波场TRON凭借其完善的生态体系、活跃的用户群体以及庞大的资产规模,已在主流公链中稳居核心地位。

尤其在这本轮加密牛市中,波场TRON取得的成绩堪称惊艳:不仅是USDT发行量排名第一的公链网络,还是稳定币首选的结算层,承担了约60%的稳定币交易流量;5月单月收入突破3.5亿美元,已成为加密市场中盈利能力排名第二的产品等等。

据DeFiLlama数据,6月16日,波场TRON生态内的DeFi应用总锁仓价值(TVL)高达48.4亿美元,活跃地址数在230万以上,稳定币资产规模逼近800亿美元,其TVL长期位居整个公链市场前五名。

这些亮眼的数据背后,不仅展现了波场TRON所拥有的坚实用户基础与雄厚资产实力,更是其生态繁荣的强大证明。

驱动数据增长的“三驾马车”:日新增地址约20万+、资产体量超千万亿、生态协议丰富多样

近一年来,波场TRON链上数据呈现出全面爆发式增长,生态活力也如日中天。“每日新增地址超20 万个、链上流通资产体量超千万亿规模、生态协议也丰富多元”正是驱动波场TRON数据增长的“三驾马车”,一系列亮眼的数据成果彰显了波场TRON强劲的发展潜力与领先的市场竞争力。

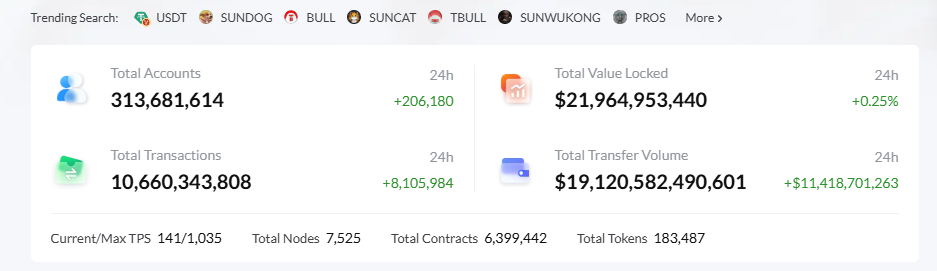

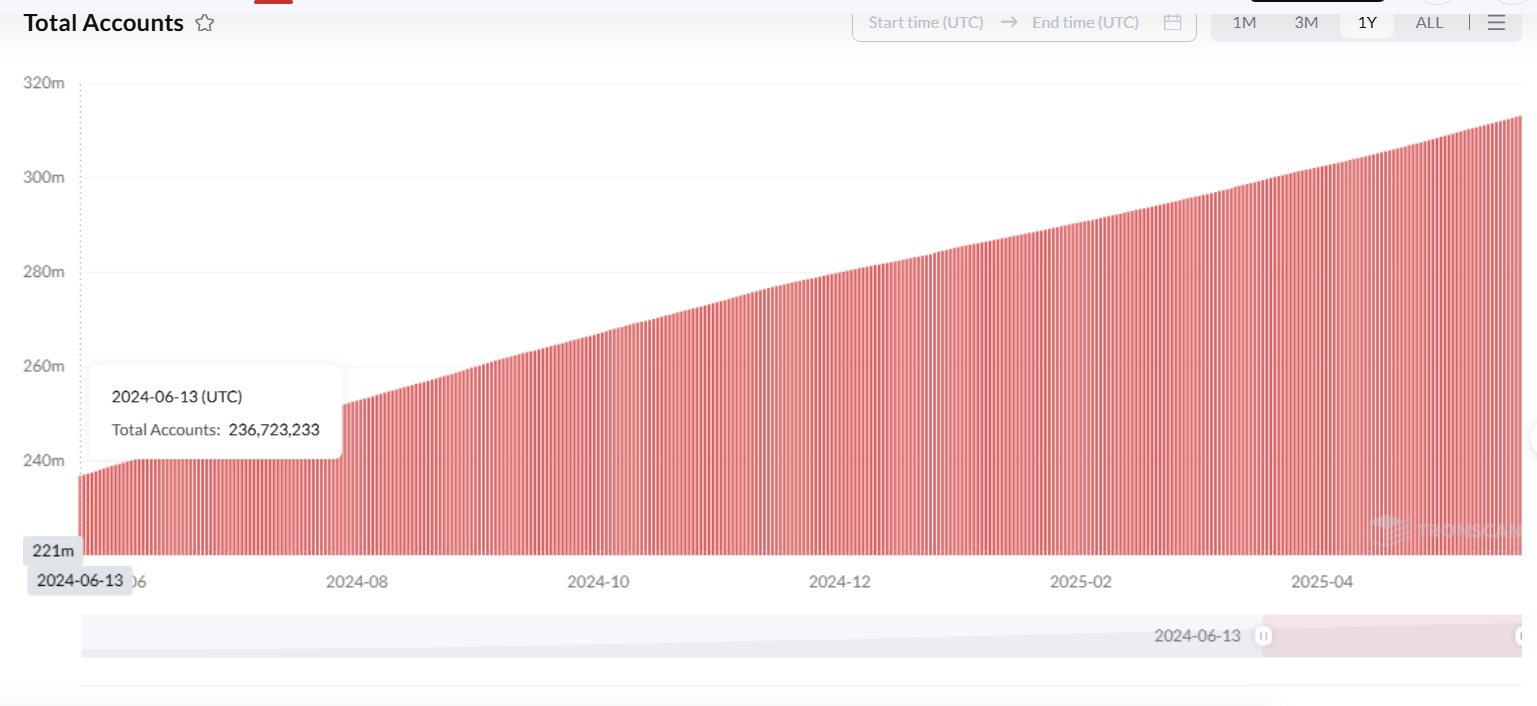

在用户规模及增长方面,波场TRON网络用户基础稳步扩大,链上账户总量与新增地址均保持强劲的增长势头,用户基础也愈发稳固。根据TRONScan浏览器数据显示,截至6月13日,链上账户总量已超过3.13亿,每日新增地址数20多万个,每日链上发生的交易数超过867万笔,每日总转移资产价值规模高达250亿美元。

值得一提的是,波场TRON链上地址账户增长态势呈现出稳定的线性轨迹,回溯至1年前的同一天,链上账户总数约有2.37亿个,而如今已实现超32%的跨越式增长,日均新增账户数约21万个。这一数据不仅有力印证了波场TRON网络用户基础的持续扩张,更彰显出其生态系统在全球范围内的广泛吸引力与强大的市场渗透力,成功吸引了全球海量用户,为生态系统的持续繁荣筑牢根基。

在交易数据处理方面,波场TRON网络同样表现出色,链上交易极为活跃,每日交易次数动辄数百万至上亿笔,近30日内平均每日链上总转移价值维持在230亿美元以上。如此大规模、高频率的交易数据,不仅体现了波场TRON网络在资金流转方面的强大能力,更反映出其网络具备较为稳定和安全的特性。

