Recently, a little-known Web3 fund, Aqua1, announced a strategic purchase of $100 million in governance tokens for the Trump family project, World Liberty Financial (abbreviated as "WLFI").

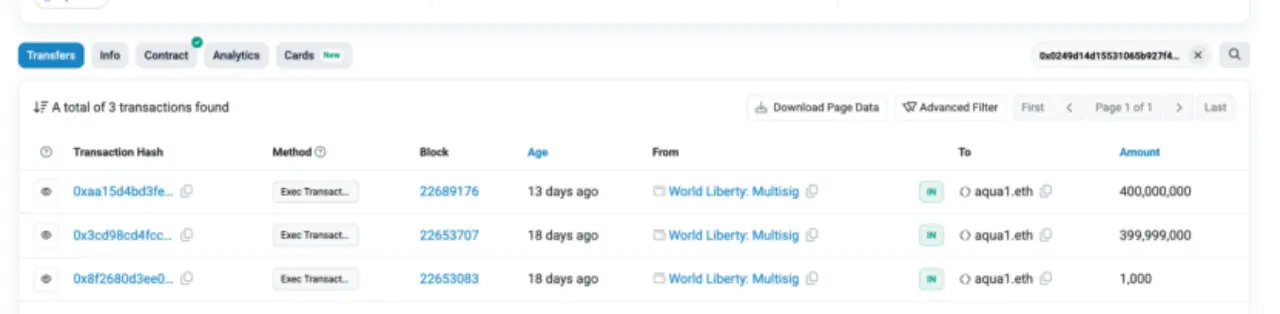

Two weeks before the announcement, on-chain data had already captured clues: an ENS address named "aqua1.eth" had cumulatively spent $80 million to purchase at least 800 million WLFI tokens in batches. However, the remaining $20 million of this $100 million subscription has yet to be linked to a discovered subscription address.

This fund is quite mysterious, having registered its official domain name only on May 28. Current public information shows that Aqua1 is headquartered in the UAE and focuses on primary market investments and secondary asset management in the Web3 space.

After investing in WLFI, Aqua1 will also collaborate with WLFI to develop and incubate the institutional-level RWA platform BlockRock and plans to establish another fund, Aqua Fund, in the Middle East.

With an initial investment of over $100 million in the Trump family project, who exactly is Aqua1? What secret connections does it have with the Trump family?

_Image source: _Reuters

_Image source: _Reuters

Founder Dave Lee: A Possible South American Chinese Tycoon

According to insiders close to Aqua1, the founder and general partner, Dave Lee, has a significant background.

Dave Lee graduated from New York University's Stern School of Business and has worked at well-known Wall Street institutions such as UBS Group and Tiger Global, possessing nearly a decade of experience in traditional investment banking and cross-border merger and acquisition funds, familiar with the operational logic of global capital markets and strategic investment layouts.

In addition to his Wall Street background, it is less known that Dave Lee has a South American tycoon background. He hails from a prominent Chinese-Brazilian business family, with family enterprises spanning key sectors such as import-export trade, mining, real estate, energy, and sports entertainment, wielding considerable influence. Reports suggest he has close ties with certain powerful royal family members in the Middle East, and both parties may be brewing a series of strategic collaborations.

Despite his deep background, Dave Lee rarely discusses family matters publicly, leaving many mysteries about his business layout. Insiders reveal that his investment moves often carry long-term strategic intentions and frequently align with subtle changes in international capital flows. Some analysts believe that the resource network behind him may far exceed what is visible on the surface, potentially leading to more secretive and far-reaching operations in key global markets in the future.

Aqua1's first investment in WLFI, achieving a strategic partnership, may not be coincidental, as it is backed by a professional team that has been deeply engaged in the Web3 field for a decade, accumulating rich experience in key technical areas such as distributed system development and cryptoeconomics design, while also possessing capital backgrounds and industrial resources spanning South America and North America.

A $100 Million Bet Aimed at the Trillion-Dollar RWA Market?

Aqua1's $100 million strategic cooperation with the Trump family project WLFI may not simply be a financial investment but rather a key move by Aqua1 in the Web3 field, especially in the RWA direction.

From Aqua1's announced investment news, it can be seen that the purpose of this investment is to accelerate the construction of a financial ecosystem centered on blockchain development, RWA tokenization, and stablecoin integration. With the imminent passage of the U.S. "GENIUS Stablecoin Act," RWA, stablecoins, and crypto payments are the core tracks this year and are also key directions for Aqua1's bets.

As a project supported and participated in by Trump and his family members, WLFI's Web3 layout directly targets RWA and stablecoins, aiming to merge the stability of traditional finance with the openness of blockchain, striving to become a bridge between traditional finance and the future digital world.

Currently, WLFI has launched the digital dollar stablecoin USD1, which is the first stablecoin endorsed by a president, with a market value exceeding $2.2 billion. The political background of USD1 also helps it become one of the most notable and promising stablecoins after USDT and USDC.

In terms of adoption, USD1 has already been adopted by nearly 20 CEX or DeFi protocols and crypto wallets. USD1 is gradually penetrating real-world consumption and payment scenarios, with WLFI launching a global debit card supporting USD1, and AEON Pay has integrated USD1, allowing payment with USD1 at over 20 million offline merchants in Southeast Asia.

For Aqua1, which has multiple traditional industry resources in South America, the importance of riding the Trump family's RWA express train is more significant than the $100 million financial investment, as it rapidly opens the market for the tokenization of its traditional industry resources.

For WLFI, the Aqua1 team can also assist WLFI in expanding into South America, Europe, Asia, and emerging markets.

Currently, Aqua1 and WLFI plan to jointly develop and incubate the RWA platform BlockRock, but no further detailed information has been released. However, it can be expected that Aqua1 and WLFI's commercial landscape in traditional fields, along with the political forces behind them, will provide natural advantages for BlockRock's compliance and growth.

Strategic Ambitions Behind Betting on the Trump Family Project

On the surface, Aqua1's first investment in WLFI aims to expand RWA, but its strategic ambitions may go far beyond that. The vision behind Aqua1 seems to point towards integrating resources from the Middle East, South America, and North America, attempting to build a cross-regional Web3 ecological network.

From Aqua1's naming and the future plans announced by its team, it appears that Aqua1 may just be a future branch of the group behind it.

According to the press release, WLFI will also assist the Aqua1 team in establishing another fund, "Aqua Fund," in the Middle East. This fund will collaborate with core interest groups in the Middle East to accelerate the digital economic transformation through blockchain infrastructure, AI integration, and Web3 applications, and it also plans to list on secondary trading markets such as the Abu Dhabi Global Market (ADGM) to provide liquidity for investors.

The reason Aqua1 was able to smoothly invest in WLFI may also be based on the cooperative foundation previously built between the group behind it and the Trump family in traditional business fields. By investing in WLFI, Aqua1 quickly forms a strategic alliance with the presidential family in the Web3 chess game.

Aqua1's foundation in South America and emerging markets, along with the Trump family's business and political influence in North America and globally, creates a resource complementarity for both parties' layouts in the Web3 field.

By integrating financial innovation from the Middle East, resource networks from South America, and market influence from North America, Aqua1 and WLFI may be joining forces to create a global Web3 financial ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。