撰文:Musol,Foresight News

7 月,美国劳工部公布的 6 月非农就业数据让全球市场预期落空——新增就业 14.7 万人,远超预期的 11 万人,失业率降至 4.1%。这一数据直接浇灭了市场对 7 月美联储降息的预期,但令人费解的是,比特币却在数据公布前后均出现大涨行情。这反常现象背后,究竟隐藏着怎样的市场逻辑?无论是传统市场或是加密市场,为什么非农都在市场的合奏中扮演着打响前奏的角色?

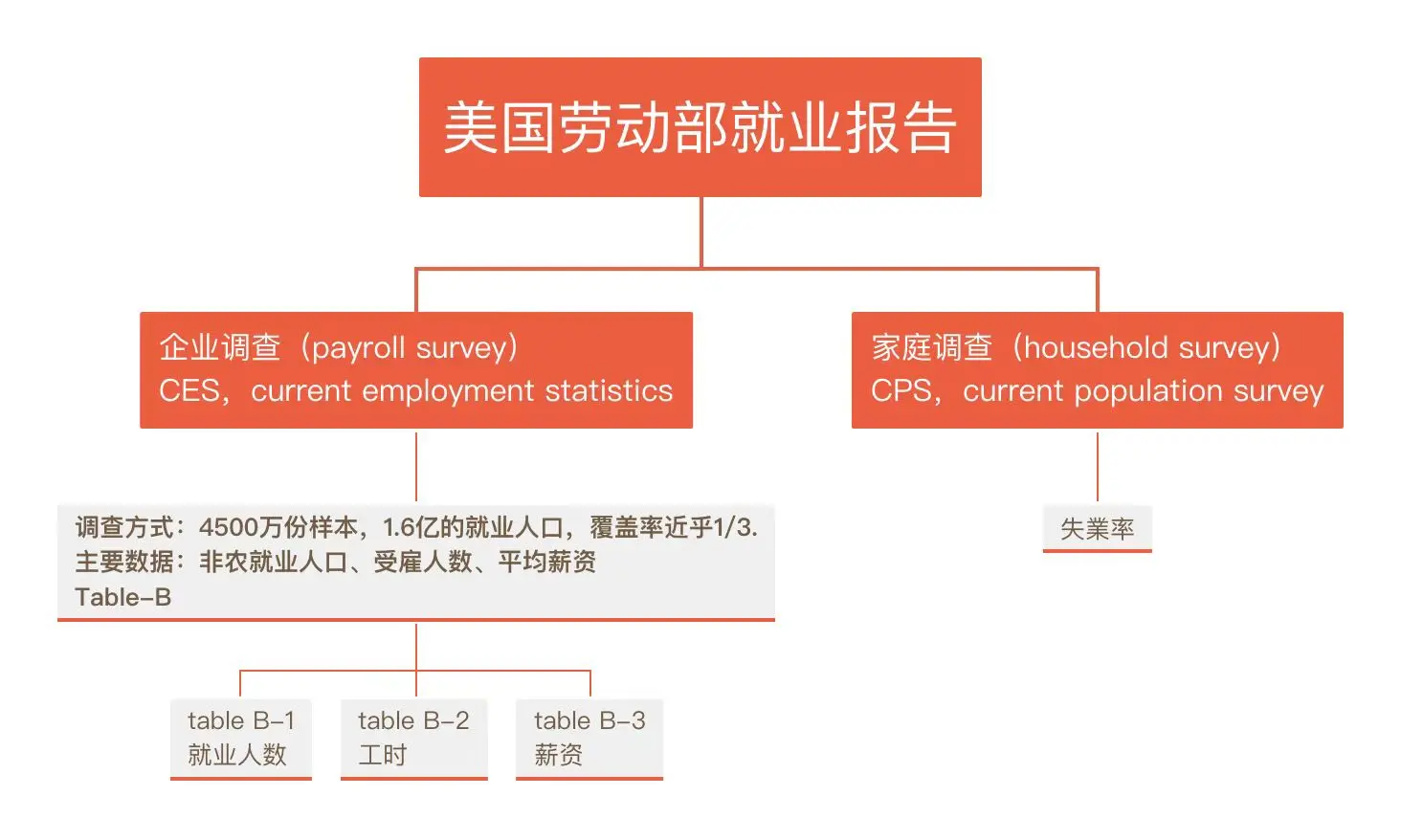

什么是非农数据?

