Original Title: The Future Of Stablecoins

Original Source: Artemis

Original Translation: DePINone Labs

Release Date: May 29, 2025

Editor's Note: In the critical phase where the crypto market shifts from "concept" to "industry," stablecoins will be a key link connecting on-chain and off-chain financial worlds. The Artemis team's report "The Future of Stablecoins" provides profound insights by systematically reviewing the development history, current application status, and future outlook of stablecoins. This report focuses on the transformation of the stablecoin ecosystem: from an early focus on issuance to today's emphasis on distribution and actual usage.

· The use of stablecoins outweighs supply: The report emphasizes that understanding the actual application scenarios of stablecoins is more important than merely focusing on their total supply. Stablecoins have expanded from a single trading tool to diversified uses such as payments, savings, cross-border remittances, and DeFi collateral.

· Power shifts from issuers to distributors: As the barriers to stablecoin issuance lower, distributors (such as wallets, trading platforms, and fintech platforms) gradually become the dominant force in value capture. They not only integrate stablecoins but also shape market influence through user relationships and experiences.

· The rise of new infrastructure: To accommodate diverse use cases, new infrastructure is developing to support programmability, compliance, and value sharing. Stablecoins are no longer simple digital assets but dynamic financial primitives capable of adapting to the needs of different scenarios.

· Data insights: The report provides detailed data analysis showing that stablecoin supply and trading volume are primarily concentrated in centralized exchanges (CEX), DeFi protocols, and maximum extractable value (MEV) infrastructure. Unattributed wallets also account for a significant share, representing the growth potential of grassroots users and emerging use cases.

The following is the original text of the research report:

Executive Summary

Whether stablecoins will reshape global finance is no longer the question; rather, it is how they will reshape it. In the early days, the growth of stablecoins was measured by total supply. The key challenge was trust: which issuers are credible, compliant, and scalable? This question has been answered. Today's leading issuers demonstrate operational resilience, and new entrants are entering the market with institutional support and regulatory readiness.

As issuance becomes commoditized, power is shifting from minting to distribution. The days of astonishing profits at the issuer level are numbered—distributors are beginning to realize their influence and capture their rightful share of value. Given this shift, understanding which applications, protocols, and platforms are achieving real growth is becoming increasingly important. Are stablecoins driving real payments? Cross-border capital flows? Institutional finance?

In the competitive stablecoin space, distributors need to capture the value they create to survive. Every digital bank, wallet, or fintech company moving stablecoins is generating revenue—the only question is who retains it. Builders who recognize this are shifting from default options to offering programmability, embedded financial rails, and modular infrastructure.

Just as early innovations were defined by reserve quality and protocol security, the next era will be defined by product design and distribution strategies. Those who do the right things will define the future of finance.

About This Report

This report aims to redefine our understanding of stablecoin growth: from issuance to implementation. It is the first in a series of reports examining the evolving landscape of stablecoin use cases, mapping the distribution of key applications, and estimating reserve-based revenues related to major categories. By analyzing how usage patterns change over time, we reveal the evolution of use cases—and where value is truly being created. While the data in this report highlights many of the largest participants, it does not capture all entities due to attribution limitations. Our goal is to support more informed dialogue, development, and investment, covering both emerging and established use cases.

Industry Insights

· We are in the midst of a significant transformation—a shift in perspective, where stablecoins are no longer seen as "cryptocurrencies" but as "global infrastructure"; a shift in utility, where financial builders are actively reshaping their products to leverage these new rails. The arena is changing; be prepared. —Ran Goldi, Senior Vice President of Payments and Networks at Fireblocks

· The growth of stablecoins has reached escape velocity, and regulatory clarity is opening doors for institutions. The next frontier is not just about who has scale today—it concerns the business models of all participants in the stablecoin supply chain, from issuers and distributors to holders. In the next 12–24 months, we will certainly see changes and challenges in the value chain and value accumulation. —Martin Carrica, Vice President of Stablecoins at Anchorage Digital

· Stablecoins are the first primitives of the new financial stack. Everything we know about finance is being rebuilt on stablecoins. And the winners? They will control distribution. —Simon Taylor, Head of Strategy and Content at Sardine

· Stablecoins have transitioned from experimental to essential in just a few years, with their product-market fit being undeniable. But we are now entering a new era where issuance and liquidity alone are insufficient for sustained growth. The next phase of stablecoin adoption will involve new factors, including sharing economic benefits with partners, the convenience of on-chain and off-chain integration, and the extent to which programmability features are utilized. —Jelena Djuric, Co-founder and CEO of Noble

· Stablecoins have proven to be highly profitable, whether through Tether's excess returns, Stripe's acquisition of Bridge, or the $100 trillion in settlement volume annually, solidifying their position as the foundation of global financial infrastructure. —Stefan Cohen, Partner at Bain Capital Crypto

Table of Contents

Stablecoin Landscape

From Minting to Market

Use Case Analysis

· Total Market

· Centralized Exchanges (CEXs)

· Decentralized Finance (DeFi)

· Maximum Extractable Value (MEV)

· Unattributed Wallets

- Conclusion

Overview of Stablecoins

Beyond Market Capitalization

Stablecoins have become one of the most widely used products in cryptocurrency. With a supply exceeding $240 billion and annual on-chain transaction volume surpassing $7 trillion, they rival traditional payment networks in scale. But these numbers tell an incomplete story. Supply reflects the existence of stablecoins, not their usage, flow, or purpose. Meanwhile, volume reflects a mix of on-chain human activity and bot activity but fails to capture off-chain data.

Usage is the New Direction

Not all stablecoins in circulation are equal. Some are dormant. Others are key drivers of real economic activity across platforms, users, and regions. As seen in the "2025 State of Stablecoins," there are significant differences between ecosystems. Stablecoins on Ethereum tend to be used as DeFi collateral and trading liquidity, while stablecoins on Tron are more commonly used for remittances and payments in emerging markets. USDC has a high share in institutional liquidity, while USDT thrives due to its coverage and accessibility.

These usage patterns not only reflect the direction of value flow; they also provide builders with opportunities to target underserved or high-growth niche markets. Understanding where stablecoins are implemented and the functions they achieve is now the clearest signal for assessing the authenticity of adoption and where the next wave of innovation will emerge.

From Institutional Issuance to Market Distribution

Historical Value of Issuers

In the early stablecoin era, value capture was concentrated among issuers. Maintaining a 1:1 peg at scale was a challenge that few managed well. Tether and Circle dominated not only because they were early entrants but also because they were among the few capable of consistently managing issuance and redemption, reserve management, banking partnerships, and surviving market pressures.

Monetization through reserve earnings (primarily short-term U.S. Treasuries and cash equivalents) turned even modest interest rates into significant revenue. Early successes doubled down: trading platforms, wallets, and DeFi protocols built around USDT and USDC reinforced the network effects of distribution and liquidity.

Distribution as a Layer of Value

Reliable custody, liquidity, and redemption are no longer differentiators—they are expected. As more issuers with similar capabilities enter the market, the importance of the issuers themselves diminishes. What matters is what users can do with stablecoins. Thus, power is shifting from issuers to distributors. Wallets, trading platforms, and applications that integrate stablecoins into real-world use cases now hold influence and leverage. They possess user relationships, shape experiences, and increasingly determine which stablecoins gain traction.

Moreover, they are monetizing this position. Circle's recent IPO filings show that it paid nearly $900 million to partners like Coinbase in 2023—over half of its total revenue—for integrating and promoting USDC. The current situation is that issuers pay distributors, not the other way around.

Many distributors are moving further upstream. PayPal has launched PYUSD. Telegram is collaborating with Ethena. Meta is exploring stablecoin rails again. Fintech platforms like Stripe, Robinhood, and Revolut are embedding stablecoins directly into payment, savings, and trading functionalities. Issuers are not standing still. Tether is building wallets and payment rails. Circle is expanding through payment APIs, developer tools, and infrastructure acquisitions. But the dynamic is clear: distribution is now the strategic high ground.

Built for Programmability and Precision

As stablecoin adoption expands, new infrastructure is emerging—built for programmability, compliance, and value sharing. Simply relying on issuance is no longer sufficient to compete. Stablecoins must adapt to the platform demands driving usage. Next-generation stablecoins include programmable features such as hooks, compliance rules, and conditional transfers. These features make stablecoins application-aware assets, automatically routing value to merchants, developers, liquidity providers, or affiliates without the need for off-chain protocols.

