EthCC 上出现 “ETH 要涨到1万”的口号... 还有什么能重振 ETH ?

这个问题的答案或许不在链上,而在美股。

随着“比特币储备”成为美股上市公司的新潮流,以太坊储备,已经成为美股市场的新宠儿。

比如上周,SharpLink 宣布再次购买了7689枚 ETH,使其成为了拥有 ETH 储备最多的上市公司;昨天其股价(SBET)也上涨了近30%;

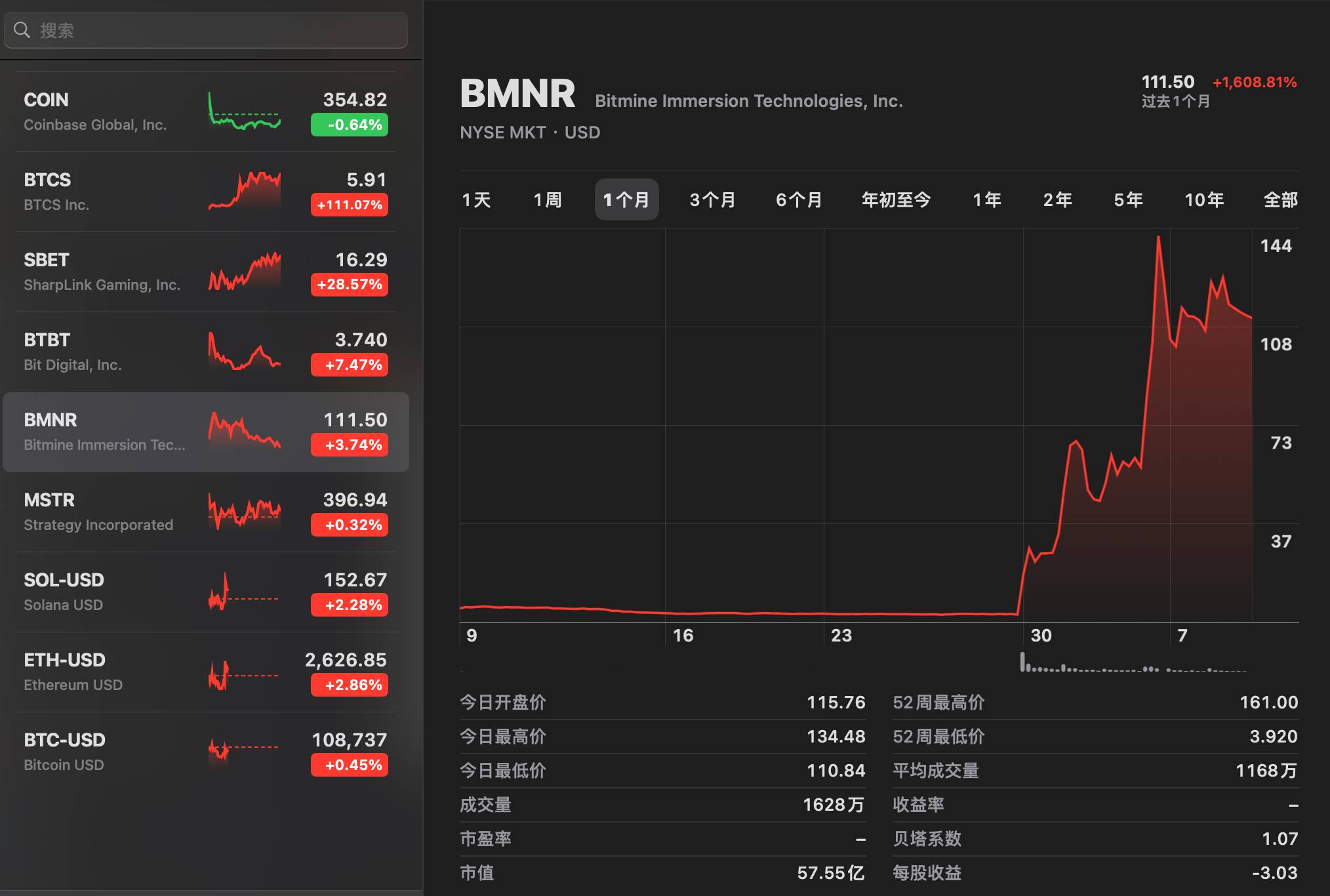

而专注于比特币挖矿的矿企 BitMine(BMNR),近日也宣布启动 2.5亿美元的 ETH 资产储备计划,意图效仿微策略。该公司的股价在1个月内已经上涨了16倍,短期财富效应甚至已经超过某些 Meme 币。

此外,另一家美股上市的比特币挖矿公司 Blockchain Technology Consesus Solutions(BTCS)也遵循了类似路径,周二宣布计划筹集1亿美元,用于购买 ETH。

消息一出,该公司的股价狂飙110%。

还有更加激进的 Bit Digital,主营业务为比特币挖矿和以太坊质押,直接宣布全面转向以太坊并出售比特币,昨天其股票 BTBT 盘中一度上涨约20%。

这4家企业,是最近美股积极拥抱以太坊叙事的一个缩影,也是资本市场风口浪尖的明星。

投机的资金注意力有限,市场往往记不住更多的后来者,于是你能看到它们争先恐后的官宣,要的就是一个明确的姿态和心智定位。

我们也盘了盘这几家公司在业务和背后资源上的异同,为更多关注币股联动的玩家们提供一些参考。

业务不同,但都寻求扭亏为盈

SharpLink(SBET)、BitMine(BMNR)、Blockchain Technology Consensus Solutions(BTCS)和Bit Digital(BTBT)四家企业争相押注ETH,股价暴涨的背后有着各自的业务逻辑。

