On June 6, 2025, when BTC fell below $103,000, many traders might have exclaimed, "The liquidation wave is coming." However, this time the plunge was not triggered by the familiar factors of Federal Reserve interest rate hikes or ETF approval failures, but rather by a public fallout between two of America's most influential men—Elon Musk and Donald Trump.

This was not an ordinary verbal spat, but a direct collision between technological capital and populist politics. As a highly sensitive asset to risk appetite, crypto assets almost immediately felt the chill; it can even be said that behind this round of decline lies a structural signal.

From Allies to Adversaries: The Timeline of Musk and Trump's Conflict

In 2024, the two had briefly shaken hands under the slogan of "Reviving American Manufacturing." But as 2025 began, the atmosphere took a sharp turn:

- April 16: Musk criticized Trump's high tariff policies for damaging supply chains, claiming that the acquisition of X platform had exhausted funds and refused to pay for "protectionism."

- May 28: Trump announced the "Great Beautiful Plan" (super tax cut plan), and Musk warned that it threatened fiscal efficiency, threatening to establish a "centrist new political party."

- June 4: Musk stated that Trump was "sacrificing fiscal health for votes," urging the market to "return to rationality."

- June 6: The situation spiraled out of control. Musk claimed Trump's budget proposal "would cripple the economy" and hinted at pushing for radical reforms. Trump immediately retaliated on Truth Social, threatening to cancel federal contracts worth up to $38 billion for Tesla and SpaceX. Tesla's stock plummeted 15% in a single day, and the digital asset market collapsed simultaneously.

These rounds of confrontation have repeatedly made it to our AiCoin hot topic tracking list, often ranking in the top five of trending searches, becoming a significant trigger for emotional trading.

The market does not always focus on macro factors, but when the two super narratives of technology and politics intersect, the money bags on-chain often react faster than verbal responses.

BTC—The Structural Panic Triggered by Musk

Musk did not directly short BTC, but his statements restructured the market's emotional anchor: shifting from "tech leaders represent long-term growth" to "even Musk is starting to worry about fiscal deficits and policy stability." This conveyed not just simple emotional fluctuations, but a signal of the market repricing risk appetite.

From a technical structure perspective, this was not an emotional plunge caused by sudden bad news, but a structural breakdown following a clear platform consolidation:

- Since May 30, BTC had been oscillating at high levels between $105,000 and $109,000, with market expectations for a breakout;

- In the early hours of June 6, under the trigger of sudden events, the key platform support level (around $103,000) was broken with increased volume, hitting a low of $100,372 during the session;

- The current rebound strength is limited, and the trend is in a structural reassessment phase, with no clear signals of a stop or reversal.

This is a "fundamental expectation rupture + technical support failure" composite decline, not a capitulation-style crash, but the market calmly assessing: how long can the current valuation system support high-risk asset allocations? The real decision window may still lie deeper.

Ethereum: The Misunderstood Faith Coin, Falling Harder

On June 6, ETH plummeted to $2,379 within just a few hours, with a daily drop of nearly 17%, far exceeding BTC's decline during the same period. The market generally viewed this as a correlated downturn, but from a structural and rhythmic perspective, ETH was "hurt more severely" this time.

Why Did ETH Fall More Severely?

1. Weaker Technical Structure: Previously, ETH struggled to rebound effectively and failed to maintain above $2,600, and on the early morning of June 6, it directly broke through multiple short-term supports under heavy selling, showing a typical "accelerated breakdown" pattern.

2. Damaged Confidence Combined with Misreading Events: Musk's comments about SpaceX's adjustment plans were misinterpreted by some in the community as a denial of decentralization or the direction of technological development, indirectly impacting the emotional expectations for ETH and similar "tech narrative" assets.

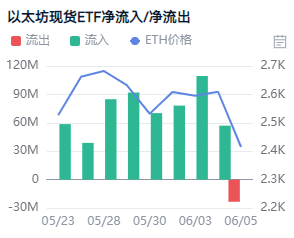

3. Misalignment of Funds: ETF funds originally supported ETH, but due to sudden market fluctuations and regulatory uncertainties, new funds have become noticeably cautious, slowing the inflow rate.

4. High Leverage Triggering Chain Liquidations: From on-chain and derivatives data, ETH has a higher leverage ratio compared to BTC, leading to concentrated liquidations during the downturn, further amplifying the decline.

Although the current price has stabilized around $2,379, the rebound volume has not been sustained, and the overall market is still in a phase of emotional digestion. If it cannot return to consolidate above $2,500, it may continue to maintain a downward trend within a volatile range.

This is not simply a "correlated panic," but more like a "technical weakness + funding fragility" joint amplification of the pullback. Whether the market stabilizes still depends on whether ETH can regain a foothold above $2,500 and reduce the volume of downward transactions.

Behind the Power Conflict, There Are Structural Signals in the Crypto Market

The conflict between Musk and Trump is not just a political verbal battle; it resembles a market signal test—who can dominate the "new American vision": tech elites or populist forces? Here are three truly important structural variables to pay attention to, which will determine the next trend in the crypto market:

1. CFTC / SEC Regulatory Qualitative Assessment (Q3 Hearing)

Last year, Trump was still shouting "support for Bitcoin mining," but this year he suddenly turned, publicly proposing to "curb speculative assets." The market is worried that BTC and ETH may be classified as securities or face stricter regulation from the CFTC. The Q3 joint hearing of the CFTC/SEC will be crucial. If transaction taxes or mandatory KYC are implemented, exchanges with poor liquidity may not withstand it, and a short-term correction of 20%-30% for BTC/ETH is not exaggerated.

2. Fiscal Deficit → U.S. Treasury Yield → BTC Pressure

Trump's "Beautiful Plan" stimulates fiscal spending, increasing the risk of a widening deficit. In June, U.S. Treasury yields remained below 4.5%; if the 10-year Treasury yield breaks above 4.5%, even approaching 4.8%, BTC valuations may come under pressure. After all, historical data shows that BTC has a negative correlation of -0.65 with U.S. Treasury yields.

3. Reversal of Social Media Sentiment

On the AiCoin platform, the keywords "Musk crypto" and "Trump regulation" have seen a surge in popularity, necessitating real-time monitoring of market sentiment trends to capture signs of a reversal.

Conclusion: Look at the candlestick charts, but don't only look at the candlestick charts; the real variables in the crypto market are narratives and power structures.

Musk's tweets won't directly crash the market, and Trump's threats won't make BTC go to zero. However, how investors interpret these statements and how funds reprice based on expectations are the essence that affects prices.

Observing narratives is to understand direction, while looking at candlestick charts is to grasp rhythm. Focusing on only one aspect makes it difficult to build a true advantage amid volatility.

This game has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。