Each use case has a unique context. Remittances prioritize speed and conversion, DeFi requires composability and collateral flexibility, and fintech integration demands compliance and auditability. The emerging infrastructure stack aims to serve these diverse needs, allowing the stablecoin layer to dynamically adapt to its context rather than providing a one-size-fits-all solution. Crucially, this infrastructure shift enables more precise value capture. Programmable flows mean that value can be shared throughout the stack—not just hoarded by issuers. Stablecoins are becoming dynamic financial primitives, shaped by the incentives and architecture of their moving ecosystems.

Focusing on Use Cases

As the value capture of stablecoins shifts downstream, it is the distributors that define their actual use cases. Wallets, trading platforms, fintech applications, payment platforms, and DeFi protocols determine which stablecoins users can see, how they interact with these stablecoins, and where they create utility. These platforms shape the user experience and control the demand side of the stablecoin economy. Analyzing the actual usage of stablecoins in payments, savings, trading, DeFi, and remittances can reveal who is creating value, where the friction points are, and which distribution channels are effective. By tracking the flow of stablecoins across wallets and platforms, we can gain insights into the infrastructure and incentive mechanisms that influence their application.

Use Case Analysis

This report focuses on stablecoin use cases related to on-chain activity from attributed wallets—these addresses are identified as belonging to specific entities, such as centralized exchanges, DeFi protocols, or institutional participants. Among these known (also referred to as "tagged") participants, stablecoin usage is currently concentrated in three main environments:

1. Centralized Exchanges

2. DeFi Protocols

3. MEV Infrastructure

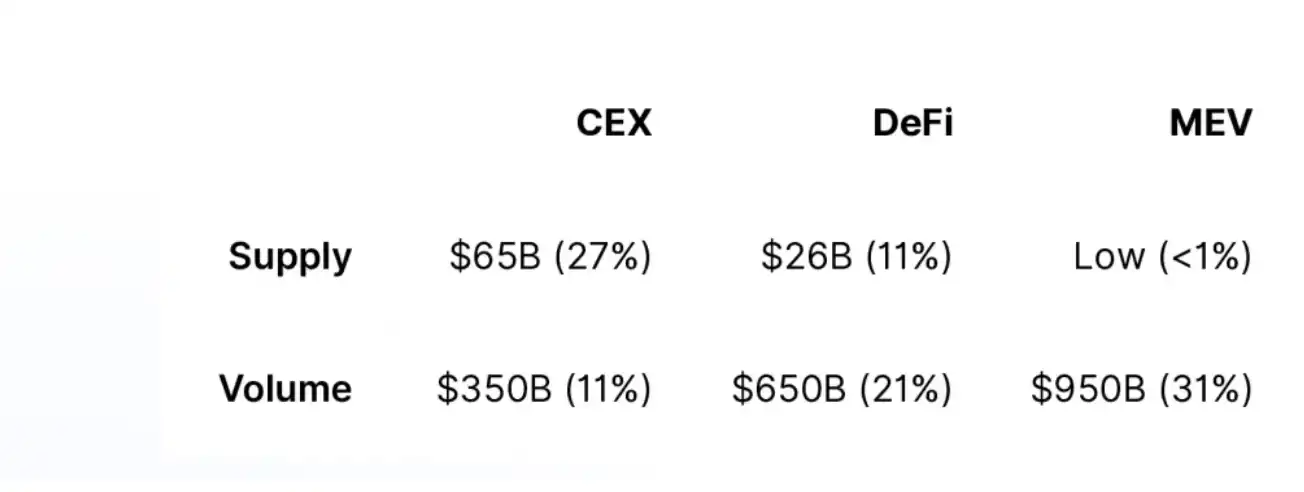

The table below shows the supply and trading volume shares of each category as of April 2025:

These three categories account for 38% of the total stablecoin supply and 63% of the total stablecoin trading volume. Unattributed addresses make up the majority of the remaining supply and trading volume. These are wallets not directly linked to known institutions, trading platforms, or smart contracts. We will explore the trends of unattributed addresses later in this report. To estimate the revenue from supply operations, we use the current floating reserve and calculate an annual yield of 4.33% based on the current effective federal funds rate in the U.S. In practice, many issuers have higher yields, but this serves as a rough benchmark for estimating expected revenue figures.

Total Market Overview

· Total stablecoin supply: $240 billion

· Total stablecoin trading volume: $3.1 trillion (last 30 days)

· Reserve income: $10 billion (assuming fixed floating annual yield)

