An overview of the adoption of stablecoins in global payment scenarios, including regional distribution and categories of transactions.

Author: Artemis

Translated by: Web3 Xiaolu

It is well known that stablecoins have evolved from merely serving as a convenient medium of exchange for crypto trading (without relying on banking tools) to being more widely used tools in consumer and business payments. Recently, major payment companies such as Visa, Mastercard, and Stripe have begun to incorporate stablecoins into their payment processes.

Against this backdrop of trends, as an emerging major payment and settlement network based on blockchain, the overall supply of stablecoins is approximately $239 billion, compared to less than $10 billion five years ago. About 10 million blockchain addresses conduct stablecoin transactions daily. More than 150 million blockchain addresses hold a non-zero stablecoin balance.

Although it is difficult to accurately estimate transaction volumes, areas such as decentralized finance (DeFi, $7.8 trillion), centralized exchanges ($4.3 trillion), and miner extractable value (MEV, $1.9 trillion) all have annualized transaction volumes exceeding $1 trillion and support various application scenarios. The Bank for International Settlements (BIS) also estimates that approximately $400 billion in cross-border transactions are settled through USDC and USDT each year.

Over 99% of stablecoins are pegged to the US dollar and are correspondingly backed by dollar assets. If stablecoins were considered a country, they would be the 14th largest holder of US Treasury bonds. US Treasury Secretary Scott Bessent has stated, "We want to maintain the United States' position as the global dominant reserve currency and will leverage stablecoins to achieve this goal." The Treasury Borrowing Advisory Committee estimates that by 2028, the supply of stablecoins will grow to $2 trillion.

However, specific data on stablecoin payments has historically been scarce, typically estimated through a top-down approach (i.e., looking at all on-chain stablecoin transactions and attempting to filter out noise sources), but these estimates remain incomplete. Last year, Artemis, Castle Island, and Visa jointly released a survey targeting five emerging market countries to understand how ordinary stablecoin users utilize stablecoins in their economic lives. However, specific data on known stablecoin payment volumes does not exist.

To this end, Artemis, in collaboration with Castle Island and Dragonfly, presents a new dataset in this study provided by 31 stablecoin-based payment companies, which represent end-users processing transactions, including a survey of 20 stablecoin-based payment companies and estimates from 11 other companies covering various fields (including B2B, P2P, B2C, card payments, and pre-financing). This is the most comprehensive report to date, believed to cover most of the transaction volume in the emerging stablecoin payment sector.

Through the research, we can derive the following data:

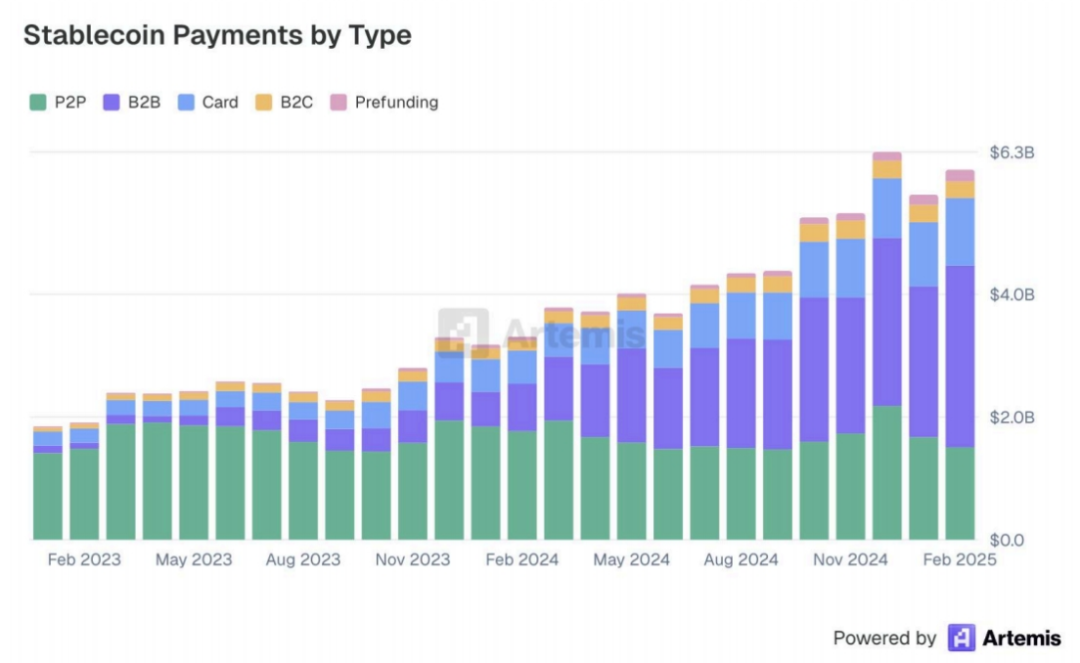

From January 2023 to February 2025, the amount clearly attributable to stablecoin payments reached $94.2 billion. As of February 2025, the annualized rate of stablecoin payments in the sample reached approximately $72.3 billion.

B2B payments (annualized rate of $36 billion) are the most active, followed by P2P ($18 billion annualized rate), card-related payments ($13.2 billion), B2C ($3.3 billion), and pre-financing ($2.5 billion). All areas except P2P show rapid growth.

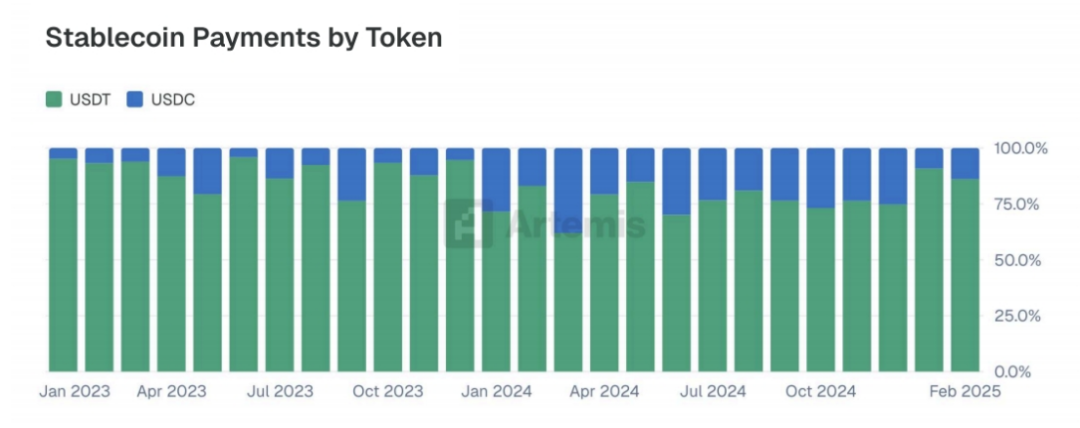

Among the sample companies, Tether's USDT is the most widely used stablecoin, accounting for about 90% of the market share by transaction volume, followed by Circle's USDC. Tron is the most popular blockchain by transaction volume, followed by Ethereum, Binance Smart Chain, and Polygon.

Although the covered sample does not represent a complete picture of global stablecoin payments, we can still see the adoption of stablecoins in global payment scenarios from the most frontline data in this report, including regional distribution and categories of transactions.

Thus, this article compiles Artemis's latest research report: Stablecoin Payments from the Ground Up, aiming to provide guidance for us in the era of crypto navigation.

Original report:

I. Core Indicators of Stablecoins

Based on data from contributing companies and additional on-chain estimates, we can describe the $94.2 billion stablecoin settlement situation across various payment types from January 2023 to February 2025, with the vast majority of settlements completed directly on the blockchain. The annual average processing speed of these settlements reached approximately $72.3 billion by February 2025.

B2B payments account for the majority of the volume, followed by P2P transfers, card payments (usually linked to stablecoin wallets), and B2C payments.

