撰文:Nancy,PANews

近期,MEME 市场的情绪逐步回暖,尤其是在多个金狗项目的带动下,整体市场活跃度有了显著提升。然而,MEME 生态仍处于修复初期,资金信心尚未完全恢复。与此同时,在流动性不足与情绪高敏感并存的背景下,车头效应逐渐成为流量与资金的核心驱动力,特别是平台与工具的协同效应进一步放大车头的市场影响力,使其成为资金流向与情绪波动的关键变量。

Launchpad:车头效应显著,带动新兴平台

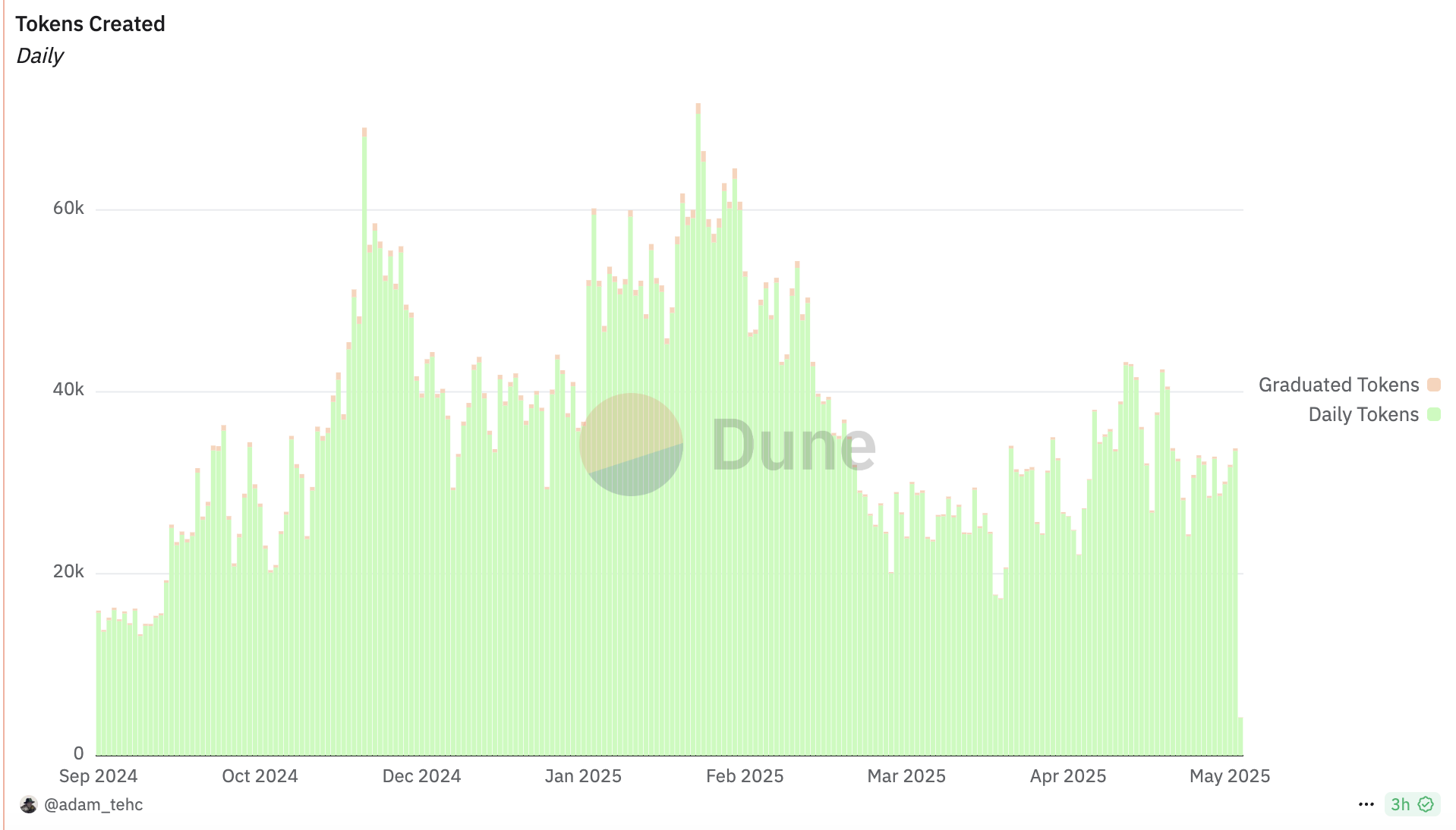

虽然 MEME 市场已有所回暖,但从代币创建数量与用户活跃度层面来看,距离历史高点仍有不小差距。

以当前 MEME 币发射主阵地 Pump.fun 为例,根据 Dune 数据,截至 5 月 7 日,该平台单日代币创建量已超过 3.3 万个,较此前低谷时期(约 1.7 万个)增长了 48.6%,但仍仅为历史峰值的 47.5%。在代币毕业率方面,目前已回升至 0.81%,相比最低点已有明显改善,但距离历史高点的 1.67% 仍有不小差距。