Binance Alpha has provided many community-based, meme-type, and small to medium-sized crypto projects with a channel to reach a broader range of investors and strive for listing on Binance.

Written by: Black Mario

In fact, in the previous rounds of competition, Binance's layout has been somewhat slow. For example, during the inscription period, OKX Wallet seized the opportunity early (Binance Wallet only entered the inscription market in April 2024, and the inscription market cooled down within a few months). In the last meme season and AI season, the Solana ecosystem has clearly become the core of liquidity and speculation, especially with platforms like PumpFun continuously becoming huge pumps. In contrast, BNB Chain, backed by the giant Binance, has been lukewarm, lacking standout tokens and vibrant trading markets.

On the other hand, the rise of on-chain derivatives markets is also impacting Binance, with the emergence of platforms like HyperliquidX attracting a wave of users and funds to the chain. Therefore, under multiple pressures, Binance is indeed facing challenges. The launch of Binance Alpha in December last year clearly indicates its purpose:

I believe its strategic significance can be summarized in several points:

1) Activate the vast user trading activity and liquidity within the platform

Binance CEX itself does not lack users (250 million registered) or funds, but it lacks the factors to fully mobilize the trading activity of these users and the liquidity of their funds, especially to guide these token holders into its own chain ecosystem. Therefore, Alpha 2.0 introduced a points mechanism, using TGE, Alpha airdrops, and IDOs as catalysts, hoping to encourage more token holders to participate in trading within the Alpha zone, particularly to enhance liquidity in the Alpha zone.