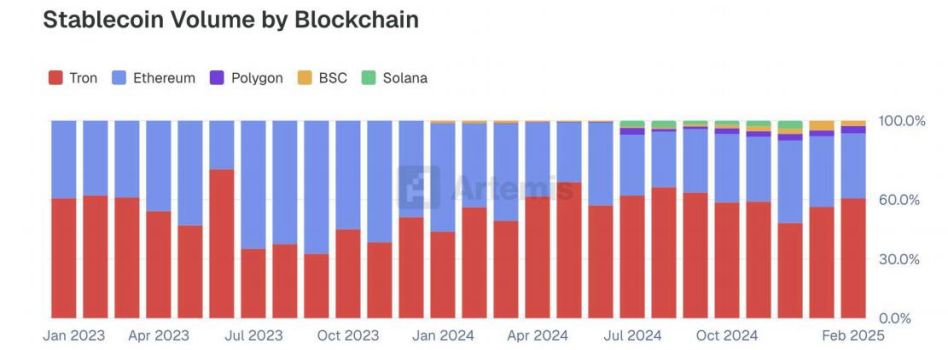

In terms of the proportion of sending value, the most popular blockchain for settling customer fund flows is Tron, followed by Ethereum, Polygon, and Binance Smart Chain. This aligns with the findings from our 2024 report, which discovered that users preferred these five blockchains, although Ethereum was the most popular network at that time.

The data in the following chart is a representative subset of all data provided by the participating companies (accounting for 57%), as not all participants reported their fund flows categorized by blockchain. This data has also been validated against Artemis's estimated data derived from directly monitoring blockchain nodes.

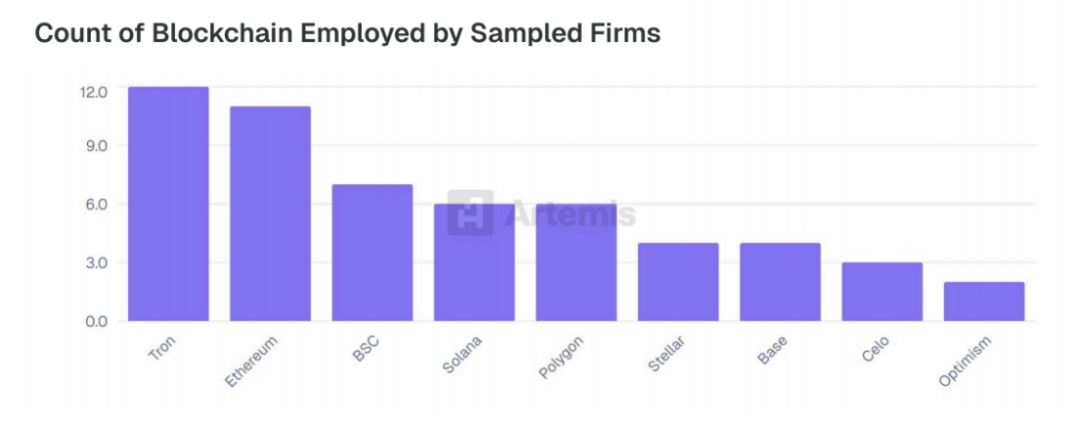

Most of the companies providing data use multiple blockchains for stablecoin settlements. Among the companies involved in this study, Tron, Ethereum, and Binance Smart Chain are the most popular networks, although there is a longer tail of supported blockchains.

In the sample of surveyed companies, Tether's USDT is used far more than other stablecoins, making it the most popular stablecoin for settling fund flows among the companies studied. We will explore the comparative usage of USDT and Circle's USDC across different countries later in the report.

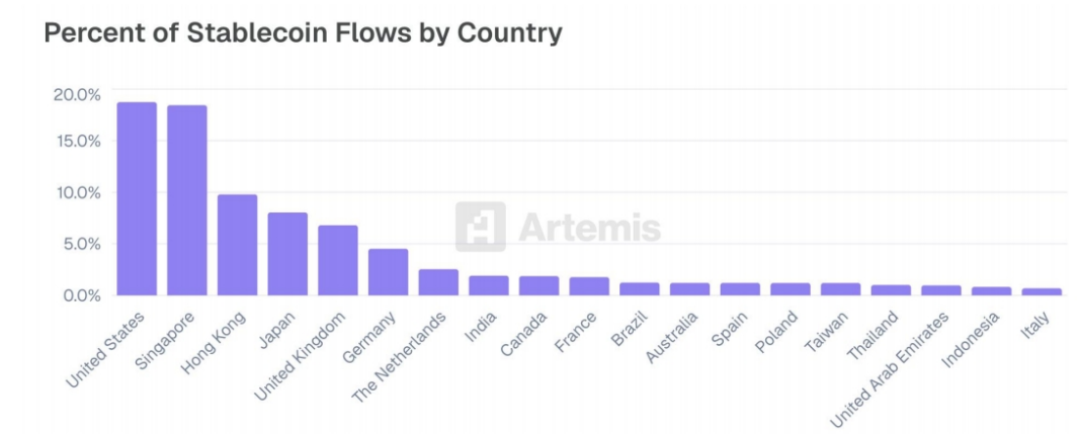

Based on the geographical data provided by the participating companies, combined with additional geographical attribution estimates obtained by examining the IP addresses and time zones of on-chain entities when transactions reach blockchain nodes, we can identify the countries generating the majority of stablecoin transactions. The United States, Singapore, Hong Kong, Japan, and the United Kingdom are the leading countries for stablecoin remittances.

Among the companies included in this study, the Singapore-China corridor has become the most active channel for stablecoin flows. The next seven largest channels all involve the United States, highlighting the core position of the U.S. in global stablecoin usage. Singapore and Hong Kong also frequently appear, reflecting their importance as regional financial centers and their deep integration into cross-border stablecoin activities.

One use of cross-border payments is to replace remittances, which remain expensive worldwide, especially outside of more widely used channels. Stablecoin-based remittances can flow directly between exchanges, reducing costs and delays. In countries with high cryptocurrency adoption, such as India, Nigeria, and Mexico, remittances settled through blockchain rails have replaced traditional remittances, facilitated by correspondent banks or fintech companies like Wise or Remitly.

Case A - Binance Pay Consumer Payment Tool

Binance Pay is a contactless, borderless, and secure global cryptocurrency payment solution embedded within the Binance exchange. Binance is the largest centralized exchange in the world, with over 270 million registered users. Binance Pay allows users and merchants to make cryptocurrency payments globally without incurring any miner fees (gas fees). Binance Pay brings the power of cryptocurrency into everyday transactions. Currently, Binance Pay supports:

300+ cryptocurrencies for payments between cryptocurrencies (Binance users can instantly send and receive cryptocurrencies to other Binance users).

100+ cryptocurrencies for business-to-consumer (B2C) payments (using cryptocurrency payments at Binance Pay online and offline merchants worldwide).

A global ecosystem with over 40 million active payment users and 32,000+ merchants.

Binance Pay aims to make cryptocurrency practical, accessible, and useful in everyday life—from P2P transfers to seamless payments at thousands of online and physical stores. It offers users instant transactions with zero miner fees, multi-currency support, and seamless transaction methods through QR codes, in-app processes, or payment links for online and physical store merchants. Currently, Binance Pay has integrated with Pix, an instant payment system developed by the Central Bank of Brazil, which has over 174 million users and 15 million businesses, enabling users to make real-time cryptocurrency payments with Brazilian reais.

For merchants, Binance Pay offers numerous advantages:

Real-time settlement: Transactions are processed and settled instantly in cryptocurrency.

Cross-border payment support: Send and receive cryptocurrency payments globally without bank restrictions.

QR codes, in-app payments, or payment links: Seamlessly accept cryptocurrency payments for online and physical store merchants.

Direct debit and pre-authorization: Achieve recurring or automated payments through a one-time authorization from customers—suitable for subscriptions, travel, or transportation scenarios.

Invoicing: Create and send cryptocurrency invoices with QR codes for easy collection.

Payments: Instant large-scale distribution of cryptocurrency—suitable for global payroll, vendor payments, loyalty rewards, refunds, etc.

Case B—BVNK Enterprise Stablecoin Payment Infrastructure

BVNK provides a stablecoin payment infrastructure that integrates banking and blockchain into a single platform to accelerate global fund flows. Although stablecoins offer compelling advantages such as instant global settlement, businesses often find it challenging to integrate them at scale. BVNK addresses this issue in the following ways:

BVNK's automatic conversion feature means businesses do not need to directly handle stablecoins—they can hold funds in USD, GBP, or EUR.