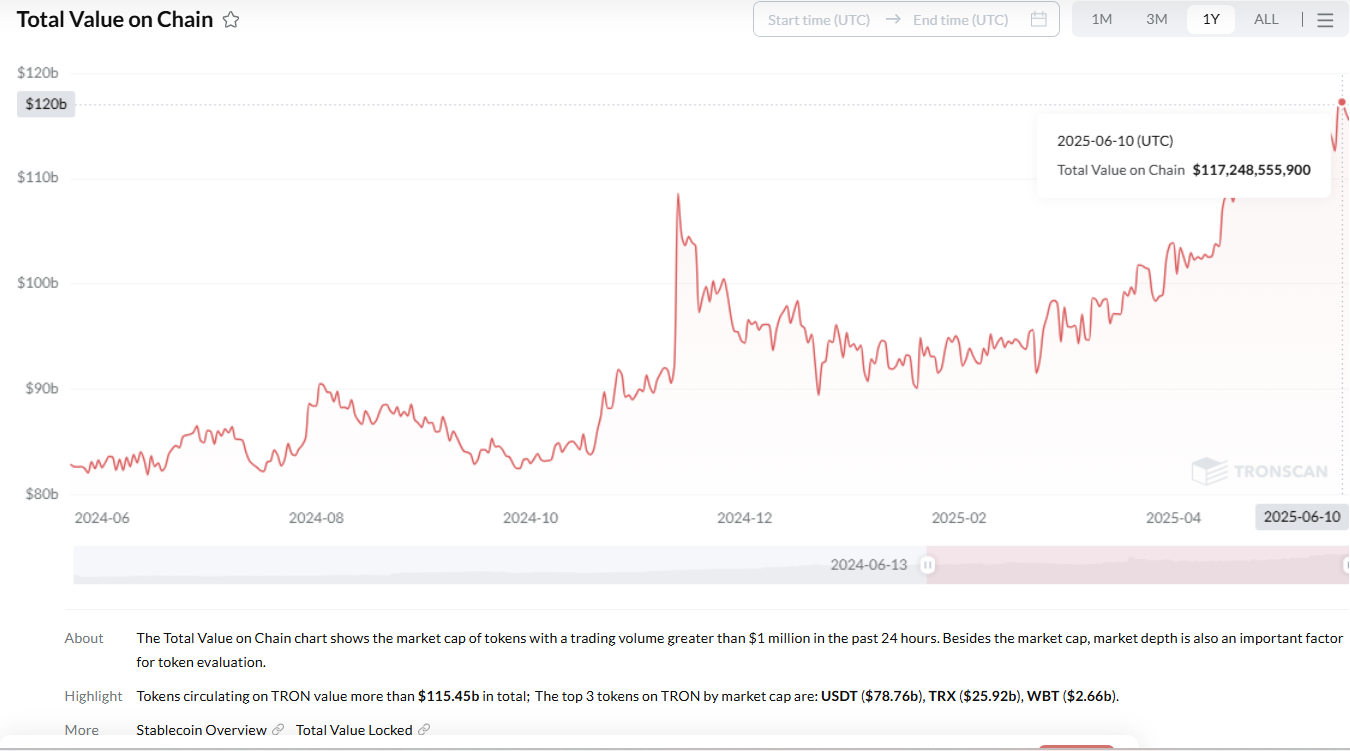

在资产体量上,波场TRON耶展现出了强劲的增长势头。从波场TRON链上流通资产的总锁仓价值(TVC)来看,年内增加了超40%,且资产呈现多元化生态体系。

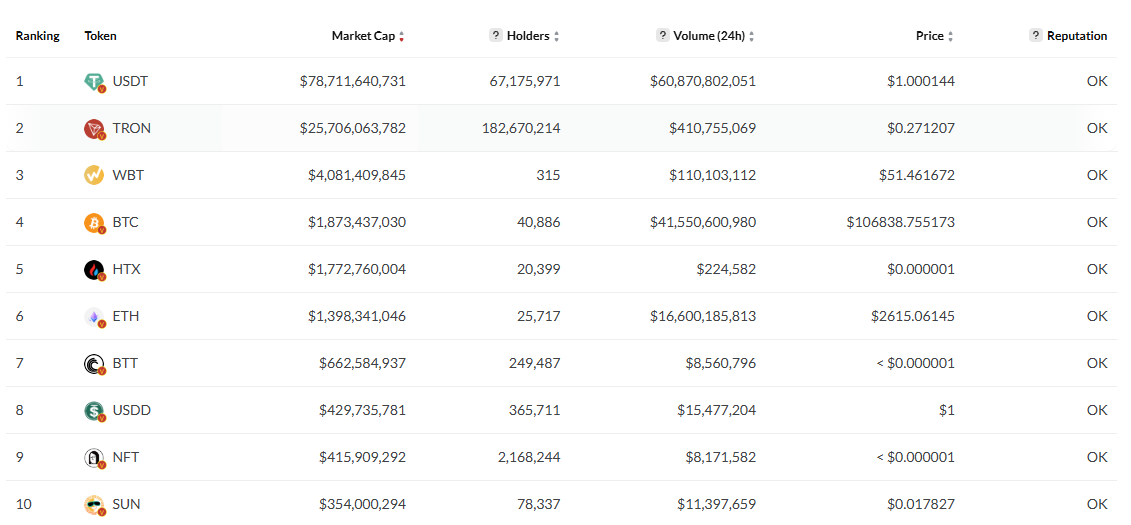

根据TRONScan浏览器,截至6月13日,波场TRON网络中资产流通总价值(TVC)约1155万亿美元,较去年同期的820亿美元实现了40%的显著增长。其中,在波场TRON网络中流通价值排名前三的资产分别为USDT(约788亿美元)、TRX(约259亿美元)、WBT(约26.6亿美元),BTC、ETH紧随其后。此外,还有WBT、HTX、USDD、BTT、NFT及TUSD等波场TRON生态项目资产,涵盖领域广泛,共同构建起丰富且多层次的价值体系,更加多元化。

