We can only hope that when we are exhausted from cheering for our favorite team’s thrilling buzzer-beater, we are not witnessing a meticulously staged play.

Written by: Bright, Foresight News

As summer approaches, the NBA playoffs' Eastern and Western Conference Finals are nearing their conclusion. On May 29, the Oklahoma City Thunder defeated the Minnesota Timberwolves with a 4:1 record, claiming the Eastern Conference Finals championship.

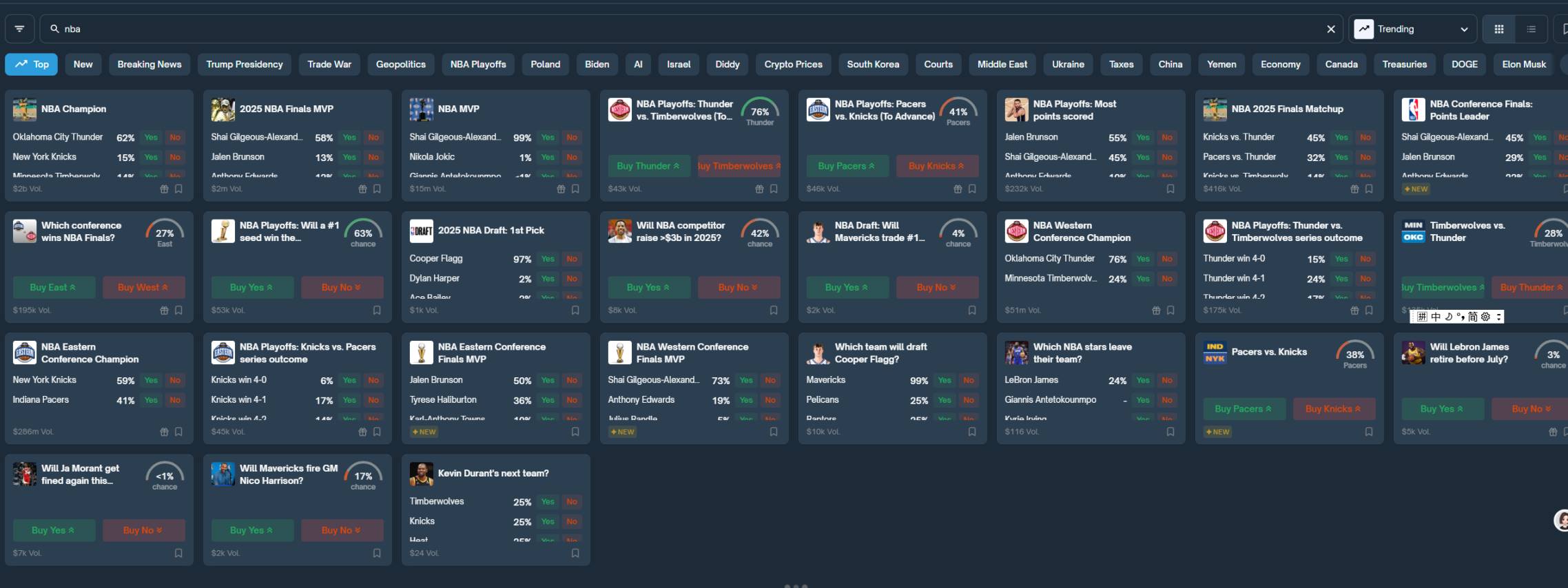

If you are a seasoned basketball fan, you must have come across game predictions from foreign media such as ESPN, Yahoo, BPI, and The Athletic on sports forums or during live broadcasts. However, in the 2025 season, you cannot miss the prediction data from Polymarket. Domestic sports media have already begun to widely adopt data from this emerging prediction platform for analysis.