用户活跃度方面,Pump.fun 当前日活跃钱包数达到 19.9 万个,较上月低点反弹 55.1%,但仅为历史高点(约 42.4 万个)的 46.9%。值得注意的是,从新增用户角度来看,目前日新增钱包约为 9.4 万个,相比历史峰值的超 21.6 万个,恢复幅度仍有限。这意味着虽然短期内 MEME 热度回暖明显,但整体用户参与和流动性广度仍未完全修复。

不过,部分新兴的代币发射平台也借助车头效应快速扩张。例如,近期走红的 Boop 通过 KOL 驱动的 FOMO 效应、平台激励机制和精准的市场节奏把控,成功利用车头效应在短期内实现了用户增长和市值跃升。但这种方式也面临 KOL 空投带来的短期留存挑战、以及竞品可能复制策略带来的竞争压力等。

值得一提的是,最近热炒的多个「金狗」项目展现出显著的车头效应,即 KOL 和大户等高影响力人物驱动流量和资本流入,形成滚雪球式传播,进一步放大代币叙事价值。例如,大户集体推高 Fartcoin 市值再破 10 亿美元、House 获得 ansem 和 him 等知名 KOL 造势蹿红等。相比之下,近期那些依赖事件驱动或草根叙事的 MEME 币,尽管一度能够吸引短期关注,但难以持续将流量转化为有效资金流入,导致热度快速衰退。