SharpLink(SBET):从赌中来,到赌中去

SharpLink Gaming(SBET)主营业务是线上体育博彩。此外也与体育媒体公司合作,帮助其制定战略、产品和创新解决方案。

不过,2024年该公司的营收仅366万美元,同比暴跌26%;当年还通过出售了部分业务才实现扭亏为盈。

在转型前,SBET 市值约1000万美元,股价徘徊在退市边缘(低于1美元),股东权益不足250万美元,面临合规压力。其传统业务增长有限,难以在竞争激烈的博彩行业中突围。

2025年5月,SBET 通过4.25亿美元私募狂买ETH,目前持有205,634枚ETH(截止7月9日)。

大规模融资收购 ETH,也让它成为了全球最大的公开交易 ETH 持有者之一,仅次于以太坊基金会。

公开资料显示 SBET 超过95%的 ETH 都被部署在流动性质押协议中,目前已获得 322 个ETH的质押奖励。

通过质押产生的现金流,确实能对优化资产负债表产生正面影响,但更重要的在于这种策略不仅优化了财务结构,还让SBET从一家挣扎于退市边缘的小公司,摇身一变成了资本市场追捧的“加密概念股”。

在主营业务瓶颈和以太坊ETF热潮的大背景中,SBET 的转型更像是一场豪赌,高 ETH 占比也让其极容易受到币价波动的影响,毕竟 ETH 跌起来比 BTC 剧烈的多。

BitMine(BMNR):从BTC 矿场, 到 ETH 金库

从名字上就可以知道,BitMine Immersion Technologies(BMNR)是一家比特币挖矿公司,依靠浸没式冷却技术在德克萨斯和特立尼达的矿场掘金区块链。

通过自有挖矿和托管第三方设备,BMNR 产生比特币收入。

2025年第一季度,公司营收331万美元,但高能耗和低利润率(2024年净亏损329万美元)让它举步维艰。在转型前,BMNR 市值仅2600万美元,其挖矿业务受制于高成本和激烈竞争,增长空间有限。