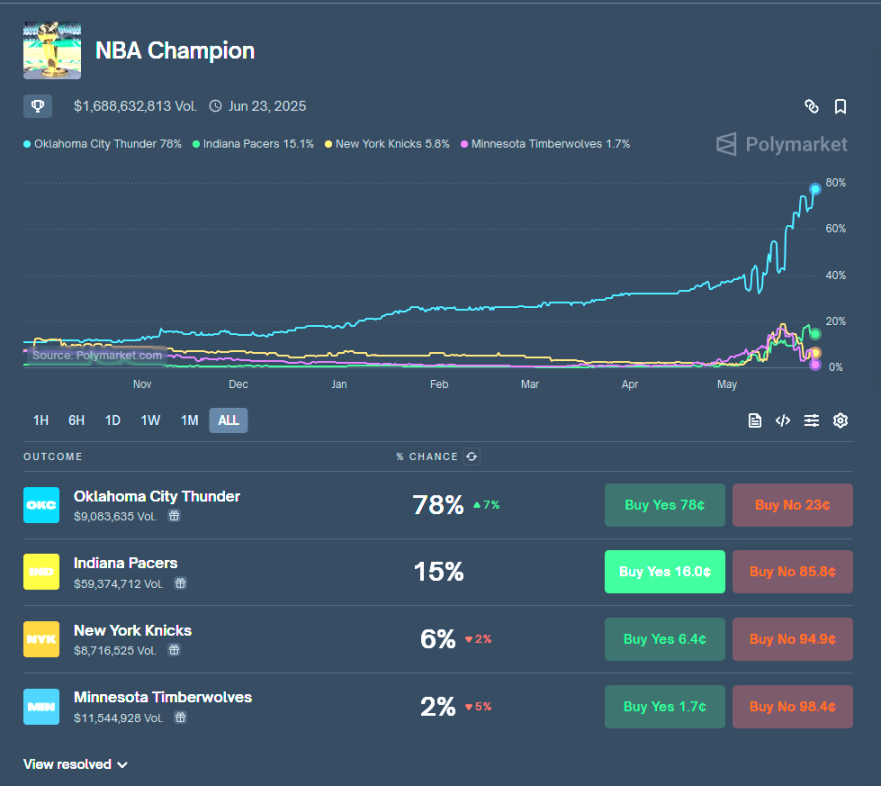

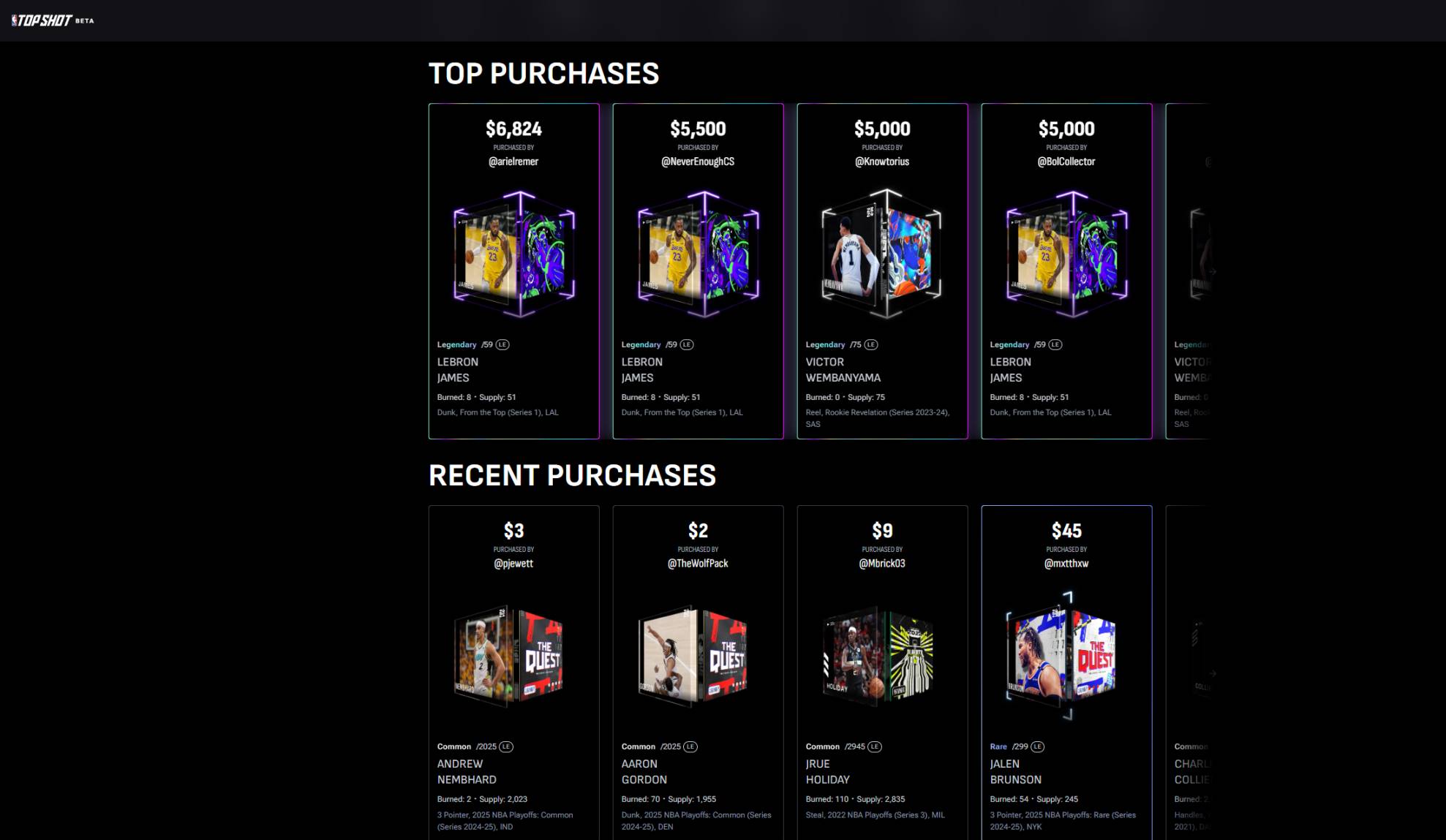

Before the Conference Finals officially began, Polymarket had a real-money prediction of a 61% chance for the Thunder to win the championship, with a total transaction volume exceeding $1.684 billion. As the series approached the end of Game 4, the odds for the NBA Champion fluctuated like a meat grinder, with the Thunder's championship probability rising to 78%, while the Pacers, with a 3:1 record, surged from 10% to 15%. Meanwhile, the Timberwolves, mired in a 1:3 deficit, had plummeted to 2%.

When the Timberwolves were still trailing by 25 points in the third quarter of Game 5, their championship probability on Polymarket had already dropped below 1%.

At this point, curious friends might ask, how does the NBA openly allow and even "encourage" gambling? Furthermore, why doesn’t the NBA collaborate exclusively with gambling giants like Sands, but instead tacitly allows $1.684 billion to flow into the relatively unknown startup Polymarket?

1. The "Copper Smell" of the O'Brien Trophy — Sports Betting Meets Crypto

The Shift in NBA Management's Attitude: From Strict Prevention to Capital Collaboration

In the early days of the NBA, gambling was like the sword of Damocles hanging over the league. The 1954 Jack Molinas case serves as a classic footnote — this All-Star rookie, averaging over 20 points, was banned for life for betting on his own team to win. Then-commissioner Walter Brown lured him to drop his appeal with a promise to "help his Jewish brethren," but remained silent about the truth after his imprisonment. At that time, the league had only 9 teams, with an average ticket price of less than $2, and any rumors of match-fixing could trigger a systemic collapse. Therefore, Brown chose to maintain fragile credibility through "thunderous means + public silence."