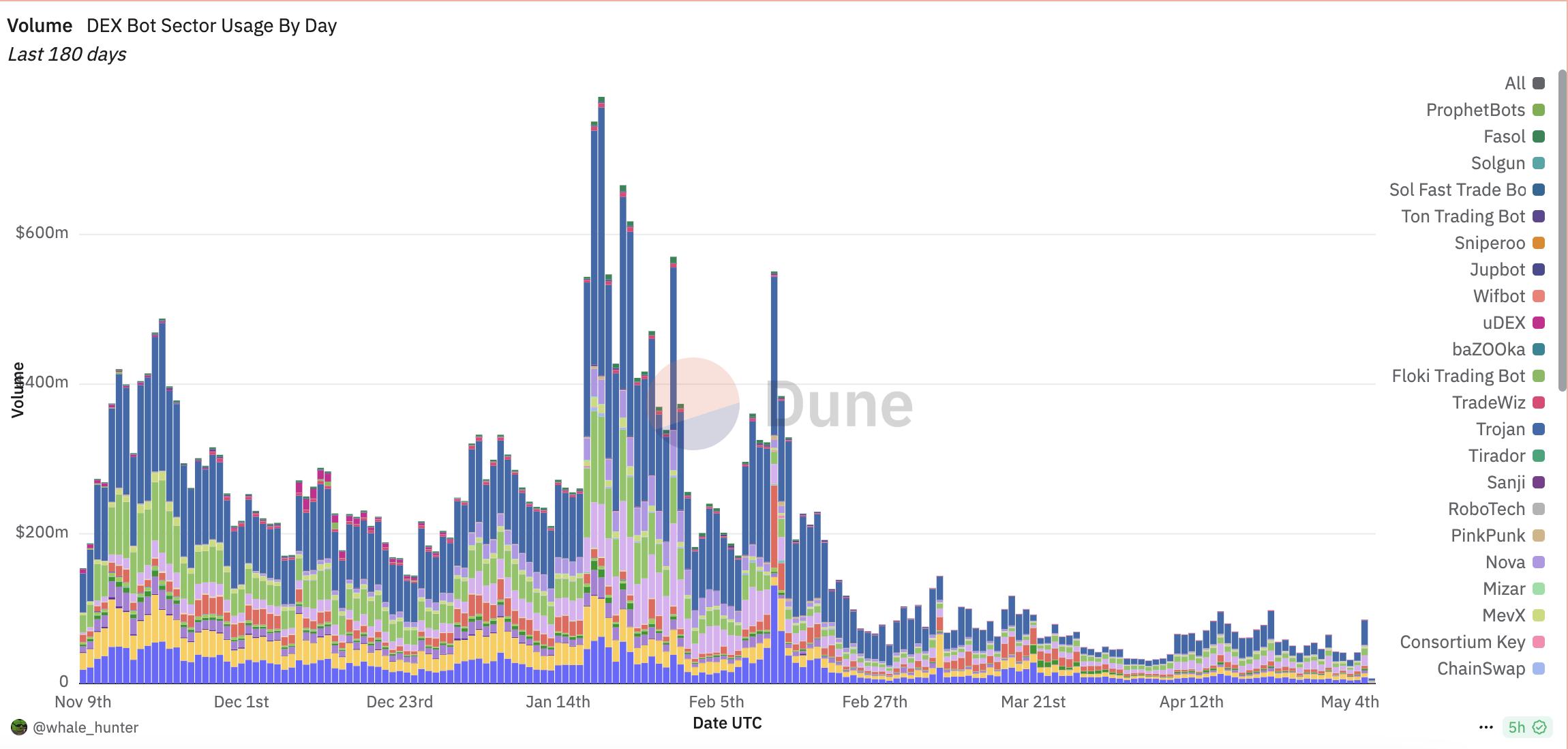

交易机器人:交易量回暖,较峰值跌幅仍近 9 成

交易机器人正逐渐成为链上用户提升交易效率的重要利器,近期也随着市场情绪回暖回升。Dune 数据显示,截至 5 月 6 日,交易机器人的日交易量达 8537 万美元,日用户数超 5.7 万个,较近几个月低点分别上涨了近 64.1% 和 43.8%。然而,与今年 1 月的峰值相比,日交易量和日用户数仍然分别下降了 89.1% 和 62.5%。

其实,对于普通散户而言,交易机器人的聪明钱追踪、自动化跟单和链上数据分析等功能,能够使他们在信息不对称的市场环境中实时监控并迅速捕捉 KOL/ 大户等动态,从而有效提升参与效率以及降低 PVP 风险。

与此同时,散户对于这些车头推荐或使用的交易机器人往往持有较高的信任度,这种背书效应显著提升了相关机器人的市场接受度与活跃度。当然,车头因其资金体量和市场号召力,更倾向于采用具备操作便捷性、执行速度快、成功率高等特点的机器人工具,以确保交易效率和收益最大化。因此,交易机器人能否在功能多样化、安全或响应速度等方面满足需求,是影响车头使用意愿的核心因素。当然,也无法排除部分车头通过机器人进行市场操控的潜在风险。

比如,前不久兴起的 Axiom 凭借复杂策略支持、高效交易执行和用户友好设计等优势迅速获得 MEME 玩家青睐,特别是满足车头(KOL/ 大户)的核心需求,从而短期内快速跃升为交易机器人赛道龙头。

