Last night, Robinhood's product launch event in Cannes was quite the spectacle. Dramatically, this Gen Z Silicon Valley brokerage, which started with a "retail-friendly" core philosophy, decorated the event with a plethora of "old money aesthetic" visual elements. This stark contrast in imagery quickly sparked heated discussions.

Related Reading: "Robinhood's High-Profile Product Launch in Cannes This Summer Ignites the On-Chain Brokerage Competition"

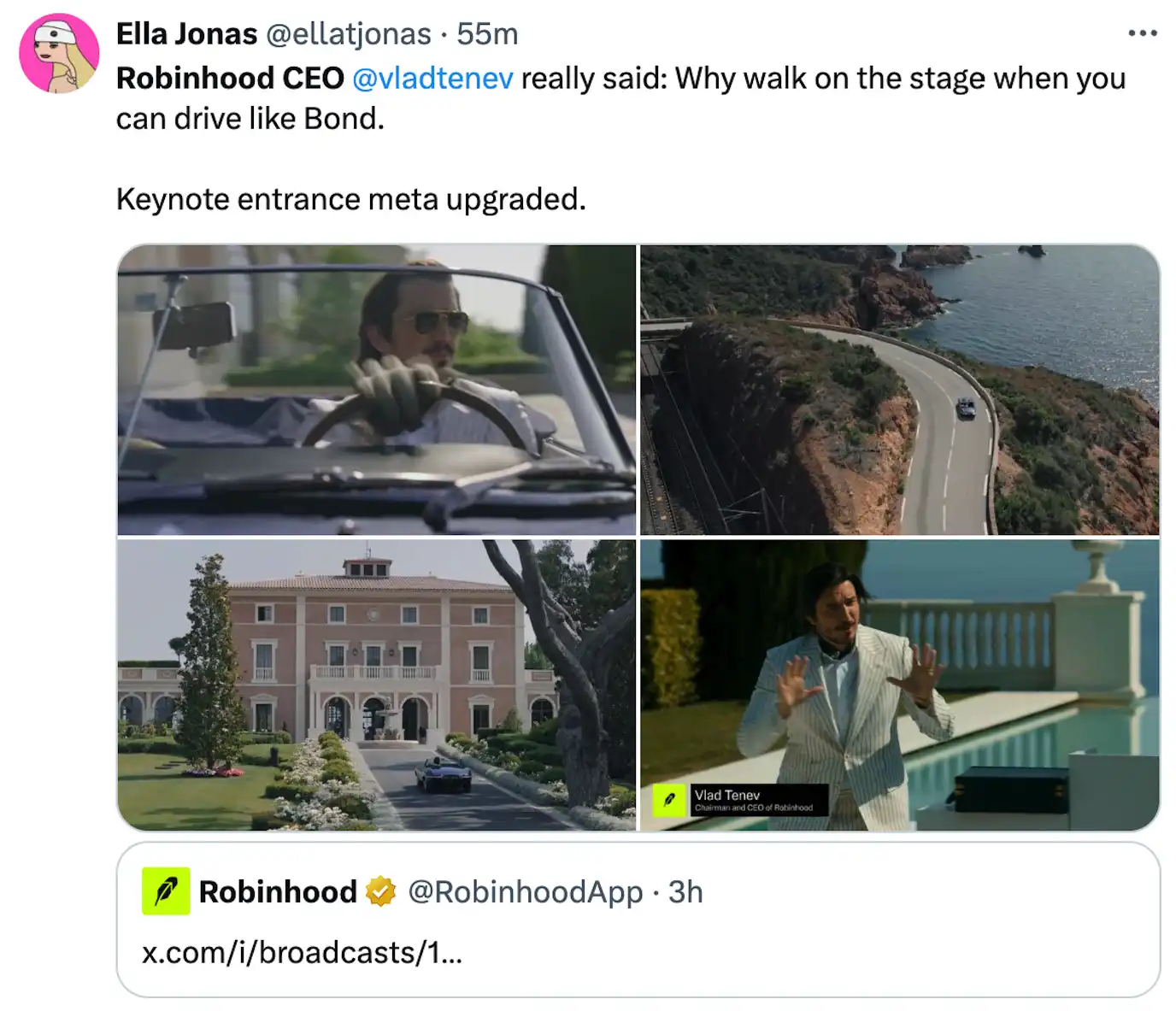

At the beginning of the event, a shiny antique convertible drove along the winding mountain road into the Château de la Croix des Gardes estate. At Robinhood's latest launch in Cannes, guests donned elegant gentleman attire, as if they were at a private dinner for the wealthy from the mid-20th century. This was no coincidence. The event, titled "To Catch a Token," pays homage to Alfred Hitchcock's classic 1955 film "To Catch a Thief."