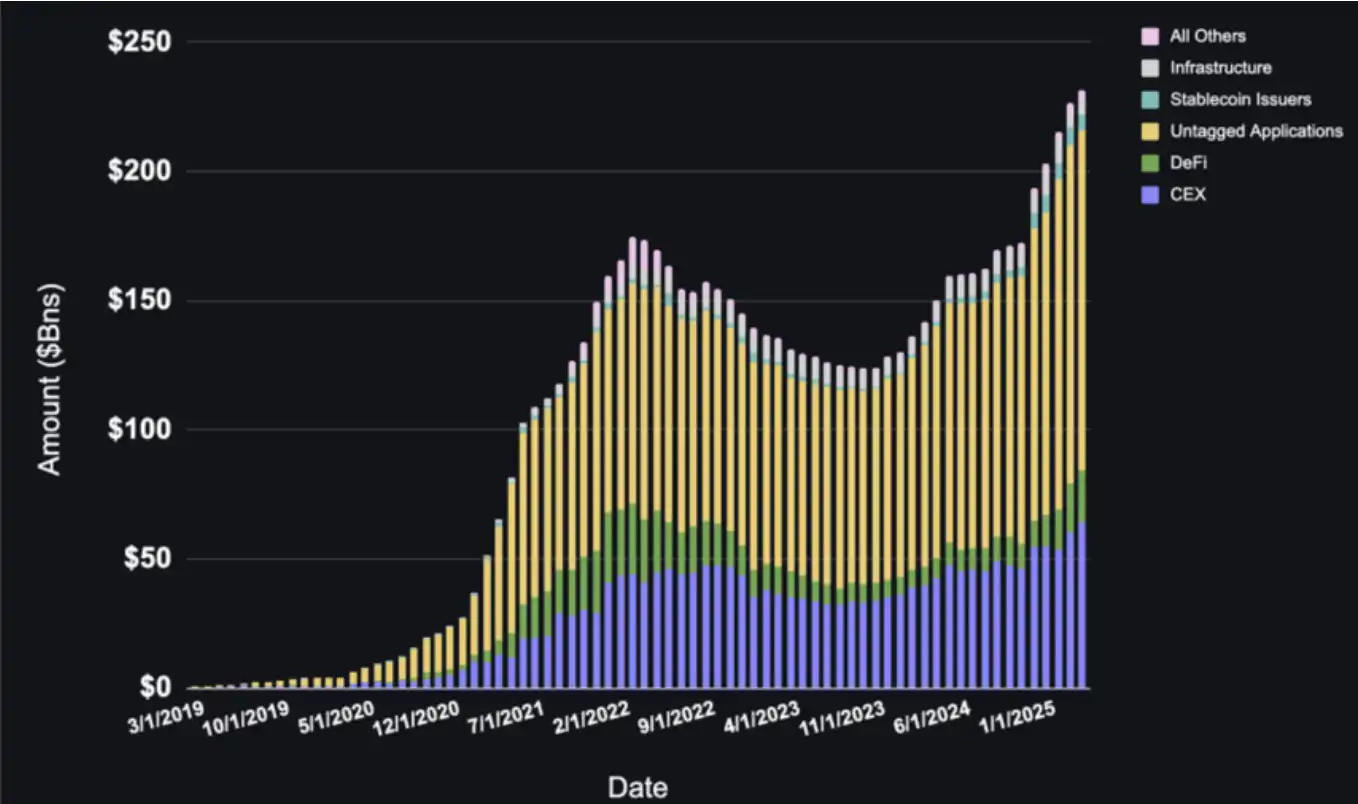

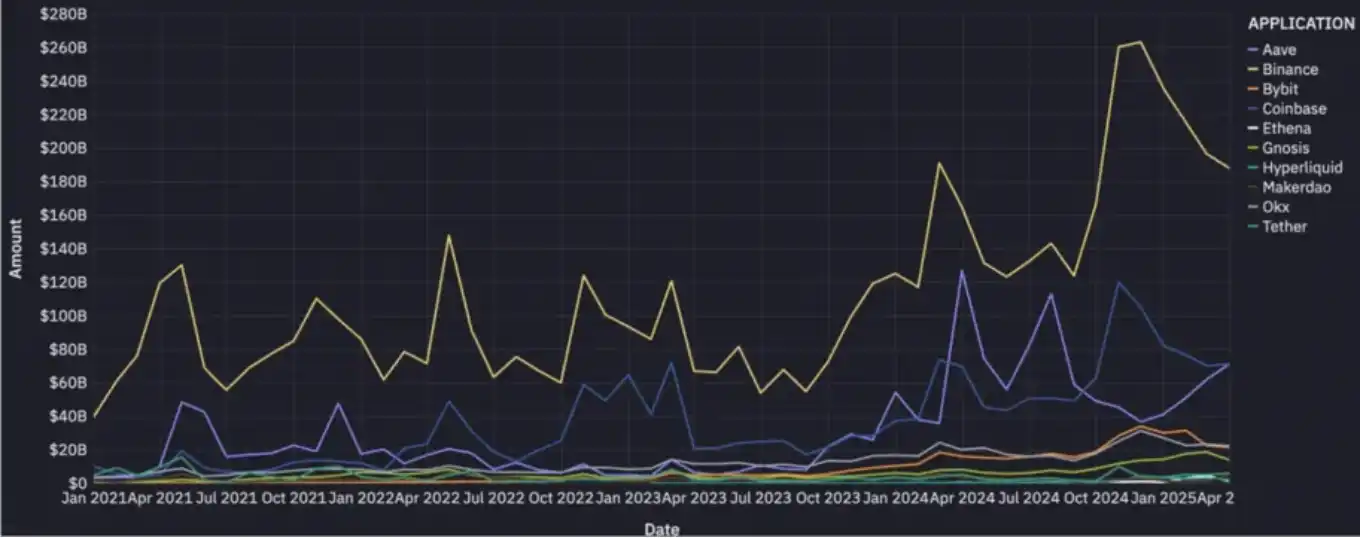

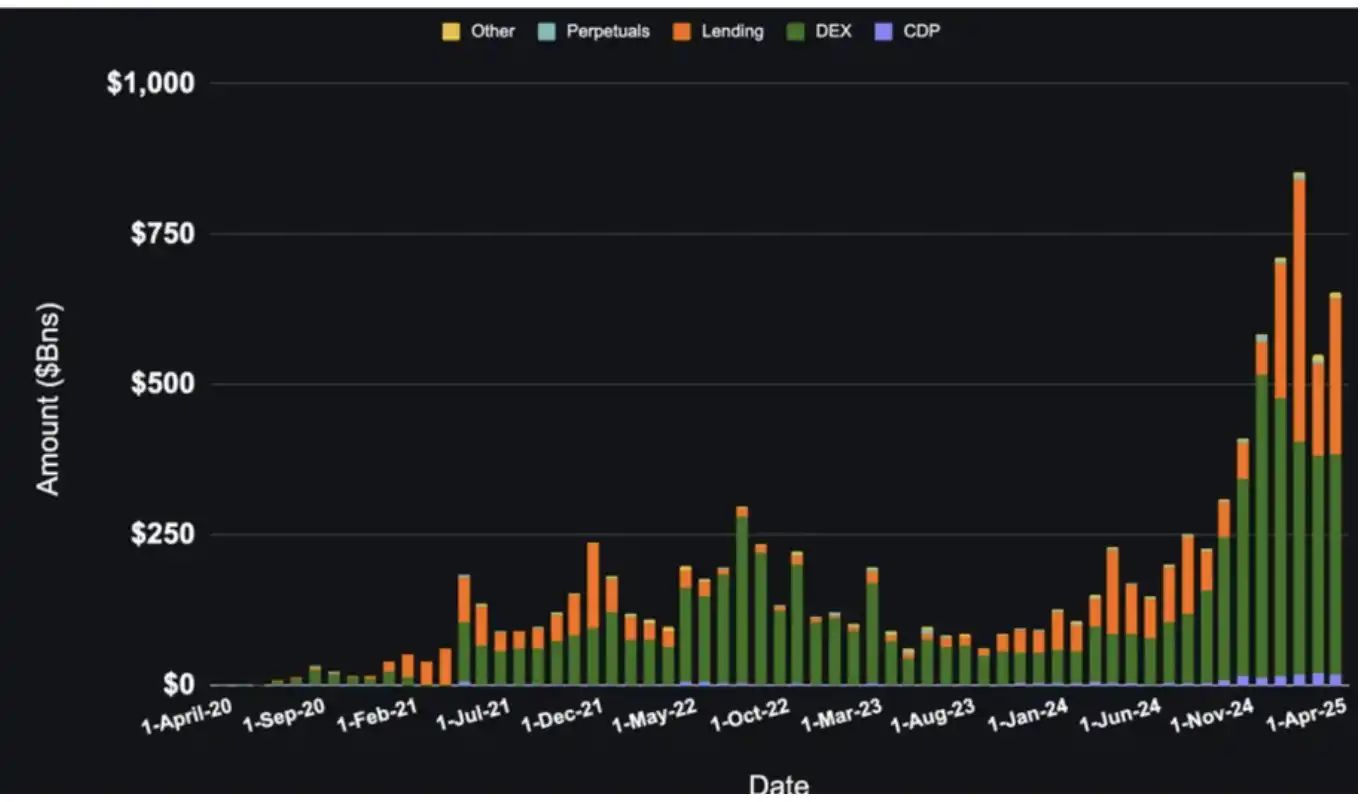

Total stablecoin supply by use case

The distribution of stablecoin supply reveals which platforms and use cases are sufficiently attractive and retain floating reserves. Total supply has steadily climbed since the summer of 2023, reaching an all-time high this year, with high growth in CEX, DeFi, and unattributed wallets.

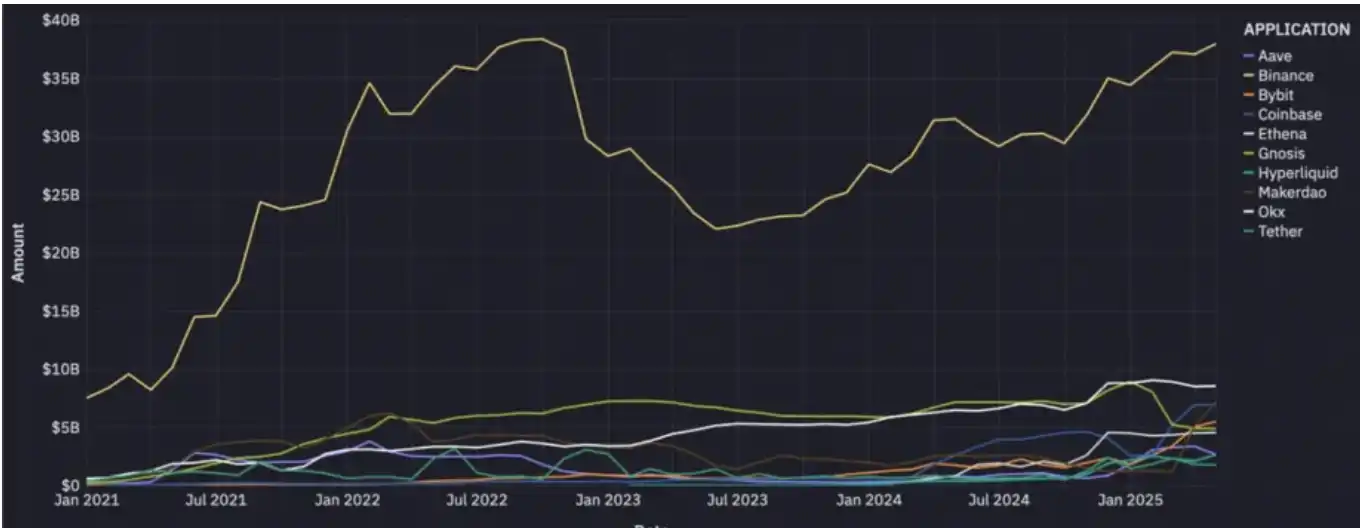

Top 10 entities by stablecoin supply

The majority of stablecoin supply is concentrated in centralized exchanges, with Binance holding a significant lead. DeFi protocols and issuers also account for a substantial share.