Proprietary infrastructure and modular APIs maintain consistency between fiat and cryptocurrency, ensuring rapid integration and flexibility.

Through its stablecoin infrastructure, BVNK collaborates with fintech companies and enterprises with global payment use cases:

One of the world's largest merchant acquirers, Worldpay, uses BVNK's embedded wallet to provide its clients with instant global payments in stablecoins—paying partners, customers, contractors, creators, sellers, etc., in over 180 markets. Payments come from fiat balances, so Worldpay or its clients do not need to handle or hold cryptocurrency.

The employer record platform Deel uses BVNK to pay over 10,000 freelancers in more than 100 countries in stablecoins. Workers can choose to receive their salary payments in stablecoins to ensure quick payments and as a means to hedge against local currency inflation.

The digital asset financial platform Bitwave has partnered with BVNK to integrate its stablecoin payment functionality into its invoicing software, allowing its business clients to receive stablecoin payments from customers and automatically convert them to fiat—or vice versa.

BVNK's infrastructure connects major stablecoins with traditional banking functions and is supported by regulatory licenses across multiple jurisdictions. The company recently launched Layer1, a self-custody infrastructure product that allows financial institutions to integrate stablecoin functionality and efficiently coordinate cross-border payments between stablecoins and traditional payment rails.

BVNK's approach to unifying traditional financial systems and blockchain financial systems positions it as a key driver of the next phase of digital payment innovation.

II. Global Regional Adoption

This section summarizes key findings at the regional level based on existing specific country data. Among the companies included in the broader study, 52% provided geographical reports, allowing us to analyze the usage patterns of stablecoins in regional and national contexts.

These insights reveal the operational status of stablecoin-driven companies (including fintech companies, exchanges, payment platforms, and deposit/withdrawal channel providers) across various markets. By examining regional behaviors, we can identify where companies settle transactions, their preferred blockchains and stablecoins, and how local infrastructure influences product design and user engagement.

2.1 Latin America

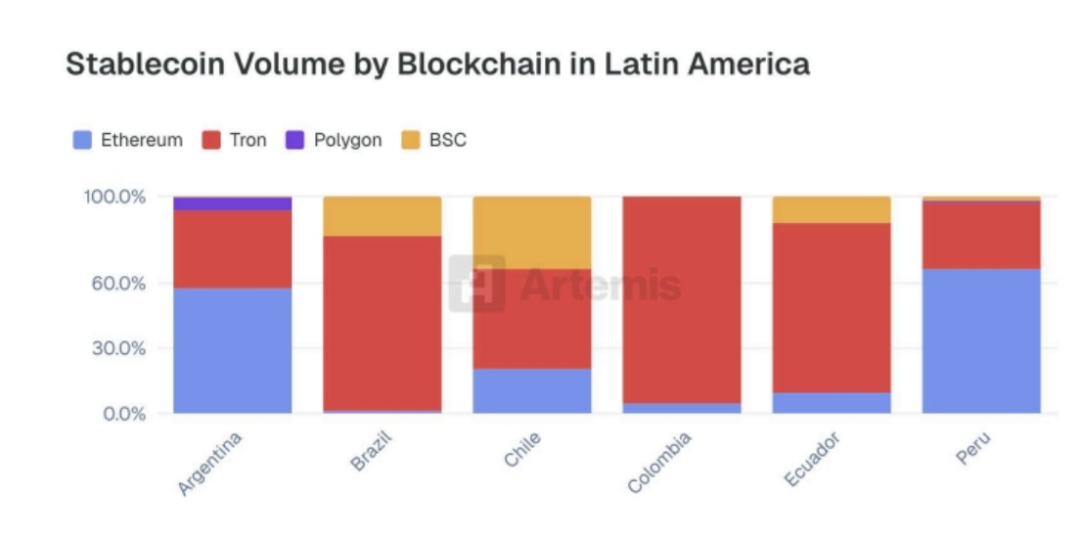

Throughout Latin America, Tron dominates as the primary blockchain for stablecoin settlements, particularly in Colombia, Ecuador, and Brazil, where it accounts for most of the observed activity. In contrast, Ethereum remains the leading blockchain in Argentina and Peru, surpassing Tron in these markets. Polygon has moderate usage in Argentina and Peru, while BSC has gained significant traction in Chile, Brazil, and Ecuador.

In Latin America, USDT is the leading stablecoin by transfer volume. Unlike other markets, Argentina is the only country in the region where USDC has reached a significant share, accounting for nearly half of stablecoin transaction volume. In Brazil, Chile, and Colombia, USDC usage has only seen moderate growth, while in Ecuador and Peru, it is almost negligible.

Other stablecoins, such as PYUSD and DAI, have virtually no activity in the analyzed countries. The widespread presence of USDC in Argentina compared to other regional markets may reflect the country's ongoing currency instability, prompting the establishment of more venture-backed startups. In contrast, stablecoin usage in neighboring countries still primarily relies on the long-established USDT-based systems.

Case C—Bitso Focuses on Cross-Border Payments for Latin American Enterprises

Bitso Business provides a suite of stablecoin-driven financial services for businesses in Latin America (Argentina, Brazil, Colombia, and Mexico), the United States, and Europe, focusing on transforming cross-border payments.

Bitso Business offers solutions utilizing stablecoins and other digital assets, enabling businesses of all sizes to achieve faster, more transparent, and cost-effective cross-border payments.

Businesses can streamline international transactions, manage multi-currency operations, and reduce complexities and costs associated with traditional banking systems. This results in shorter cross-border settlement times and improved cash flow management.

Bitso Business provides robust APIs and enterprise-grade infrastructure, allowing businesses to integrate cryptocurrency-driven payments into existing workflows. This enables businesses to conduct international fund transfers with greater flexibility and control.

Innovations within Bitso Business, such as the development of MXNB, a fiat-backed stablecoin (a fully reserved Mexican peso stablecoin), reflect their commitment to providing tailored solutions for specific regional needs.

By offering a regulated and secure platform, Bitso Business is becoming a key partner for Latin American enterprises and global companies looking to optimize their cross-border payment processes in Latin America.

Case D—Conduit Facilitates Cross-Border and Local Payments with Stablecoins

At Conduit, we enable businesses to transact seamlessly between stablecoins and local fiat currencies, covering a wide range of domestic payment rails. By integrating with our API, payment platforms, fintech companies, and neobanks can offer their customers stablecoin-assisted cross-border payment services—allowing them to make fast, low-fee payments in USD and over 10 other currencies.

Why stablecoin-driven payments are crucial for businesses:

Near-instant settlement speeds significantly reduce payment transit times, freeing up funds for businesses' working capital and credit needs.

Businesses in Brazil settle payments in euros through Conduit at speeds over 500 times faster, saving thousands of hours in transaction settlement time each year.

In markets with volatile local currencies, stablecoins allow businesses to maintain their treasury in USD while still making quick domestic payments.

In 2024, Colombian companies holding their treasury in USD-pegged stablecoins reduced their fund's inflation rate from 6.6% to 2.96%.

The transparency of blockchain and increased settlement speeds eliminate the black box of cross-border payments, removing the need for MT103 and other traditional transaction verification methods.

Stablecoin payments are instant and immutable, reducing the time required for reconciliation and lowering operational costs.