6月30日公司宣布私募募资,计划购入约95,000枚ETH,但实际持有量尚未披露。不过消息公布后,BMNR 的股价从4.50 美元飙至111.50美元,6月以来暴涨 3000%。

同时,股价上涨也推高了 BitMine 的市值,目前在 57亿美元左右。与 SBET 不一样的是,BitMine 仍保留了原有的BTC挖矿业务,这也显得做ETH储备更像是短期叙事。

Blockchain Technology Consensus Solutions(BTCS):老活新整,叙事符合业务

BTCS 和上面两家公司都不同,储备 ETH 在历史业务上站得住脚。

该公司专注于区块链基建,成立于2014年,是纳斯达克上市的早期区块链企业之一。其核心业务聚焦于以太坊及其他权益证明(PoS)区块链网络的基础设施运营,主营业务包括运行以太坊节点和提供数据分析平台 ChainQ,为 DeFi 和企业提供质押和数据服务。

但同样的,该公司的财务表现不佳。

2024年,BTCS 营收约260万美元,同比下降12%,主要因节点运营成本高企和市场竞争加剧。净亏损达580万美元,陷入高投入低回报的财务困境。

BTCS 自2021年起持有 ETH 并运行验证者节点,积累了14,600枚 ETH,远早于前述两家上市公司的 ETH 储备计划;今年6-7月,BTCS 加速 ETH 积累,通过 AAVE DeFi 借贷和传统融资,并于7月8日发布公告,计划开展1亿美元的募资计划进一步扩大 ETH 持仓。

客观来说,增持 ETH 可以增强 BTCS 主营业务中验证者节点的质押能力,提升 gas 费用收入和市场竞争力。市场也相当买账,这波公告这也使得 BTCS 的股价单日暴涨超100%,从2.50美元升至5.25美元。

Bit Digital(BTBT):卖 BTC,全面转向 ETH

Bit Digital, Inc.(BTBT)是一家总部位于美国纽约的区块链技术公司,成立于2015年,最初专注于比特币(BTC)挖矿,2022年起逐步布局以太坊质押(staking)基础设施,另外还有 GPU 云算力和资管服务等业务。

同样该公司在财务上也陷入亏损,财报显示2025年第一季度,营收2510万美元,会计口径调整后其亏损在4450万美元左右。

2025年7月,公司通过1.72亿美元公募和出售280枚BTC,增持ETH 至 100,603枚(约2.64亿美元),ETH占资产60%,使其成为仅次于持有 ETH 数量仅次于 SharpLink 的公司。