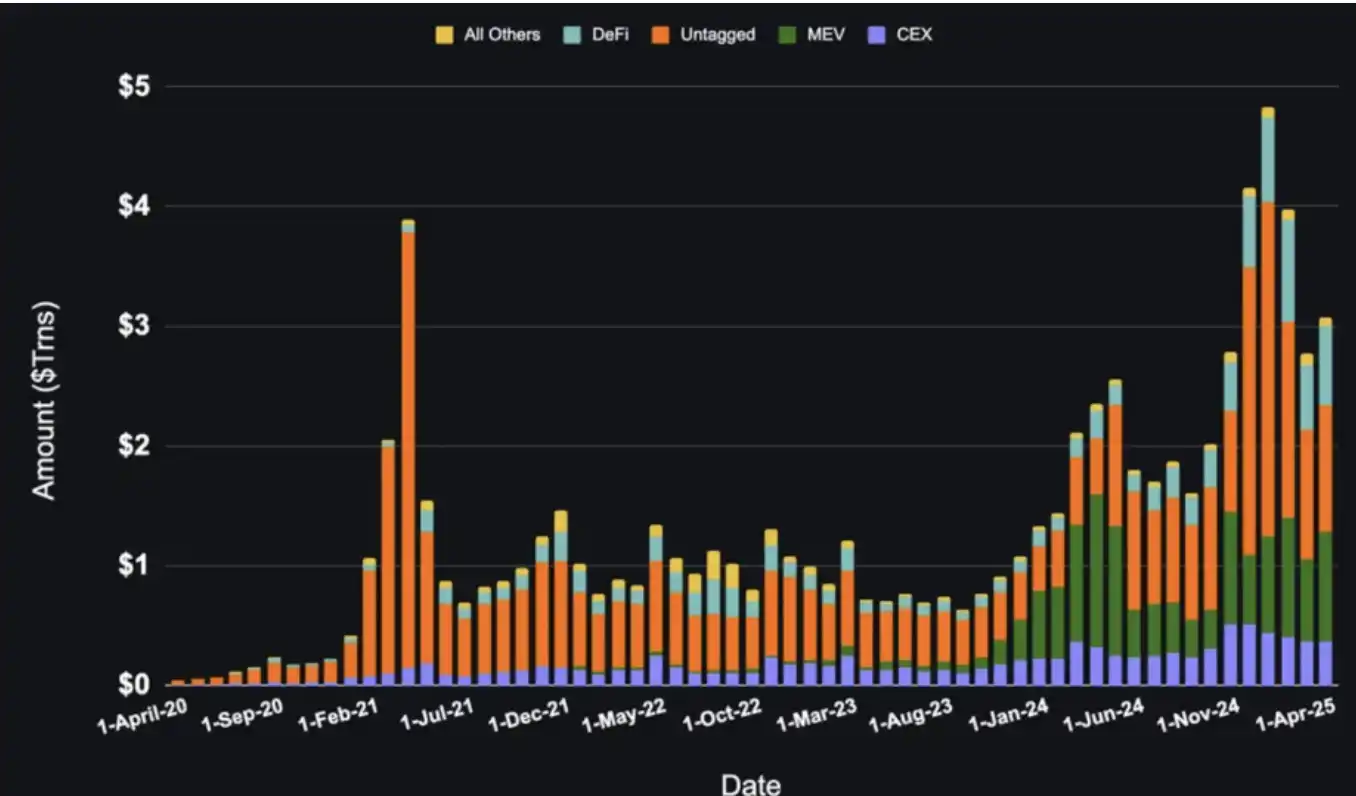

Total stablecoin trading volume by use case

Since the summer of 2023, the total trading volume of stablecoins has steadily increased, with significant spikes during periods of high market activity. DeFi has seen the highest growth in trading volume, while MEV and unattributed wallets have high but volatile trading volumes.

Top 10 entities by stablecoin trading volume

Entities with the highest stablecoin trading volumes are often centralized exchanges, followed by DeFi and issuing institutions. CEX trading volume does not reflect trades on CEX platforms, as most transactions occur off-chain. Instead, it reflects user deposits, withdrawals, transfers between trading platforms, and internal operational activities.

In-Depth Analysis by Use Case

Centralized exchanges continue to anchor stablecoin supply, holding a significant portion of circulation across ecosystems. In terms of trading volume, DeFi protocols and MEV-driven participants are currently the most active, highlighting the growing role of on-chain applications and composable infrastructure. This section will delve into these categories to analyze key participants, emerging trends, and revenue opportunities.

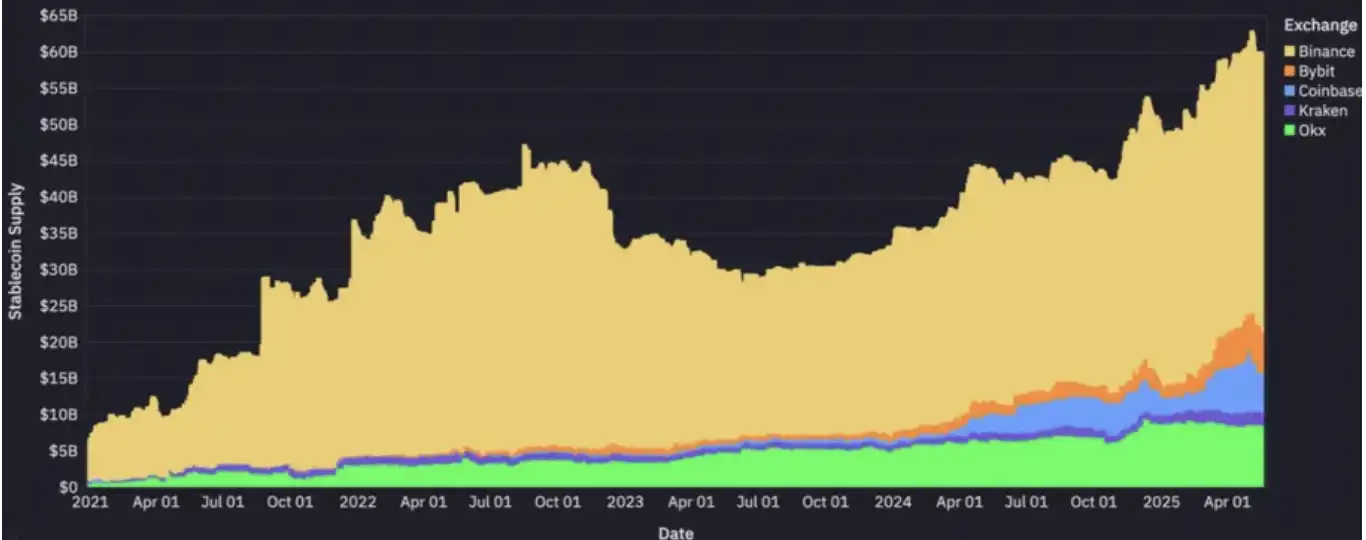

Centralized Exchanges (CEX)

· Stablecoin supply share: 27%

· Stablecoin trading volume share: 11% (last 30 days)

· Reserve income: $3 billion (assuming fixed floating annual yield)

Top 5 CEX by stablecoin holdings

Since the local low in 2023, the supply of top centralized exchanges (CEX) has nearly doubled. The supply of Coinbase, Binance, and Bybit often fluctuates with market conditions, while Kraken and OkX have seen more stable growth.

