Multiple parts of the crypto ecosystem will form a symbiotic relationship in the long term.

Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: AIMan@Golden Finance

Circle's IPO reminds us why cryptocurrency investors can benefit from simultaneously allocating to crypto assets and crypto-related stocks.

Circle, the issuer of the world's second-largest stablecoin USDC, went public on the New York Stock Exchange last Thursday under the ticker symbol CRCL. This is one of the most successful IPOs in recent years:

- The offering was oversubscribed by 25 times, with institutional investors' demand reaching 25 times the amount the company planned to issue;

- The offering price was set at $31 per share, higher than the $25-$27 pricing range in the prospectus;

- On the first day of trading, the stock price surged 167% on high volume, reaching $105 as of Tuesday (when I wrote this).

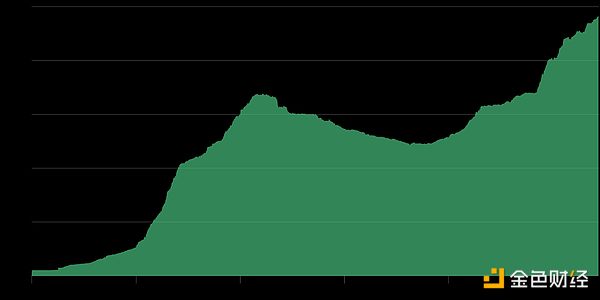

It's easy to understand investors' eagerness to gain exposure to CRCL. Stablecoins have become the "second killer application" in the crypto space after Bitcoin. Over the past five years, the assets under management (AUM) of stablecoins have grown from $4 billion to $250 billion, with the U.S. Treasury predicting that this figure could exceed $2 trillion by 2030—it's hard to find another industry where the government forecasts a growth rate of 700% over the next five years.

Changes in stablecoin market capitalization. Data source: Bitwise Asset Management, data from The Block and DeFi Llama, time range: January 1, 2020, to June 10, 2025

Issuers of stablecoins like Circle are at the core of the ecosystem: they absorb dollars from investors, issue digital tokens (stablecoins) that represent these dollars, and invest the funds in U.S. Treasury bonds, promising investors that they can redeem stablecoins for dollars at a 1:1 ratio at any time, profiting by earning interest on the Treasury bonds (the stablecoins themselves do not pay returns to holders).

This is a simple yet high-quality business model. Current short-term Treasury bond rates are around 4%, and stablecoins generate approximately $10 billion in high-margin revenue for issuers each year. If stablecoin AUM grows to $2 trillion, annual revenue will reach $80 billion.

But today, I want to discuss something other than Circle's business model or economic prospects, although I believe they are impressive enough.

Building a Comprehensive Crypto Portfolio

Stepping outside the realm of Bitcoin, one of the oldest and most critical debates in the crypto space is: where will value flow? Will it concentrate on underlying assets like Ethereum and Solana that provide the core infrastructure for a decentralized economy, or will it flow to upper-layer applications (such as Uniswap, Polymarket, etc.) that utilize this infrastructure to build revenue-generating products?

Circle is a typical application layer case: it leverages public chain infrastructure while incurring very low costs. In other words, Circle can issue stablecoins on Ethereum for less than a cent, yet instantly reach hundreds of millions of users—supporting low-cost instant cross-border transfers, accessing DeFi applications, and programming through smart contracts.

Just as the internet democratized global content production thirty years ago (anyone connected to the internet can publish content and be accessed globally in real-time), public chains are achieving the same breakthrough in the financial sector: they are financial infrastructures that anyone can develop.

This is not limited to Circle and stablecoins. An increasing number of crypto-related public companies are building new business models based on blockchain:

- Coinbase generates substantial revenue from its Layer-2 network Base deployed on Ethereum;

- Galaxy, known for crypto trading, could earn nearly $100 million annually from its staking business;

- Mastercard operates platforms integrated with blockchains like Ethereum and Avalanche, helping businesses conduct lending and cross-border payments more efficiently.

This means that multiple parts of the crypto ecosystem will form a symbiotic relationship in the long term: core infrastructure will appreciate due to the access of more applications, and the application layer will create value as the infrastructure continues to improve.

Of course, we cannot determine whether the blockchain itself or the companies built on it will capture more value—this is precisely why I believe the optimal strategy is to allocate to both simultaneously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。