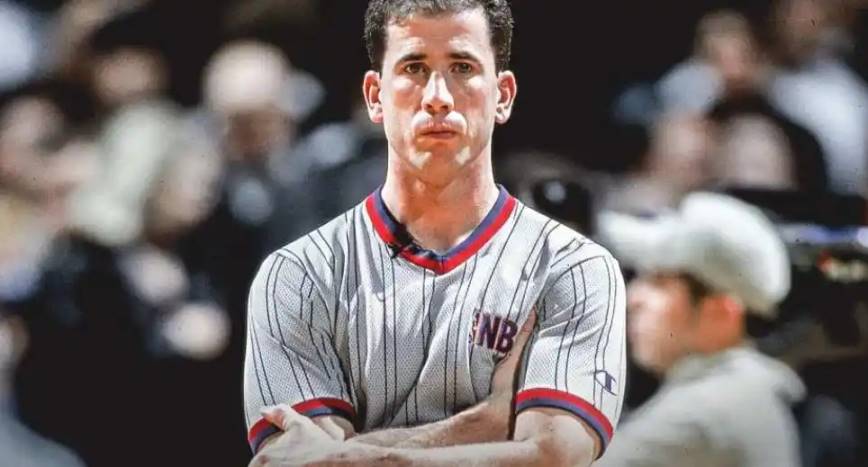

During former commissioner David Stern's tenure, there was a "strict crackdown" on off-court gambling. However, the 2007 scandal involving NBA referee Tim Donaghy exposed the dark underbelly of off-court betting and remains a scar on the NBA's credibility. This referee, who officiated for over 13 years and called 772 regular-season games, was imprisoned for manipulating games after accepting gambling money. According to an ESPN investigation, he intentionally favored the side he bet on in 23 out of 30 games, even intervening in the 2006 Finals and the 2007 Spurs vs. Suns playoffs, claiming "superior orders." Ironically, Donaghy revealed in his autobiography that behind classic battles like the 2002 Lakers' comeback against the Kings and the 2006 Heat Finals turnaround, there were league-level "referee biases" — a farce of "blowing a game for $2,000," where power rent-seeking in a centralized system peaked fan skepticism about NBA game outcomes.

Over seventy years of change, when Adam Silver announced a lifetime ban on Raptors player Jontay Porter in 2024, the context was entirely different. In the U.S., the Professional and Amateur Sports Protection Act of 1992 explicitly prohibited state governments from issuing sports betting licenses. In 2011, under Stern's leadership, the NBA, along with three other North American professional sports leagues and the NCAA, jointly sued the New Jersey government for allowing the legalization of sports betting. However, in 2018, the U.S. Supreme Court overturned the sports protection law, clearing the way for the legalization of sports betting in various states. Seven years later, 38 out of 50 states in the U.S. have legalized sports betting.

In fact, after the legalization of sports betting in 2018, the NBA quickly became the biggest beneficiary: U.S. gambling revenue surpassed $10.9 billion in 2023, and the NBA profited handsomely through revenue-sharing agreements with platforms like FanDuel and DraftKings. Commissioner Silver directly stated in a council meeting, "With the advent of the internet, online sports betting has become widespread, existing even before we legalized it. Now, over 30 states allow legal betting, and we must confront the technology directly, recognizing that even without legalizing sports betting, people will find ways to gamble illegally." This shift reflects the inevitable compromise of a commercial empire with an average team valuation exceeding $2 billion.

However, the other side of the coin reveals the technological upgrade of gambling behavior and the regulatory black box. In the Porter case, players manipulated game data through text messages (e.g., "crazy shooting in garbage time," "claiming to leave due to illness, only playing 2-3 minutes"), and their group even reached into the NCAA, manipulating point spreads in three games involving Eastern Michigan University. More ironically, when the Mavericks had a 1.8% chance of winning the first pick, the odds offered by bookmakers at 1:50 far exceeded the Super Bowl's underdog odds, sparking nationwide skepticism about whether the "quantum random number generator was manipulated" — after all, the $3.5 billion financing for the team's new home, the "Galaxy Center," desperately needed the commercial value endorsement of a star rookie. Even more subtly, the NBA's attitude: the league's official website embeds real-time odds but emphasizes in the Porter case that "gambling is a personal behavior," creating a logic of "official guidance, individual responsibility," which reduces Silver's "transparent governance" to a cover for capital.