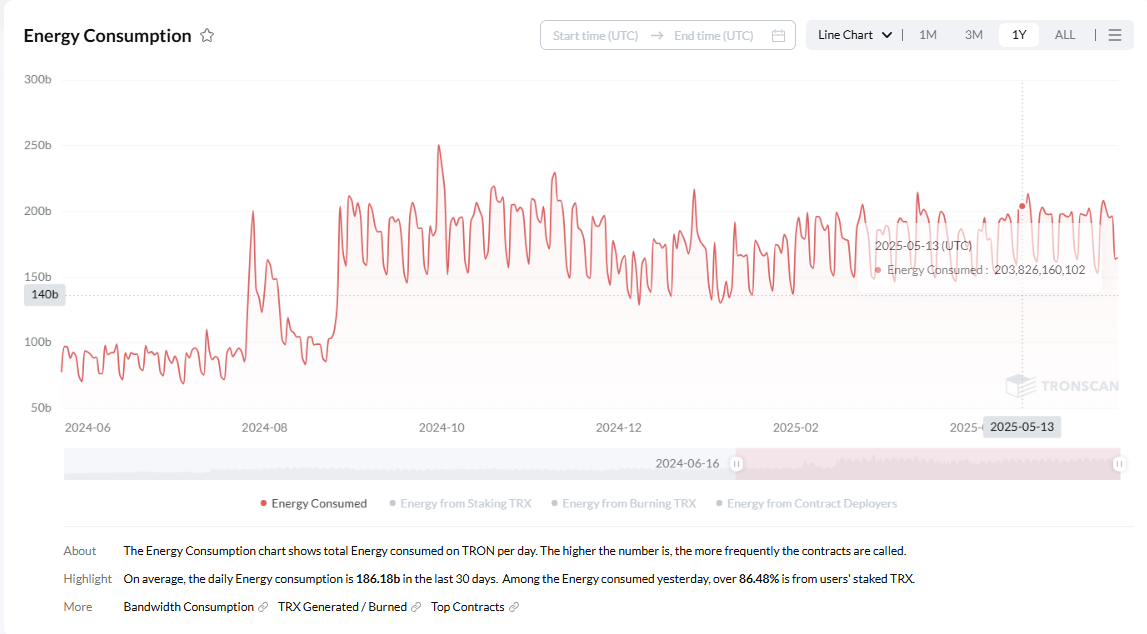

关于网络活跃度,从Gas fee消耗情况便可见一斑。在波场TRON网络中,Gas fee 机制以能量(Energy)与带宽(Bandwidth)二者组合的形式呈现。用户进行转账、提现等操作时需消耗 Gas fee支付成本。

官方浏览器数据显示,近一年内,能量(Energy)消耗规模从初始的800多亿激增至1900亿,增幅高达240%。这一飙升的数据不仅直观展现了网络交易活跃度的爆发式增长,更从侧面印证了能量消耗与用户真实交易需求呈强正相关关系。能量需求越高,意味着链上转账、合约调用等交易活动越频繁,凸显了波场TRON网络生态的繁荣态势与用户参与的深度广度。

从能量消耗账户分布来看,OKX、Bybit、Binance 等头部加密货币交易所占据TOP10席位,高频能量消耗直观体现出它们对波场TRON网络的深度依赖与庞大需求,凸显TRON网络在承载大规模商业级应用上的卓越性能及作为头部交易所底层基础设施的关键战略地位,成为连接数字资产交易与Web3技术的桥梁。

在生态发展层面,波场TRON生态应用已涵盖了交易中枢SUN.io、及MEME资产发行平台SunPump,一站式DeFi解决方案JUST推出的借贷系统JustLend DAO、流动质押协议Staked TRX及能量租赁平台,还有稳定币USDD等等核心协议及产品,共同丰富了波场TRON的DeFi生态发展,为用户提供了丰富多样的选择。

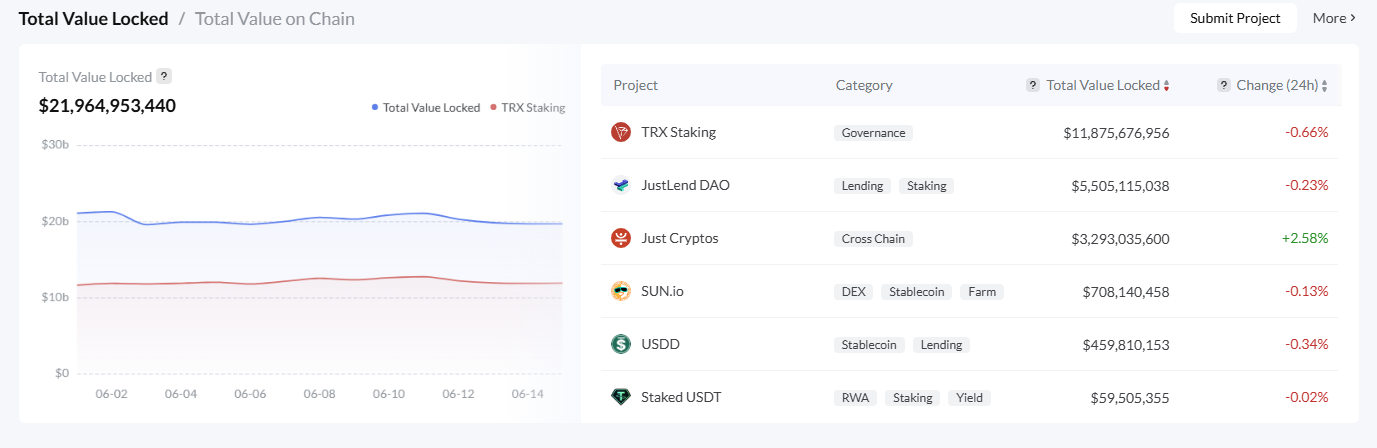

截至6月16日,TRON链上TVL已超过220亿美元,近一年稳定在200亿美元左右。其中,质押TRX Staking 的TVL已超过118亿美元,占比最大;借贷JustLend DAO TVL约55亿美元,排名第二;跨链Just Cryptos TVL为 33亿美元;交易平台SUN.io TVL为7亿美元;稳定币USDD TVL为4.58亿美元。这些数据充分展示了波场TRON生态的繁荣与活力,预示着其未来广阔的发展前景。