2.2 Africa

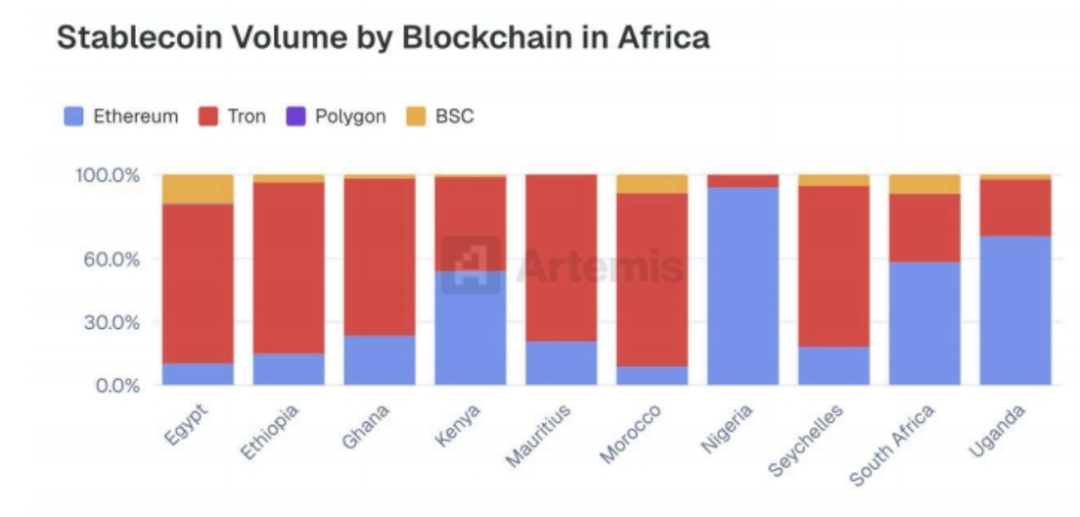

In the African market, Tron and Ethereum are the primary blockchains for stablecoin settlements. Among the ten African countries analyzed, Tron leads in six, including Egypt, Ethiopia, Ghana, Mauritius, Morocco, and Seychelles, while Ethereum is the most used blockchain in Kenya, Nigeria, South Africa, and Uganda. BSC holds a secondary position, contributing moderate but stable transaction volumes in countries like Egypt, Morocco, and South Africa.

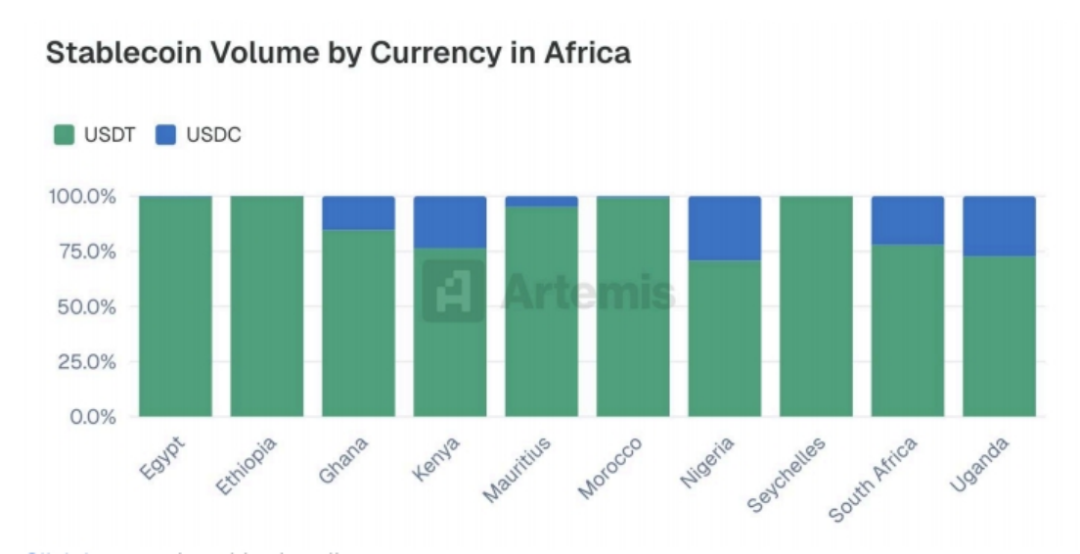

USDT is the dominant stablecoin across all analyzed African markets, consistently accounting for the majority of transfer volumes. However, USDC has also shown significant adoption in some countries (particularly Nigeria, Uganda, South Africa, and Kenya), where it holds a considerable minority share. In contrast, USDC usage is minimal in markets like Egypt, Ethiopia, and Morocco.

Case E—Yellow Card, a Pioneer of Stablecoin Applications in Africa

Yellow Card is Africa's largest and first licensed stablecoin company, operating in 20 countries. We enable individuals and businesses of all sizes to easily make international payments, protect their financial assets, manage their treasury functions, and access hard currency liquidity. Our over 25,000 customers are primarily businesses using stablecoins for B2B payments.

Stablecoins address critical issues in Africa's currency and banking systems. Over 70% of African countries face a foreign exchange shortage crisis. In many markets, local bank debit cards cannot be used internationally, banks cannot process cross-border payments, and access to US dollars is severely restricted.

Stablecoins do not replace local currency transactions—they replace payments that previously relied on the SWIFT network, which is expensive, slow, and inefficient. Stablecoins provide a faster, cheaper, and simpler alternative. Yellow Card has facilitated over $5 billion in transactions.

In economies like Nigeria, stablecoins have become essential tools for making dollar payments without hard currency leaving the country. Africa is at the forefront of the practical application of stablecoins, cryptocurrencies, and blockchain technology.

2.3 North America and the Caribbean

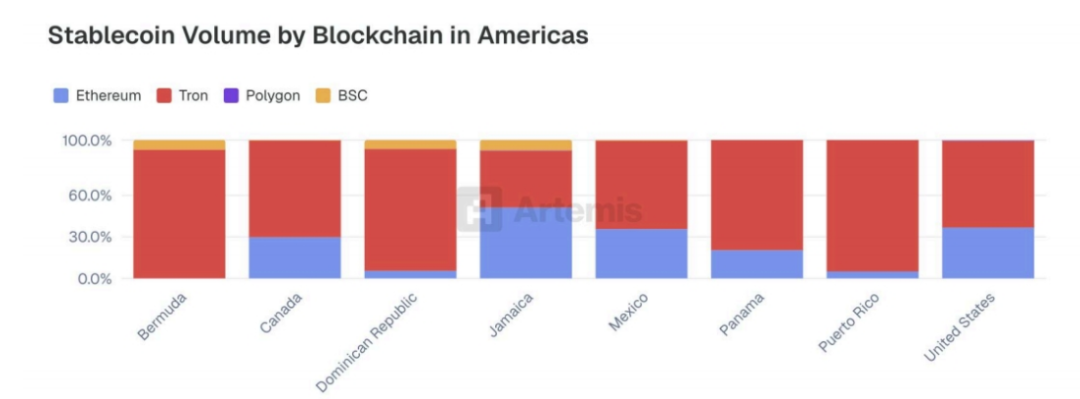

Stablecoin settlements in North America and the Caribbean follow global trends, with Tron and Ethereum being the primary networks in all surveyed markets. Tron consistently holds the majority in transaction volume, surpassing Ethereum in every country except Jamaica, where the usage of both blockchains is roughly equal. BSC shows moderate but visible activity in several markets, including Bermuda, the Dominican Republic, and Jamaica. Other networks like Polygon, XRP, and Solana have very low or almost no adoption in the region. Compared to most countries, Ethereum has a strong influence in the United States.

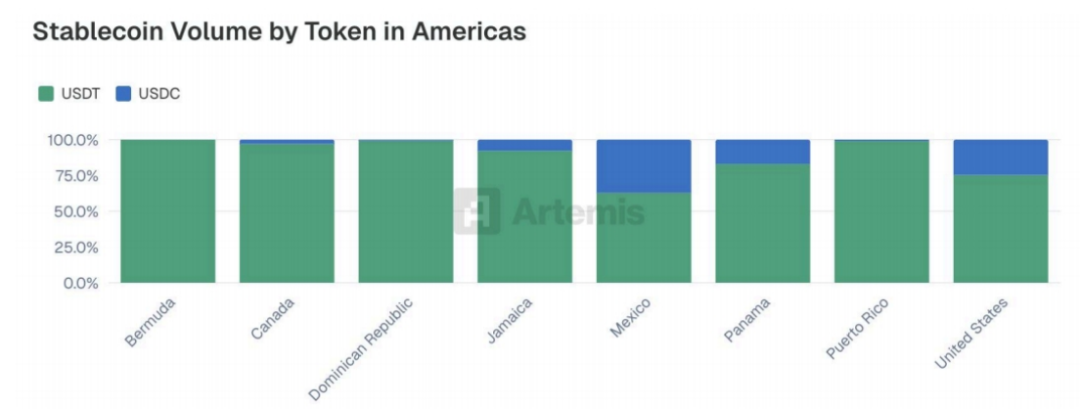

In North America and the Caribbean, stablecoin activity is primarily concentrated in USDT, which consistently accounts for the vast majority of transaction volume across all markets. USDC, while in a secondary position, has measurable adoption in some countries, particularly in the United States, where it accounts for nearly a quarter of stablecoin transaction volume. Other markets like Mexico, Panama, and Jamaica also show moderate but visible USDC usage, while its presence remains low in Bermuda, Canada, the Dominican Republic, and Puerto Rico. Similarly, PYUSD and DAI are virtually nonexistent in all studied markets.

