Investing does not require a high IQ; it only requires you to maintain stable emotions and the ability to think independently. You need to detach yourself from the worries during losses and the greed during profits, making decisions through your own thinking while ignoring market emotions.

Hello everyone, I am trader Gege. Following up on the previous article, I have detailed my views on this week's market trends, and the short position on Bitcoin has been perfectly executed and exited. Today, I will briefly discuss the points to focus on in the short term.

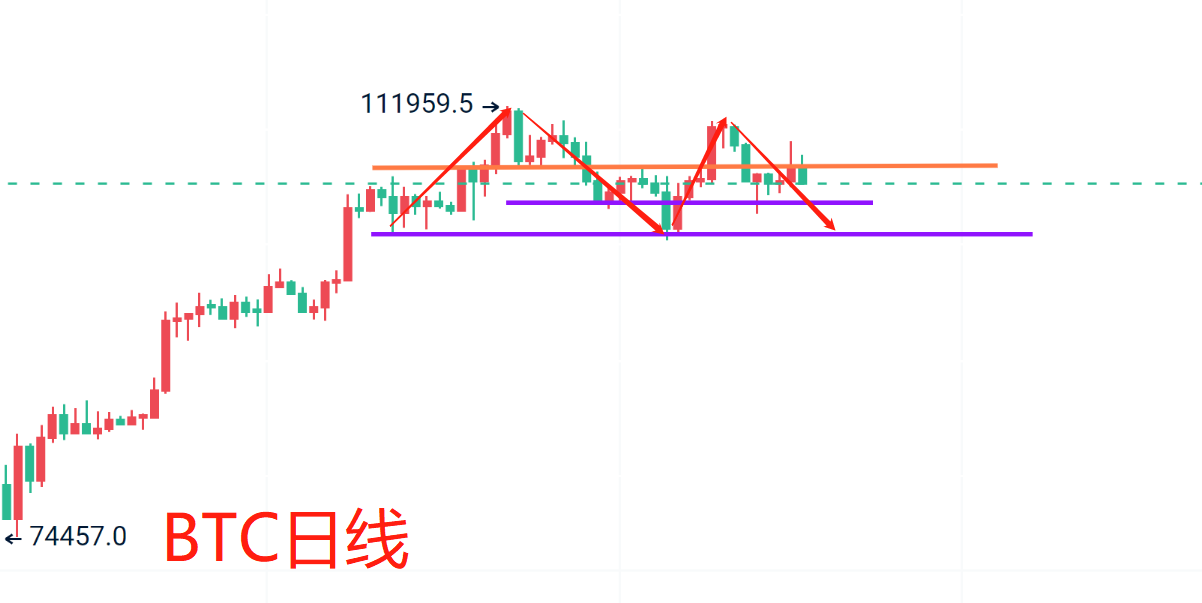

Looking at the daily K-line pattern of Bitcoin, it has broken below the middle track and MA support, and the probability of today's daily K-line turning bullish is very low. The bullish scenario is likely to yield a doji, while the probability of a bearish candle is higher. The first level of support below is around 103,000, and the second level of support is around the 100,000 mark, which is also near MA60 and the lower track. From the overall K-line structure, the double top pattern has not completely ended, so short-term bulls should participate cautiously; profits should be taken when earned, and one should not be overly greedy. Currently, the market does not support a large bullish trend.

After a wave of false bullishness in the morning K-line on the 4H level, there have been two consecutive solid bearish candles. The next K-line may show an accelerated closing pattern. The support near EMA200 has not yet been tested. Combining this with the daily support reference, one can wait for a pullback to enter once; if it breaks down, we need to extend our view to the key positions below. The resistance above is moving down with the high points, and one can refer to the resistance near the intraday high.

The short-term structure of Ethereum has not changed significantly; it is still within a box structure. Therefore, in the short term, we should still refer to the box structure. If there is an effective break below the lower edge of the box, friends who like breakout trades can enter with a light position. It has been mentioned before that the longer the box oscillates, the greater the probability of a breakout later, so one must be cautious as the market approaches the end of the box.

Short-term Bitcoin: Enter long at the 104,300-103,500 range, and if it breaks down, enter long at the 102,000-101,500 range, looking for 2,000-3,000 USD. Enter short at the 106,800-107,700 range, looking for 2,000-3,000 USD.

Short-term Ethereum: Enter long at the 2,500-2,460 range, looking for 80-100 USD, and if it breaks down, one can enter with a light position at 2,400. Enter short at the 2,620-2,650 range, looking for 100-120 USD.

PS: The strategy activation is for one-time use only.

The suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss space accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone success in their trading endeavors and smooth sailing in the crypto world! More real-time advice will be sent internally. Today's brief update ends here. For more real-time advice on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。