一览波场TRON生态内的主流DApp

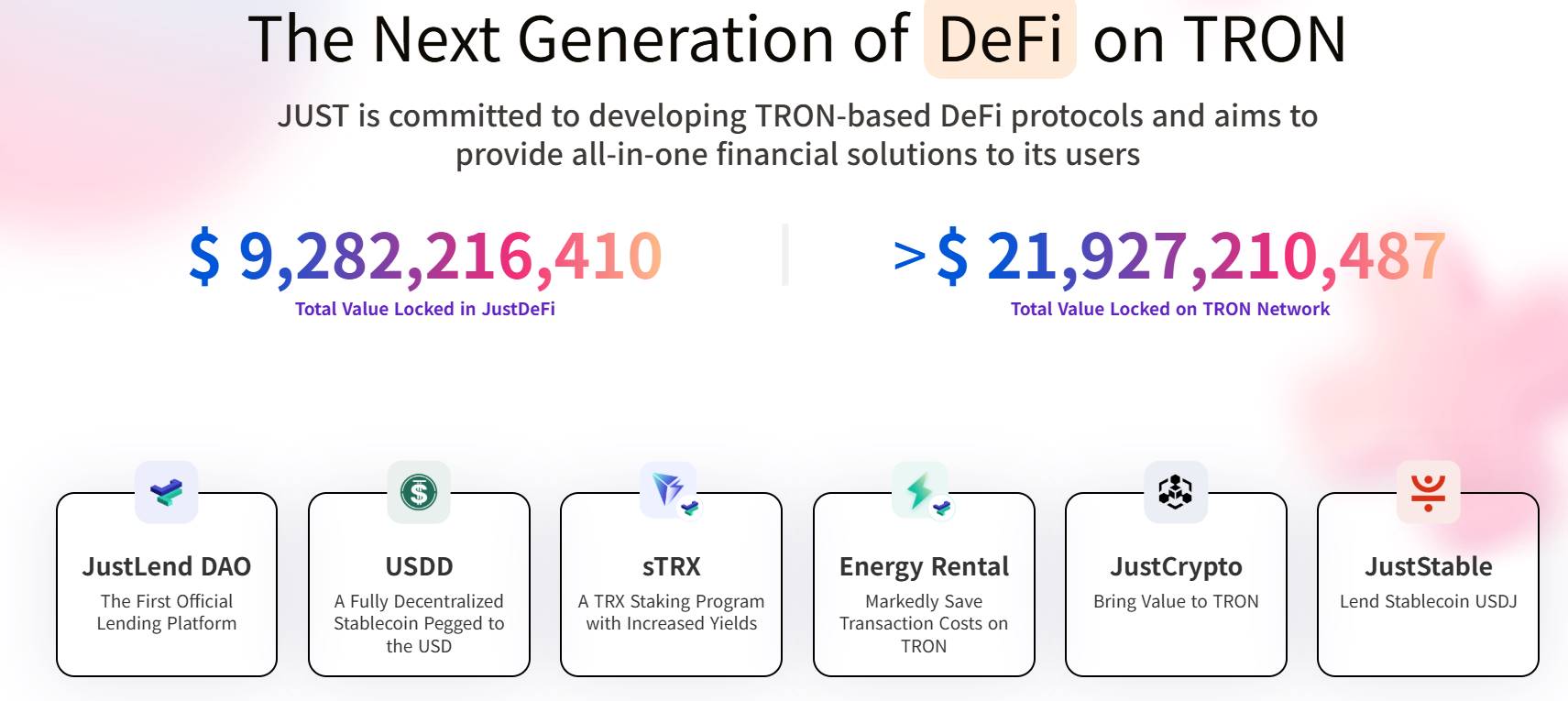

一、JUST一站式DeFi解决方案

JUST专注于开发基于波场TRON的DeFi协议,致力于为用户打造一站式金融解决方案。其产品矩阵涵盖了JustLendDAO、USDD、sTRX、Energy Rental、JustCrypto、JustStable等多种组件,可为用户提供一站式的多元化金融体验,满足不同用户在DeFi领域的多样化需求。

根据官方数据显示,截至6月16日,JUST协议总TVL接近约93亿美元。

● JustLendDAO是波场TRON上首个官方借贷平台,用户不仅可以在此进行抵押借贷,还能将闲置资产存入平台赚取稳定利息,实现资产的灵活增值。

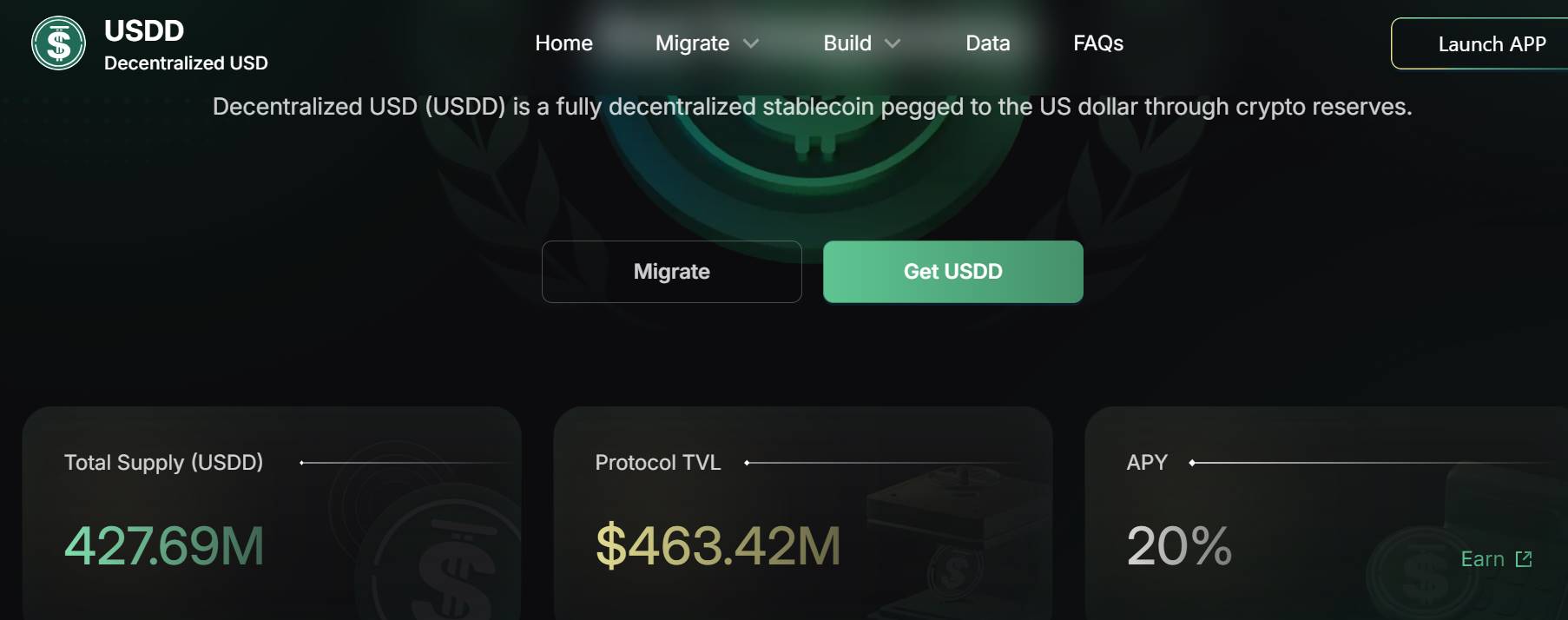

● USDD是一种与美元1:1挂钩的完全去中心化稳定币,支持抵押TRX、USDT等多种优质加密资产超额抵押铸造。

● sTRX(Stake TRX)是基于波场TRON的流动性质押产品,sTRX 为用户提供了更高的收益回报,同时具备更灵活的解除质押选项,让用户在享受质押收益的同时,能够根据自身需求灵活调整资产配置。