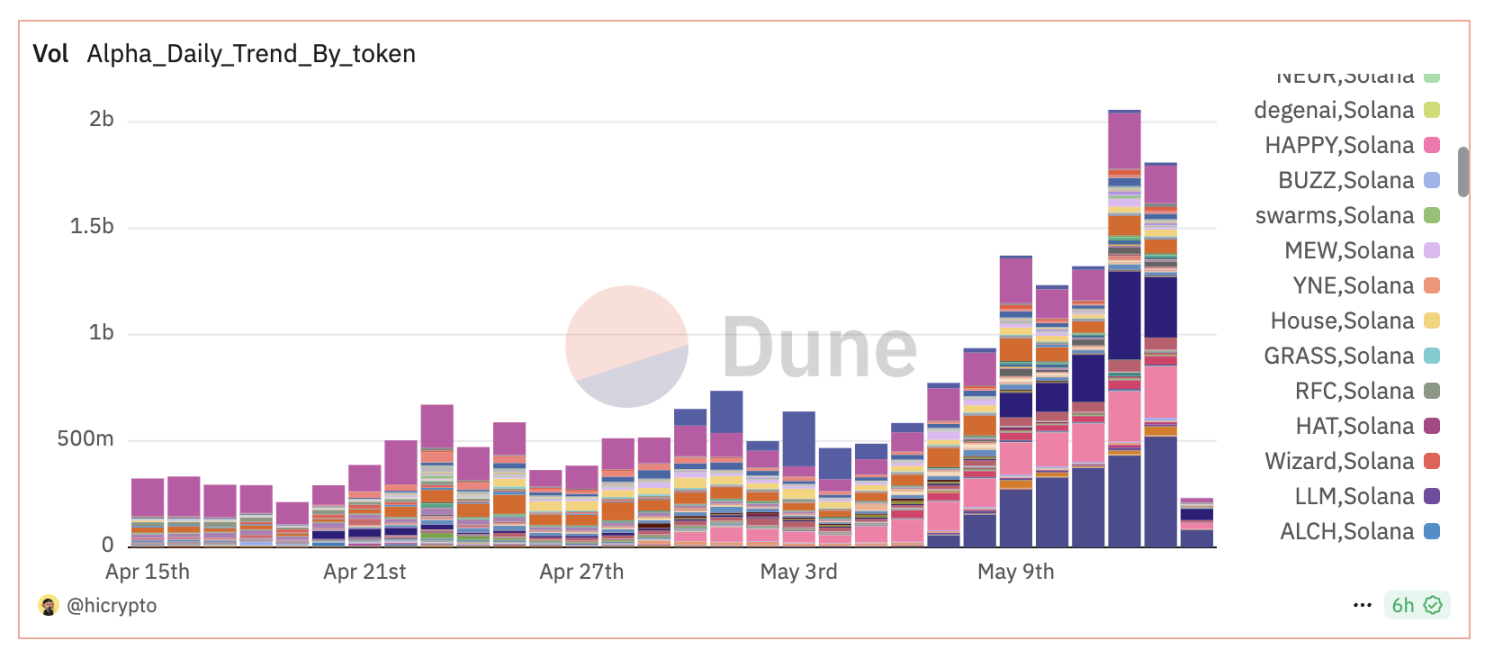

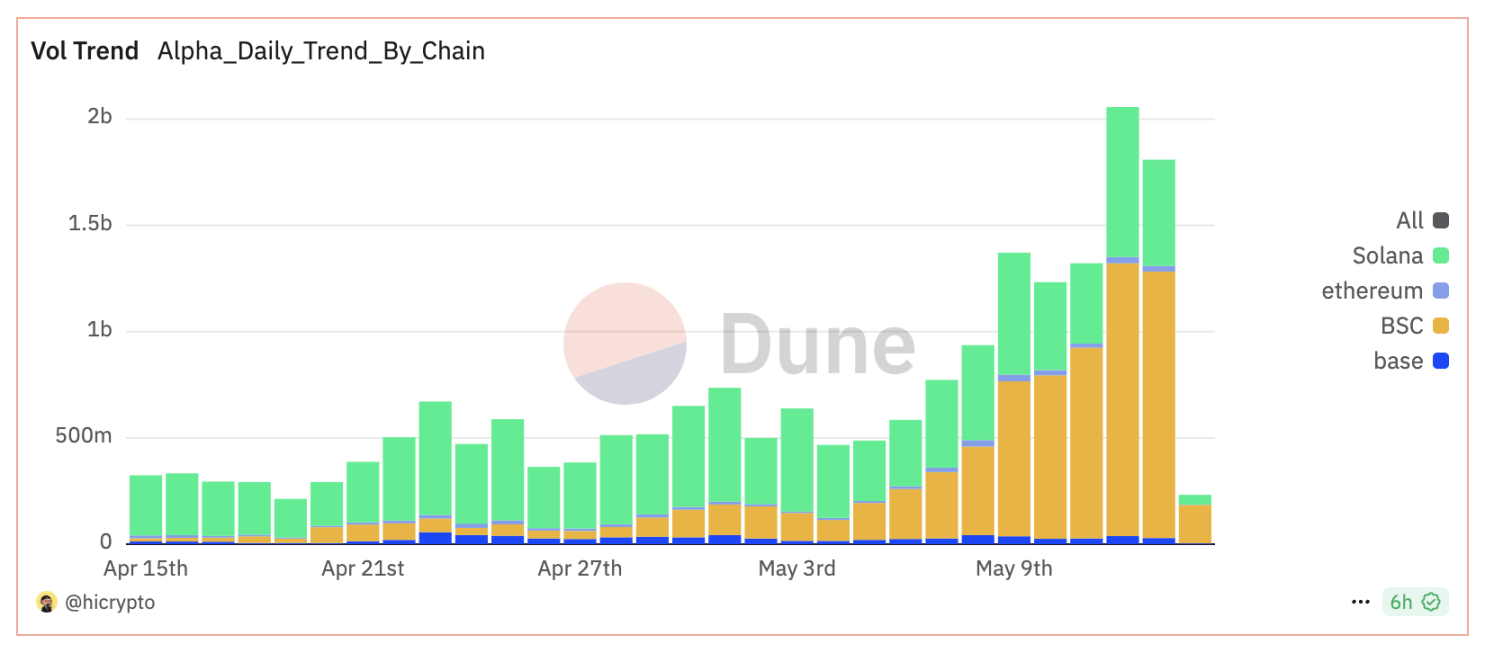

We have seen that after the introduction of 2.0, especially with the points system, the trading effects brought to the Binance Alpha trading area have been extremely significant. Since the first TGE event requiring points on the 25th, trading volume has surged dramatically, and the more intense the trading, the better the results.

