⌈买房⌋一直是人生的主线任务之一。只是对于当代人来说,买房已经从绝对主线逐渐变成需要考虑良久的难题。

对于生活富足的人群来说,买不买房貌似是不用额外过多考虑的事情。而对于还在奋斗的群体,过高的房价也令买房这事被迫变得“没那么着急”。而对于收益中间层已经对住房有刚需的适龄人士来说,买房往往是幸福与痛苦参半的一件人生大事。一方面,拿到房本代表有了真正属于自己的一块空间,安心之感无需多言。另一方面,在住房市场走势不明朗的大环境下,买房意味着可能要承受持续亏损,掏空几个钱包买了房子,却每天睁眼就要亏钱。面对忽明忽暗的未来,⌈买房还是租房?⌋成为经久不衰的社会话题。

而作为对资产收益十分敏感的加密群体,对于房产这类重资产也有更加激进的观点碰撞。周末,华语加密圈就买房一事产生诸多讨论,其中各方观点都有独到的看法。

1.不买房派:买房收益太低,不买!

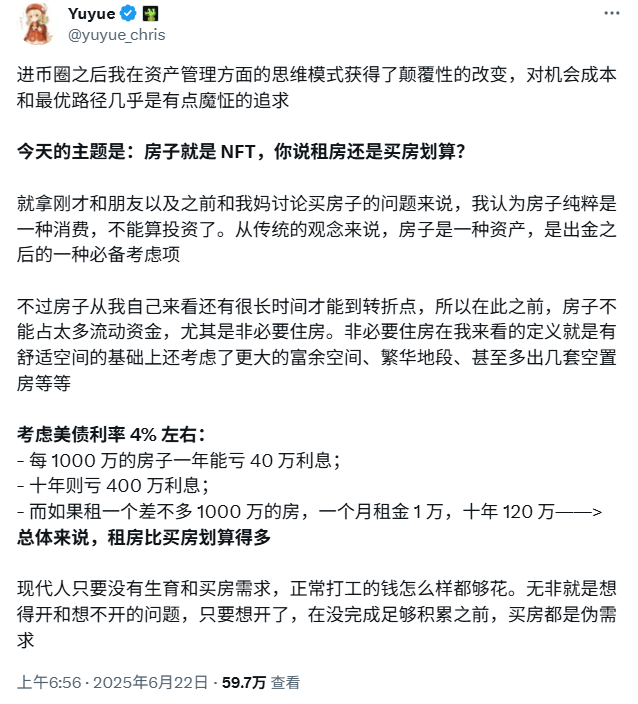

Yuyue(@yuyue_chris):现在选择买房每年只会面临亏损

本次讨论起源于 X 用户 Yuyue。

Yuyue 表示,从资产规划的最优路径来看,当前买房(尤其是非必要住房)并不是好的理财选择。以美债当前 4% 的利率为参考,现在购买 1000 万的房子一年能亏 40 万利息,而如果选择租同样的房子会划算非常多,买房在当前只能算作一种消费,不能算作投资。

0xTodd (@0x_Todd):买房相当于 2-4 倍杠杆顶着费率做多

“买个 1000w 的房子,实际的建筑成本不超过 10%,剩下的 90% 全是看涨期权的期权费。而且,按照租售比在 2.5% 来算,你等于每年倒亏 2.5% 也就是 25w rmb 的利息,这还没算人民币印得比美元更多的那部分通胀差。更别说,如果是贷款的话,那每年亏的利息就更多了。”

“如果你 1000w 买了 100 平的房子,相同地段,别人拿 1000w 领的利息的可以租 200 平房子。虽然自己买的更幸福,但是后者更大啊。或者后者也租 100 平的房子,多出的 25w 各种消费,创造的美好回忆只比前者更多,而不是更少。所以,如果要认识到买房子这个行为,它就是 2x-4x 杠杆顶着费率做多。”

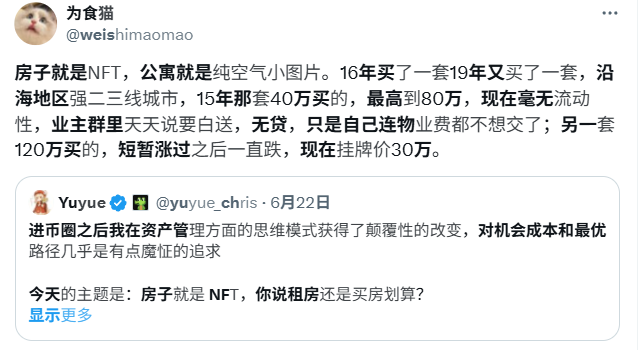

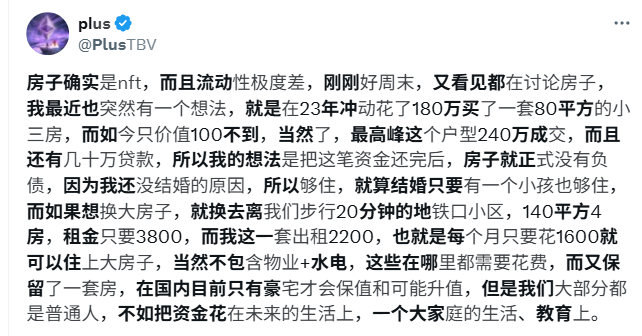

还有更多有房族现身说法:

X 用户 @weishimaomao 与 @PlusTBV 用自身经历阐述“买房爆亏”的感觉,与其用重资金买房不如把钱花在自己的生活上。

2.可以买房派:自己的房子有不一样的情绪价值+资产价值,值得!