"To Catch a Thief" was filmed at the famous Château de la Croix des Gardes estate in Cannes. Historically, the French Riviera, where Cannes is located, has been a playground for the "old money" class in Europe: British aristocrats built villas here in the 19th century (such as the Rothschild estate), and Hollywood stars and royalty frequently visited in the 20th century. The Château de la Croix des Gardes estate is a landmark mansion in the area and has been immortalized by the film "To Catch a Thief," becoming a sought-after vacation spot for the upper class.

By choosing the same location for the launch and employing similar visual elements, Robinhood clearly intended to leverage the film's ambiance, cleverly placing its innovative fintech products within the narrative of "a global plan brewing in the shadows of traditional wealth." On one hand, the symbols of "old money" (antique cars, castles, tuxedos, gold watches) represent a long-standing tradition of wealth and status, creating a tone of stability and trustworthiness; on the other hand, the products launched at the event were cutting-edge offerings like cryptocurrencies and on-chain stocks.

This fintech feast staged in the "old money sanctuary" conveys the story the brand wants to tell: behind the old world of wealth, a "thief" of financial futures is quietly at work. It also embodies Robinhood's consistent mission—"to steal wealth opportunities that were once only available to the rich and hand them to the public."

From Rogue to Noble: Robinhood's Transformation of 'Old Money'

At the end of "To Catch a Thief," the protagonist transforms from a rogue to a hero, collaborating with the police and ultimately joining the nobility. This transformation mirrors the message Robinhood has been conveying through its recent brand visuals and product upgrades.

Young and Grassroots

In its early days, Robinhood was perceived as a disruptive startup: zero-commission trading, colorful confetti animations celebrating successful trades, and an emphasis on "making stock trading easy for young novices." The brand's tone leaned towards youthfulness, grassroots appeal, and internet culture. However, as the business has evolved, the user demographics and needs of Robinhood have quietly changed.

According to analysis, by the third quarter of 2024, the average assets of new users on Robinhood have surged to about $100,000, nearing the core customer base of traditional brokerage giant Charles Schwab. This indicates that many wealthier, more serious investors are beginning to enter the Robinhood platform. Their needs extend far beyond "one-click trading"; they expect more comprehensive and professional financial services.

Subtle Luxury

In Robinhood's new visual system, the previous cartoonish color palette has been abandoned in favor of black, white, and neutral tones with a refined design style. This "Quiet Luxury" aesthetic aligns perfectly with the understated elegance of the "old money" class. Marketing Vice President Michael Goodbody pointed out that the company's new visuals are "an external reflection of business maturity and growth," aimed at creating a modern, elegant image that welcomes more serious investors and positions itself as a reliable home for future generations of investors. It is evident that Robinhood is no longer content with being just a beginner's trading app for young people; it aims to establish a sense of trust and authority similar to that of traditional brokerages.

This shift is also reflected in Robinhood's recent product strategy. The company has begun to offer high-end user services, such as lower margin loan rates, cash management features, retirement accounts, and advanced analytical tools, even issuing a gold co-branded credit card for high-end clients. These initiatives essentially align Robinhood more closely with the comprehensive wealth management models of traditional brokerages. Robinhood previously described the differences between two types of investors as "poor people borrowing money to trade stocks, and rich people managing assets." Now, Robinhood clearly aims to break this stereotype, positioning itself as a comprehensive investment platform that caters to both the poor and the rich.

From Rogue to Hero, "the once unruly newcomer in the financial industry must ultimately grow into a stable and seasoned elder." The visual style of Robinhood's launch event, infused with the aura of old nobility, is a declaration to the outside world: we are no longer just a playground for young retail investors; we are now capable of serving high-net-worth clients, a trustworthy and more mature financial platform.

Who Does the 'Noble' Narrative of Crypto Target?

The "old money" visual narrative employed at Robinhood's launch cleverly tells different layers of stories to various audiences:

Crypto Users in Europe and America

First and foremost, this launch event essentially introduced a series of crypto products (on-chain stock tokens, L2 blockchain, perpetual contracts, etc.). Crypto enthusiasts and professionals in Europe and America are the primary audience.