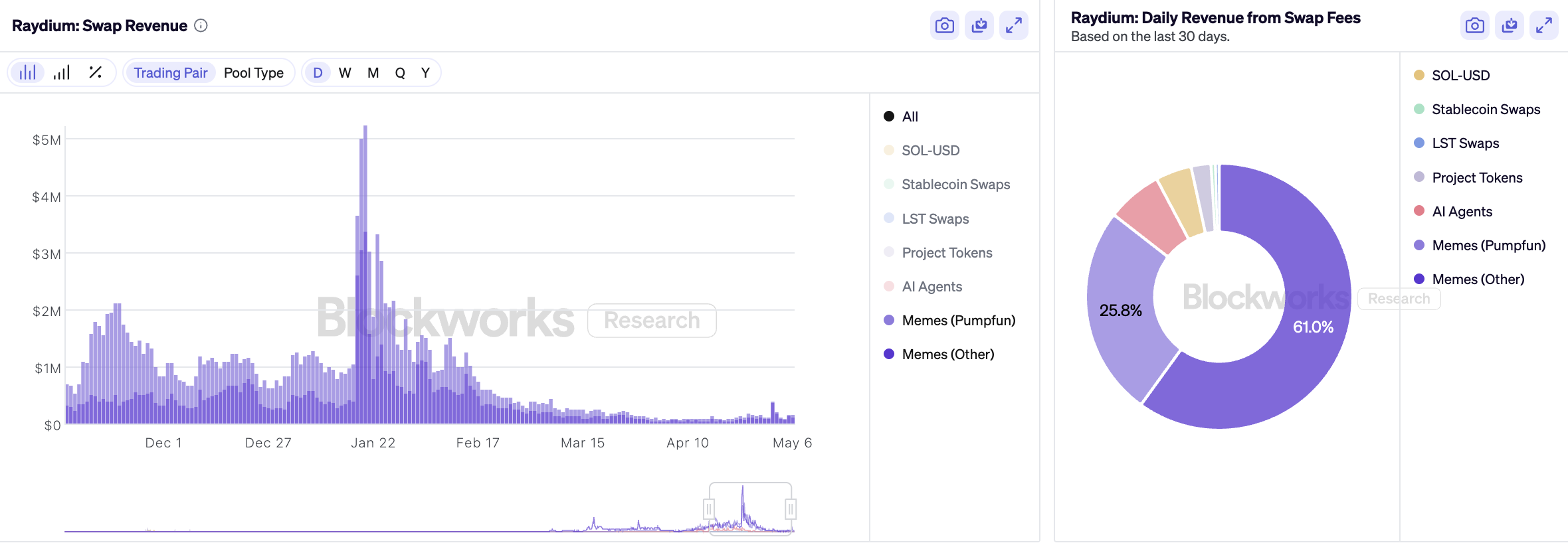

DEX:MEME 收入骤降,PumpSwap 已显初步优势

MEME 依然是 DEX 收入的核心来源之一。以 Raydium 为例,Blockworks 数据显示,在过去 30 天的交易收入中,来自 MEME 相关交易的日收入占比高达 86.8%,而来自 MEME 代币发行的日收入占比更是达到 93.5%,足见其对平台整体收入结构的主导地位。

然而,MEME 所带来的收入正经历显著下滑。Blockworks 数据显示,截至 5 月 6 日,Raydium 来自 MEME 的日交易收入仅为 15.6 万美元,相较于 1 月份峰值的 524.4 万美元,跌幅超过 97%。同时,MEME 币发行的日收入也从高点的 14.9 万美元下滑至仅 1.9 万美元,也展示了市场热度的快速冷却和用户投机情绪的明显退潮。