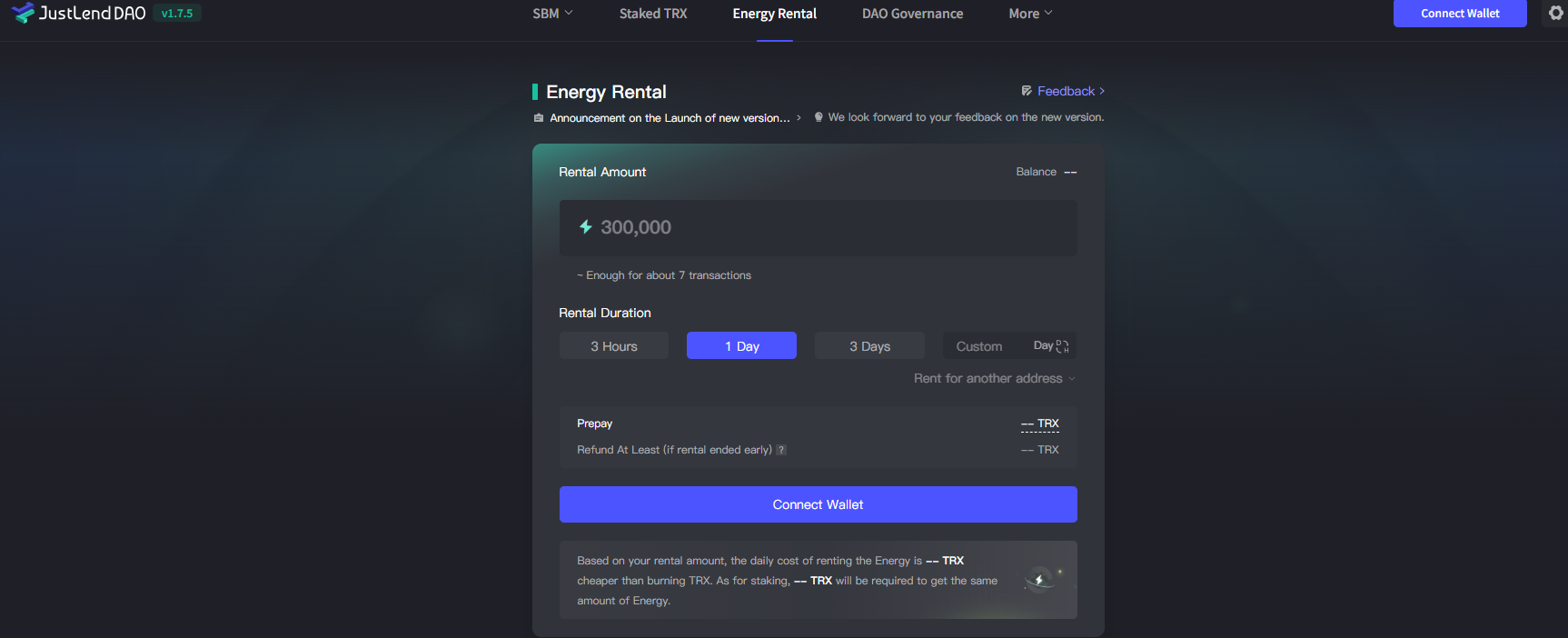

● Energy Rental是波场TRON生态内独有的能量租赁平台,为不同地址进行能量租赁服务,通过租赁能量,链上交易用户无需直接消耗 TRX 来兑换资源,就像使用了一张“能源优惠券”,可显著降低交易支付的 Gas 费成本,提高资金使用效率,让交易更加经济。

● JustCrypto 是由JUST生态系统支持的跨链代币,可使BTC、ETH、DOGE、LTC等跨链资产代币在不同网络之间保持价格稳定,其跨链机制由Poloniex和BitTorrent Chain等优质平台提供。

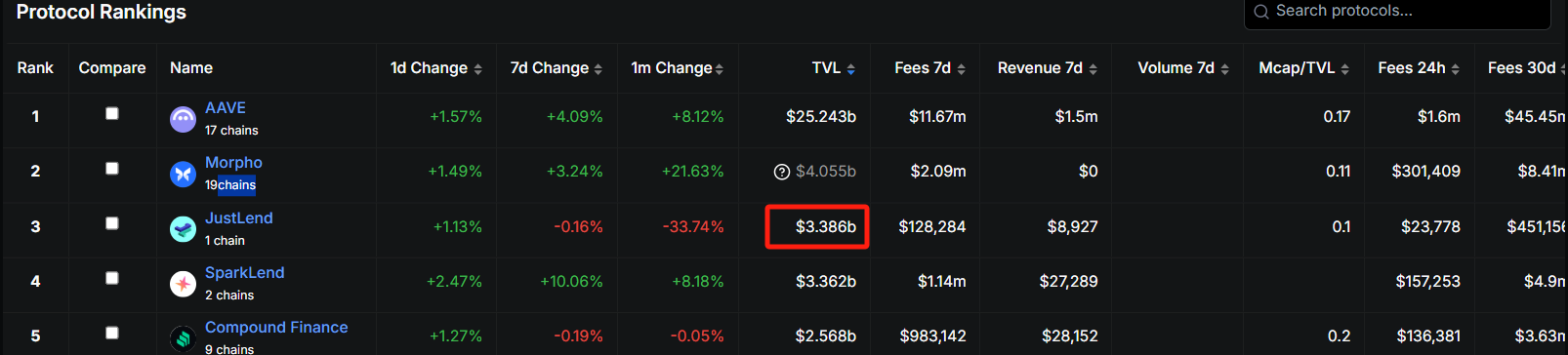

二、借贷生态JustLendDAO

JustLend DAO是一个基于波场TRON的高效、灵活的借贷服务平台。在这里,用户可以将闲置资金投入其中,轻松赚取利息收益;同时,还能借入其他加密资产,巧妙运用杠杆效应,放大投资回报。借贷双方基于智能合约实现自动化操作,系统会根据JustLend DAO上特定资产的供需状况,通过算法自动设定浮动利率,确保资产的动态平衡与合理性。