「非农」是指就业人数中排除了农业部门,个体户和非盈利机构雇员后的就业相关数据,基本能反映美国经济的实际就业和经济情况。由美国劳工部劳动统计局公布——公布时间每月第一个周五,美国发布时间分别是东部时间上午 8 点 30 分(夏令时)和 9 点 30 分(冬令时),对应的北京时间分别为 20:30 和 21:30。

简而言之,非农数据就是美国非农业就业人口的月度变化数据,包括就业人数、失业率等。

它就像金融界的 「天气预报」,能让我们提前感知经济的 「阴晴冷暖」。

何出此言?就业可以理解为经济的 「晴雨表」,当就业形势好时,大家便都有工作,口袋里有钱,消费就会增加,经济自然而然就会繁荣起来;反之,就业不好,大家都需要勒紧裤腰带过日子,经济就恰似 「感冒」了一般。

在股票市场,当非农数据表现强劲时,企业盈利预期增加,股票价格往往会上涨,投资者们就像 「打了胜仗的将军」,不得开心颜;而在债券市场,强劲的非农数据可能会导致债券价格下跌,因为市场预期利率会上升。这就好比一场金融市场的 「大戏」,非农数据就是那个关键的 「Director」,掌控着剧情的走向。

PS:

1.什么是小非农数据——小非农是由 Automatic Data Processing( 美国自动数据处理公司,简称 ADP) 发布的私营部门非农数据。他们发布的就业人数比较权威。ADP 全美就业报告由 ADP 赞助,Macroeconomic Advisers 公司负责制定和维护。小非农数据每月公布一次,一般在每个月第一个星期三公布。这个数据在(冬令时:11 月 --3 月)21:15 和(夏令时:4 月 --10 月)20:15 公布。通常而言小非农对非农数据有一定的预示作用。

2.大非农和小非农之间的区别——第一,小非农主要是私营部门的非农数据,大非农是由全美所有的行业的统计。第二,小非农是在非农数据公布的前两天公布的,对非农数据有预示作用,一般情况下,小非农的数据和大非农的数据相差不会很大的。大家都是根据小非农的数据来预测大非农数据的。

非农数据凭何作为前奏?

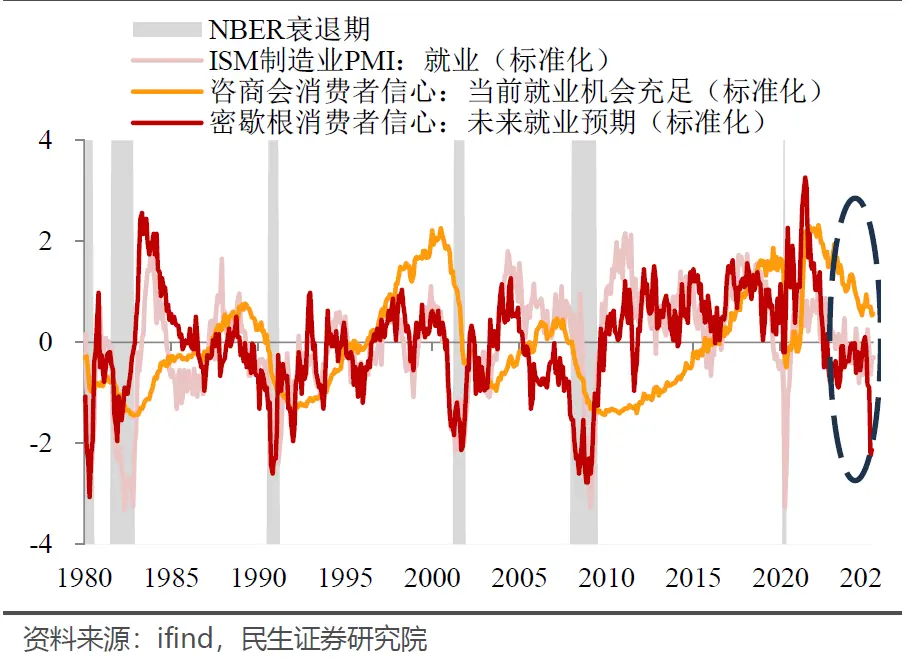

非农就业数据是判断经济周期的重要指标

衰退的定义:工业产出、就业、实际工资等经济活动持续几个月增速放缓,从周期上看,经济处于波峰到波谷之间。

从这里可以看出,判断经济是扩张还是收缩的关键在于对经济月度数据的观测。由于工业产出数据通常按季度公布,时效性较弱,因此能够衡量整体就业情况的月度数据——非农就业数据,便成为判断经济周期性的最重要指标。