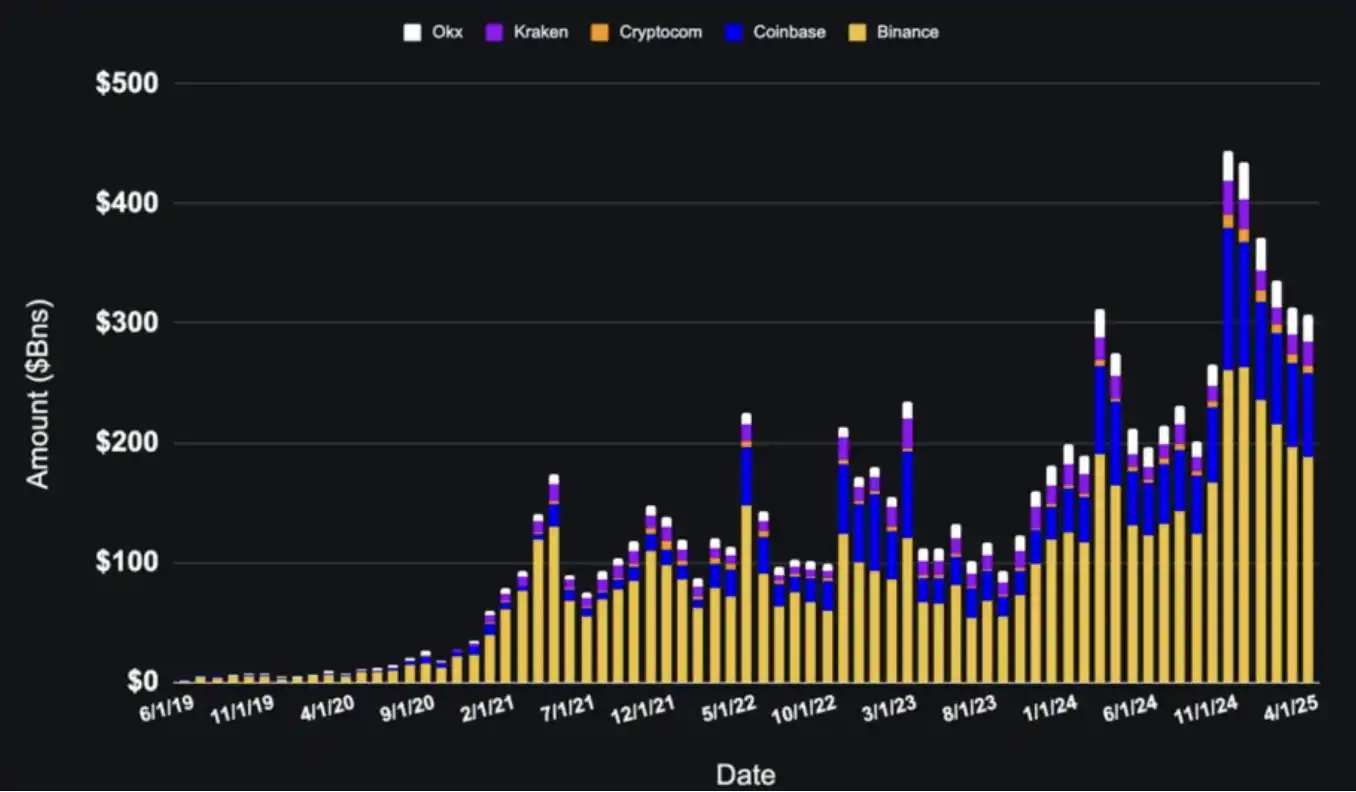

Top 5 CEX by stablecoin transfer volume

Due to most activities occurring off-chain, it is challenging to obtain specific data on how centralized exchanges (CEX) use stablecoins. Funds are often pooled together, with specific uses rarely disclosed. This opacity makes it difficult to comprehensively assess stablecoin usage within centralized exchanges (CEX).

The stablecoin trading volume attributed to centralized exchanges (CEX) reflects on-chain activities related to deposits, withdrawals, transfers between trading platforms, and liquidity operations, rather than internal trading, margin collateral, or fee settlements. Therefore, it is best viewed as an indicator of user interaction with trading platforms rather than a measure of total trading activity.

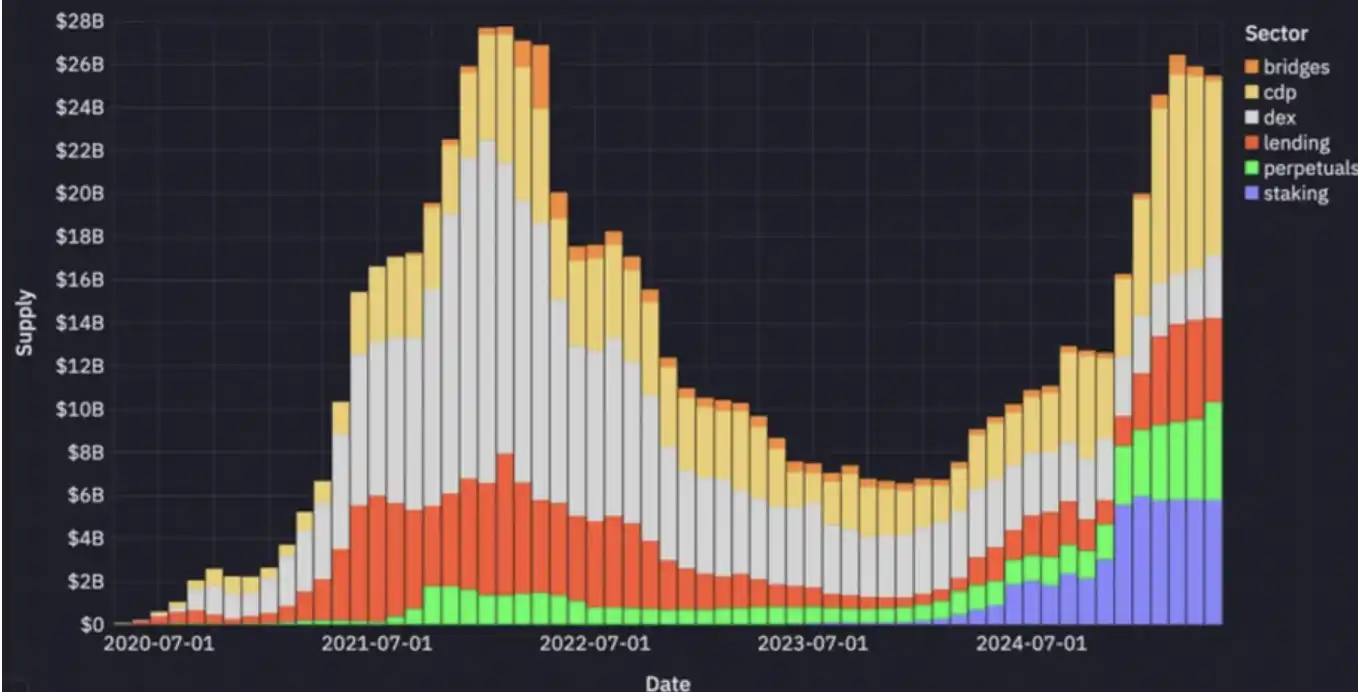

DeFi

· Stablecoin supply share: 11%

· Stablecoin trading volume share: 21% (last 30 days)

· Reserve income: $1.1 billion (assuming fixed floating annual yield)

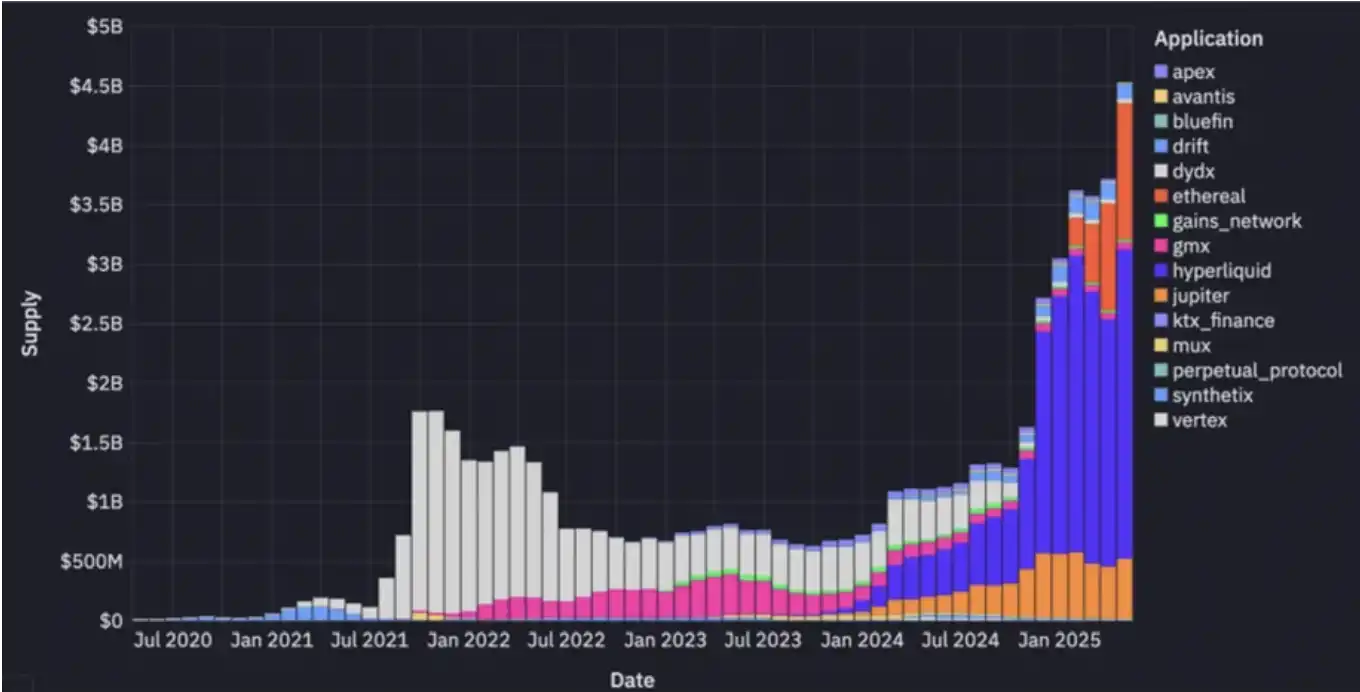

Main categories of DeFi stablecoin holdings

The supply of DeFi stablecoins comes from collateral, liquidity provider (LP) assets, and the settlement layers of lending markets, decentralized exchanges (DEX), and derivatives protocols. In the past six months, the supply from CDPs, lending, perpetual contracts, and staking has nearly doubled. The supply share of DEX has significantly decreased, not due to a decline in DEX usage, but because of the higher capital efficiency of DEX. With the rising popularity of Hyperliquid, the supply locked in perpetual contracts has recently increased significantly.

