原文:Sam Kessler,CoinDesk

编译:Aki Chen,吴说区块链

据悉 Layer 2 区块链项目 Movement Labs 正调查一起涉嫌欺诈的做市协议事件。原本旨在推动 MOVE 加密代币顺利上市的一项安排,最终却演变为一起震动市场的抛售丑闻。该协议疑在项目方未完全知情下,将 6600 万枚 MOVE 代币控制权交予一家身份模糊的中间机构 Rentech。Rentech 在协议中同时扮演 “ Web3Port 子公司”与“基金会代理方”双重身份,涉嫌自我交易。该安排直接引发 MOVE 上线次日价值 3800 万美元的代币抛售潮,导致币价大幅下跌,并招致 Binance 封禁。

尽管内部曾明确反对该协议,高层仍推动签署,引发对治理失效、尽职调查缺失和利益冲突的严重关切。当前,多位高管与法律顾问正被审查,项目治理结构与合作机制遭全面质疑。此次危机揭示了 Movement 在制度设计、风险控制和合规能力方面的深层漏洞,或对其未来声誉和生态建设造成长期冲击。

MOVE 代币上线即暴跌,Movement Labs 疑遭误导签署高风险协议

据 CoinDesk 审阅的内部文件披露,MOVE 加密代币背后的区块链项目 Movement Labs,正就一项争议性财务协议展开内部调查。该协议可能在项目方不完全知情的情况下,将代币市场的主要控制权授予某一单一实体,造成结构性失衡。

该协议直接导致 6600 万枚 MOVE 代币在 2025 年 12 月 9 日上线交易所次日即遭集中抛售,触发币价断崖式下跌,并引发市场对 “内部交易” 与利益输送的广泛质疑。值得注意的是,MOVE 项目获得了由特朗普支持的加密创投基金 World Liberty Financial 的公开背书,使这一事件更具政治与行业影响力。

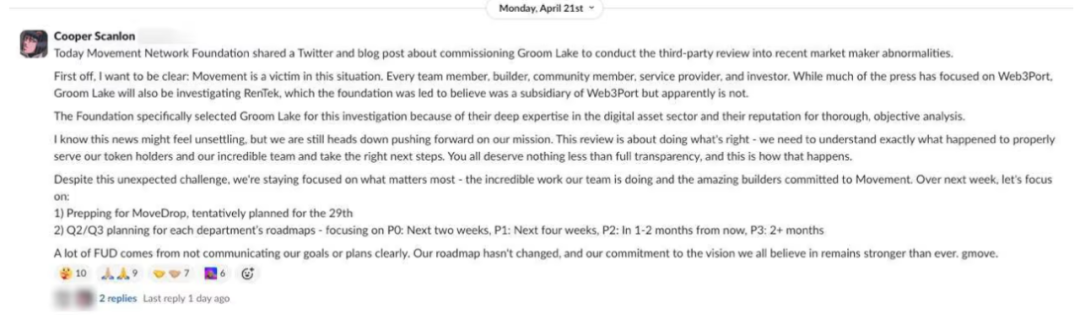

Movement Labs 联合创始人 Cooper Scanlon 于 4 月 21 日在 Slack 内部通告中表示,团队正在调查一项关键问题:原本预留给做市商 Web3Port 的超过 5% MOVE 代币,是如何被转交给一家名为 Rentech 的中间机构的。

据称,Movement Foundation 最初被告知 Rentech 是 Web3Port 的子公司,然而调查显示事实并非如此。Rentech 方面则否认存在任何误导行为。

Rentech 单方控制近半流通盘,MOVE 代币流通结构失衡

根据 Movement Foundation 的一份内部备忘录显示,Movement 与 Rentech 签署的协议中,将约占 MOVE 代币流通供应总量一半的份额借给了该单一对手方。这一安排使 Rentech 在代币上市初期即掌握了极为不寻常的市场影响力。

多位受访行业专家指出,这种集中化结构严重背离了加密项目通常追求的去中心化分发原则,极易被用于操纵币价或实现单边套利。

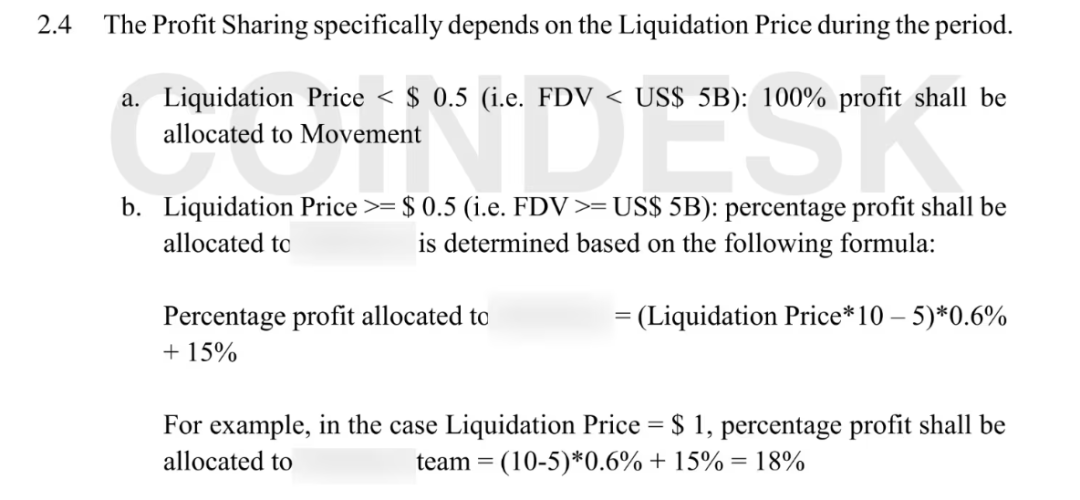

资深加密行业创始人 Zaki Manian 在审阅 CoinDesk 获取的合同版本后指出,协议中包含的部分条款实质上为 “通过人为推高 MOVE 代币完全稀释估值(FDV)至超过 50 亿美元后再对散户抛售获利” 设定了明确激励。

