作者:RootData

一、融资数据

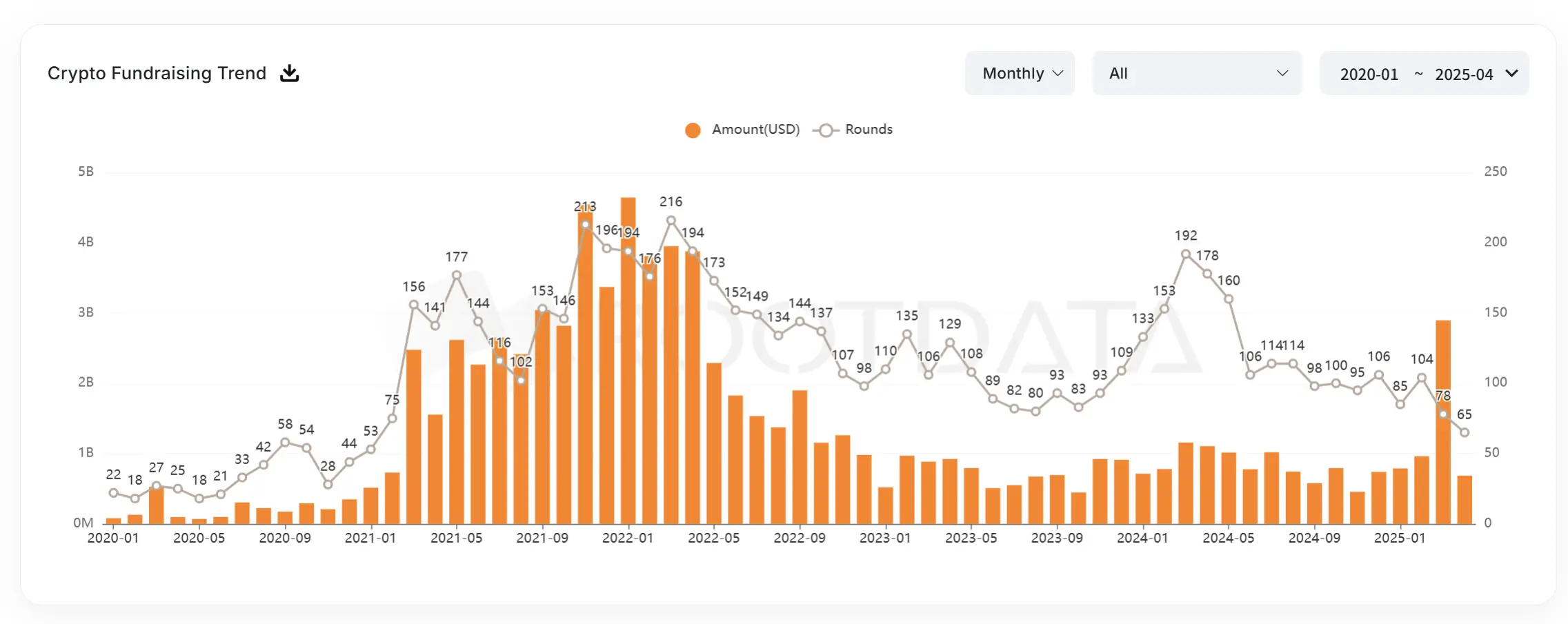

4月,加密一级市场的融资总额为 6.85 亿美元,同比下降 37.7%,融资项目数量为 65 个,继续创造自 2021 年 2 月以来的新低。此前 3 月虽然由于币安的 20 亿美元融资,市场整体融资额逼近 30 亿美元,但这仍然无法改变市场的整体颓势。

从一级市场融资来看,最大的融资(1.53 亿美元)来自区块链和人工智能基础设施 Auradine,该公司主要业务之一是生产多元化的比特币挖矿,包括风冷、浸没式和水冷矿机。其次分别是 Layerzero(5500 万美元) 、Blackbird(5000 万美元)与 Nous Research(5000 万美元)。

不过如果把融资性质扩大为所有融资,包括债务融资与 Post-IPO 融资,4 月的整体融资金额会超过 15 亿美元,例如 Sol Strategies 完成 5 亿美元 Post-IPO 融资、Upexi 完成 1 亿美元 Post-IPO 融资、Bitdeer 完成 6000 万美元债务融资。

这些融资主要由上市公司发起,以可转债的形式进行,主要用于购买比特币矿机或者直接投资比特币,投资的退出路径更加明确或者现金流更加稳定,这使得越来越多的资金流向该领域。

基于该趋势,很多公司也在积极推动 IPO 计划。在最近一两个月,Circle 、Galaxy Digital、Bithumb、Kraken、Antalpha、Gemini 等公司都有披露出具有明确的上市计划。