Main categories of DeFi stablecoin trading volume

In the past six months, monthly stablecoin trading volume in DeFi has grown from about $100 billion to over $600 billion, primarily driven by significant growth in DEX, lending, and CDPs.

In the DeFi space, stablecoins are deployed in several key areas:

· DEX Pools

· Lending Markets

· Collateral Debt Positions

· Others (including perpetual bonds, bridge bonds, and staking)

These sub-markets use stablecoins in different ways—whether as liquidity, collateral, or payment—shaping user behavior and protocol-level economics.

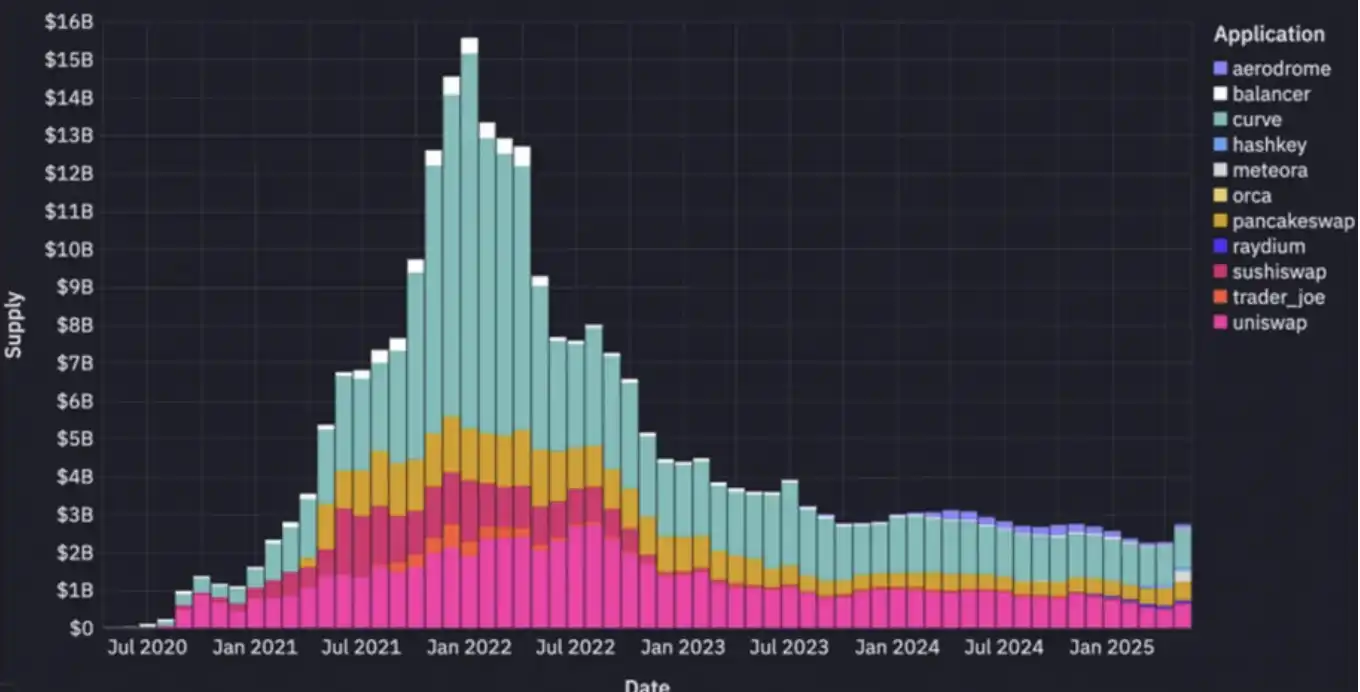

Top DEX ranked by stablecoin TVL

Concentrated liquidity and DEXs focused on stablecoins, along with cross-protocol composability, reduce the need for DEXs to maintain high stablecoin floating.

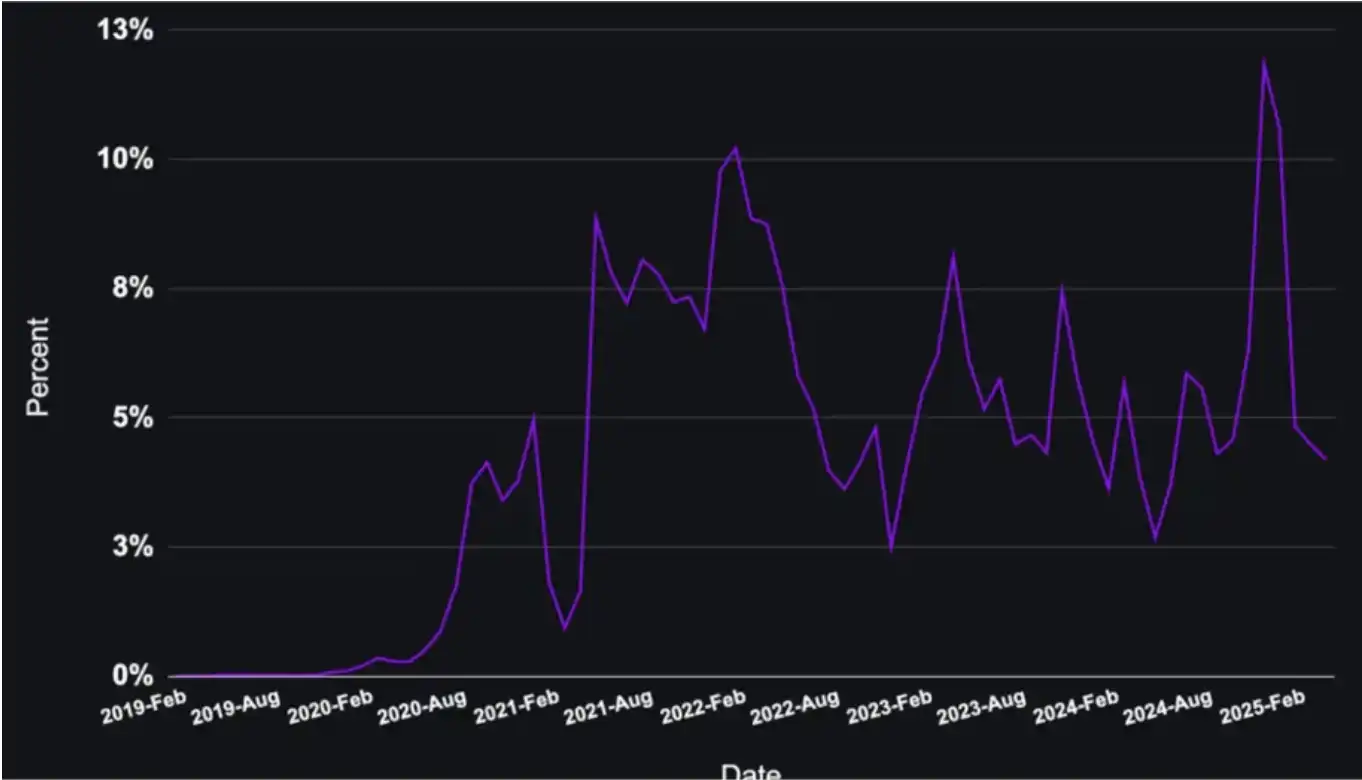

DEX's share of total stablecoin volume

The trading volume of stablecoins in DeFi primarily comes from DEXs. The share of DEX in total trading volume fluctuates with market sentiment and trading trends, with recent memecoin trading volumes soaring to over $500 billion, accounting for 12% of total trading volume.

