After experiencing a transitional period in operations during the fourth quarter of last year and the first quarter of this year, Bitdeer is about to welcome an important moment.

Written by: Cycle Trading

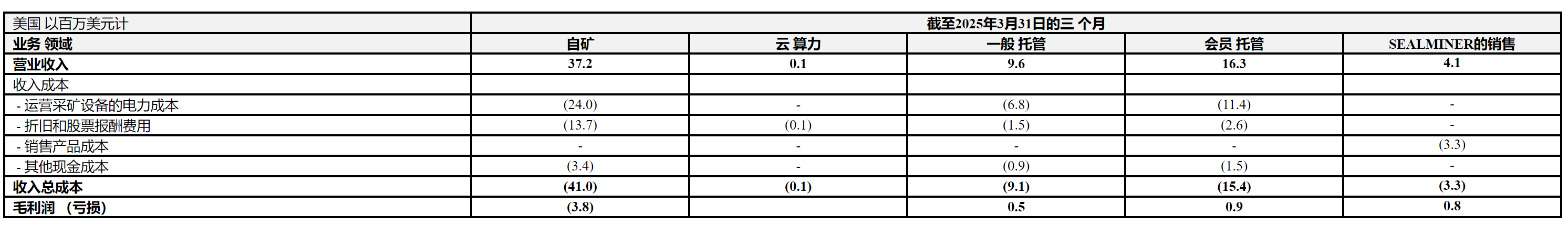

Event: Bitdeer (Btdr.US) released its first quarter report for the fiscal year 2025. The company achieved a revenue of $70.1 million in the first quarter, a year-on-year decrease of 41.3%, but a quarter-on-quarter increase of 1.6%. Among this, the self-operated business revenue was $37.2 million, a year-on-year decrease of 10.4%; the comprehensive gross profit was negative $3.2 million, with a gross margin of -4.6%. The main reason for this was the increase in electricity prices due to the dry season in Bhutan, which led to a temporary shutdown of the Bhutan mining site. However, after entering the wet season in the second quarter, electricity prices have returned to $0.042/kWh. Sales of Seal mining machines reached $4.1 million, marking the official start of the company's mining machine sales. The adjusted EBITDA was negative $56.1 million, compared to a positive $27.3 million in the same period of 2024. The net profit was $410 million, mainly due to the fair value reversal of convertible notes ($448.7 million) and Tether options ($58.4 million) accrued in the fourth quarter of 2024.

Commentary:

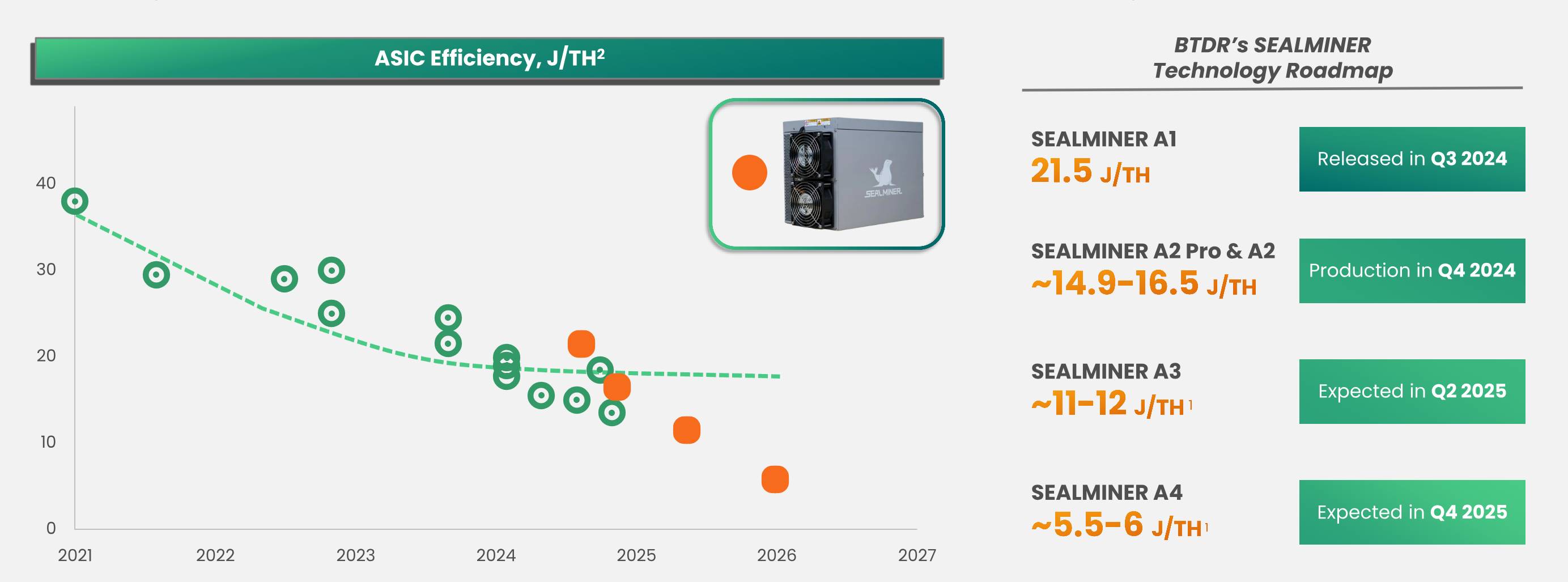

- In the first quarter of 2025, Bitdeer's prepaid accounts receivable further increased to $382 million (compared to $310 million in the fourth quarter of 2024), fully covering the amount needed for the maximum available chip volume. The Seal02 mining machines have entered the shipping phase, and the subsequent pace of self-operation and sales will depend on competitors' pricing strategies. If competition is fierce, priority will be given to lighting up self-operated mining sites; the Seal03 mining machines also completed chip production in the first quarter and are currently still in the testing phase, with expectations to officially enter the layout and sales phase for self-operated mining sites by the end of the third quarter and into the fourth quarter of 2025.

Regarding the U.S. tariff war, Bitdeer will complete the construction of its North American assembly plant in the second quarter. After that, sales in North America will come from localized assembly. Although costs have risen by nearly 10%, this is negligible compared to the current tariffs in Southeast Asia. The Southeast Asian assembly plant will meet the needs of mining sites in non-U.S. regions.

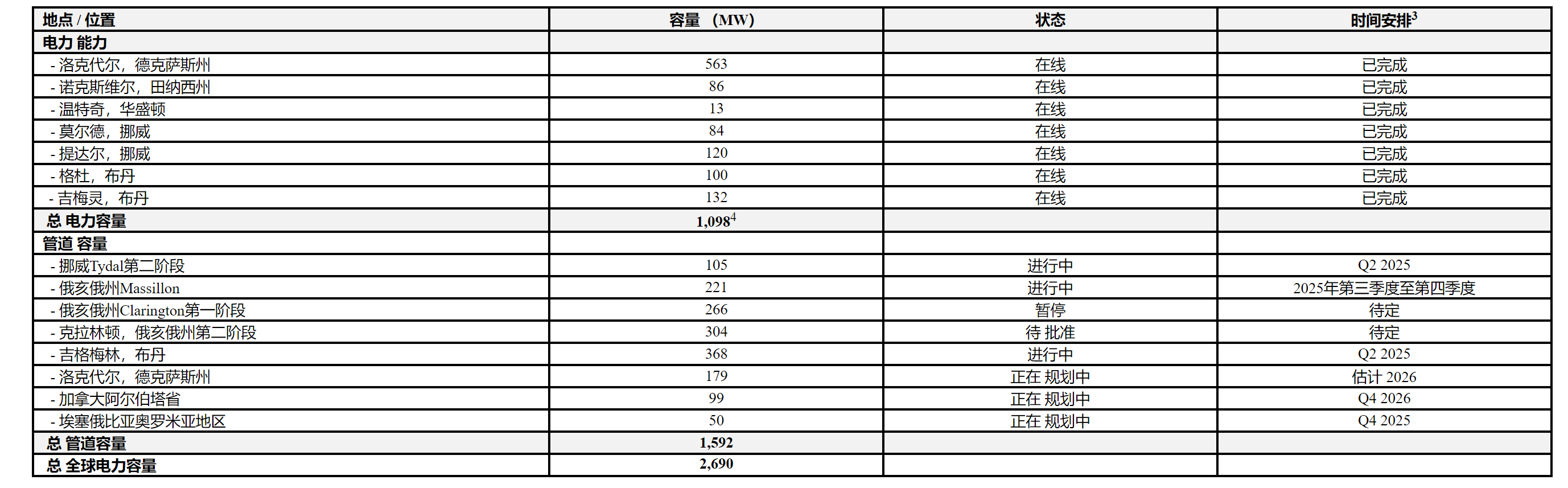

Bitdeer's global power infrastructure construction remains rapid, with global available power capacity expected to approach 1.6GW by the end of the second quarter and reach 1.8GW by the end of this year.

