技术创新与代币价格毫无关联。

撰文:Pavel Paramonov,Hazeflow 创始人

编译:xiaozou,金色财经

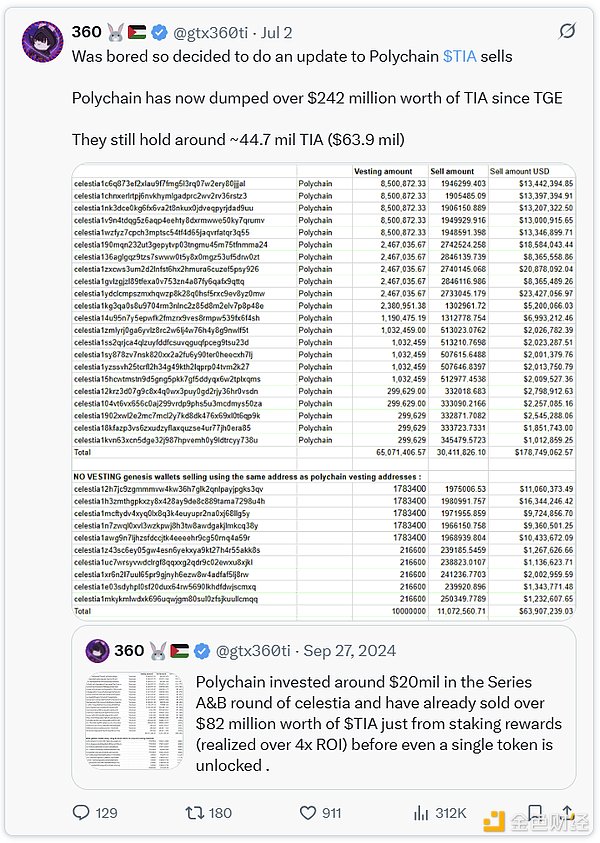

本文针对近期 Celestia 与 Polychain 的抛售事件展开分析——Polychain 抛售了价值 2.42 亿美元的 TIA。我认为这既是好事又是坏事,本文将深入探讨其中的原因,以及我们能从中吸取哪些经验教训。

1、难道你指望投资者不赚钱吗?

许多人(包括优秀的研究员)将此事描述为 Polychain 极具掠夺性和不确定性的行为。一家被视为一线基金的公司,怎能向公开市场抛售如此巨量持仓来冲击币价?

首先,Polychain 是风险投资基金,其职责就是从非流动性时期购入的资产中获利(难以置信我居然需要解释这个)。

Polychain 不仅承担了投资 Celestia 早期阶段的风险,还押注了「外部数据可用性层」这类当时全新的概念。这个理念在当时相当超前,许多人并不相信(尤其是那些「以太坊阵营」的人)。

想象一下在 2008 年有人发现了 Spotify,并相信大家会通过流媒体服务而非 CD 和 MP3 播放器听音乐,那么这个人肯定会被当成疯子。这就是当你不仅是行业新秀,而且还想在数据可用性吞吐量领域开拓新市场时的融资处境。

Polychain 的职责就是承担风险并获取回报,和其他人并无二致。创始人承担公司可能失败的风险,普通人每天做选择时也承担着特定风险。

我们都在做选择并承担风险,区别仅在于风险的性质和规模。

Polychain 并非唯一的投资方,还有其他多家风投基金参与。

有趣的是,没人指责他们,因为他们的交易数据更难追踪。

但仅凭 Polychain 的抛售并不足以造成如此剧烈的价格崩盘。必须指出,这种只针对 Polychain 的指责是不公平的,原因如下:

- 他们的职责就是承担风险并赚钱,而且做得相当出色。

- 他们并非唯一的抛售方,其他投资者也在行动。

这些操作对投资者有利吗?当然。

这些操作对社区道德吗?你懂的。

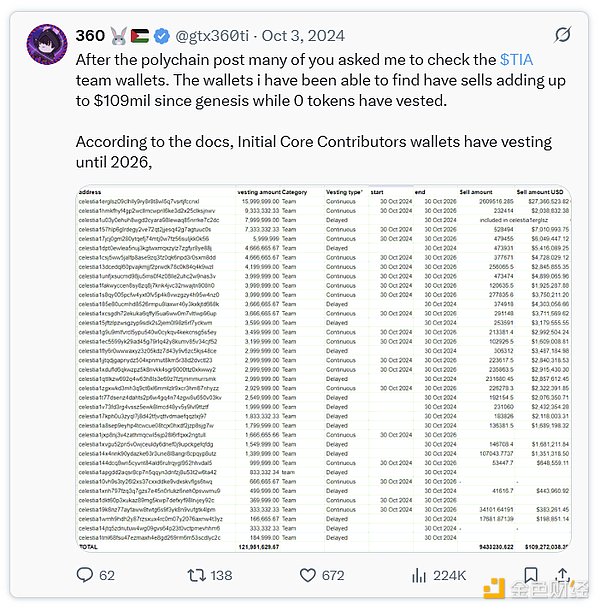

2、难道你指望团队不赚钱吗?