很明显,这4家公司都有着财务状况差、市值低的特点,与加密市场某些没有收入的低市值协议有类似之处,在获得了叙事和关注之后快速拉升。

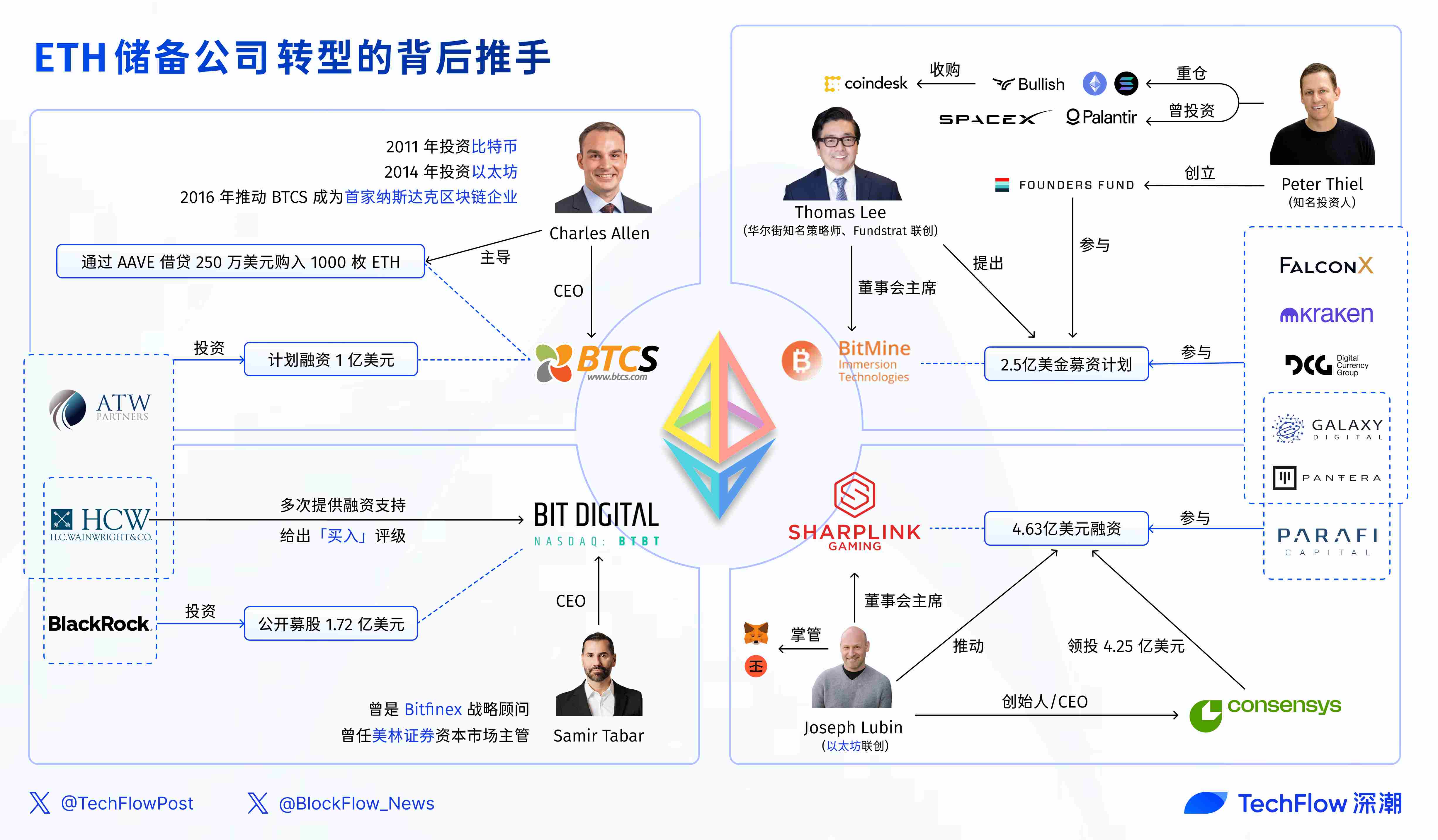

转型背后的关键推手们

Bankless 创始人 David Hoffman 在最近的一篇文章中,对 ETH 储备现象有着一个非常深刻的洞见:

“策略很简单:把 ETH 纳入资产负债表,然后把 ETH 推销给华尔街 ...以太坊本身就有很多叙事亮点,ETH 需要的只是一个足够有活力、能让华尔街兴奋的人”。

人脉和资源,连接着加密叙事走进传统资本市场。从币圈大佬到投行巨擘,这4家公司背后也有着不同的关键人物。

SharpLink:以太坊联创和他的加密帮

从濒临退市到 ETH 最大持有者,背后离不开以太坊联合创始人 Joseph Lubin 的操盘。

作为 ConsenSys 的创始人兼 CEO,Lubin 掌管着以太坊生态中的重要基建,比如 MetaMask 钱包和 Infura (后者处理着超50%的以太坊交易)。

2025年5月,Lubin 加入 SBET 董事会,担任主席,亲自推动4.63亿美元的融资。而这背后也与曾经投过以太坊生态各类项目的加密 VC 们有着紧密的联系:

他自己的 ConsenSys 领投 SBET 4.25亿美元的私募,联合 ParaFi Capital(DeFi 领域顶级风投,投资 Uniswap、Aave)、Pantera Capital(以太坊早期投资者,管理资产超50亿)和 Galaxy Digital(管理以太坊 ETF)等多家机构共同入局。

