撰文:Will Owens,Galaxy

编译:AididiaoJP,Foresight News

将比特币纳入资产负债表的公司,已成为 2025 年公开市场最受关注的叙事之一。尽管投资者已有多种直接获取比特币敞口的途径(ETF、现货比特币、封装比特币、期货合约等),许多人仍选择通过购买股价较比特币净资产值 (NAV) 存在显著溢价的比特币储备公司股票来获取比特币风险敞口。

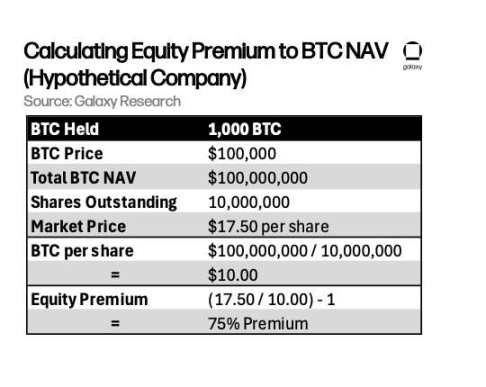

这种溢价是指公司股价与其每股比特币持有价值之间的差额。例如若某公司持有价值 1 亿美元的比特币,流通股为 1000 万股,则其每股比特币 NAV 为 10 美元。若股价为 17.5 美元,则溢价率为 75%。在此语境下,mNAV(即净资产值倍数)反映股价是比特币 NAV 的多少倍,而溢价率即为 mNAV 减 1 后的百分比。

普通投资者或许会疑惑:为何这类公司的估值能远超其比特币资产本身?

杠杆效应与资本获取能力

比特币储备公司股价较其比特币资产存在溢价的最重要原因,或许在于它们能通过公开资本市场进行杠杆操作。这些公司可通过发行债券和股票筹集资金以增持比特币。本质上,它们充当了比特币的高β代理工具,放大了比特币对市场波动的敏感性。

这一策略中最常用且最有效的手段是「按市价发行」(ATM) 股票增发计划。该机制允许公司以现行股价逐步增发股票,且对市场冲击极小。当股价较比特币 NAV 存在溢价时,通过 ATM 计划募集的每 1 美元所能购买的比特币数量,将超过因增发导致的每股比特币持有量稀释。这就形成了一个「每股比特币持有量增值循环」,不断放大比特币敞口。

Strategy(前身为 MicroStrategy)是这一策略的最佳案例。自 2020 年起,该公司通过可转债发行和二次股权募资筹集了数十亿美元。截至 6 月 30 日,Strategy 持有 597,325 枚比特币(约占流通量的 2.84%)。

这类融资工具仅适用于上市公司,使它们能持续增持比特币。这不仅放大了比特币敞口,还形成了复合叙事效应,每次成功募资与比特币增持,都强化了投资者对该模式的信心。因此,购买 MSTR 股票的投资者不仅是在买入比特币,更是在买入「未来持续增持比特币的能力」。

溢价幅度有多大?

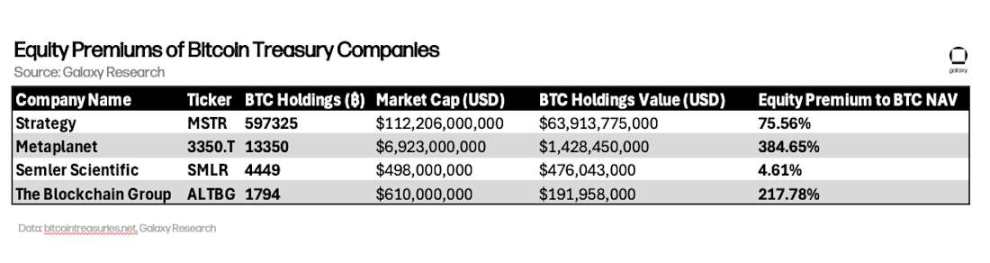

下表对比了部分比特币储备公司的溢价情况。Strategy 是全球持有比特币最多的上市公司,也是该领域最知名代表。Metaplanet 是最激进的比特币增持者(后文将详述其透明度优势)。Semler Scientific 较早涉足这一趋势,去年便开始购入比特币。而法国的 The Blockchain Group 则表明这一趋势正从美国向全球蔓延。

部分比特币储备公司的 NAV 溢价率(截至 6 月 30 日;假设比特币价格 107,000 美元):

尽管 Strategy 的溢价率相对温和(约 75%),但 The Blockchain Group(217%)和 Metaplanet(384%)等小型公司的溢价率显著更高。这些估值表明,市场定价已不仅反映比特币本身的增长潜力,还包含了资本市场准入能力、投机空间和叙事价值的综合考量。

比特币收益率:溢价背后的关键指标

驱动这些公司股票溢价的核心指标之一是「比特币收益率」。该指标衡量公司在特定时间段内每股比特币持有量的增长,反映其在不造成过度股权稀释的前提下,利用募资能力增持比特币的效率。其中 Metaplanet 以透明度见长,其官网提供[实时比特币数据看板],动态更新比特币持仓、每股比特币持有量及比特币收益率。

来源:Metaplanet Analytics (https://metaplanet.jp/en/analytics)

Metaplanet 公开了储备金证明,而同行其他公司尚未采纳这一做法。例如 Strategy 未采用任何链上验证机制证明其比特币持仓。在拉斯维加斯「比特币 2025」大会上,[执行主席 Michael Saylor 明确反对]公开储备证明,称此举会因安全风险成为「糟糕的主意」:「这会削弱发行人、托管方、交易所和投资者的安全性」。这一观点存在争议,链上储备证明只需公开公钥或地址,而非私钥或签名数据。由于比特币的安全模型基于「公钥可安全共享」的原则,公开钱包地址并不会危及资产安全(这正是比特币网络的特性)。链上储备证明为投资者提供了直接验证公司比特币持仓真实性的途径。

若溢价消失会怎样?

比特币储备公司的高估值至今存在于比特币价格上涨、散户热情高涨的牛市环境中。尚未有任何比特币储备公司股价长期低于 NAV。这一商业模式的前提是溢价持续存在。正如[VanEck 分析师 Matthew Sigel 指出]:「当股价跌至 NAV 时,股权稀释将不再具有战略意义,而变成价值榨取。」这句话直指该模式的核心脆弱性,ATM 股票增发计划(这些公司的资本引擎)本质上依赖股价溢价。当股价高于每股比特币价值时,股权募资能实现每股比特币持有量的增值;但当股价跌至 NAV 附近时,股权稀释将削弱而非增强股东的比特币敞口。

该模式依赖一个自我强化的循环:

-

股价溢价支持募资能力

-

募资用于增持比特币

-

比特币增持强化公司叙事

-

叙事价值维持股价溢价

若溢价消失,循环将被打破:融资成本上升,比特币增持放缓,叙事价值弱化。当前比特币储备公司仍享有资本市场准入优势和投资者热情,但其未来发展将取决于财务纪律、透明度以及「提升每股比特币持有量」(而非单纯堆砌比特币总量)的能力。在牛市中赋予这些股票吸引力的「期权价值」,可能在熊市中迅速转化为负担。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。