To seize the first-mover advantage in the on-chain market, CEXs must accelerate their layout to avoid continuous erosion of market share by DEXs.

Written by: ChandlerZ, Foresight News

Recently, Bybit CEO Ben Zhou posted on the X platform stating that "the first on-chain DEX incubated by Bybit, Byreal, will launch at the end of this month. It was born from scratch within the Solana ecosystem."

He pointed out that Byreal's uniqueness lies in: 1/ CEX + DEX synergy. Byreal is not just "another DEX." It combines CEX-level liquidity with DeFi's native transparency. This is true hybrid finance. More CEX + DEX projects are set to launch in the future. 2/ Unified liquidity and speed using RFQ + CLMM routing design. Byreal will provide users with low-slippage, MEV-protected swap transactions at extraordinary speeds.

According to official information, the Byreal testnet will go live on June 30, with the mainnet expected to launch in the third quarter.

Bybit is not the first centralized exchange to venture into the DEX space. With the continuous growth of decentralized trading platforms, the improvement in liquidity and user activity of DEXs is gradually narrowing the gap with CEXs.

DEX Market Share Rising, Solana Becomes a Major Choice

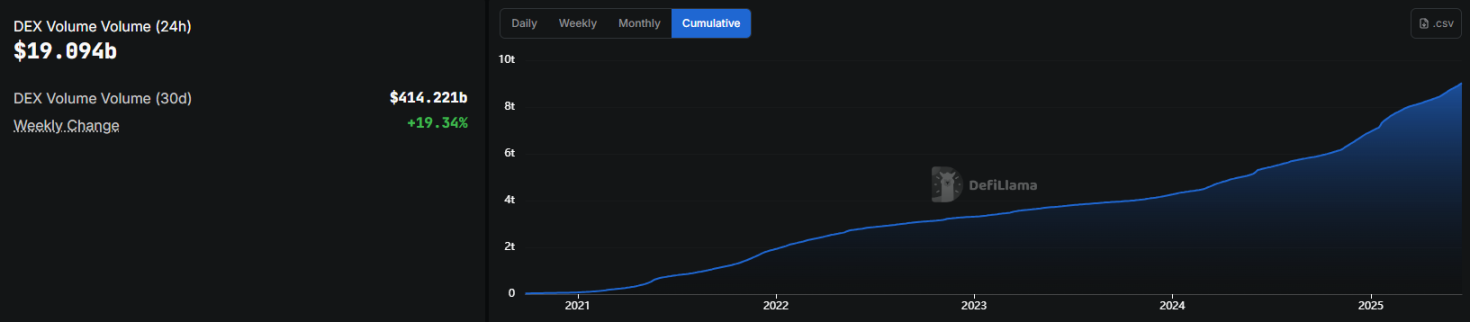

According to DeFiLlama data, DEX trading volume has been steadily increasing. In May 2024, the monthly trading volume of DEXs reached $405.3 billion, accounting for about 25% of the total global spot trading volume, setting a historical high. Meanwhile, the total value locked (TVL) in DEXs surpassed $20 billion.

From the blockchain distribution perspective, Ethereum remains the dominant chain, with Solana ranking second, having a TVL of about $3.3 billion, more than half of which is occupied by Raydium.

Bybit chose Solana as the underlying infrastructure for Byreal mainly based on its significant growth performance. In 2024, the trading of meme tokens and on-chain token issuance platforms (such as Pump.fun) on Solana saw a substantial increase in activity, making DEXs the primary channel for token launches. Mainstream meme assets, including WIF, BOME, and BONK, formed initial liquidity on Solana DEXs like Raydium and Jupiter, which were subsequently listed on centralized exchanges.