冰蛙(@Ice_Frog666666):如果条件允许,自己买房能承载许多情感积累

“房子除了能给家庭带来生活品质的变化以外,还能承载和记录美好回忆,如果买的是郊区大院子别墅,可能会更直接明显。

特别是当家里有几个小朋友的时候,这套房子可能就是他们童年的全部,是他们从小到大所有快乐时刻的发生地,这个房子会像是一本无形的家庭相册。

房子承载和记录的这些温馨时刻的,这些跨越时间的温暖记忆,这些情感积累,可能就是一种真正意义上的“传承”。”

汤汤(@lichuan679):买房是资产配置,自有房产的可抵押性被低估

“买房虽然一次性成本高,但本质上是“强制储蓄+长期持有的硬资产”。如果你买的是核心地段稀缺标的,这个资产的抗通胀能力和对冲风险能力就更强。”

“房产,尤其是一线城市优质房产,在系统性金融危机下依然可以找银行借出低息资金。这相当于你多了一把“进可攻、退可守”的大刀。这背后其实是:中国和很多地区的金融系统对房子信贷偏好远高于其他资产。这不是市场效率问题,是制度红利。”

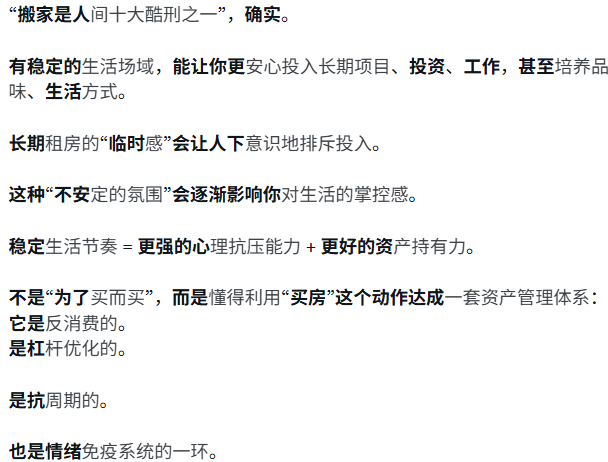

“长期租房的“临时感”会让人下意识地排斥投入。这种“不安定的氛围”会逐渐影响你对生活的掌控感。稳定生活节奏 = 更强的心理抗压能力 + 更好的资产持有力。不是“为了买而买”,而是懂得利用“买房”这个动作达成一套资产管理体系,它是反消费的、是杠杆优化的、是抗周期的、也是情绪免疫系统的一环。”

upzhu.eth(@bubblegold2):房产从资产保存的角度来说更有优势

“如果单从租售比看当然是租房划算,而且越是豪宅租售比越低,租房就越划算。

但是,从资产保存的角度看,持有房产有天然的优势,尤其是一线城市的好房子。相对币圈虚无的资产来说,好房子亏起来没那么容易没那么快,还能够从银行获得现金流。

所以如果你在币圈赚到钱了,还是需要买一套好房子的,至少万一哪天在币圈亏光了,还有房子保底,不至于返贫。”

3.混合观点派:买不买看个人,只看收益率也不一定是好事

SweetY(@shirleyusy):买房能比买 NFT 少亏点

“换个角度想,买猴地的亏99%了,用猴地割出来钱买一线城市豪宅的顶多亏20%。当投资被迫成了消费,那就不如去消费”

cryptoolddog(@CryptoOlddog):纯金融角度来看不买,但手中有房心中不慌

“1.纯金融角度,房子是一个较差的金融产品,如果资金紧张,不要买房

2.房子是有情绪价值在的,就跟买豪车一样:

情绪一:

可以自己装修,上仓位买一些改善生活的物品,比如 3 万块钱的床垫,也不需要担心被赶走

情绪二:

住在屋子里的安心感,在最差的情况,也有个地方住

情绪三:

防守类资产,cryptocurrency 高危行业,出了问题,现实里,也有资产

情绪四:

结婚,谈恋爱,身边人互动,说一千,道一万,都没有,那个红本本,能降低沟通成本,就跟你开个迈巴赫出门,很多时候,自然有物品替你说话。”

BY(@By_Web3):购房需求还夹杂人性问题

对于普通人来说,买房不仅仅是经济问题,还包含结婚等人生需求。

TingHu(@TingHu888):投资还需考虑人性问题,持有房产比梭哈投资稳妥

“其实很简单,当房子在总资产中的占比不多的时候,你不会考虑这种性价比的。

很多人把房子卖了或者抵押去投资,结局99.9%都很惨烈,而出金买房子的虽然遇到了回撤,但起码保住了大部分盈利。

投资在很多时候不光要考虑盈亏性价比,还要考虑人性在其中的负面作用,无法控制过于贪婪的人性,还是稳妥为上。”

购房与否,其实是件很个人的事。

从讨论内容来看,各方都在用事实作例证来阐述自身观点的正确性。而跳脱单一视角来看,其实⌈房产收益低⌋和⌈有房很幸福⌋本身就是两件不冲突的事。现在许多人对购房没想法或许也并不是单纯因为房子作为资产“不够优秀”,房价本身过高、经济环境预期差是更主要的因素。

房子作为生活必需品,或买或租都基于个人情况或观念选择。经济实力足够,当作消费品购置房产不考虑收益率无可厚非;经济实力差点,以租代买缓解生活压力更是正确的环境做正确的事。

只是⌈坚决要买房⌋或者⌈坚决不买房⌋都不该沦为某种政治正确。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。