为什么资产管理公司对Solana ETF寄予厚望

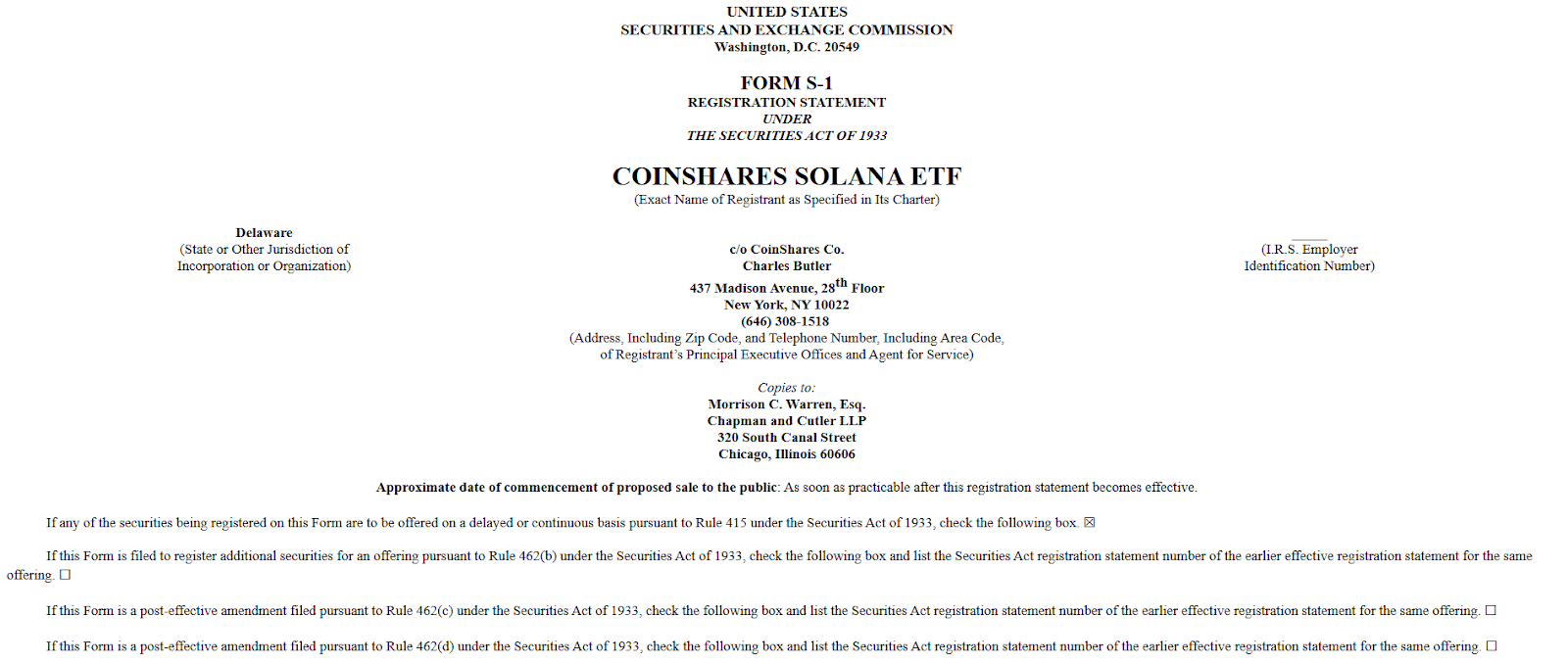

Solana正在吸引眼球,因为CoinShares可能会推出一个现货Solana交易所交易基金,向美国证券交易委员会(SEC)提交了其S-1表格。

另外七个现货Solana ETF也加入了竞争,其他发行者包括Fidelity、Grayscale、Bitwise和Canary,上周五更新了S-1。

来源 : Coin Shares

但真正的问题是,这个币会面临另一个监管障碍,还是SEC会同意或批准该计划?

为什么CoinShare加入Solana ETF会改变一切?

根据6月16日向美国SEC提交的文件,为了推出自己的亮点,欧洲资产管理公司CoinShares提交了S-1表格。作为赞助商,CoinShare Co和Coinbase Custody在文件中被提及,BitGo Trust作为保管人。

文件中还披露了计划,计划将基金持有的部分SOL进行质押,寻求SEC的批准,CoinShare成为第八个现货山寨币基金的发行者。

“如果他们包括质押,净流入可能会比ETF的推出更好。如果他们在没有质押的情况下推出,我可能会说非常不可能。” - James Seyffart(彭博交易所交易基金分析师)

为了让全球加密市场保持投机,两个专家简要讨论了Blackrock是否可能申请现货币种。

现在,如果我们想象包括Fidelity、Grayscale和现在的CoinShares在内的八家重量级金融公司都在争相推出首个山寨币ETF。这就像是一场奥运会,但在加密版本中,赌注高达数十亿。

CoinShare急于前往特拉华州,为什么?

上周,CoinShare迅速在特拉华州为SOL交易所交易基金信托进行注册。从吸引注意力到激发对SEC批准现货Solana ETF的美好前景。

为了更新赎回的语言并接触发行者的质押,SEC通知了发行者。

彭博ETF分析师认为,1940年质押ETF在《投资公司法》下的影响可能提高了80%到90%的概率。Balchunas认为,跟踪Solana价格的批准可能需要2到4个月。

Invesco和Mike Novograt的Galaxy Digital管理着1.7万亿美元的资产。上周五,他们作为合作伙伴在特拉华州注册了Coins交易所交易基金信托。

为什么Solana ETF可能是游戏规则的改变者?

在2024年,比特币交易所交易基金爆炸性增长后,以太坊交易所交易基金紧随其后,现在Solana想要它的机会,以下是它的重要性:

机构资金洪流:如果获得批准,华尔街可能会在一夜之间涌入数十亿的山寨币。

质押:(意味着免费加密货币)与比特币不同,Solana ETF可能提供质押奖励,这意味着您可以通过ETF持有获得被动收入。

$300 SOL价格:如果比特币能够推动其价格,Solana也可以做到同样,甚至可能更好,分析师表示。

虽然有些人同意,但并不是每个人都信服,与此同时,SEC仍然将这枚币视为潜在的证券。

$300 SOL 有可能吗?

在撰写本文时,SOL的价格为151.39美元,自ETF消息发布以来下跌了3.37%。与此同时,加密交易者更关注长期投资,而不是短期波动。

$200数字:被认为是神奇的数字,因为自1月以来,SOL没有触及这个数字,突破后,$300变得现实,交易所交易基金将解锁数十亿的资本。

ETF批准:与该基金的谈判不足以带来显著的恢复,因为SEC的决定仍在待定中。但如果SEC批准这一点,SOL可能会像比特币在交易所交易基金后那样飙升。

你应该购买SOL吗?这值得吗?

如果你相信SOL技术和交易所交易基金的炒作,这可能是你的机会。

尽管有一些关键点需要记住:

交易所交易基金的批准并不是保证。

你应该为起伏做好准备,因为波动性将会很大。

$200是需要关注的关键水平。

一些其他分析师预计SOL将超过$200的激增。上一次这些山寨币在1月交易超过$200时,价格至今未能突破$184,这让交易者自那时起保持谨慎。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。