2.4 Europe

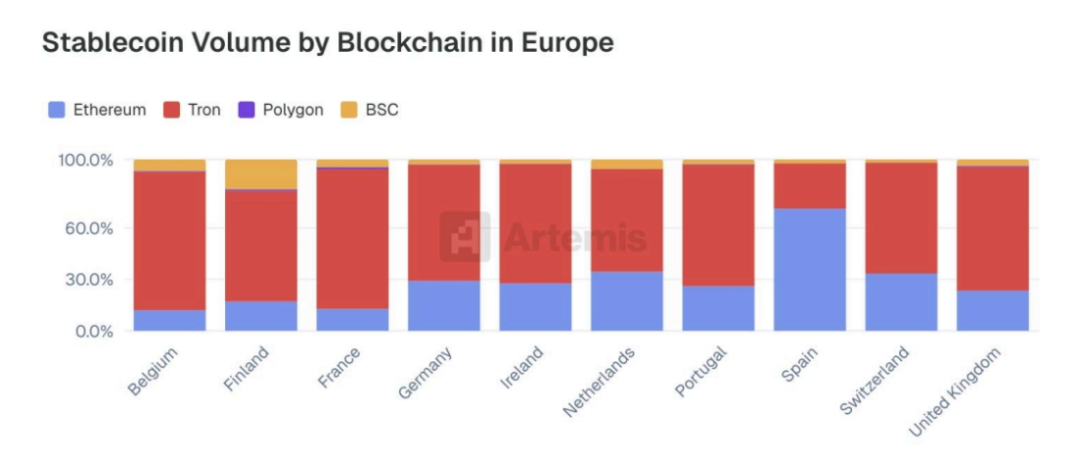

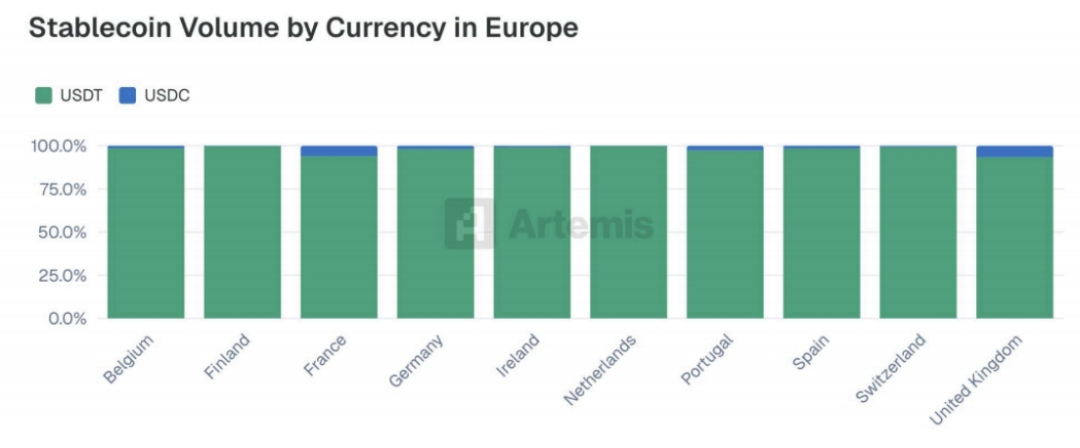

In almost all European markets covered by this study, Tron leads in stablecoin settlement volume, continuing its trend as the most widely used network globally. Spain is the only exception, where Ethereum holds a larger share of stablecoin activity. Ethereum maintains a consistent secondary role across the region, with significant adoption in countries like the Netherlands, Portugal, and Switzerland. BSC contributes moderate transaction volumes in some specific markets, particularly Finland and Belgium, while Polygon shows only minimal activity.

Among all analyzed European countries, USDT holds an overwhelming advantage in stablecoin usage, consistently accounting for over 90% of transfer volumes. USDC's activity is limited to a narrow range, with its market share remaining below 10% in each market. Other stablecoins, including PYUSD and DAI, are virtually absent from the dataset.

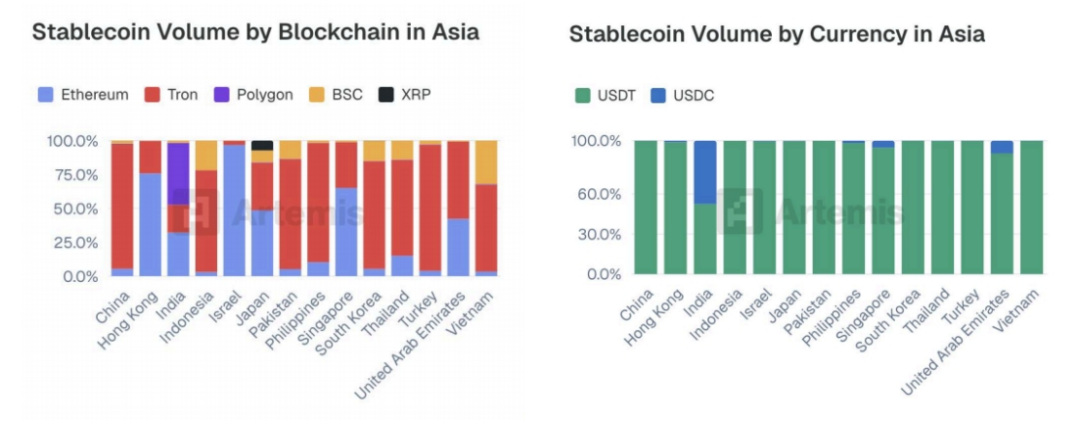

2.5 Asia

Asia exhibits the most diverse network distribution among all analyzed regions. While Tron leads in most markets, Ethereum and BSC have also gained considerable adoption in several countries. Notably, India is the only country where Polygon holds a significant market share—this finding is not surprising given that Polygon was founded in the country. This relatively decentralized pattern indicates a more diverse local infrastructure, exchange integration, and user behavior in Asia.

In the Asian markets covered by this study, USDT is the dominant stablecoin by a large margin. The only exception is India, where USDC holds a substantial share—accounting for nearly half of all observed stablecoin transaction volume. In other countries, while USDC usage exists, it is limited, and alternative stablecoins like PYUSD and DAI show very little or no adoption.

2.6 Overall Observations

Across all analyzed regions, USDT is the dominant stablecoin by a large margin, while USDC ranks a distant second, but its position is firmly established. These two stablecoins account for the vast majority of observed transaction volumes, far exceeding all other alternatives.

A similar trend is observed in blockchain infrastructure: Tron leads in overall usage, followed by Ethereum, with these two networks far ahead of others in stablecoin settlement activity. While this hierarchy remains consistent in most regions, the Asian market shows relatively greater diversity in blockchain usage.

Currently, global stablecoin activity is primarily concentrated on USDT and USDC transactions conducted on Tron and Ethereum.