For this group, Robinhood aims to convey two messages: first, that traditional finance and the crypto world are merging, and Robinhood is playing a bridging role at the intersection; second, that Robinhood offers high-end, trustworthy crypto services, rather than a speculative platform akin to the wild west. After all, following the recent tumultuous fluctuations and regulatory storms in the crypto market, crypto users are increasingly prioritizing the security and compliance of the platforms they use.

By presenting itself with a solemn old-fashioned image, Robinhood can instill more confidence in these users. "We understand both the trends of Crypto and the rules of traditional finance," emphasized Robinhood President Vlad Tenev at the start of the event.

Additionally, the choice of Cannes as the event location echoes Robinhood's international expansion strategy. In recent years, Robinhood has been seeking to expand beyond the U.S., particularly into Europe. The content of this launch event focused on the European market (such as launching on-chain U.S. stock tokens in 30 European countries and introducing crypto perpetual contracts in the EU), hosted by its EU subsidiary. Holding a high-profile event in France, a European country, signifies Robinhood's commitment and importance to the European market.

This stands in stark contrast to its 2019 announcement of entering the UK, which was later postponed due to various reasons, preventing Robinhood from launching its UK operations as planned. Now, by entering the European market through crypto services, Robinhood needs to demonstrate its sincerity and strength to European users and regulators. In the EU financial landscape, London and New York are financial centers, but Cannes, as an internationally neutral and symbolically significant stage, avoids falling into the clichés of any specific financial center. It conveys a more globalized feel, transcending political and economic disputes, giving the event a sense of "world tour."

As Vlad Tenev stated at the event, Europe's clear crypto regulations pave the way for innovation, and the U.S. will eventually catch up—this is essentially endorsing Robinhood's global expansion. The choice of Europe as the event location and the grand scale of the launch are meant to declare to the world: Robinhood is no longer a local company but is actively embracing the international market.

Young High-Net-Worth Individuals

This visual style also targets a new group of emerging high-net-worth young individuals—those who have risen to wealth through tech entrepreneurship or crypto investments. They are relatively young but possess considerable assets, familiar with internet culture while yearning for traditional elite lifestyles. The so-called "Old Money" aesthetic is currently trending among this generation.

For instance, a video of an influencer wearing a blue pinstripe suit, driving a 1962 red Alfa Romeo convertible along the shores of Lake Como, garnered millions of views on social media. This fantasy of noble living is a reflection of the popularity of the "old money" aesthetic. By creating a similar scene at the launch event, Robinhood undoubtedly resonates emotionally with this group of young affluent individuals, elevating the brand's status in the eyes of high-net-worth young clients—using Robinhood is not just a financial choice but also a choice of a tasteful lifestyle.

Traditional Financial Institutions and Investors

Although Robinhood primarily serves individual investors, the narrative of this launch event may also target institutional audiences—potential partners, investors, and regulators.

In the financial circle, the "old money" style is often associated with stability and credibility. Robinhood's high-profile launch of new services in Europe not only announces its ambition to enter the international market to the traditional financial sector but also serves as a public relations strategy to showcase its professionalism and compliance. The event was hosted by its European subsidiary, conducted under the European regulatory framework, and featured heavyweight guests such as the co-founder of Ethereum for discussions. In the context of a global roadshow, this emphasis on "presentation" signals to institutional investors and regulators that Robinhood is striving to be a responsible market participant, rather than merely a synonym for "retail investor collective," and conveys its strong financial backing and long-term planning to potential strategic partners (such as local banks and exchanges in Europe).

Overall, Robinhood's visual and narrative strategy achieves three objectives: it inspires ordinary users to imagine a life of noble wealth, enhancing brand appeal; it reassures high-net-worth users regarding the platform's credibility; and it caters to the traditional financial sector's preference for a stable image. By packaging new fintech with old money elements, it maximizes the effectiveness of its communication.

The "Old Money Sentiment" of Financial New Nobles

Robinhood is not the only company attempting to employ "old money" or similar aesthetic reversal strategies in its marketing. In the Web3, fintech, and broader internet industry, many brands have recently borrowed elements from old aristocracy and American high society to achieve unexpected communication effects. The underlying logic is to create topics and freshness for the brand by introducing high-end traditional elements that starkly contrast with their original tone. Here are a few comparable cases:

BAYC (Bored Ape Yacht Club): A Satire of Web3's Aristocratic Club

BAYC is a well-known NFT project, and its brand concept is essentially a parody and replication of the old money class. The bored apes form a "yacht club," which is a traditional social scene for the wealthy (private yacht clubs). BAYC uses cartoon ape imagery to give this typical "old money" symbol a new twist, creating a digital club that only crypto new nobles can join. As a result, this NFT series with an aristocratic club tone achieved great success, attracting numerous celebrities and wealthy individuals to purchase.