尽管有社区质疑这是以太坊基金会的阴谋,但 Lubin 的人脉和 ConsenSys 的资源,无疑让 SBET 有成为以太坊华尔街化先锋的能力。

BitMine:Thomas Lee 与硅谷 VC 的联动

Thomas Lee,华尔街知名策略师、Fundstrat 联合创始人,以精准预测闻名,是 BitMine(BMNR)ETH 储备战略的幕后推手。

Lee 自 2017 年起就看多比特币,2024年预测 ETH 将达 5000-6000 美元,2025年6月宣布出任 BMNR 董事会主席。

他在一次采访中曾提到押注以太坊的原因:

“说白了,我选择以太坊的真正原因是稳定币正在爆发。Circle是五年内最好的IPO之一,市盈率100倍EBITDA,给一些基金带来了非常好的表现 ... 稳定币是加密世界的ChatGPT已经进入主流,是华尔街尝试“股权化”代币的证据。而加密圈则在“代币化”股权,比如美元被代币化。”

同时他在 CNBC 表示,BMNR 将成为“以太坊的 MicroStrategy”。

而由 Lee 提出的 BitMine 2.5亿美金的募资计划中,我们也看到了知名硅谷 VC Founders Fund 的身影,其由Peter Thiel 创立,曾投资过 SpaceX、Palantir,2021年起也开始重仓加密,包括以太坊和 Solana 和 Bullish集团,该集团也收购了CoinDesk。

此外,Pantera、FalconX、Kraken、Galaxy Digital 和 DCG 等加密原生机构也参与其中。

Bit Digital:CEO 曾是 Bitfinex 顾问

Samir Tabar 是 Bit Digital(BTBT)ETH 储备战略的掌舵人,他也有从华尔街到币圈的跨界经历。

Tabar 曾任美林证券资本市场主管,2017-2018年担任 Bitfinex 战略顾问,优化 USDT 在以太坊网络的交易流程,2021年加入 Bit Digital。

Tabar 在 CNBC 采访中称以太坊为“重塑金融体系的蓝筹资产”,强调其在稳定币和 DeFi 应用中具有巨大潜力。传统金融背景和加密经验为 Bit Digital 的转型提供了更多的可信度,其“蓝筹资产”的言论也迎合了重振以太坊的叙事。

2025年6月,Bit Digital 通过公开募股(ATM 发行)筹集1.72亿美元购入 ETH;主要资方包括贝莱德和投行承销商H.C. Wainwright,而后者曾多次为 Bit Digital 提供融资支持,2025年重申 BTBT 为“买入”评级,目标价5-7美元。