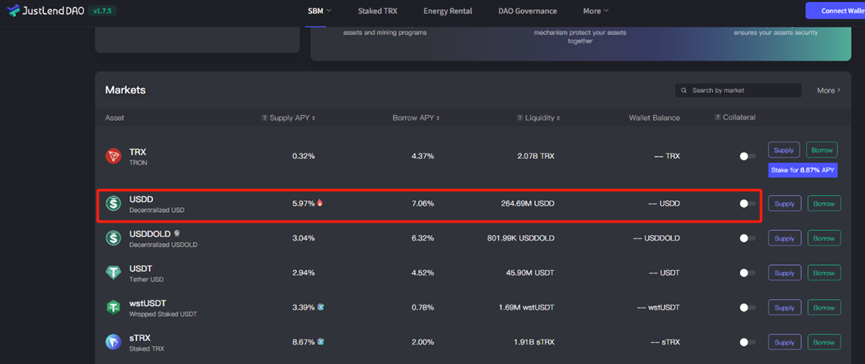

目前,JustLend平台主要支持的借贷资产包括TRX、USDT、USDD、SUN、JST、BTC、ETH、TUSD、BTT等。

根据DeFiLama数据显示,6月16日,JustLend平台上TVL高达约34亿美元,在整个借贷赛道市场排名位居前三。

除了借贷产品JustLend外,JustLend DAO还提供Staked TRX质押和能量租赁(Energy Rental)服务。

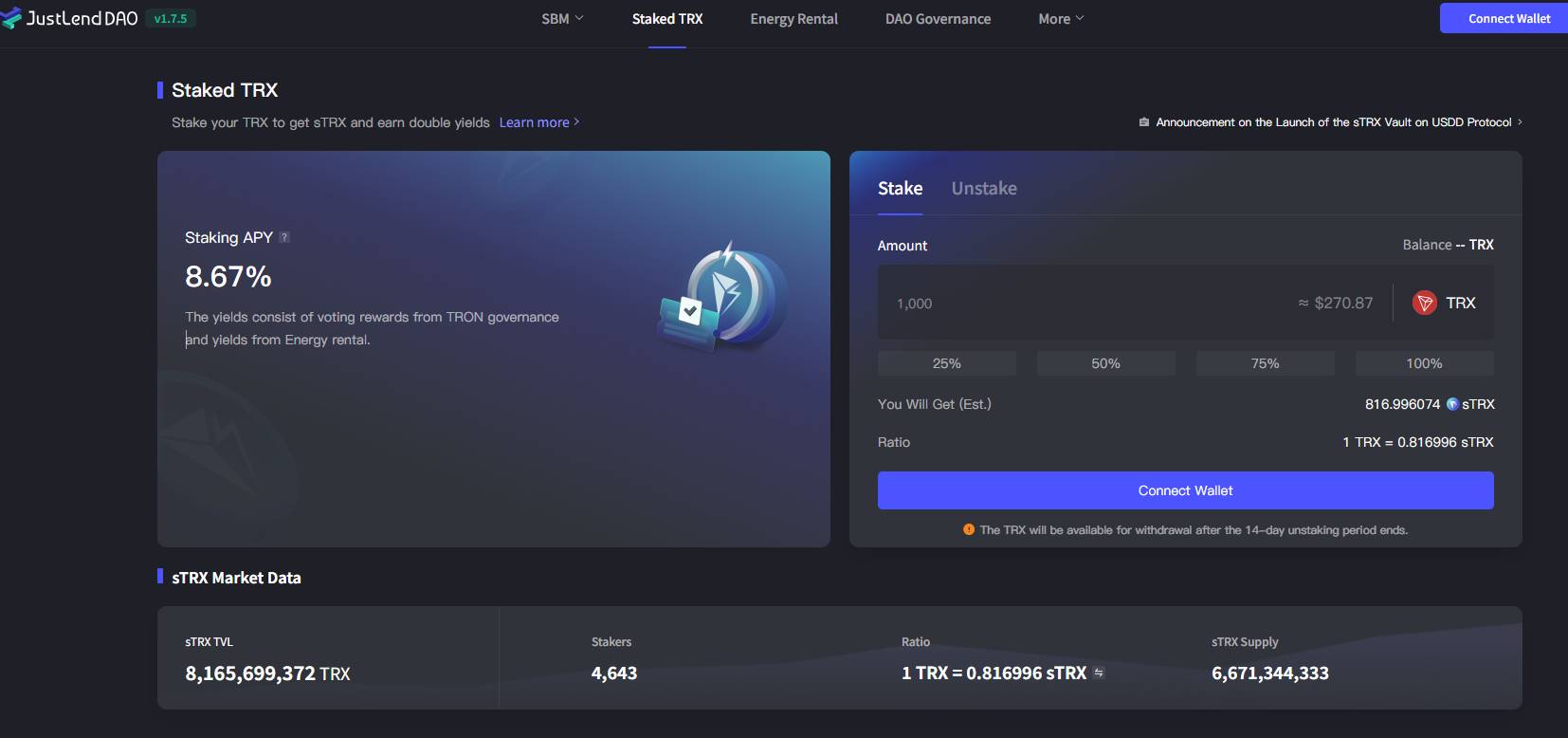

其中,Staked TRX 服务为用户提供了一种便捷的质押方式。用户只需通过一键操作,即可将TRX质押兑换为sTRX。质押的TRX平台会用于投票治理以及能量租赁,用户仅通过持有sTRX就可轻松获得质押收益。截至6月16日,该平台质押的TRX数量已有81.66亿枚,参与质押的地址数超过4600个,当前年化收益为8.67%。

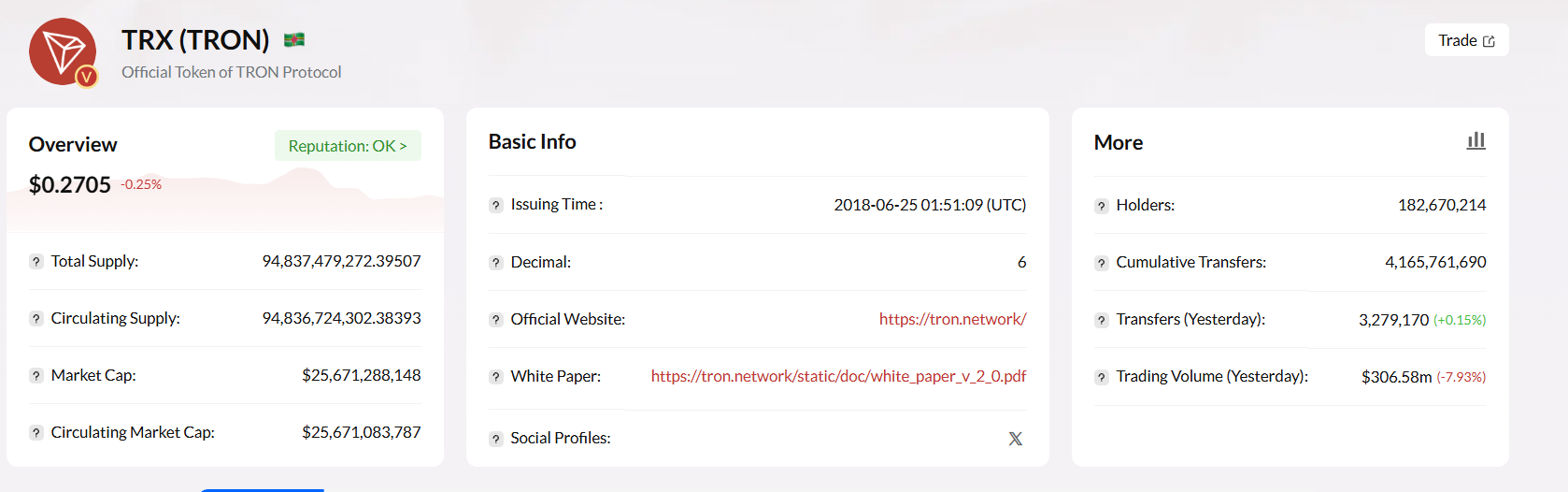

不过,根据TRONScan链上数据来看,6月16日TRX持币地址已超过1.82亿,市值逾256亿美元,持币用户群体极为庞大。而当前质押市场渗透率仅为8.6%,这意味着质押参与率仍存在显著增长潜力。

能量租赁(Energy Rental),则是JustLend DAO为用户提供的另一项贴心功能,支持用户直接租赁能量,通过能量来抵扣Gas fee的消耗,无需燃烧TRX来做为Gas fee,这一功能可帮助用户节约了链上交易成本。从波场TRON链上数据分析可看出,其用户持币地址数、交易频次都在稳步上升,能量租赁功能可更好为波场TRON生态用户服务。6月16日的数据显示,JustLendDAO平台有370亿能量可供用户租赁使用,参与过能量租赁的地址数超过6.5万个,这一数据充分体现了能量租赁功能的受欢迎程度。

此外,目前用户在JustLend DAO平台,除了通过提供资产赚取利息外,还可以通过存储USDD获得额外奖励收益。USDD是由JustLend DAO的子DAO—GrantsDAO联合TRON DAO 储备库共同发起的去中心化稳定币。今年1月,USDD升级为USDD 2.0版本。同期,JustLendDAO上线了USDD借贷服务功能,用户可通过存储USDD赚取收益,当前收益为约6%。截至6月16日,该资金池已有高达2.64亿的USDD。