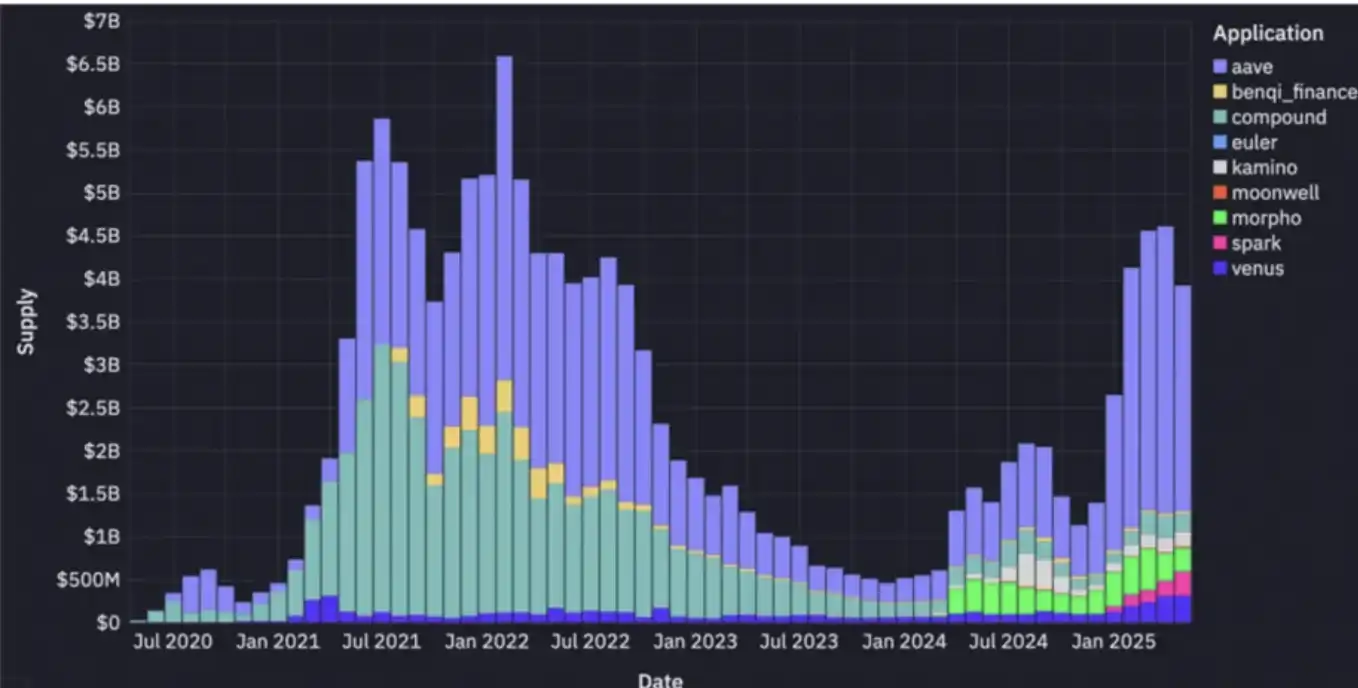

Top lending markets ranked by stablecoin TVL

Although lending activities have retreated from their peak, Aave has shown strong recovery momentum, while newer protocols like Morpho, Spark, and Euler have also gained attention.

Top collateral debt positions (CDP) ranked by stablecoin TVL

MakerDAO continues to manage one of the largest stablecoin vaults in DeFi, with high savings rates driving the adoption of DAI. They hold billions of dollars in stablecoins, which play a crucial role in maintaining DAI's peg to the dollar.

Other top DeFi protocols ranked by stablecoin TVL

Stablecoins also play a key role in supporting derivatives, synthetic assets, perpetual contracts, and trading protocols within DeFi. The supply rotates among various perpetual contract protocols over time, currently concentrated in Hyperliquid, Jupiter, and Ethereal.

MEV

· Stablecoin supply share: 1%

· Stablecoin trading volume share: 31% (last 30 days)

· Reserve income: Not applicable (assuming fixed floating annual yield)

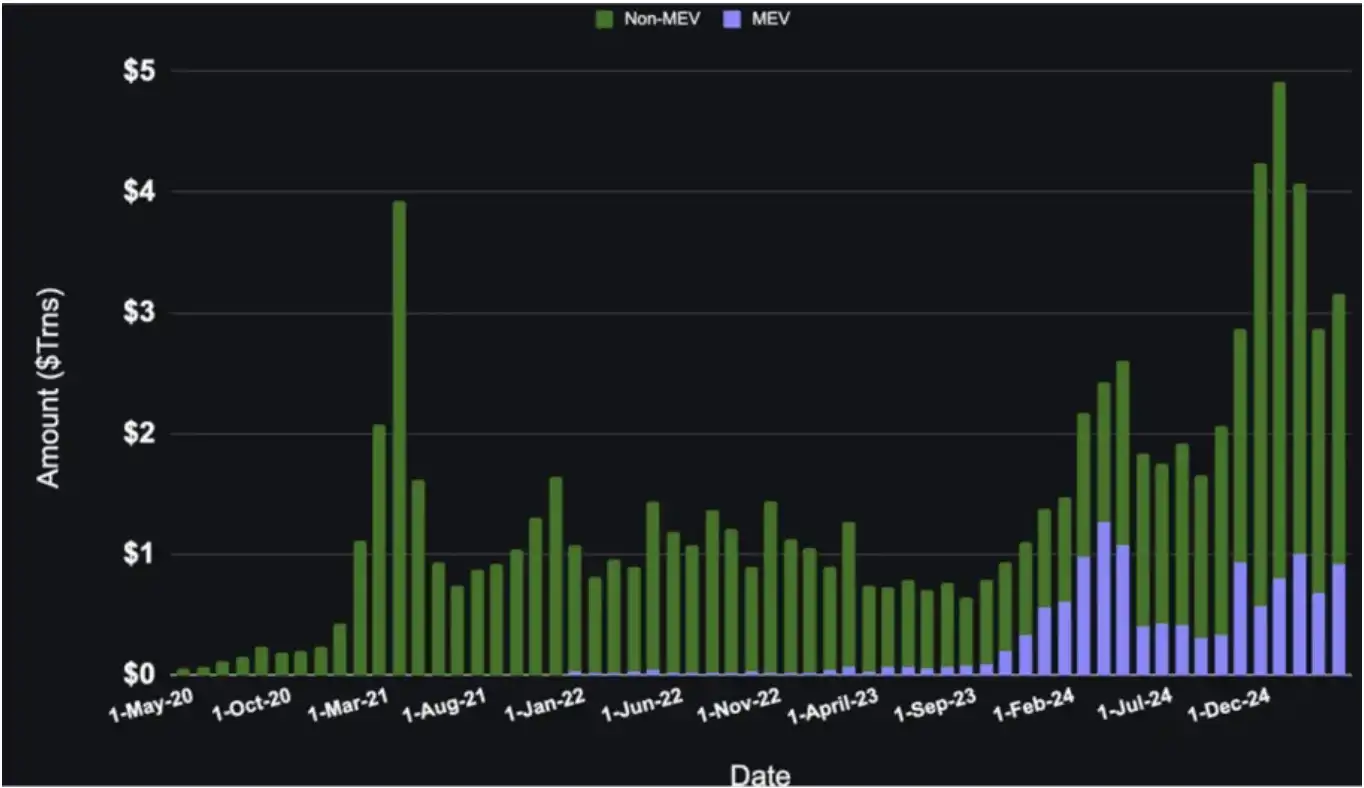

MEV vs Non-MEV Trading Volume

MEV bots capture value by reordering transactions. Their high-frequency behavior leads to an excessive share of on-chain trading volume, often reusing the same funds. The above chart distinguishes MEV-driven activity to differentiate between bot trading volume and manual trading volume. MEV trading volume surges during peak trading periods and fluctuates as blockchains and applications attempt to counter MEV strategies. Predicting revenue for high trading volume, low floating amount use cases like MEV is not as straightforward as predicting high floating amount use cases. Estimating reserve yield is less applicable here, but these use cases can adopt various monetization strategies, such as trading fees, spread capture, embedded financial services, and monetization for specific applications.

Unattributed Wallets

· Stablecoin supply share: 54%

· Stablecoin trading volume share: 35% (last 30 days)

· Reserve income: $5.6 billion (assuming fixed floating annual yield)

The stablecoin activity in unattributed wallets is harder to interpret, as the intent behind transactions must be inferred or confirmed through private data. Nevertheless, these wallets account for the vast majority of stablecoin supply and often dominate trading volume.

