全球市场在主要经济体之间的贸易争端加剧的情况下,正面临更高的不确定性。NEAR Protocol的NEAR在这种波动中表现出韧性,从急剧下跌的5.2%中恢复,建立了2.42美元的支撑位。

最近的价格走势显示出积累的良好迹象,在第二次测试支撑时,成交量增加,形成了潜在的双底形态。

这一技术结构,加上成功突破2.46-2.47美元的阻力区,表明尽管市场动荡,买方正在重新掌控局面。

随着中央银行在通胀担忧与经济增长之间权衡,NEAR的复苏可能表明对具有实际应用的区块链基础设施项目的机构信心正在增强。

技术分析

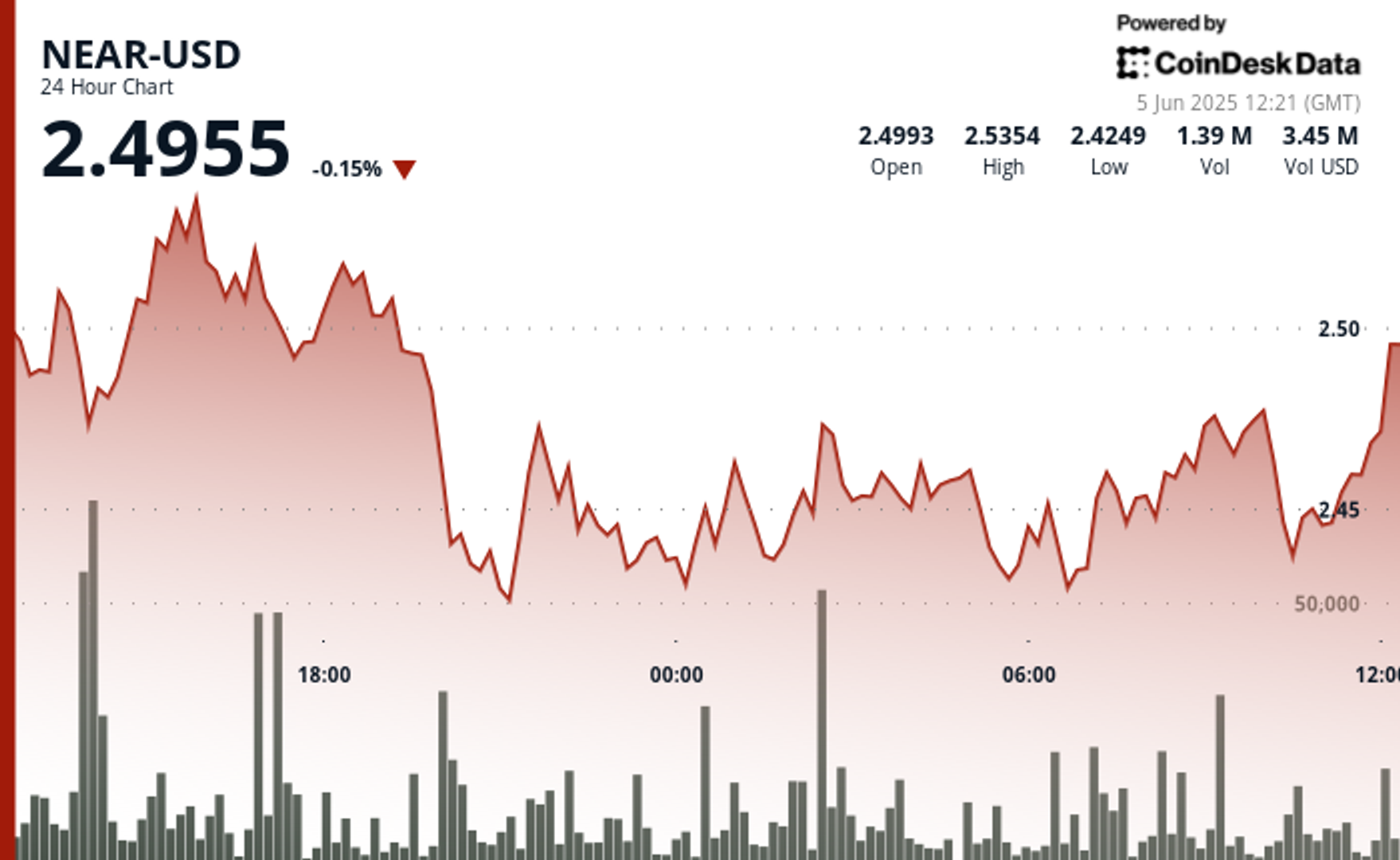

- NEAR-USD在24小时内表现出显著的波动,最高点为2.547,最低点为2.415,波动范围为0.132(5.2%)。

- 该资产在6月4日20:00时经历了急剧下跌,建立了2.423的关键支撑位,成交量为2.69M,超过平均水平。

- 在第二次测试支撑时,随着成交量的增加,形成了潜在的双底形态,暗示在较低水平的积累。

- 阻力位在2.462-2.470附近建立,目前的复苏接近这一关键区域。

- 在最后一小时,NEAR-USD表现出显著的看涨动能,从2.433上涨至2.455,涨幅为0.9%。

- 价格走势形成了明显的上升趋势,在07:15(206K)和07:37(120K)时出现了显著的成交量峰值,表明买方兴趣强烈。

- 在07:34时达到了2.462的暂时高点,随后急剧回落至2.445,建立了新的支撑位。

- 从这一回调中恢复后,在07:54时最终推高至2.458,随后在2.455附近进行整合。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。