III. Adoption Across Different Transaction Categories

3.1 Business-to-Business (B2B)

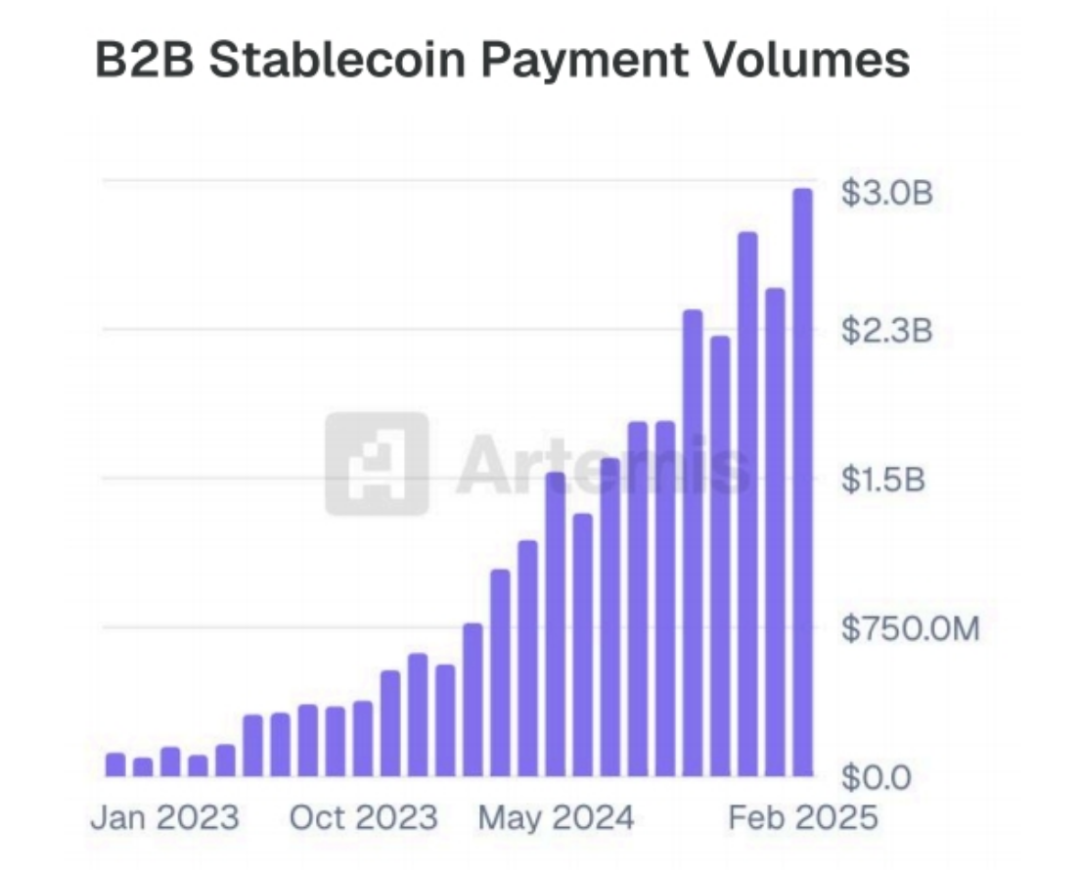

Although stablecoins are often associated with retail use and remittances, an increasing volume of transactions is driven by B2B transactions. This section explores how companies utilize stablecoins for cross-border payments, vendor settlements, treasury operations, and other business use cases.

Among the companies in this study, the total volume of stablecoin B2B transactions has significantly increased, rising from less than $100 million per month at the beginning of 2023 to over $3 billion by early 2025. This steady rise reflects the growing adoption of stablecoins by businesses for use cases such as vendor payments, invoicing, and collateral transfers. The sharp acceleration in the second half of 2024 indicates that for many businesses, stablecoins have transitioned from experimental phases to core financial operations.

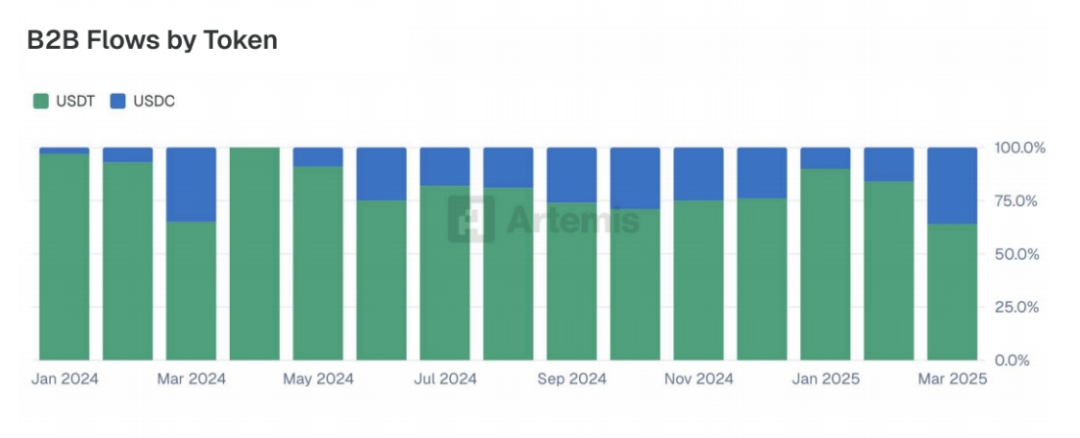

Among the businesses in this study, USDT remains the primary stablecoin for B2B transfers, although USDC maintains a considerable share, averaging about 30% of monthly transaction volume.

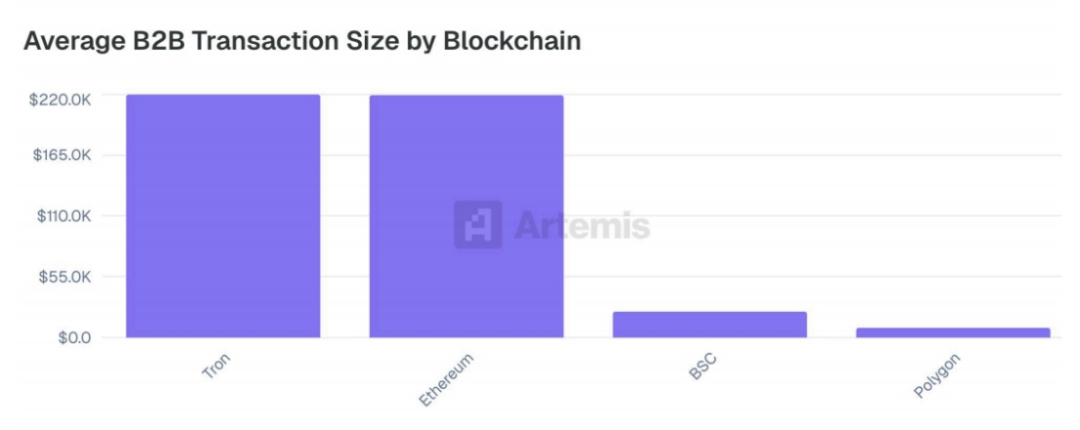

There are significant differences in average B2B transaction sizes across different blockchains. Notably, Tron and Ethereum record nearly identical average transaction sizes (over $219,000 per transaction), indicating that they are the preferred channels for high-value business transfers among the companies involved in this study. In contrast, BSC and Polygon have significantly lower average transaction sizes, suggesting they are more often used for smaller-scale or higher-frequency business activities.

3.2 Card Payments

As stablecoin infrastructure matures, one of the fastest-growing applications is card-based consumption. Supported by fintech issuers and cryptocurrency-native platforms, stablecoin-linked cards enable global users to make payments in real-world scenarios using digital dollars. This section explores how businesses and consumers use stablecoins to fund card transactions, providing insights into adoption trends, transaction behaviors, and network-level distributions.

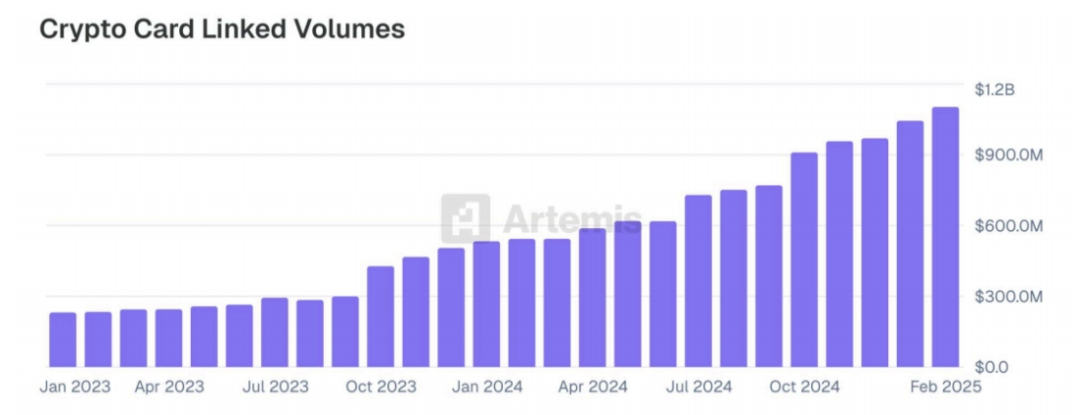

Among the companies participating in the study, the transaction volume of stablecoin-linked card payments has shown steady and significant growth, increasing from about $250 million per month at the beginning of 2023 to over $1 billion by the end of 2024. The growth during this period has been relatively smooth.