三、去中心化稳定币USDD

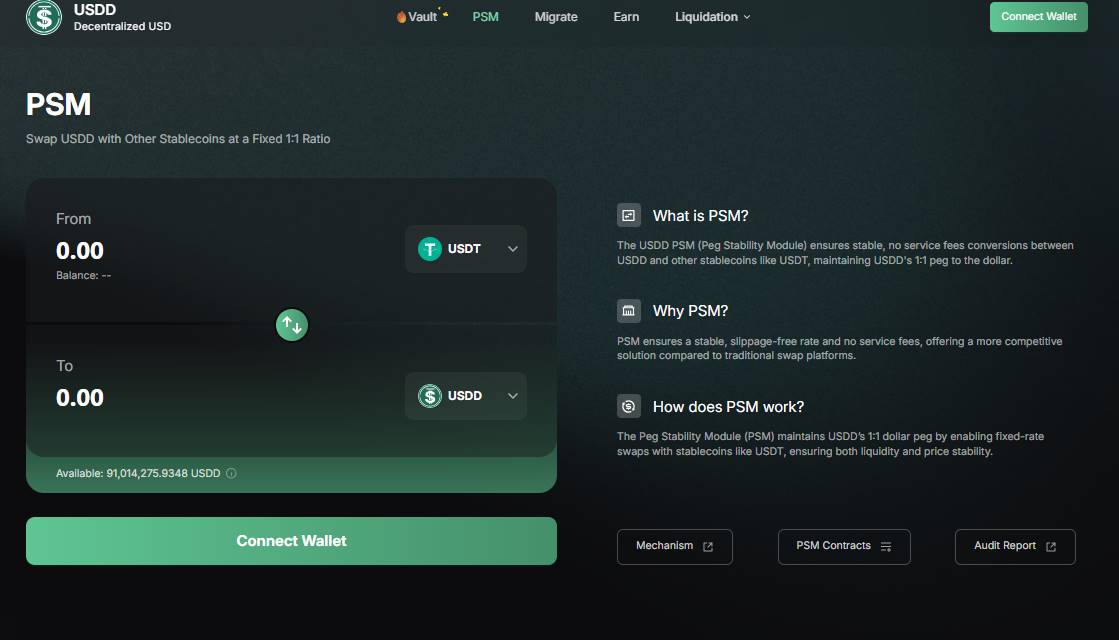

USDD是基于波场TORN的去中心化稳定币。目前,用户可通过两种方式来获取USDD。一是通过超额抵押“TRX、sTRX、USDT”等优质资产来铸造USDD;二是稳定币兑换工具PSM,直接使用USDT按照1:1兑换成USDD,而且整个过程0GAS费和0手续费。

根据官方数据,截至6月16日,USDD总供应量约4.3亿枚。

目前,USDD已无缝对接JustLend DAO、SUN.io等DeFi平台实现了无缝对接,同时还与Kraken、HTX、Bybit、Gate.io、Poloniex等合规交易所建立了紧密的合作关系。在这些平台上,用户可将USDD进行质押,赚取高收益。这种广泛的生态对接为USDD的流通和应用提供了广阔的空间,使其能够更好地融入加密货币市场的各个环节,为用户带来更多的价值和便利。

四、一站式交易平台SUN.io

SUN.io是基于波场TRON公链的一站式交易平台,整合了资产兑换、Meme资产发行、流动性挖矿和DAO治理等功能,旨在为波场TRON生态提供高效、安全的资产交易服务。

目前,SUN.io的产品功能矩阵主要包括以下板块:

● SunSwap(交易核心引擎):是基于AMM机制的交易平台,历经V1、V2、V3三个版本的升级迭代,当前交易主要发生在V3板块中。

● SunCurve和PSM主要专注稳定币资产交易,PSM专为稳定币USDD推出的稳定币兑换Swap工具,支持用户将USDD与USDT/USDC/TUSD等稳定币之间进行1:1的固定比例兑换,且交易0滑点、0手续费。

● SunPump是Sun.io推出的最新产品,定位为波场TRON生态系统中首个致力于公平发射meme币的平台。

● SunBoost(流动性激励中心):则是平台的LP质押挖矿模块,用户可将SunSwap的LP Token进行质押,获取代币奖励,是流动性激励的核心机制。

● DAO治理系统:通过veSUN模型支持用户参与SUN.i平台治理与激励分配决策,构建了一个社区主导的治理结构。

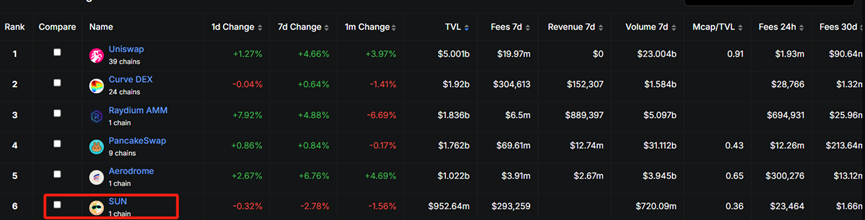

从数据层面来看,SUN.io的表现非常优异。根据DeFiLlama数据显示,6月16日,SUN.io平台锁仓的加密资产价值(TVL)超过9.52亿美元,这一数字在波场TRON网络长期位居前三之列,在整个DEX赛道中也排名前六。

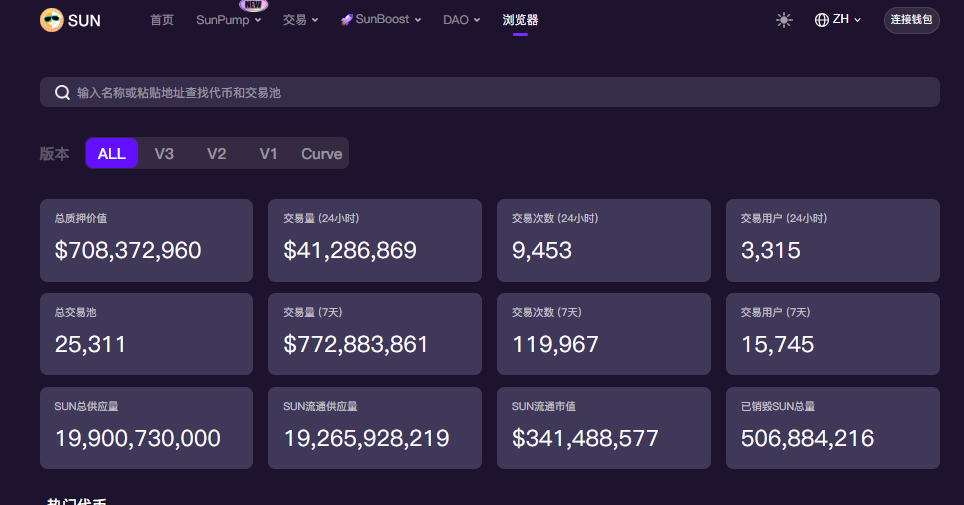

同时,根据SunScan官方浏览器数据显示,SUN.io的交易活跃度同样表现亮眼,近7日内,SunSwap处理的交易笔数已约12万笔,交易量高达7.7亿多美元。过去一周,平台交易活跃地址数已超过1.5万,当前累计交易资金池数量超过2.5万,涵盖从稳定币资产、主流资产到 Meme长尾资产在内的广泛资产结构,形成了一个多元化、包容性的金融生态系统。

