Stablecoins are not a revolution, but a reconstruction of U.S. Treasury bonds, a reshaping of the dollar, and an extension of sovereignty.

In the new wave of digital finance, stablecoins are not disruptors of the old system, but more like a "digital relay station of the Bretton Woods system" — carrying the credit of the dollar, anchoring U.S. Treasury assets, and reshaping the global settlement order.

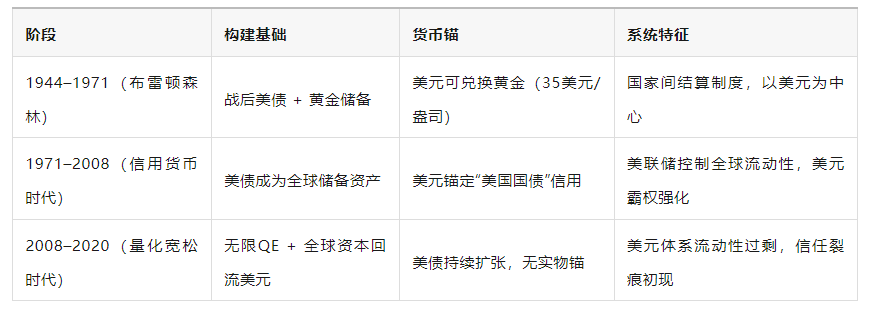

I. Historical Reflection: Three Structural Leaps of Dollar Hegemony

The new phase after 2020 is a reconstruction process of the digitalization, programmability, and fragmentation of the dollar's credit base, with stablecoins being the key connective tissue in this reconstruction.

II. The Essence of Stablecoins: The "Dollar-Treasury" Anchoring Mechanism on the Chain

Stablecoins (Stablecoin), especially those pegged to the dollar like USDC, FDUSD, and PYUSD, have an issuance mechanism of "on-chain dollar certificates + Treasury or cash reserves," forming a simplified version of the "Bretton mechanism":

This indicates that: The stablecoin system effectively rebuilds a "digital version of the Bretton Woods framework," where the anchor has shifted from gold to U.S. Treasury bonds, and from national settlement to on-chain consensus.

III. The Role of U.S. Treasury Bonds: The "New Reserve Gold" Behind Stablecoins

Currently, in the reserve structure of mainstream stablecoins, U.S. Treasury bonds, especially short-term T-Bills (1-3 month Treasury bills), account for the highest proportion:

USDC: Over 90% of reserves are allocated to short-term U.S. Treasury bonds + cash;

FDUSD: 100% is cash + T-Bills;

Tether is also gradually increasing the weight of U.S. Treasury bonds while reducing commercial paper.

▶ Why have U.S. Treasury Bonds become the "hard currency" of on-chain finance?

Extremely liquid, suitable for handling large on-chain redemptions;

Stable returns, providing issuers with interest margin income;

Backed by U.S. sovereign credit, enhancing market confidence;

Compliance-friendly, serving as a regulatory compliant reserve asset.

From this perspective, stablecoins are "new Bretton tokens with T-Bills as gold," embedding the credit system of the U.S. Treasury behind them.

IV. Stablecoins = An Extension of U.S. Sovereignty, Not a Diminishment

Although on the surface, stablecoins are issued by private institutions, seemingly undermining central banks' control over the dollar, in essence:

Each USDC issued must correspond to 1 dollar in Treasury bonds/cash;

Each on-chain transaction is priced in "dollar units";

Each global circulation of stablecoins expands the usage radius of the dollar.

This means that the U.S. no longer needs SWIFT or military projection to "airdrop" dollars into global wallets, representing a new paradigm of outsourced monetary sovereignty.

Therefore, we say:

Stablecoins are the "unofficial contractors" of U.S. monetary hegemony

— They do not replace the dollar, but push the dollar onto the chain, into the global arena, and into the "unbanked zone."

V. The Emergence of the Bretton 3.0 System: Digital Dollar + On-Chain Treasury Bonds + Programmable Finance

In this framework, the global financial system will evolve into the following model:

This means: The future Bretton Woods system will no longer take place at the Bretton Woods conference table, but will negotiate and reach consensus through smart contract code, on-chain asset pools, and API interfaces.

VI. Risks and Uncertainties: How Far Can This System Go?

VII. Conclusion: Stablecoins Are Not the End, But a "Midfield Supply Station" for U.S. Global Governance

Stablecoins may seem like private innovation, but they are actually becoming a "de facto bridge" for the U.S. government's digital currency strategy:

They connect old finance (U.S. Treasury bonds) with new finance (DeFi);

They extend U.S. financial sovereignty to the smart contract layer;

They ensure that the dollar maintains its dominant position in the digital transformation.

Just as the Bretton Woods system established dollar credit through gold anchoring, today's stablecoins are attempting to rewrite the monetary governance structure with "on-chain T-Bills + dollar settlement consensus."

Stablecoins are not a revolution, but a reconstruction of U.S. Treasury bonds, a reshaping of the dollar, and an extension of sovereignty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。