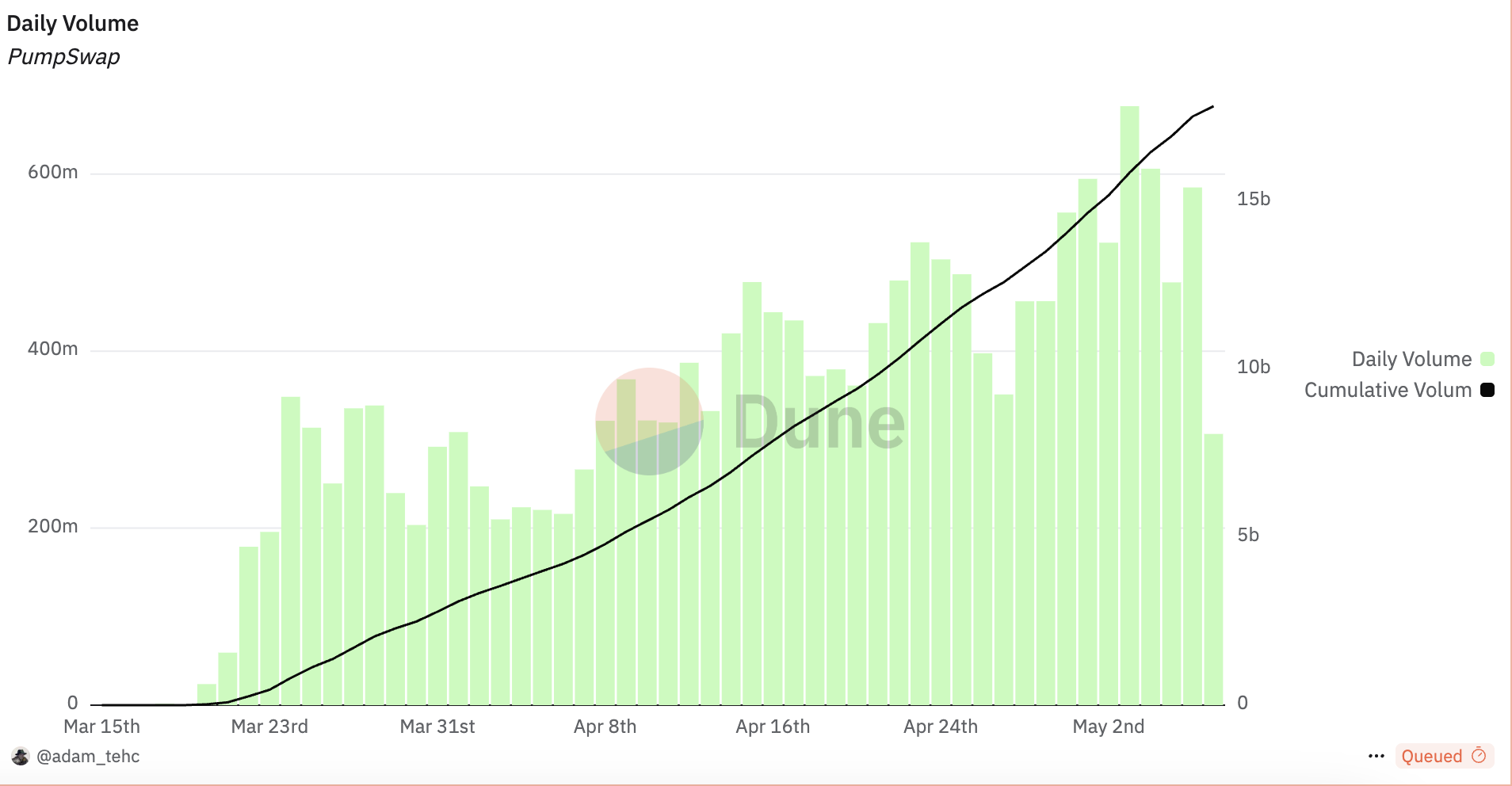

相比之下,PumpSwap 展示了强劲的发展势头。Dune 数据显示,自 3 月 20 日推出至今,该平台已累计获得 176.7 亿美元的交易量,且从 4 月初开始呈现显著上升趋势,单日最高交易额超 6.7 亿美元。同时,平台的用户活跃度也持续攀升,冷启动阶段迅速吸引大量新用户,随后回访用户比例逐步上升,显示出较强的用户留存能力。尤其在 5 月初,其日活钱包数一度突破 45 万。值得关注的是,截至 5 月 7 日,PumpSwap 已占据 Solana DEX 总交易量的 12.7%,在生态中占据了初步的竞争优势。

在这一过程中,大户 /KOL 的作用亦不可忽视,不仅可推动 MEME 交易量的显著增长,也可带动流动性池的迅速扩张和新用户的集中涌入,成为平台短期爆发的核心驱动因素。

