欧洲中央银行ECB降息决定对加密市场的影响

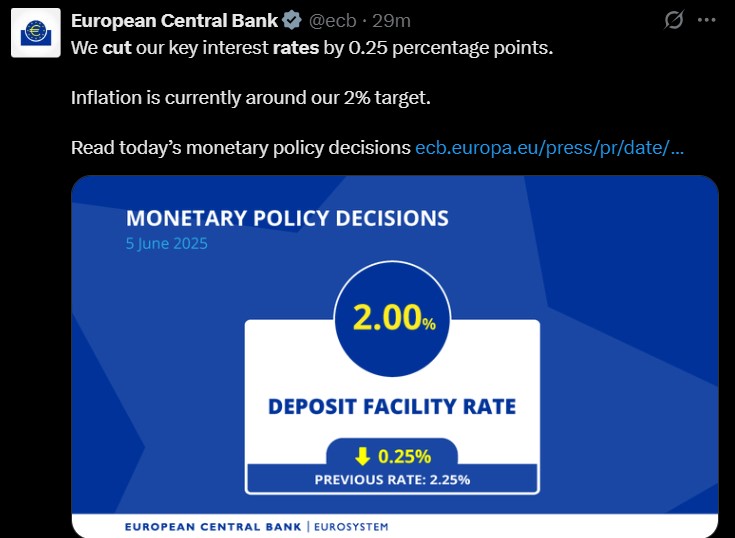

ECB降息决定2025年现已正式公布。6月5日,欧洲中央银行将其三项关键利率均下调了25个基点。存款便利利率现为2.00%,再融资操作利率为2.15%,边际贷款利率为2.40%,这一信息已通过X的官方账户确认。

来源: 欧洲中央银行X账户

这是连续第八次降息,符合大多数分析师的预期。但这不仅仅是关于利率收益——它可能影响从欧洲的通货膨胀到加密货币价格的表现。

ECB连续第八次降息——为什么是现在?

此次ECB降息决定的原因是通货膨胀下降。银行现在认为,2025年通货膨胀将平均为2.0%,2026年为1.6%,2027年将回升至2.0%。能源价格正在下降,欧元也在走强——这两者都有助于降低通货膨胀。

如果你想知道货币宽松的幅度是多少,答案是每项主要费用下调25个基点(0.25%)。这在金融圈内引起了广泛关注,正如最新的ECB降息新闻所示。

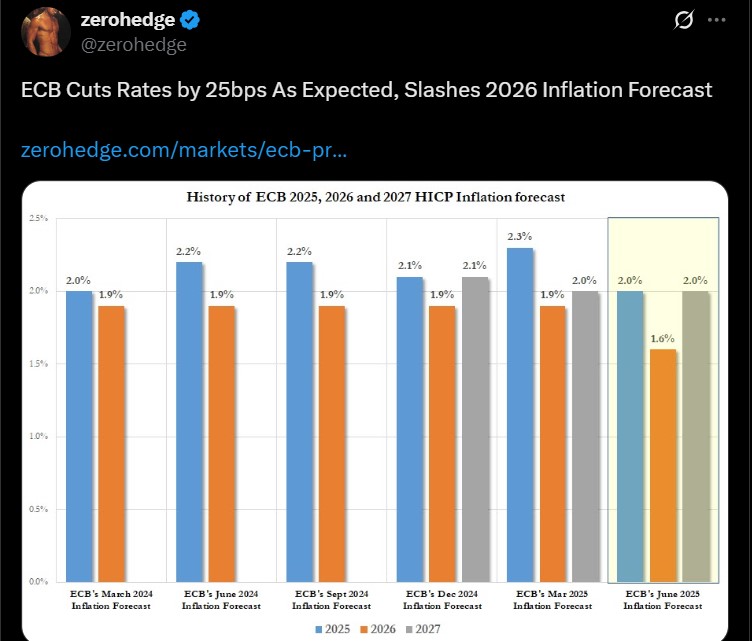

甚至Zerohedge,一个在X上颇受欢迎的财经频道,也分享了一张图表,表示:

“如预期降息25个基点,削减2026年通货膨胀预测。”

来源: X

这进一步强调了这一举措的严重性。

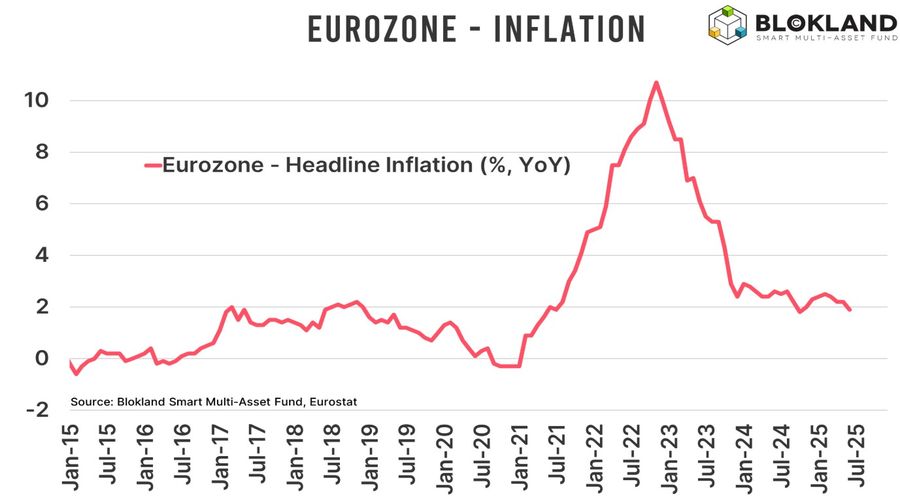

欧洲通货膨胀前景——风险真的结束了吗?

尽管整体通货膨胀在下降,但核心通货膨胀(不包括食品和能源)仍然略高——2025年为2.4%。预计到2026年和2027年将降至1.9%。工资仍在上涨,但增速不如以前,这有助于减缓价格上涨压力。

来源: BLOCKLAND图表X

中央银行尚未明确表示下次是否会降息或加息。这是因为未来充满不确定性——贸易紧张局势和油价等因素仍可能引发波动。

欧洲经济增长的驱动力是什么?又是什么在拖累它?

中央银行认为欧洲经济缓慢增长——2025年增长0.9%,2026年1.1%,2027年1.3%。这并不是一个巨大的推动,但一些积极的迹象依然存在。政府在国防和基础设施等方面的支出预计将在未来几年内提供帮助。

与此同时,由于全球不确定性,企业可能会有所保留。所有这些因素将在塑造投资者(包括加密货币领域的投资者)未来的行动中发挥作用。

加密视角:ECB降息对加密市场的影响

那么这对加密货币有什么影响呢?根据我的分析,它对加密市场的影响可能很大。较低的利率通常使借贷变得更容易,并增加市场活动。较弱的欧元可能使人们将比特币等加密货币视为更安全的选择。

根据我的分析,过去的趋势显示,在ECB降息决定事件后,比特币(BTC)通常会出现价格飙升。为此,这里有关于比特币价格在最新的降息新闻后反应的情况。截至撰写时,根据CoinMarketCap的数据,$BTC的交易价格约为$105,925.49,反映出在今天的持续下跌后,价格上涨了约1%。

来源: CoinMarketCap

该银行表示,将根据数据逐步决定未来的举措。这为市场波动创造了空间,而这通常是加密交易者所喜欢的。

结论:ECB降息打开了大门,但不确定性依然存在

此次欧洲中央银行的降息是一个强烈信号,表明其希望支持经济。但他们也保持谨慎。他们试图在帮助经济增长的同时,不让通货膨胀再次上升。

对于加密投资者来说,这一ECB降息决定是一个保持警惕的时刻。随着货币宽松、借贷变得更简单以及灵活的政策在前,传统市场和加密市场的情况可能会迅速变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。