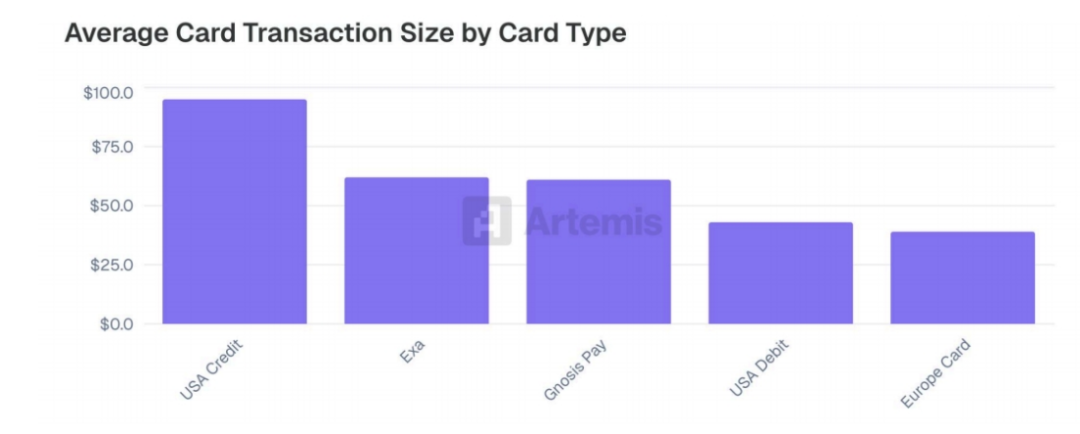

The usage patterns of stablecoin-linked cards are very similar to those of traditional cards, indicating that they are likely used for everyday purchases and routine payments. The average transaction sizes of Exa and Gnosis Pay, two well-known crypto card management platforms, are roughly comparable to the average transaction sizes of traditional credit and debit card products. This further reinforces the notion that users increasingly view stablecoin cards as functional equivalents to existing payment tools.

Case F—Reap's Stablecoin Solutions from Corporate Visa Card Issuance to Cross-Border Payments

Reap is a fintech company that provides infrastructure supporting stablecoins for modern enterprises, enabling global borderless finance. As Asia's leading stablecoin debit card issuer, Reap processes billions in stablecoin payments each month.

Reap offers stablecoin-supported financial services for businesses of all sizes. For companies familiar with Web3 and digital assets, Reap Direct provides a comprehensive business account that includes corporate cards, payment, and expense management. Businesses can manage their digital asset treasury, fiat expenses, and financial operations within a single integrated account.

Through our API-driven embedded finance solutions, businesses can directly integrate Reap's stablecoin services—from Visa card issuance to cross-border payments—into their systems and build new solutions.

Our clients include some of the world's largest cryptocurrency exchanges and rapidly growing neobanks like KAST. Based in Hong Kong, Reap adheres to the highest regulatory and compliance requirements of one of the world's top financial centers, enabling access to major financial institutions and global currencies for efficient and cost-effective fund flows.

3.3 Peer-to-Peer (P2P) Payments

P2P payments are one of the earliest application scenarios for stablecoins, providing a faster, cheaper, and more accessible alternative to traditional remittance and fund transfer channels. This application scenario gained traction early in regions facing currency instability, limited banking services, or high cross-border fees.

One of the early major catalysts for scaling this behavior was Binance Pay C2C, which allows Binance Pay users worldwide to send stablecoins directly to other Binance Pay users in real-time. Since then, we have witnessed a widespread emergence of stablecoin P2P applications globally. Today, the use of stablecoin P2P encompasses individuals, informal businesses, and online communities, solidifying its position in the global stablecoin landscape.

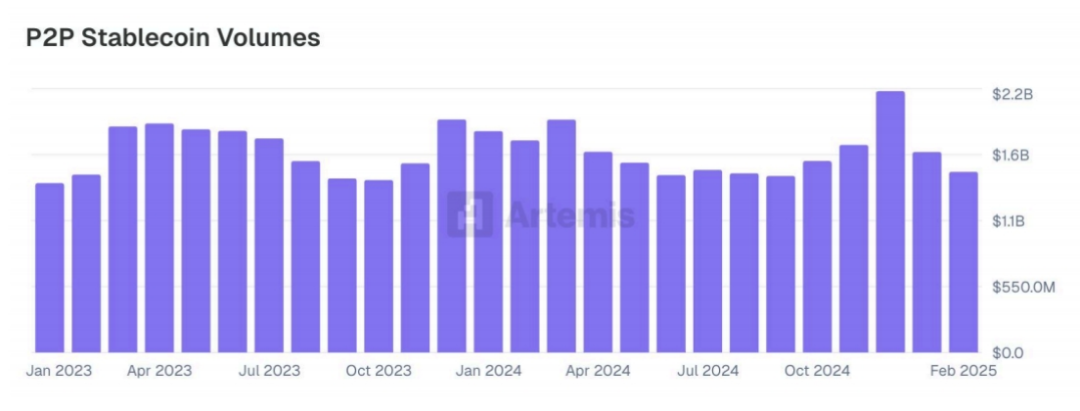

Unlike other areas, P2P payments among the sample companies remained stable throughout the observation period, with an operational rate of $18 billion by the end of February 2025. At the beginning of 2023, P2P transfers constituted the vast majority of all stablecoin-based payments, but this has since declined significantly, falling far behind recent B2B payments.

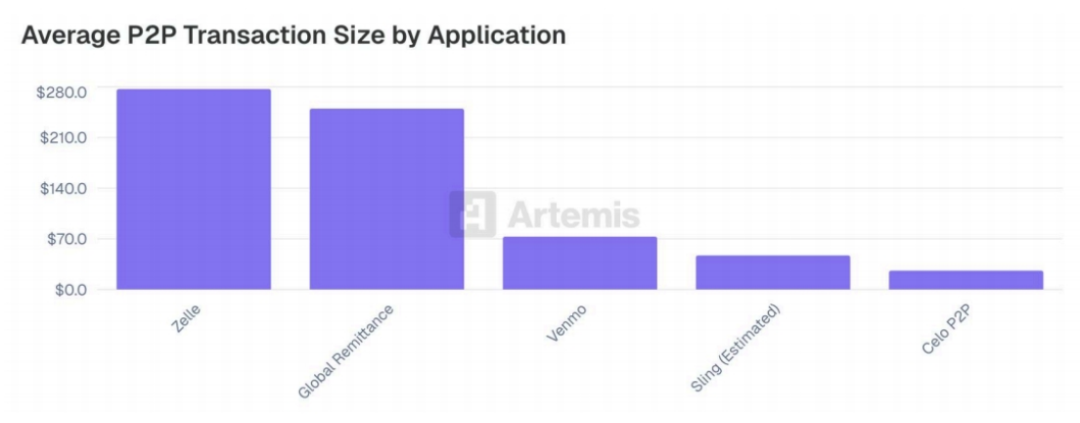

The low-cost nature of stablecoin transfers unlocks a broader range of application scenarios, particularly for small transactions. Platforms like Sling and Celo P2P record average transaction sizes significantly lower than traditional alternatives, such as Zelle ($277) and global remittance services ($250), which typically charge higher fees. This cost efficiency allows stablecoins to be used not only for high-value remittances but also for lightweight, frequent peer-to-peer payments.

