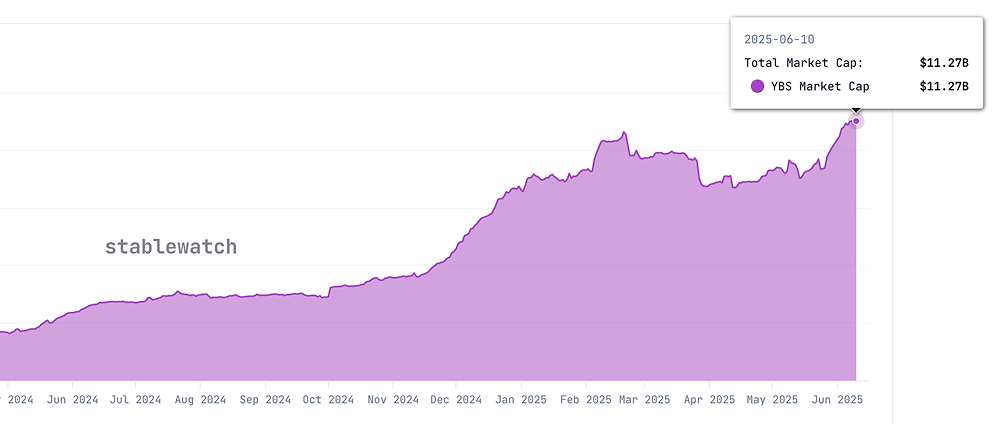

Yield-Bearing Stablecoins, this "digital dollar that automatically generates money," has a total scale exceeding $11 billion. From June 2024 to June 2025, the total market value of yield-bearing stablecoins experienced an astonishing growth of over 382%. However, this may just be the prologue.

1. Redefining "Stability": From Cash Tools to Productive Assets

To understand the profundity of this silent revolution, one must first clarify the essential differences between yield-bearing stablecoins and traditional stablecoins.

Traditional stablecoins, represented by USDT and USDC, primarily function as a value anchor and medium of exchange. They are the "cash" in the digital world, with their main value lying in stable purchasing power and efficient circulation. Users holding them are essentially storing value, and their assets do not inherently appreciate.

In contrast, yield-bearing stablecoins fundamentally overturn this concept. They are no longer a static value storage tool but a dynamic productive asset embedded with a yield engine. The core logic is to directly and automatically distribute the earnings generated from the underlying reserve assets of the stablecoin to token holders through mechanisms like smart contracts.

The sources of these earnings are diverse and increasingly mature, mainly divided into two categories:

Off-chain Real World Asset (RWA) Earnings: This is currently the most favored model by institutions. Project teams use the dollars deposited by users to purchase high liquidity, low-risk assets, such as U.S. Treasury Bills (T-Bills). The interest income from U.S. Treasury bonds, after deducting operational costs, is returned to users in the form of token appreciation or additional token distribution. For example, USDM issued by Mountain Protocol and BlackRock's BUIDL fund are typical representatives of this model.

On-chain Native Strategy Earnings: The earnings of these stablecoins come from complex financial operations within the DeFi world. The most well-known example is Ethena's USDe, which employs a delta-neutral strategy of "Cash and Carry," simultaneously holding long positions in Ethereum spot and short positions in futures to earn the funding rate difference between the two. This model offers potential yields far exceeding those of U.S. Treasury bonds, but its risk exposure and complexity of mechanisms are also relatively higher.

This evolution from "saving money" to "money generating money" means that the function of stablecoins has been redefined. They are no longer merely lubricants for transactions or safe havens but have transformed into entry-level investment products similar to traditional money market funds (MMF) that ordinary users can easily participate in.

2. Underestimated Growth: The Trillion-Dollar Imagination Behind the Data

Despite being a cutting-edge concept, the growth of yield-bearing stablecoins is an undeniable fact, with its speed even surpassing the expectations of most market observers.

According to public data, the total scale of yield-bearing stablecoins has exceeded $11 billion. From June 2024 to June 2025, the total market value of yield-bearing stablecoins experienced an astonishing growth of over 382%.