The Carnival of On-Chain Casinos: How Polymarket Restructures the NBA Crypto 3.0 Ecosystem

After the NBA lifted the gambling ban, it reached a $25 million annual sponsorship deal with MGM in 2018, and by 2023, all 30 teams had integrated gambling data interfaces. According to the NBA's 2023 financial report, league gambling sponsorships grew by an average of 39% annually, with data licensing generating $45 million per season, and the emerging real-time betting revenue expected to reach $200 million by 2025.

As of the time of writing, Polymarket has made over 25 predictions regarding the 2025 NBA playoffs. A total of over $1.683 billion is being wagered on the O'Brien Trophy, meaning the NBA could extract over $10 million in profits from it. In the betting market, the probability of the Oklahoma City Thunder winning the trophy has already surged to 80%. Previously popular bets like "Celtics' win rate when Tatum is absent" and "whether Jokic will achieve a triple-double in this game" have also sparked considerable discussion.

The magic of on-chain casinos lies in their ability to flexibly break down games into countless tradable "atomic events," distinguishing them from the relatively fixed betting points of offline betting, such as guessing wins or betting scores. When the Thunder and Nuggets' Western Conference semifinals reached the second quarter, fans could even bet in real-time on "whether Alexander's next drive will draw a foul" or "whether Porter will hit the next three-pointer," keeping users' attention fully engaged throughout.

Even more radical is the "instant settlement" feature — when Gordon hits a buzzer-beater three-pointer, Polymarket quickly determines all related bets, and this "millisecond feedback" significantly boosts dopamine secretion efficiency, leading to millions of dollars being collectively liquidated amid the cheers of fans in the venue.

Polymarket's restructuring of the NBA crypto ecosystem stems from its underlying blockchain technology and cryptocurrency characteristics, which disrupt traditional betting models. The blockchain's open and transparent accounting mechanism naturally fits the gambling scene, with every bet and probability change displayed on stage.

This decentralized prediction market based on Polygon allows users to anonymously use USDC to bet on "events" such as NBA player data, game progress, and even referee calls, with the preset smart contracts automatically settling at a mere 1.5% fee (the NBA takes 1%), far lower than the 5%-8% or even 13% fees charged by other NBA betting platforms.

In fact, Polymarket made headlines during the 2024 U.S. presidential election, being hailed as the "top non-sports prediction/betting platform." In the month leading up to the election (from October 6 to November 5), Polymarket's daily trading volume hit a historic high, averaging $103 million per day. On election day, it ranked second in the Apple free app chart, only behind the legal betting market Kalshi open to U.S. citizens.

However, Polymarket has not given up on the lucrative sports betting sector. Unlike traditional betting giants that face strict anti-money laundering and KYC management restrictions, Polymarket's expansion into sports betting does not encounter the "tail wagging the dog" dilemma. On the contrary, with lower fees, Polymarket prides itself on being a "media" rather than a casino in the sports sector, believing it provides the public with "financial truth," revealing society's true preferences and information distribution.

However, even with many advantages, the compliance of on-chain gambling remains a "sword of Damocles." Countries like Singapore and India have placed Polymarket on their illegal lists, and several states in the U.S. require it to integrate a KYC system. Nevertheless, the platform can still disperse its liquidity pools to Layer 2 networks like Arbitrum and Optimism through cross-chain bridges. The "whack-a-mole" game between regulators and decentralized casinos continues.

2. Five Years Since the Staples Center Renaming — The NBA's Crypto Roots

Naming Rights: The "Traffic Offensive" of Leading Crypto Capital

In 2025, the Staples Center had long been renamed Crypto.com Arena, a landmark that witnessed the glory of the NBA powerhouse Los Angeles Lakers, now illuminated every night by purple LED lights as a totem of cryptocurrency. The $700 million naming fee for 20 years reflects Crypto.com's hunger for the large sports market — in fact, traditional industry giants like American Airlines spent only $195 million for a 10-year naming deal for the Dallas home arena.