3.4 Business-to-Consumer (B2C)

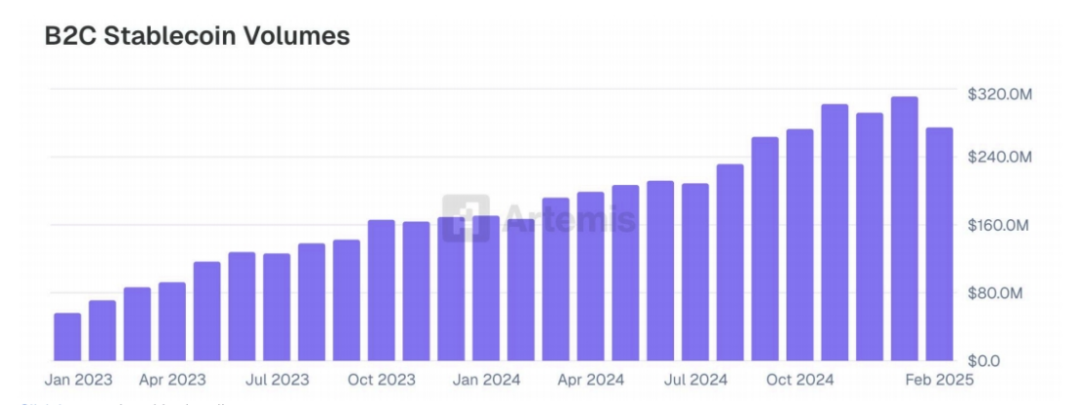

B2C payments represent another rapidly growing area of stablecoin adoption, particularly in use cases where individuals receive payments (such as salary transactions) or make regular purchases using digital dollars. The B2C analysis in this study focuses on two key players: Binance Pay and Orbital, both of which support stablecoin-based consumer payments across various industries. Among these participants, transaction volumes have significantly increased, rising from about $50 million per month at the beginning of 2023 to over $300 million by early 2025. This growth highlights the expanding role of stablecoins in everyday digital commerce and service platforms.

3.5 Prefunding

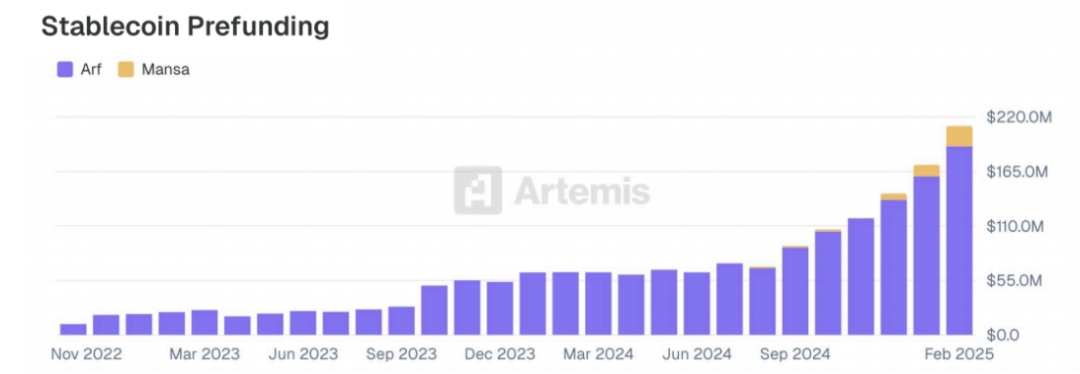

Prefunding refers to the practice of businesses sending funds in advance, typically in fiat currency, before a transaction is completed to ensure seamless execution. In stablecoin-based transfers, this often means delivering local currency to the recipient's destination before the underlying stablecoin settlement or conversion back to fiat occurs. This creates a short-term funding gap for the sender, who assumes the risk and responsibility of covering the prepayment. Arf and Mansa are two companies that help address this issue by providing short-term funding to stablecoin businesses, enabling them to offer prefunded cross-border payments, vendor payments, and working capital without tying up their own cash. The loan volumes from these providers have been steadily increasing, particularly in early 2024 and 2025, highlighting the growing demand for flexible on-chain liquidity solutions in global finance.

Case G—Huma Finance Meets Cross-Border Prefunding Needs with On-Chain PayFi Innovation

Huma Finance provides on-demand stablecoin liquidity through its PayFi network, enabling licensed financial institutions to complete cross-border transactions and stablecoin-supported card payment settlements without traditional prefunding. This innovative approach addresses the $4 trillion currently held in global bank accounts for payment settlements.

Key prefunding use cases:

Cross-border payment financing: Collaborating with regulated entity Arf Financial and global payment institutions

Stablecoin-supported card solutions: Settling with Visa/Mastercard networks

Market payment acceleration: Piloting with Amazon's payment partners to reduce Asian vendor payment times from days to under 3 hours. Amazon processes about $1 trillion in payments annually, typically collecting from U.S. buyers and paying Asian vendors.

Instant merchant settlements: Eliminating multi-day waiting times for card payment processing

Huma minimizes risk by using protected incoming funds to finance existing transactions in the system. Growth is primarily driven by expanding stablecoin liquidity, especially since the launch on Solana. Additionally, the recent launch of Huma 2.0 represents a significant protocol innovation, extending PayFi access from institutions to everyday retail investors. Finally, through Arf, Huma serves licensed financial institutions globally, aiming to expand its business as the global regulatory framework for stablecoins becomes clearer.

IV. Conclusion

This survey indicates that stablecoins are evolving from a niche tool into a significant alternative means of global payment. Our data analysis of 31 stablecoin payment companies shows that over $94.2 billion in payments were settled from January 2023 to February 2025. These payments represent ordinary transactions, not economic activities related to trading or speculation.

Business-to-business (B2B) transactions are the largest usage category, with a significant annual operational rate of $36 billion, highlighting the adoption of stablecoins in cross-border payments, treasury management, and vendor settlements. Card-linked stablecoin payments have also seen substantial growth, with annual transaction volumes exceeding $13.2 billion.

Consistent with previous findings, our survey participants report that payments are primarily dominated by USDT, followed by USDC, mainly settled on the Tron and Ethereum blockchains.

Overall, stablecoins have established themselves as a growing and important component of global payment infrastructure, with their usage expanding across transaction types and regions, indicating their increasing significance in the international economic system.

For this study, we collected transaction data from 20 payment service providers and other companies facilitating stablecoin payments, combined with estimates from on-chain data and 11 other companies as auxiliary data sources, covering a total of 31 stablecoin payment companies. All data, except for Binance Pay (which settles transactions directly between exchange account users), pertains to stablecoin transactions settled on-chain.

Generally, these payments are made on behalf of end users (consumers or businesses), including card transactions, business-to-consumer (B2C) payments, business-to-business (B2B) payments, or peer-to-peer (P2P) payments. The exception is prefunding, which refers to loans provided in stablecoin form to other stablecoin-based payment processors. Other forms of loans (even if the related transactions are settled in stablecoins) were not considered, as they are unrelated to payments.

Some companies listed in the dataset are service providers for other companies; therefore, there may be some duplication in transaction volumes, although we have made efforts to deduplicate where traffic data is available. For certain providers, we chose to use only partial data; for example, in Binance Pay, we excluded internal transfers (which we believe are more likely to be non-economic transactions). In general, we opted for conservative estimates wherever possible.

In this study, our goal was to limit data collection to specific payment transactions that reflect real payment activity (excluding fund flows related to investments). There are trillions of dollars in stablecoin transactions on-chain each year, but we are only interested in bottom-up analyses of companies that settle payments for known individuals and businesses.

As of the publication date, Artemis estimates that there are $26 trillion in annual on-chain stablecoin settlements (adjusted to remove known noise sources), but a significant portion of this is related to trading (on exchanges and DeFi), validating extractable value (MEV), and other non-payment type transactions. In our study, we were able to aggregate about 1% of all stablecoin settlement activity. While this figure may seem small, based on our data from the last month (February 2025), it corresponds to known stablecoin-based payment amounts of $72.3 billion.

The companies represented are a subset of all stablecoin payment service providers and do not comprehensively represent the field, but we believe we have captured a significant portion of the transaction volume. We expect to expand our coverage in future versions of this study.

Data is categorized by user type (B2B, B2C, P2P, etc.), blockchain, sending and receiving countries (where applicable), and specific stablecoins used in monthly transaction data. In some cases, charts are derived from partial company data (as not all participating companies provided detailed breakdowns). Data was collected in May 2025, traceable back to 2023. Naturally, some companies have only recently begun operations, so growth in some charts reflects both the increase in payment volumes for each company and the emergence of more companies in the field. Data is aggregated by transaction type and anonymized at the company level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。