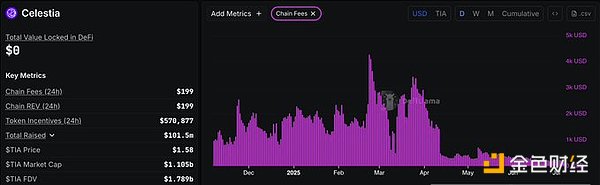

好吧,你可能确实这么想。加密领域存在一个严重的盈利性问题:大多数协议并不盈利,而且它们根本不考虑盈利。根据 DefiLlama 的数据,Celestia 目前每天仅赚取约 200 美元(相当于东欧一名高级软件工程师的日薪),同时却发放约 57 万美元的代币激励。

这只是团队链上的盈亏数据,我们对其链外盈亏一无所知,但我相信如此规模的团队运营成本也相当高昂。如今,确实有一些 KOL 正儿八经地宣称:「Web3 协议应该盈利,企业应该赚钱。」我们居然把这种观点当回事,是不是疯了?

是的,我们确实疯了,但核心问题不在于商业模式。关键在于团队将代币销售视为利润,并围绕此构建商业模式,却从未考虑后果。如果代币销售就等于商业模式,那还有什么必要考虑商业模式和现金流呢?没错吧?但问题是,投资者的钱不是无限的,代币也不是。

与此同时,风险投资本就是押注具有巨大成功潜力的初创公司。许多公司并不盈利,但它们可能带来足够革命性或有趣的东西,吸引他人探索并发展这一理念。

不管怎样,你总不会指望核心团队永不抛售吧?事实是:当你的协议不赚钱时,总得从别处搞钱。基金会不得不出售部分代币来支付基础设施、工资和一大堆其他开支。

至少,支付运营费用是我愿意相信的抛售理由之一。当然也可能存在其他原因和不同视角:一方面,他们「砸盘」伤害了社区;另一方面,他们毕竟构建了这个协议并营造了市场热度,或许他们至少有权出售部分代币?注意是部分,而非全部。

归根结底,这是代币 / 股权问题的体现,也是加密风投不太喜欢股权的原因。相比私募或等待退出,公开市场抛售更便捷,时间周期也更短。

3、代币经济学不是核心问题,代币本身才是

显然,投资者越来越倾向于代币投资而非股权。我们身处数字资产时代,投资数字资产不是理所当然吗?

但这种趋势并不像表面那么简单。有趣的是,许多创始人自己也意识到他们的产品可能并不真正需要代币,他们更倾向于通过股权融资。尽管如此,他们仍面临两大挑战:

- 正如我之前所说,大多数加密原生风投不喜欢股权(退出难度更大)。

- 股权估值通常低于代币估值,而人们总想融更多钱。

这种情况不仅造成两难,更是直接激励团队选择代币模型。代币发行能吸引更多投资者,因为它提供了明确的公开市场退出路径,从而更容易融资。对团队而言,这意味着更高估值和更多开发资金。

你公司的核心股权价值不受影响。你可以保留 100% 股权,同时通过这些「人造」代币筹集大量资金。这种方式还能吸引专门寻找代币投资机会的更广泛投资者群体。

遗憾的是,在当前环境下 99% 的情况下,代币模型让散户变穷、让风投变富。或者正如 Yash 所说的:基础设施 / 治理代币不过是穿西装的 Meme 币。

然而当 TIA 上线时,它确实给散户带来了丰厚回报——从 2 美元涨到 20 美元。人们当时感谢团队让他们致富,还质押代币获取各种空投。是啊,我们有过那段时光,那是 2023 年的秋天......

当价格开始下跌后,人们突然开始散布大量关于 Celestia 的恐慌情绪:传言团队行为异常、代币经济学具有掠夺性、嘲笑链上收入等等。

发现问题并指出是好事,但如果仅仅因为价格走势,那些曾经称赞 Celestia 的人现在就把其视为「垃圾场」,那就太糟糕了。

4、我们能从中得出什么结论?

风投机构几乎不会与你为友。他们的核心业务是赚钱,你的核心业务是赚钱,风投 LP 的核心利益也是赚钱。

不要因为风投抛售就指责他们:他们的代币已解锁,对自己的资产拥有完全所有权,自然可以自由处置。

真正该指责的是那些一边抛售、一边在推特上唱多代币的风投:这是欺骗行为,绝不应被容忍。

商业模式不应只围绕代币销售设计。要么想出盈利模式,要么用顶尖技术保持非盈利状态——只要做得好,市场自会买单。

代币经济学对所有人公开透明:如果团队代币已解锁,他们当然拥有资产完全处置权。但如果你真是项目的坚定信仰者,大规模抛售就值得商榷了。

股权投资不太受青睐,某些代币估值存在水分且缺乏指标支撑。

团队应在最早阶段就高度重视代币经济学设计,否则未来可能付出沉重代价。

技术创新与代币价格毫无关联。

当 K 线上涨时,皆大欢喜;当 K 线下跌时,问题尽显。如果同一批人前脚还在歌颂项目,后脚就大肆诋毁,那才是真正的悲哀。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。