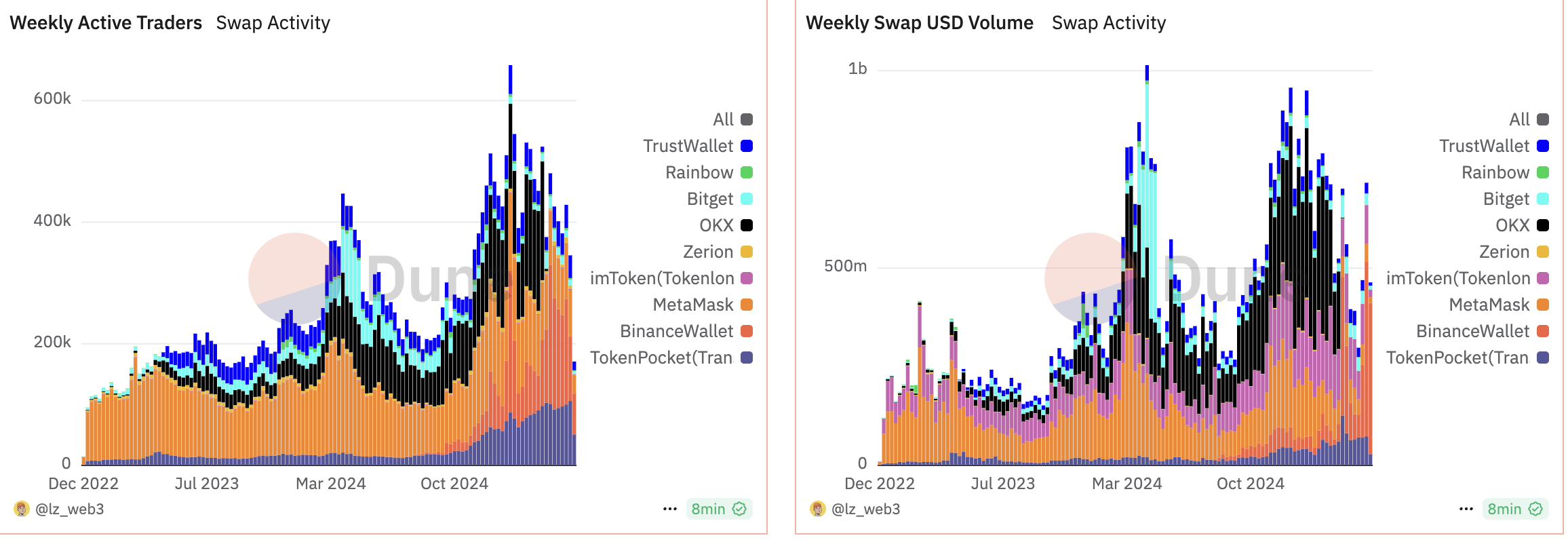

钱包:活跃度回升,较 1 月峰值下滑超 80%

钱包的使用情况也是反映链上情绪的重要指标之一。Dune 数据显示,截至 5 月 5 日,主流钱包的周交易额达到超 4.6 亿美元,较近期低谷反弹了 35.2%,但仅为今年峰值(约 9.5 亿美元)的 51.6%。与此同时,钱包的周活跃地址数达到 1.7 万个,较 1 月 8.7 万个峰值大幅下滑超过 80.4%。这表明,尽管交易规模有所回升,但用户参与度依然低迷,整体链上活跃度仍处于恢复初期,市场情绪尚未全面回暖。

同样地,钱包的吸引力和用户粘性,取决于其功能的完整性、使用场景的广度以及生态整合能力等核心因素。例如,OKX Web3 钱包和 Binance Wallet 等这类市占率较高的钱包已成功吸引了大量 MEME 玩家,成为这一细分领域的主流选择。在这一过程中,大户与 KOL 的使用率和口碑效应也起到了关键推动作用,不仅显著提升了钱包的知名度,也增强了普通用户的信任度与使用意愿。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。