此外,SUN平台币也展现出了良好的发展态势。其流通市值约3.41亿美元,当前已销毁代币已超过5亿枚,通缩路径明确,代币模型与平台价值增长形成了紧密的联动,随着平台的不断发展壮大,SUN 平台币的价值也有望持续提升,为用户带来更多的收益和回报。

五、MEME资产公平发行平台SunPump

SunPump作为Sun.io精心打造的MEME资产公平发行平台。依托波场TRON的强大技术基础设施和庞大的用户基础,SunPump在2024年8月亮相后,便迅速走红,在竞争激烈的MEME发行赛道中长期稳居前三甲之列。

上线首月,SunPump便展现出惊人的爆发力,单日发行的Meme数量一举创下7351个的惊人记录,日收益更是高达56万美元,其表现曾一度超越行业龙头PumpFun。

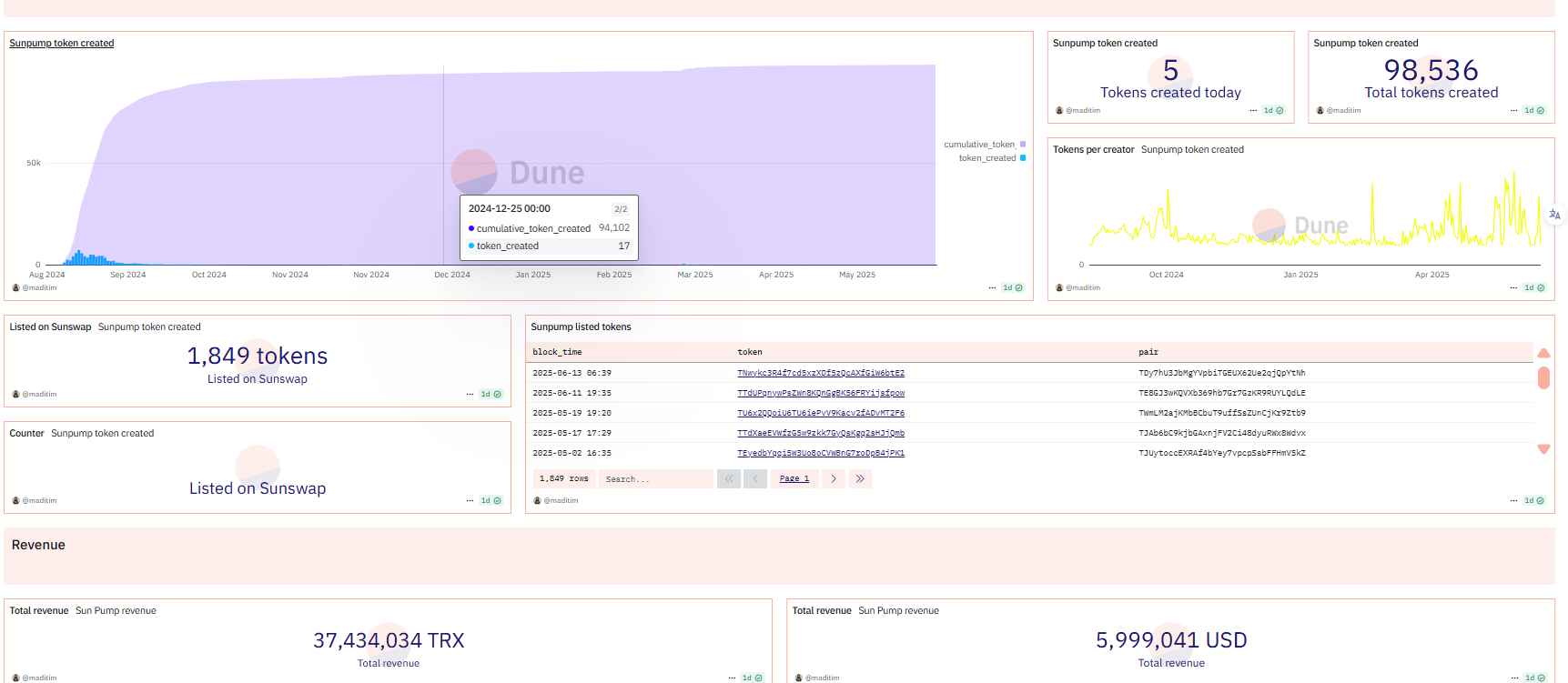

根据Dune数据显示,截至6月16日,SunPump平台已创建的Token数量已超过9.8万个,上线Sunswap的Token数量约1850个。协议上线以来累计捕获的收益已突破1000万美元。这一系列亮眼的数据,无疑是SunPump平台蓬勃发展的有力见证。

在生态表现方面,当前MEME代币市值在1000万美元以上的就有4个,如SUNdog、PePe等。

在产品功能层面,SunPump平台始终围绕代币创建、交易增长与社区互动三大核心持续迭代升级。平台已陆续上线了Sunflare(可帮助用户及时发现潜力项目)、Ranking System(根据交易量、持币人数等关键指标对代币进行实时排名,可为用户提供清晰的投资参考)、CEX Listing Apply(项目方可直接通过 SunPump 提交中心化交易所上线申请,为项目发展拓宽渠道)等一系列新功能,不仅极大地提升了用户体验,更进一步拓展了平台的生态边界,使其成为一个更加完善、更加多元的MEME资产发行与交易生态。

在产品创新上,SunPump更是积极进取、勇于突破。去年,Sun Agent Launch推出智能助手Sun Agent,优化AI驱动的工具和服务,为创作者与交易者提供了更便捷的内容生成与管理体验。今年3月,平台又创新性地推出AI Agent @SunGenX,支持“发推即发币”的轻量代币创建功能。用户仅需一条推文,即可轻松完成MEME代币的发行,极大地简化了代币发行流程。

结语

如今,波场TRON在公链赛道已占据着举足轻重的地位,生态数据也呈现出持续增长的强劲态势,而这背后是多重因素协同发力、共同驱动的结果。

波场TRON在用户规模、资产体量与生态协议发展这三大关键领域所斩获的优异成绩,已构成推动其生态蓬勃增长的“三驾马车”,引领着波场TRON在加密赛道奔驰向前,势不可挡。

Sun.io、SunPump、JustLend DAO、USDD等一系列核心协议和模块,为用户提供了丰富多样的金融产品和服务,满足了不同的投资和交易需求。这些核心产品矩阵不仅是波场TRON生态的坚实支柱,更是其在DeFi领域保持领先地位的关键力量。它们持续驱动着整个生态向着更加繁荣、多元化和创新的方向不断迈进。

展望未来,波场TRON有望凭借其深厚的技术底蕴、庞大的用户基础和强大的生态协同效应,在加密货币市场中继续续写辉煌篇章,为全球用户打造一个更加开放、高效、透明且包容的金融生态系统,真正成为推动去中心化金融的光芒照亮全球每一个角落的关键基础设施。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。