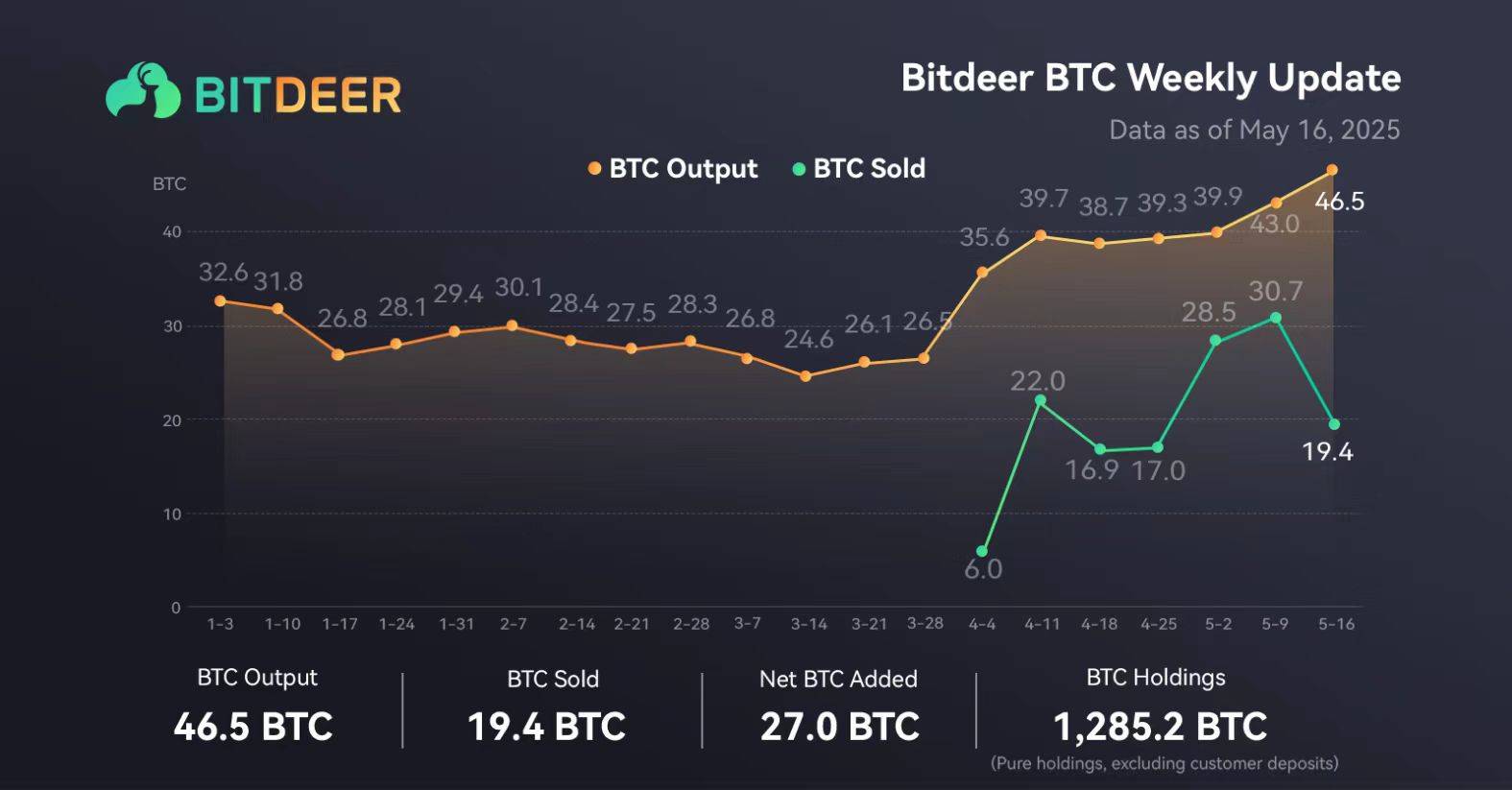

- As of April, Bitdeer's self-operated mining site's hash rate has reached 12.5Eh/s, expected to rise to 40Eh/s by October, and is anticipated to exceed 40Eh/s by the end of 2025. The company's latest Seal01 and Seal02 mining machines only went online in the self-operated mining site in March, but the overall mining costs are still at least 20% lower than peers (including Mara, CLSK, etc.). After fully replacing old mining machines, the cost advantage will become more apparent, with monthly output expected to show an exponential increase starting in the second quarter.

Investment Advice: Bitcoin prices have recently returned to an upward trend, with the potential to break the previous historical high price of $109,000 per coin. Since the U.S. trade war, the dollar has been under pressure, and Bitcoin, as an alternative asset, is beginning to show its safe-haven properties similar to gold. The Federal Reserve has also recently started adopting an "average inflation" policy, with expectations of an interest rate cut as early as June, and the anticipated total number of cuts for the year has increased to three (previously one), all forming positive support for Bitcoin prices. After experiencing a transitional period in operations during the fourth quarter of last year and the first quarter of this year, Bitdeer is about to welcome an important moment. The speed of mining machine research and development and the speed of lighting up self-operated mining sites will be important focal points in the coming quarters. The operational situation in the first quarter of 2025 should be the worst period in the next two years, and the operational turning point will begin from here, still making it the best choice among North American Bitcoin mining stocks.

Investment Risks: Risks of further adjustments in Bitcoin prices, risks of TSMC chip production falling short of expectations, and risks of the company's self-operated mining machines going online slower than expected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。