在并购事件方面,4 月的并购数量为 7 笔,环比下降超过 40%,其中 Ripple 以 12.5 亿美元收购加密货币友好经纪商 Hidden Road,创造了加密项目被收购价值的历史记录。

二、VC 动态

4 月,加密一级市场最活跃的投资者是 a16z、Coinbase Ventures、Hack VC 投资次数均在 5 笔以上,而投资次数在 2 笔及其以上的 VC 基金只有 30 家不到,这反映出加密 VC 对一级市场行情的整体看衰,甚至很多知名基金已经不再投资。

4 月 19 日,ABCDE 联合创始人杜均表示,该基金目前已正式停止新项目投资,并中止二期基金的募资计划。原团队仍将继续负责现有项目的投后支持和退出安排,确保对创业者和 LP 的承诺能够被认真履行。其个人的工作重点也将从一级市场的财务投资,逐步转向以战略投资为主导、结合深度孵化的方向,更专注在产业协同和长期价值创造。

当然,也有多家基金在本月披露了募资的进展。据彭博社报道,Galaxy Digital 旗下Galaxy Ventures Fund I LP 已超额完成原定 1.5 亿美元的募资目标,预计将在 6 月底以 1.75 亿至 1.8 亿美元完成最终关闭。该基金专注于早期初创项目,重点关注支付和稳定币领域。

Re7 Capital 宣布设立一支规模为 1000 万美元的 SocialFi 专项基金,旨在投资约 30 家早期项目。第一轮资金已完成 60%认购。

月底,ether.fi 宣布推出加密原生风险基金 ether.fi Ventures,规模为 4000 万美元,由 Breed VC 原投资者 David Hsu 担任合伙人。此前,ether.fi 已经投资 Resolv、Rise Chain、Symbiotic。

而在 4 月初,Mantra 也曾宣布推出 1.08 亿美元生态基金,计划通过其合作伙伴网络筛选投资机会,在全球范围内向“具有高潜力的区块链项目”部署资金。该基金的支持者包括 Laser Digital、Shorooq、Brevan Howard Digital、Valor Capital、Three Point Capital 和 Amber Group 等。但随着其代币 OM 价格在中下旬崩盘,该基金的规模以及未来可持续性存疑。

4 月 22 日,全球区块链支付服务商 Astra Fintech 宣布设立 1 亿美元基金,以支持 Solana 生态系统在亚洲的发展。该基金将以韩国为运营基地,主要投资于开发支付金融(PayFi)解决方案的项目,并促进与开发者、企业和监管机构的合作。

加密 VC 的整体颓势,也导致越来越多 VC 投资者的退出。在本月,RootData 记录到数十名 VC 机构的高级管理人士的离职,包括 BlockTower Capital 合伙人 David Burke、Pantera Capital 研究合伙人 Matthew Stephenson、Paradigm 研究合伙人 samczsun、Polychain 投资者关系主管 Nicole Zahrah Civitello、Galaxy 普通合伙人 Dan Zuller、Dragonfly 合伙人 Ani Pai 等。

与此同时,ParaFi Capital、Systemic Ventures、Franklin Templeton、1kx、1confirmation 等 VC 机构招募了新的高管加入。

三、项目动态

4 月,RootData 上搜索量最高的 10 个项目分别是 Huma Finance、Babylon、Initia、Sui、Monad、Gensyn、StakeStone、Hyperlane、Axiom、Towns。热门项目主要分布在 PayFi、Layer1、AI 等赛道。

同时,上线主网的项目包括 Initia、Immutable Ratings、Loopscale、subs.fun、Hive Intelligence、Felix、Glow Finance、Haven1 等项目。上线测试网的项目包括 Soul、R2 Protocol等。

本月值得注意的新收录项目包括:

Ethereum R1:基于以太坊核心价值的全新 Rollup

ZAMM:去中心化交易协议

Antifun:旨在消除狙击和 MEV 代币启动平台

Hold.Money:保护隐私的加密卡

SolFi:Solana 流动性协议

Rescue.meme:Manta Network 推出的专注于流浪宠物救助的 MEME 启动平台

Rhythm:加密量化交易平台

Senpi:用于链上交易的人工智能

MyCryptoProtocol:AI 智能协调层

Politiswap:政治交易应用程序

o1.exchange:AI 驱动的 DEX 交易

Communa.world:面向 RWA 生态的平台

babbleOS:人工智能系统

Buzzing Club:使用 AI 将病毒式内容转化为预测市场的协议

weeb.fun:与朋友一起推出和交易 memecoin 的平台

MyStonks:去中心化的数字资产交易平台

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。