2) Direct traffic to BNB Chain, activate the ecosystem, and support more on-chain projects

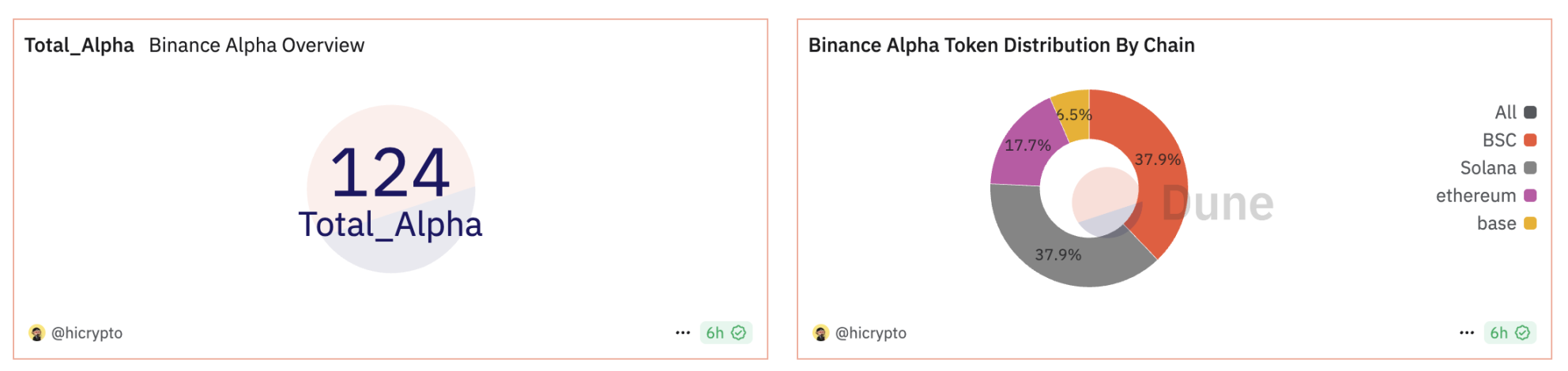

The purpose of Binance Alpha directing traffic to BNB Chain and activating the ecosystem to support more of its own on-chain projects is quite clear. In the early 1.0 phase, it was not difficult to find that the proportion of tokens launched on BNB Chain on Alpha was relatively high. Currently, among the 124 Alpha projects launched, over 70% are based on BNB Chain tokens, with 38% being native BNB Chain projects in popular fields such as AI, meme, and DeFi.

Leading trading volume: BSC tokens account for about 40% of Alpha's total trading volume, with weekly trading volume soaring by 122.5% and weekly trading value increasing by 78%, highlighting the strong momentum of the ecosystem.

Additionally, many policies are also favorable to BNB Chain, such as the double points policy launched on May 1, which directly encourages users to trade on BNB Chain, aiming to bring further liquidity and attract users to BNB Chain. From the data provided by Lookonchain on May 9:

The growth in trading data for Alpha assets on the BNB Chain also illustrates this point.

3) Capture user traffic and liquidity from other chains

Alpha also aims to capture user traffic, liquidity, and attention from other chains, especially from its "old rival" Solana. The proportion of tokens launched on the Solana chain within Alpha is also relatively high, particularly for some popular tokens on Solana, such as ai16z. Besides Solana, Ethereum and Base also have many quality assets worth noting in the meme and AI sectors. Therefore, the Alpha platform is expected to further seize active users, attention, and liquidity from other chains, especially in the current context where there is an overall lack of hot topics and FOMO narratives.

4) Incremental users

The point system has actually brought in many new users. On one hand, the rules for earning points are not very high, unlike the difficulty and cost of increasing transaction volume during the Layer 2 period. Many point-earning users will bring friends and family into the platform, providing a key opportunity for many users to access the Binance platform and become crypto investors. Although there is currently no clear data showing how much trading volume this has generated, the increase in new registered addresses on BNB Chain can provide some clues.

5) Reshape the listing mechanism

Another point I believe is related to reshaping Binance's listing mechanism. The previous controversies surrounding Binance's listing process (the "girlfriend group" manipulating the listing process) led to the CEO personally stepping in to clarify and state that they would strengthen the transparency and fairness of the listing process. Therefore, Alpha now serves as a good example, providing many community-based, meme-type, and small to medium-sized crypto projects with a channel to reach a broader range of investors and strive for listing on Binance.

Of course, after Alpha 2.0, with the integration of the Alpha zone into the app, trading Alpha zone tokens has become more convenient. I even think that from the user's perspective, there isn't much difference from being listed on the main site, so the previous Alpha zone's performance was actually quite good and could bring significant volume to projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。