In the attention-driven landscape of crypto economics, the strong resonance between star power and crypto promotion is not a losing business; the Staples Center justifies this exorbitant price as one of the busiest sports centers in the world. This legendary venue is home to four professional teams: the NBA's Los Angeles Lakers and Clippers, the WNBA's Los Angeles Sparks, and the NHL's Los Angeles Kings. This may be unique globally. It has witnessed the Lakers' six championship victories and the legendary era of Kobe and Shaquille.

Behind this gamble is a precise user profile. Coinbase CEO Armstrong stated, "35% of the population under 40 in Los Angeles holds crypto assets; they are both NBA viewers and our potential users." Data supports this: in the first month after the renaming, a Coinbase survey showed that 32% of new registered users came from California, with 61% being Lakers fans.

The NBA's Crypto 1.0 era was characterized by emerging crypto "New Money" eagerly seeking to gain visibility and recognition through sponsorship of mainstream sports events and venues. What could be more valuable for brand marketing than naming the Los Angeles cultural landmark, the Staples Center?

Before its collapse, the cryptocurrency exchange FTX was a major sponsor of the NBA. In 2019, the Miami Heat's home arena was renamed "FTX Arena," a result of FTX's $135 million naming rights deal. However, after FTX's downfall, the Miami-Dade County court stripped FTX of its naming rights for the venue.

However, as mentioned earlier, when Shaquille O'Neal shouted "I'm all in" in an FTX advertisement, crypto endorsements were no longer just simple brand exposure but a deep binding. O'Neal faced a class-action lawsuit in a Florida federal court for actively promoting Astrals NFT and Galaxy tokens on social media.

According to publicly available court documents, O'Neal and the company behind Astrals ultimately agreed to pay $11 million for a settlement, which would cover the plaintiffs' attorney fees and compensate affected NFT and token purchasers. The Heat's home arena struggled to find a "successor" after FTX's bankruptcy and had to be named after a local geographic feature. The subsequent 17-year, $117 million contract with software company Kasaya was also far less than previous sponsorship amounts.

The Peak and Dilemma of NBA Top Shot

The NBA is not only satisfied with direct endorsements and sponsorships; during the NFT and metaverse boom, the NBA, with its commercial league background, was keen to monetize its IP, marking its own foray into Crypto 2.0.

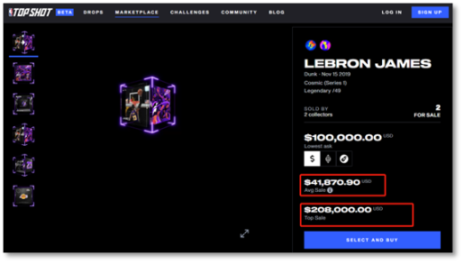

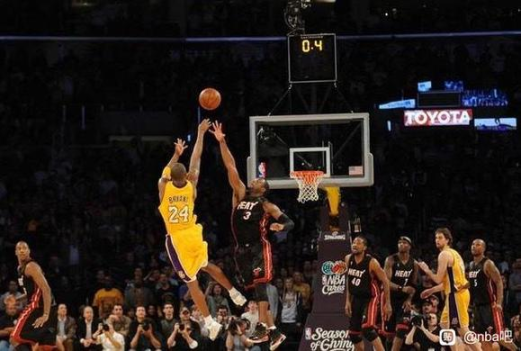

NBA Top Shot Moments (referred to as NBA Top Shot) is a sports digital collectible card based on the Flow blockchain, featuring NFT player cards that capture exciting moments of NBA players in games. Launched by Dapper Labs in 2020, it received official authorization from the NBA and investment from NBA stars like Jordan and Durant. One NFT capturing LeBron James' buzzer-beater moment was sold for a staggering $208,000 in 2021.

