提示:本文系投稿,不代表ChainCatcher观点,亦不构成投资建议,请谨慎看待。

作者:加密无畏

先说结论:

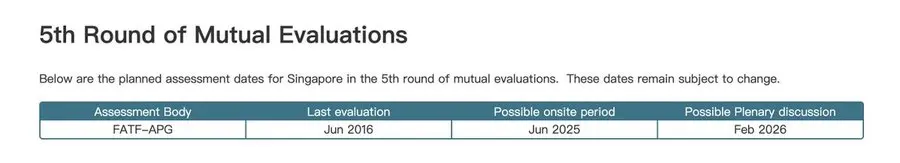

- 新加坡 MAS 实施虚拟资产法规,是为2025年6月即将启动的金融行动特别工作组 (FATF) 互评估做准备。FATF 2021年就有虚拟资产相关的指遵守南,新加坡不是没给过度期,是精准卡了时间。

- 新加坡已连续两年被FATF 警告,在反洗钱、反恐融资等方面等方面存在问题,今年评估再有问题,可能会被降级,影响真正的大钱进出和国际金融中心的形象。

- 从去年开始,新加坡政府就开始密集出台政策和自评报告,反复强调正在面临反洗钱的挑战和成效,其中虚拟资产、数字支付渠道是第一大新型威胁。

- FATF 评估的流程必须与虚拟资产服务提供商单独进行(政府部门人员不能在场)会谈。这也是新加坡在6月30日之前“驱赶”走没有发牌的虚拟资产服务商。确保只有合规者参与,降低被指监管漏洞的风险。

- 中国香港和新加坡一样,都是遵守FATF 的反洗钱指引。新加坡是MAS监管,香港主要是 SFC 监管。指望香港在 Web3 政策上更有开创性,接住新加坡这一波也很难。

展开来说:

FATF 是负责制定和评估全球反洗钱(AML)、反恐怖融资(CFT)以及反扩散融资(CPF)国际标准的政府间组织。通过审查成员国的合规性与措施有效性,维护“灰名单”和“黑名单”,对不合规国家施加压力,并应对如虚拟资产等新兴威胁。

如果被 FATF 降级,可能会面临跨境交易受限、外资流出与投资减少、金融市场波动、国际声誉受损、监管与合规成本增加等风险。

新加坡上一次 FATF 互评估是在2016年,在首份国家风险评估报告中,对外国来源的 TF 活动则评为中等风险。非金融部门中,报告确定了电信服务提供商、赌场行业和当铺行业存在较高的 ML/TF 风险。

2024年,新加坡发布的国家风险评估报告 ,将虚拟资产相关洗钱风险评估为中等偏高,并详细分析了虚拟资产在网络犯罪、投资诈骗、非法交易和恐怖融资的风险,比如加密货币交易平台之间汇款的跨境性、混币等DeFi活动的匿名性等。

报告中还提到,过去5年,新加坡查出来洗了60亿黑钱。这些资产包括银行户头存款、房地产、加密货币。在一些媒体的负面报道中,新加坡不知不觉间,成了的全球“洗钱中心”。

据新加坡加密合规方面的消息人士表示,新加坡其实已连续两年被FATF 警告,在反洗钱、反恐融资等方面等方面存在问题,今年评估再有问题,可能会被降级,影响真正的大钱进出和国际金融中心的形象。