举例来讲,若经济已持续衰退 6 个月,但非农数据显示就业已恢复并超过前期低点,那么从经济周期角度看,经济已发生反转,前期低点即为波谷,未来经济很可能持续向好,这将极大提振市场信心。

非农就业数据与经济表现高度相关

从最简单的经济学基本常识来看,非农数据向好意味着经济向好。

非农行业产出占美国总产出的 80%,非农业就业人数增加表明企业生产正在扩张,愿意雇佣更多工人。这些新就业者将拥有更多资金用于支出和消费。美国经济增长主要靠内需拉动,消费占美国 GDP 的比重高达 70%,因此消费支出增加直接反映了美国经济的整体好转。

由此可见,非农数据是预测经济增长和 CPI 水平的关键指标。

市场各方将非农数据作为经济预测的基础

非农数据是经济建模过程中最重要的参数。

美联储参考非农数据来决定未来的利率政策,机构投资者依据它来调整持仓方向和规模,经济学家和分析师则通过这些数据预测未来经济走势。作为关键经济指标,非农数据是各方决策时的核心输入变量,堪称市场风向标。每当实际非农数据公布时,便会敲响前奏,牵动市场神经,其预期值与实际值之间的差异会产生市场放大效应——差异越大,放大效应越强,甚至可能引发资本市场的剧烈波动。

非农数据的影响何在?

For 美元汇率——当非农就业人数增加,表明美国经济强劲,通常会导致美元升值;相反,就业人数减少则可能引发美元贬值。

For 美联储货币政策——非农数据良好,美联储可能会考虑加息以抑制通胀;反之,如果数据不佳,美联储可能会维持低利率以刺激经济。

For 全球股市——良好的非农数据通常会提振投资者信心,推动全球股市上涨;而糟糕的数据则可能导致股市下跌。

For 债券市场——当非农数据表现出色时,市场对经济的乐观预期会导致债券收益率上升,债券价格下跌;较差的非农数据可能导致债券收益率下降,债券价格上涨。

For 外汇市场——外汇市场对非农数据反应十分敏感。美元通常会在非农数据强劲时走强,而在数据不佳时走弱。

For 商品期货市场——非农数据的变动会影响以美元计价的商品期货价格,如黄金、原油等。美元走强通常会压低黄金价格,因为黄金以美元计价,美元升值使得黄金对持有其他货币的投资者来说更加昂贵。

For 市场情绪——当数据发布后,市场情绪波动加剧,投资者对未来经济走势和货币政策走向的预期很可能会产生分歧。

For 资金流向——非农数据的变化可能引发全球资金流向的调整,从而对 A 股市场产生影响。非农数据强劲可能增强全球投资者对美元资产的信心,导致部分资金从新兴市场回流至美国市场。

七月,非农数据下的加密市场为何存在悖论?

通常来讲,强劲的非农数据会强化美联储加息预期(至少不会是降息),导致风险资产承压。

但比特币当晚的表现恰似那整齐划一的音符中不和谐的变调:数据公布前 24 小时涨幅达 1.1%,而在降息预期落空后,比特币不仅未回调,反而继续攀升突破 11 万美元大关。

这种看似矛盾的走势,实则揭示了加密市场与传统金融市场的认知差异。

有部分专业机构分析指出,比特币在数据公布前上涨,部分源于市场对疲软数据的押注。由于贸易政策的反复无常,近期许多行业雇主持观望态度,不敢增加招聘人数。因此,不少交易员预期非农可能表现不佳,提前布局避险资产。

然而,这种解释无法回答一个关键问题——为何在数据远超预期后,比特币演奏出了属于自己的和弦乐?

深入剖析不难发现,比特币的逆势上涨,是存在一定的市场逻辑的:

首先,非农数据纵使强劲,但细分领域显示增长集中于专业化服务和金融业,而医疗保健、贸易等实体经济部门持续萎缩,这种结构性矛盾让市场对经济真实性存疑。尤其是近年来各种数据多次大幅度的修正,各项数据的公布,好像是在为其他政治目的作掩护。数据的公信力正在被逐渐消磨。