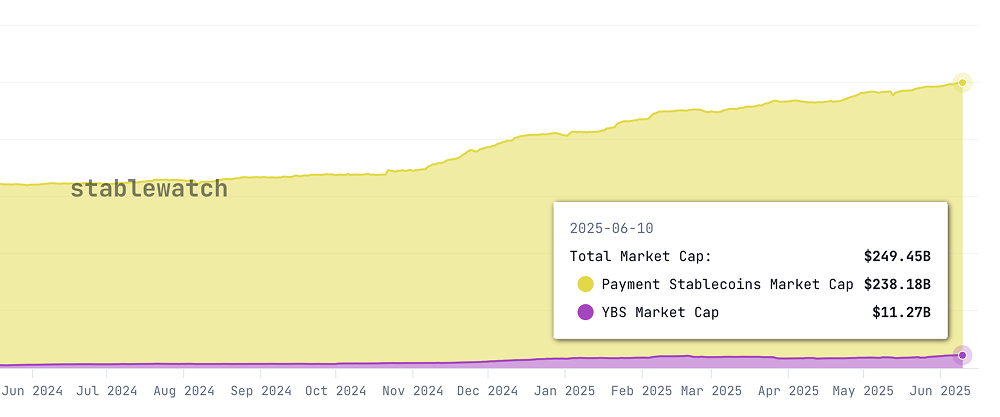

However, behind this seemingly impressive data lies a more critical fact: its penetration rate remains extremely low.

Currently, the total scale of the entire stablecoin market is about $250 billion. Even after rapid growth, yield-bearing stablecoins account for less than 5% of the market share. This vast blue ocean appears even more insignificant compared to similar products in traditional finance. As its most direct counterpart, the total scale of global money market funds reaches as high as $7 trillion.

This means that if yield-bearing stablecoins can successfully attract 10% or 20% of the stablecoin stock market, their scale will reach $23 billion to $46 billion. If they can serve as a global, efficient alternative for dollar savings, capturing even 1% of the traditional money market fund market, that would represent a massive $70 billion market. The ceiling is high enough to support a brand new trillion-dollar track.

3. The Eve of Explosion: The Triple Catalysis of Policy, Institutions, and Infrastructure

Why now? The explosion of a track is never the result of a single factor. Currently, yield-bearing stablecoins are ushering in a historic opportunity period where three forces—policy, institutions, and infrastructure—are converging.

1. Policy Shift: From Ambiguity to Clarity

Regulation has always been a sword of Damocles hanging over crypto assets, but for yield-bearing stablecoins, this sword is shifting from a threat to a guideline. In the past, the U.S. Securities and Exchange Commission (SEC) was sensitive to the word "yield," keeping the field in a gray area for a long time. However, as the crypto market expands and legislative frameworks advance, regulatory stances are gradually becoming clearer. A compliant, regulated yield-bearing stablecoin is far more attractive to traditional investors than a wild-growing "DeFi wildcat."

2. Institutional Giants Entering: From Spectators to Participants

If regulation is the green light, then the entry of institutions is the engine. In 2024, the world's largest asset management company, BlackRock, directly entered the market by issuing yield-bearing tokens pegged to the dollar through its tokenized fund BUIDL, marking a milestone event. This is not just a simple product launch but the highest endorsement from traditional financial giants for the RWA and yield-bearing stablecoin track.

3. Infrastructure Improvement: From Theory to Practice

Early DeFi protocols could provide yields but often came with extremely high technical barriers and security risks. Today, whether it is the technical standards for RWA tokenization, the depth and liquidity of on-chain derivatives exchanges, or the efficiency and security of cross-chain bridges, everything has significantly improved.

4. Echoes of History: Can We Replicate the Miracle of Money Market Funds in 1971?

The historical moment for yield-bearing stablecoins is strikingly similar to the birth of money market funds in 1971.

In the 1970s, the U.S. was experiencing high inflation, and bank savings rates were strictly regulated (Regulation Q), far below the inflation rate, causing the wealth of savers to shrink invisibly. It was against this backdrop that money market funds, which could offer higher floating yields, emerged and quickly siphoned off a large amount of deposits from the banking system, initiating decades of golden growth.

Today’s crypto world and global macro environment are playing out a similar narrative. On one hand, there is an unprecedented demand from users worldwide (especially in countries with high inflation and capital controls) for seeking dollar hedging and value preservation; on the other hand, the savings rates offered by traditional banks are almost negligible.

Yield-bearing stablecoins, with their annualized yields ranging from 3% to 27%, global non-discriminatory access, and efficient liquidity, precisely meet this core demand. They provide global users with a "digital dollar savings account" that far surpasses traditional bank savings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。