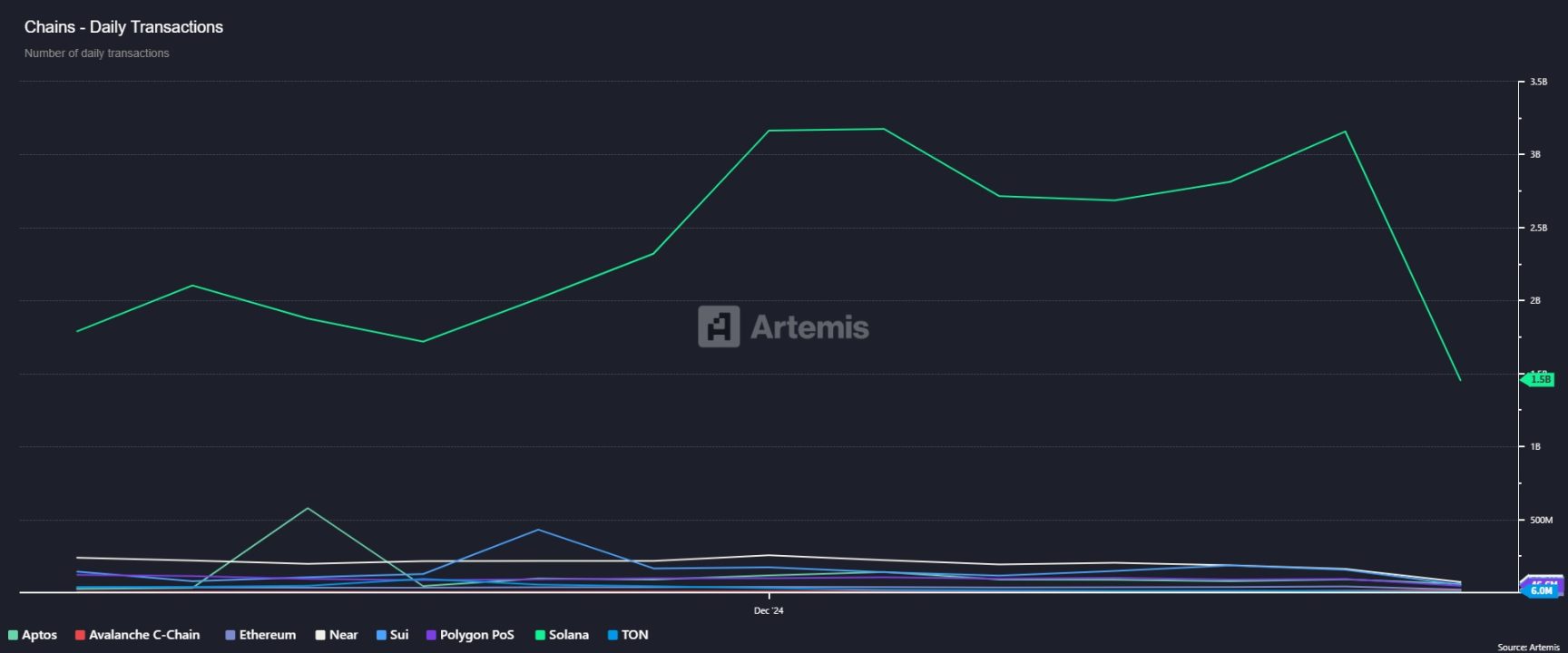

Solana has maintained high activity and developer growth over the past year, becoming one of the fastest-growing blockchains in the DEX ecosystem. Solana's daily trading volume remains stable at around 80 million transactions, with a cumulative total exceeding 3 billion transactions, ranking among the top public chains. In contrast, Base and Sui have daily trading volumes of about 7 million and 6 million transactions, respectively; although smaller in scale, they are growing rapidly and have high activity levels.

In terms of daily active address data, Solana's daily active addresses average over 4 million, peaking at over 9.4 million. For CEXs looking to expand on-chain, Solana provides a relatively mature high-performance execution environment and liquidity foundation.

The Decentralization Battle of CEXs

When users choose on-chain trading products, they typically prioritize familiar platforms and a good user experience. This trend has driven leading centralized exchanges to actively develop decentralized trading products. There have been several precedents of CEXs entering the decentralized trading space. Binance's PancakeSwap, based on BSC, has long maintained a leading position in the DEX market, OKX launched OKX DEX, and Coinbase supports the DEX Aerodrome on the Base chain, which has seen rapid growth in trading volume and ranks high in market share.

These CEXs gradually gather market liquidity through self-built on-chain platforms or strategic partnerships, covering both on-chain and off-chain user groups. On the product level, they are also actively exploring innovative features such as dark pool trading, cross-chain aggregation, and hybrid liquidity pools to enhance trading depth and execution efficiency, meeting the increasingly diverse market demands.

From a competitive landscape perspective, CEXs still maintain an advantage in overall trading volume and user scale. However, past liquidity crises and risk events at CEXs have increased user attention towards DEXs, which are trustless, on-chain transparent, and have relatively low compliance thresholds, leading to intensified competition between the two.

The data above indicates that emerging trends are leaning towards convenient and lower-compliance DEXs, with traffic flowing to on-chain products earlier, resulting in some CEXs facing the awkward situation of "not getting the meat, just the soup." To seize the first-mover advantage in the on-chain market, CEXs must accelerate their layout to avoid continuous erosion of market share by DEXs, which could lead to profit shrinkage pressures.

Conclusion

Simon Kim, CEO of crypto venture capital firm Hashed, predicts that DEX trading volume may surpass CEX by 2028. Given the increased investment by CEXs in DEXs and the current development trajectory of the DEX ecosystem, the likelihood of this prediction being realized is increasing.

From the perspective of industry development trends, the future forms of exchanges may no longer strictly distinguish between centralized and decentralized, with hybrid trading platforms potentially becoming a new direction for development. Ultimately, the needs of trading users remain the key factor for the success or failure of a platform. Platforms that can provide stable, secure, and user-demand-compliant products will have a better chance of gaining a competitive edge in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。