With the NBA's official endorsement and fan base, NBA Top Shot reached a peak daily trading volume of over $40 million in 2020 and consistently ranked among the top five in the NFT trading market. However, this good fortune did not last long; NBA Top Shot soon faced decline due to oversupply of player cards in a short period and the parent company's lawsuit from the U.S. SEC. Although the SEC no longer classified NBA Top Shot as a security and dropped the lawsuit in 2022, the now-dormant NBA Top Shot could not escape the fate of "zeroing out." On the official NBA Top Shot trading platform, the average price of Moments player cards dropped from a peak of $156 to single digits.

Even with the largest fan base globally, the NFT fan economy model of NBA Top Shot has fallen flat. Most players in the sports collectible NFT space are an intersection of sports fans and Web3 users. When the NFT market cooled down, the lack of influx from outside players led to a situation where the trading market was full of value but lacked transactions. With the NFT market's downturn and the project's inaction, project activity fell into a "death spiral."

The "Redemption" of Fantasy Sports

Despite the decline in activity for sports collectibles towards NFTs, sports themselves still carry a massive fan base, especially in top global sports leagues. With the entry of platforms like DraftKings and Sorare, the gameplay of sports NFTs has been upgraded, injecting more gaming elements.

Web3 sports games like DraftKings, Sorare, and Ultimate Champions have chosen "Fantasy Sports" gameplay, which perfectly combines real matches with NFT elements. Players can predict the performance of real-world players and teams, select suitable lineups for simulated matches, and earn points based on these athletes' performances in actual games, competing for rankings and rewards with other players. This model is not new in the sports gaming field; similar mechanisms have already been established in FM (Football Manager), basketball fantasy, etc.

However, unlike before, the core of Web3 sports games lies in star card NFTs, which players can trade on secondary markets, financializing player cards and attracting a large number of speculators. Interestingly, the growth potential and rarity of the players themselves affect the prices of player cards; for instance, a rising star in the early stages of their career has significant hype potential, while a veteran nearing retirement is the opposite. The NBA's new generation star Giannis Antetokounmpo's star NFT was sold on Sorare for 113.888 ETH (approximately $186,000).

The core factors that allow "Fantasy Sports" to maintain long-term playability are twofold.

Financial Attributes Favoring Rarity

"Fantasy Sports" games reference player preferences for star card rarity, dynamically adjusting the player card pool to generate revenue. This includes frequently raising the card pool limits (player ability values, salary cap limits, etc.), prompting players to purchase card packs and participate in lotteries, or directly acquiring preferred players through game currency purchases.

Thus, DraftKings' "Fantasy Sports" gameplay of "entry fee + prize pool" is often considered to have gambling implications, as the entry fees, player selection (similar to betting), and sharing of prize pools resemble gambling behavior. On the surface, players need to rationally predict player performance, but in reality, luck plays a significant role.

Highly Timely Data Updates

In gambling-type simulation sports games like DraftKings Reignmakers and Sorare, player performance is directly linked to the secondary prices of their player cards in real-time. Users need to understand real player data and grasp team tactics and overall team status, effectively attracting passionate fans and speculators.

Therefore, the "redemption" of Fantasy Sports still relies on the support of gambling; as a competitive sport, it may inherently be inseparable from gambling.

It can be said that after opening the Pandora's box of the sports betting ban in 2018, the NBA playoffs have become not just a basketball feast but a direct arena for capital. From Polymarket's on-chain betting to DraftKings' high-priced star cards, the NBA is maintaining this commercialized gambling order, with crypto serving as a "democratic" tool to uphold this order. However, behind the frenzy of "digging for gold" lurk the persistent shadows of scandals related to players and lottery betting, as well as the cautionary tale of the collapse in valuation of the NBA's official NFT project.

We can only hope that when we are exhausted from cheering for our favorite team’s thrilling buzzer-beater, we are not witnessing a meticulously staged play.

(This article's data is partially sourced from The Athletic, Bleacher Report, ESPN, and CoinGecko, with cases supported by public reports.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。