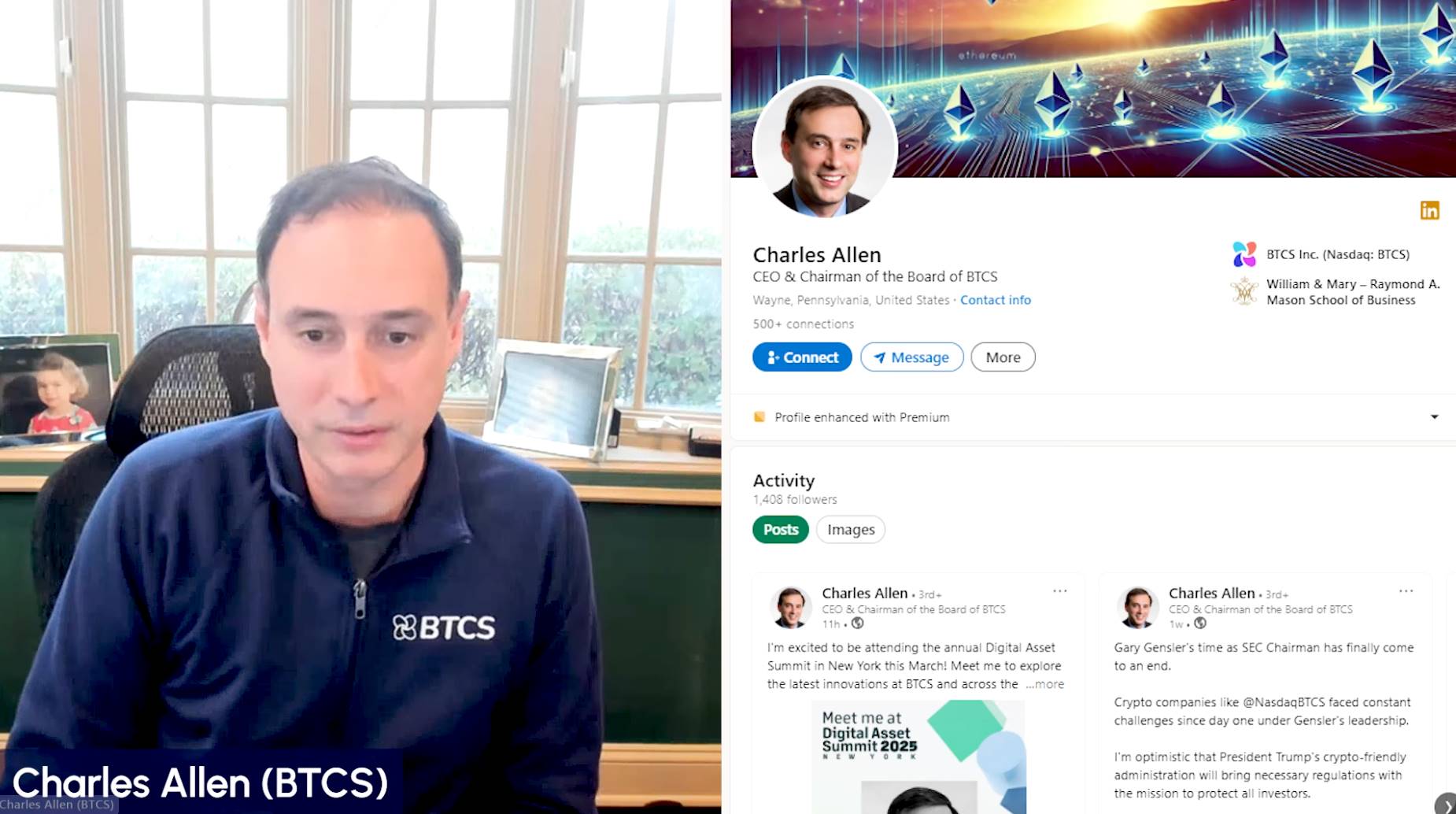

BTCS: 活用 AAVE 借贷购入 ETH

与前面三位比,BTCS 的 CEO Charles Allen 相对低调。

不过他也是位加密行业老兵,其区块链经验始于2011年比特币投资,2014年转向以太坊,2016年推动 BTCS 成为首家纳斯达克区块链企业。

2025年6月,他主导了 BTCS 通过 AAVE 借贷250万美元购入1000枚 ETH的行动,2025年7月计划融资1亿美元,资方也包括 ATW Partners 和 H.C. Wainwright,而前者是一家位于纽约的混合型风险投资/私募股权公司,既投资于债务,也投资于股权。

从这4家公司中我们可以看到的共性是:

每家公司都有与加密圈相关的核心人物,且不同公司的募资对象也有重叠。

加密基金、曾经投过以太坊的传统基金,也是 ETH 储备热潮的幕后推手;以太坊生态的资本网络触角广泛,或许也是以太坊网络本身强健性的另一个例证。

金钱永不眠。当 ETH 储备公司成为2025年的新Meme股,企业在转型中势必将造富一波人,目前来看,这场币股盛宴,仍未走到尽头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。