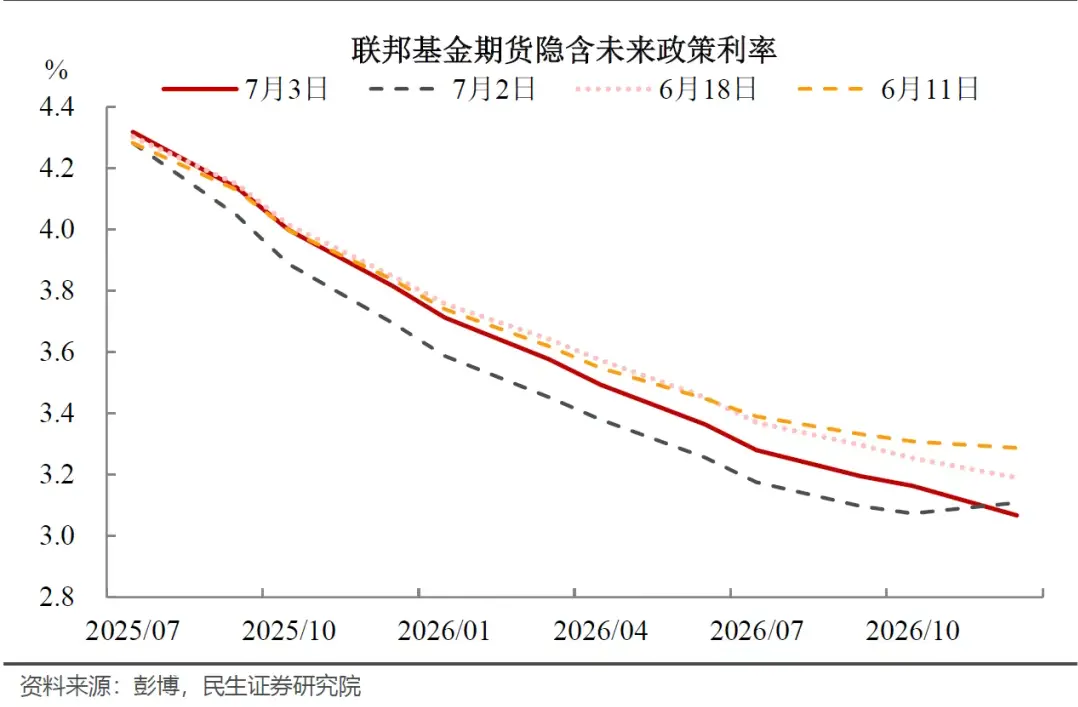

其次,美联储上周声明中「如果劳动力市场明显走弱,可能会比预期更早降息」的措辞转变,已被市场解读为长期宽松基调未改,单月数据难以扭转这一预期。毕竟,几十万亿的美国国债,一年的利息已经快赶上美国军费支出,降息大趋势已经很难改变。

最具决定性的因素是,大量机构投资者正将比特币视为「数字黄金」来对冲美元信用风险。从风险资产到数字黄金的转变,比特币已经逐渐成为主流经济体青睐的「避险资产」,近一段时间的资产表现,仿佛无论是「好消息」还是「坏消息」总能转化为比特币再次冲高的理由。价格波动小,受负面消息影响恢复快,流动性一直都很好,对于比特币市场已经逐渐形成上述共识。

数据显示,在非农公布后 1 小时内,比特币现货 ETF 净流入达 2.3 亿美元,证明传统资本正在重构资产配置逻辑。当市场既不相信美联储会一直维持眼下的高利率,又担忧经济结构性问题时,比特币就成为流动性最好的避风港。

对于存在分歧较大的市场消息时,把钱交付于比特币,或许已然成为了一个不错的选择。

刻非农求 BTC?“刻舟求剑”或许不再

回望 2024 年 12 月非农数据公布时的市场反应,同样出现类似现象——当时新增就业 25.6 万个远超预期,比特币却在随后一周上涨 12%。这种「好消息即坏消息,坏消息即好消息」的反常关联,反映出加密市场已然形成独立定价逻辑。

美联储货币政策传导机制正在发生着微妙变化。对比今年 7 月的预期(如图),去年 12 月非农的强劲却导致「全年维持利率不变」预期升温,正是因为市场洞察到就业增长与生产率提升不同步的结构性矛盾。

明明觉得已经很糟糕的现状,但是在数据层面却表现得异常强韧,这就让人们不得不怀疑数据的可信度。

当前比特币的强势,本质上是对美联储政策可信度的投票——当市场认为央行在通胀与增长间陷入两难时,去中心化资产自然获得溢价。

归根结底,是人们已经不信任美联储这类传统的金融机构。毕竟,人为不是不可以操控的。

当十年期美债收益率逼近 5% 却仍难阻资金外流,市场正在用真金白银重构一套超越主权货币的定价体系。

在美元体系信用边际递减的背景下,加密货币已然发生了从风险资产到另类储备资产的转变。

花非花,雾非雾。夜半来,天明去。来如春梦不多时?去似朝云无觅处。

推荐阅读:

OpenAI “打假” Robinhood:揭秘股票代币化背后的四大争议

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。