因此,新加坡政府同一时期,也开始密集出台相关政策、主要行业协会合规性遵守指导,以及媒体宣传,为2025年6月 FATF 互评估做准备。

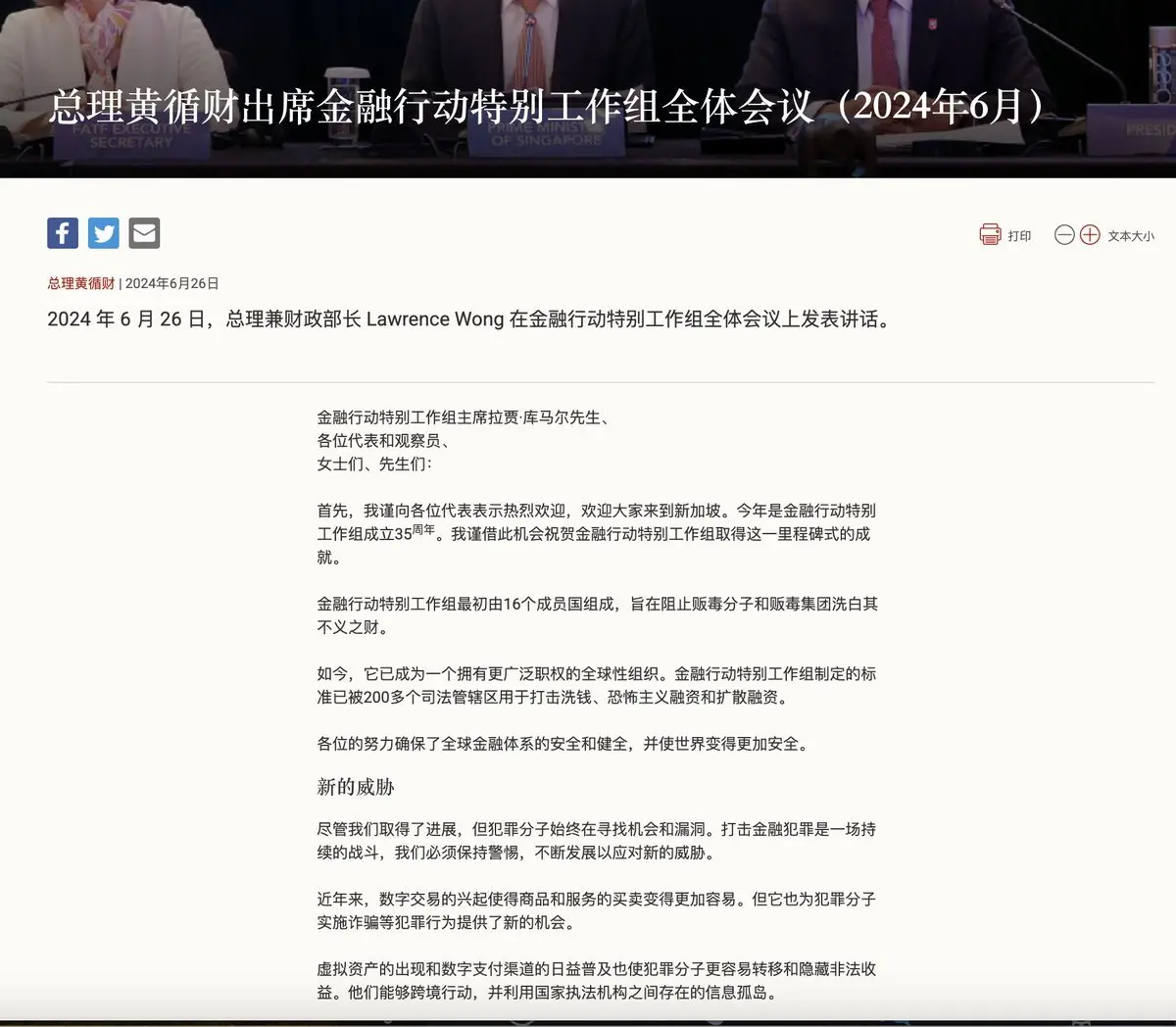

新加坡总理黄循财去年在出席FATF 全体会议时发言就强调,虚拟资产、数字支付渠道是第一大新型威胁。

新加坡今年FATF 的互评估计,在执行有效性方面,需要符合2021年FATF发布的《基于风险的虚拟资产和虚拟资产服务提供商(VASPs)方法更新指南》,涵盖了VASPs的定义、稳定币、P2P交易、许可注册、旅行规则及监管合作六个关键领域,提供详细的AML/CFT实施指导。

MAS 的6月30日开始实施的数字代币服务提供商 DTSP 的新规来看,也基本是为了符合 FATF 的指南的执行有效性。也就是说,新加坡过去几年一直都是给了虚拟资产行业足够的过度期,今年真的是到了DDL 最后一刻才收紧的。

新加坡政府素以高效著称,这次 FATF 评估也是准备许久,在技术上不太可能被 FATF 抓到硬伤,被降级或取消成员国资格可能性也不大。

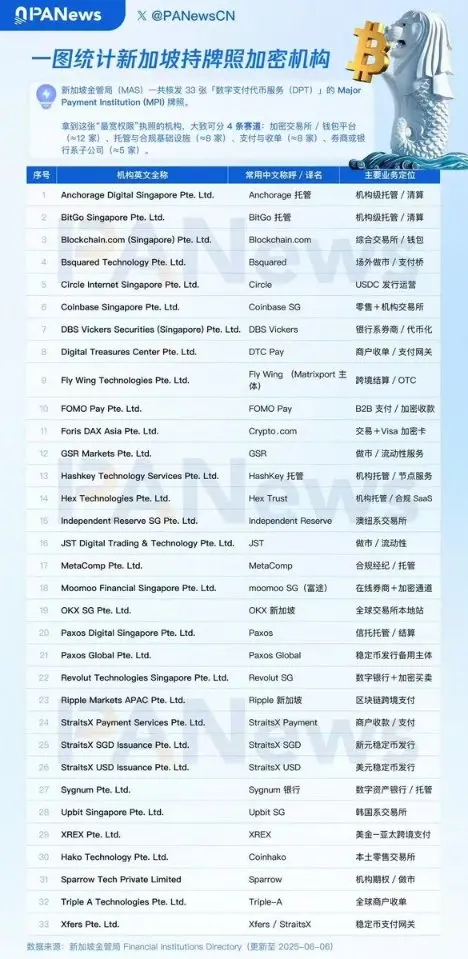

比如外FATF互评估需与私营部门(包括VASPs)单独会谈,政府人员不得在场。 新加坡为此在2025年6月30日前要求未获MAS牌照的VASPs停止运营,旨在确保评估时只有合规VASP参与,降低被指监管漏洞的风险。关于持牌和豁免企业的名单和分类则可以参考媒体整理。

另外,中国香港和新加坡两地一样,都是遵守FATF 的反洗钱指引。新加坡是MAS监管,香港主要是 SFC 监管。指望香港在 Web3 政策上更有开创性,接住新加坡这一波比较难。香港Web3的突破仍在于大陆的政策和尺度。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。