Tuxedo Society: Monetizing Nostalgic Aristocracy

Not only in finance, but a number of new brands have emerged on the internet that specialize in selling the "old money lifestyle." For example, Tuxedo Society, founded by young Italians, is essentially a luxury travel membership club that claims to offer members experiences of traditional high society parties and vacations. The founders are not true aristocrats, but they have been fascinated since childhood by the wealthy lifestyles portrayed in shows like "Gossip Girl," and they have a particular fondness for old-fashioned gentlemanly behaviors like "wearing a suit to nightclubs."

They have crafted a carefully designed "old money fantasy" through platforms like Instagram, attracting similarly affluent millennials who desire such experiences to sign up for high-priced travel events. The club has hosted balls in 16th-century palaces by Lake Como and helicoptered members to ski in St. Moritz while tasting caviar and champagne. These scenes sound like gatherings of European nobility from the last century, but the participants are a new generation of wealthy individuals. The success of Tuxedo Society indicates that "old money," as a cultural commodity, can now be packaged and sold by new brands. This aligns with some marketing strategies in the Web3/crypto space—selling products of future technology while telling stories of nostalgia.

What Do Modern Robin Hoods Want?

Overall, in today's marketing of emerging technologies, the "old money" style is becoming a noteworthy aesthetic trend. Robinhood's bold embrace of old money aesthetics is largely based on its judgment of its user structure and industry trends, making it a natural progression. In terms of effectiveness, it has indeed sparked widespread discussion within the industry, marking another successful application of old money aesthetics in fintech marketing.

In the fintech sector, some companies have also attempted to incorporate a subtle luxury tone into their marketing to reach higher-end clients. For instance, when some internet brokerages and digital banks launched metal credit cards and premium membership services, their advertisements often mimicked the style of private banks: black backgrounds, understated luxurious textures, and elite lifestyle scenes.

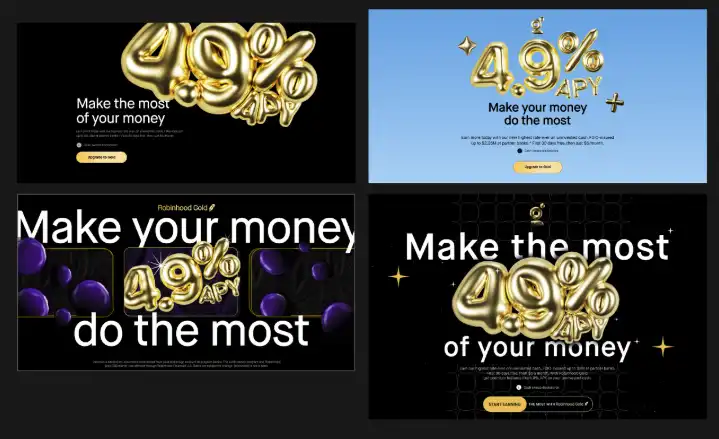

Robinhood itself emphasized in its Robinhood Gold premium account advertisement launched in September 2024 that it provides ordinary investors with "products and rates that only super-rich individuals could enjoy in the past." This advertisement adopted a newly upgraded visual system, presenting Robinhood as a platform that offers "exclusive treatment for large clients" with a clean and sophisticated color palette and refined imagery.

The "old money" visual strategy followed by Robinhood at its latest launch event is a multidimensional, carefully planned effort. From a brand communication perspective, it dramatically conveys the company's transformation from a rebellious newcomer to a mature mainstream player; from a consumer psychology perspective, it captures people's trust and longing for traditional wealth symbols, creating a unique sense of identity; in terms of fintech positioning, it aligns with the upgrade of its user structure, indicating a shift towards high-net-worth services; and drawing from historical examples, this aesthetic reversal of old versus new has proven effective under specific conditions.

The choice of Cannes as the event location cleverly anchors all of this in the coordinates of internationalization and cultural heritage, adding a significant stroke to Robinhood's global ambitions. It is foreseeable that Robinhood's future marketing and products will continue to revolve around the central theme of "bestowing the privileges of old wealth upon the new generation"—inheriting the essence of traditional finance while adhering to the democratization of finance. This "old money" launch event is a microcosm of this strategy, and the logic and thought behind it can provide numerous insights for the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。