The composition of unattributed wallets includes:

· Retail investors

· Unidentified institutions

· Startups and SMEs

· Dormant or passive holders

· Unclassified smart contracts

While attribution models are not perfect, this "gray area" category of wallets is increasingly significant in real-world payments, savings, and operational processes, many of which do not fully map to traditional DeFi or trading frameworks. Some of the most promising use cases are emerging here, including:

· P2P remittances

· Startup treasuries

· Dollar savings for individuals in inflationary economies

· Cross-border B2B payments

· E-commerce and merchant settlements

· In-game economies

As regulatory transparency increases and payment-centric infrastructure continues to attract capital, these emerging use cases are expected to expand rapidly—especially in traditionally underserved banking regions. We will explore this section in detail in the second part of this series. For now, let's look at some overall trends:

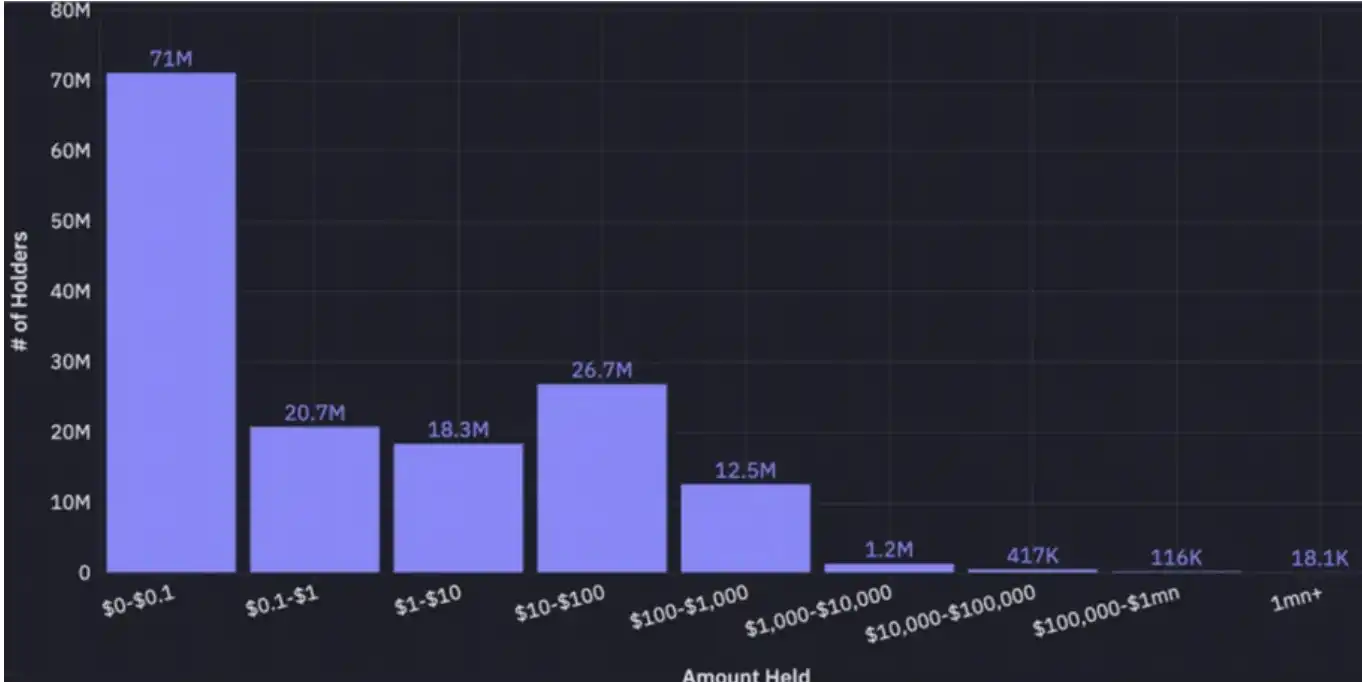

Number of holders by holdings

Despite the large number of unattributed wallets—over 150 million—the vast majority of balances are negligible. Over 60% of unattributed wallets hold less than $1 in stablecoins, with fewer than 20,000 wallets holding over $1 million in stablecoin balances.

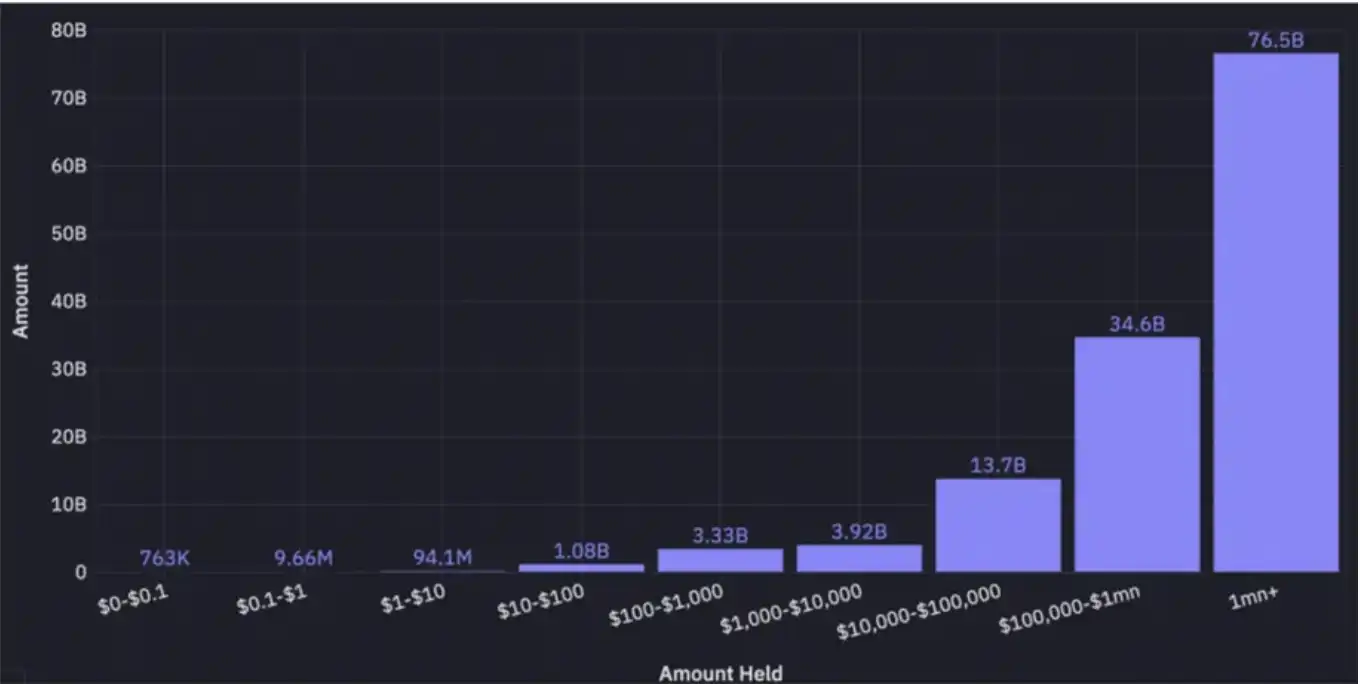

Total stablecoin holdings by wallet size

When we shift our focus to the wallet sizes corresponding to each balance range, the situation flips entirely. Fewer than 20,000 unattributed wallets with balances over $1 million collectively hold over $76 billion, accounting for 32% of total stablecoin supply. Meanwhile, wallets with balances below $10,000—over 99% of unattributed wallets—collectively hold $9 billion, less than 4% of total stablecoin supply. Most wallets are small, but the majority of unattributed stablecoin supply is held by a very small number of high-value groups. This distribution reflects the dual nature of stablecoin usage: one end is broad grassroots access, while the other end is significant institutional or whale concentration.

Conclusion

The stablecoin ecosystem has entered a new phase, with value increasingly flowing to developers building applications and infrastructure. This marks a critical maturation of the market; its focus will shift from the currency itself to the programmable systems that make the currency work. With the improvement of regulatory frameworks and the surge of user-friendly applications, stablecoins are poised for exponential growth. They combine the stability of fiat currencies with the programmability of blockchains, making them a foundational cornerstone for building the future of global finance.

The future of stablecoins belongs to those who create applications, infrastructure, and experiences that unlock their full potential. As this shift accelerates, we can expect more innovation in how value is created, distributed, and captured throughout the ecosystem. The future will not only be defined by stablecoins but by the ecosystem that forms around them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。