他直言:“哪怕仅仅是在书面文件中出现这样的讨论内容,都已经令人震惊。” 该评论进一步加剧了外界对 Rentech 协议目的与道德底线的质疑。

理论上,做市商受雇于项目方,负责为新上线的代币提供流动性服务,其职责是在交易所内以项目方提供的资金进行买卖,以维持价格稳定和市场深度。然而在实践中,这一角色亦存在滥用风险。

一旦监管缺位或协议不透明,做市商便可能成为内部人士操控市场、悄然转移大额代币持仓的工具,而不易被外界察觉,从而严重损害普通投资者利益与市场公平性。

合同曝光加密灰色地带:公有项目如何在监管真空中变为少数人套利工具

CoinDesk 获取的一系列合同文件揭示了加密行业一个鲜为人知的灰色地带:在缺乏有效监管与法律透明度的环境下,原本面向公众的区块链项目,极易被利用为幕后少数人牟取私利的载体。

这些协议的内容显示,一旦项目方在结构设计和合规把关上疏忽,所谓的 “去中心化” 项目也可能被少数操盘手通过不对等条款彻底私有化,背离原有的公平与开放初衷。

加密市场中,围绕做市机制的操纵与滥用早已屡见传闻,但相关操作的具体细节、合同结构与利益安排,极少有机会公之于众。正因如此,Movement Labs 此次事件所披露的内部合同与协议细节,成为观察 Web3 项目运作黑箱与做市灰色空间的一扇罕见窗口,也令行业再度聚焦在 “透明度” 这一最基本却最常被忽视的原则上。

CoinDesk 审阅的做市合同显示,Rentech 在与 Movement Foundation 的交易中同时以两种身份出现:一方面作为 Movement Foundation 的代理方,另一方面则以 Web3Port 子公司的身份签署协议。这一结构为 Rentech 在交易中占据 “中介主导权” 提供了可能,理论上使其能够自行设定交易条款,并在信息不对称下从中牟利。

Movement 与 Rentech 达成的做市协议,最终为一组与 Web3Port 相关联的钱包打开了抛售通道。该中国金融机构声称曾服务于 MyShell、GoPlus Security,以及与唐纳德·特朗普有关联的加密基金 World Liberty Financial。这些钱包在 MOVE 代币于交易所首发的次日即迅速清算了总价值约 3800 万美元的代币,引发市场剧烈波动,也使得协议安排本身的动机与正当性遭遇集中质疑。

Binance 因 “违规行为” 封禁做市账户,Movement 紧急启动代币回购

事件发酵后,主流交易所 Binance 已对涉事的做市账户实施封禁,理由为 “存在不当行为”。与此同时,Movement 项目方紧急宣布启动代币回购计划,试图稳定市场情绪并挽回社区信任。

与初创公司员工期权机制类似,大多数加密项目在代币分配时会设定锁仓期(lock-up period),旨在限制核心团队、投资人及早期参与方在项目初期交易阶段抛售大额持仓。

这一机制本意在于保护市场稳定、避免内部人士利用信息优势提前获利。然而在 Movement 事件中,相关代币绕过锁仓限制的流动安排正是引发外界质疑的核心问题。

Binance 对涉事账户的封禁举措在社区中迅速引发联想,不少观察者认为这可能意味着 Movement 项目内部人员与 Web3Port 之间曾私下达成协议,绕过正常锁仓机制提前出售代币。

对于这一质疑,Movement 方面予以否认,坚称未与任何第三方订立违规转让安排。然而该事件所暴露出的信息混乱与合同结构缺陷,仍使得 “内线交易” 的印象难以完全消除。

明星 Layer 2 项目深陷争议,Rentech 协议背后多方互相指责

Movement 是一个基于 Facebook 开源语言 Move 构建的以太坊扩容 Layer 2 网络,因技术创新与资本支持,近年来迅速成为加密行业讨论度最高的新兴项目之一。

该项目由两位年仅 22 岁、辍学于范德堡大学的联合创始人 Rushi Manche 与 Cooper Scanlon 创立,曾获得 3800 万美元融资,并入选了由特朗普支持的 World Liberty Financial 加密投资组合。2025 年 1 月,路透社报道称 Movement Labs 即将完成一轮高达 1 亿美元的新融资,估值或达 30 亿美元。

但围绕与 Rentech 达成的争议性做市协议,项目内部出现明显分歧。CoinDesk 采访了十余位了解项目内情的消息人士(大多数要求匿名),他们提供了多种彼此矛盾的说法。

Rentech 的所有人 Galen Law-Kun 否认存在误导行为,并称该交易结构是与 Movement 基金会总法律顾问 YK Pek 协调设计。但据 CoinDesk 审阅的内部备忘录与通信记录显示,Pek 最初对该协议持强烈反对态度,并否认参与过 Rentech 的设立过程。

Movement Labs 联合创始人 Scanlon 在内部 Slack 消息中表示:“Movement 是这一事件中的受害者。” 这番表态亦标志着项目方正试图将责任导向外部操盘方。

据四位了解内部调查进展的消息人士匿名透露,Movement 正在重点审查其联合创始人 Rushi Manche 在 Rentech 协议中的角色。据称,正是 Manche 最初将该协议转发至团队内部,并在组织内推动该合作的落地。

同时被列入调查范围的还有 Sam Thapaliya — — 他是加密支付协议 Zebec 的创始人,亦为 Rentech 所有人 Galen Law-Kun 的商业伙伴。Thapaliya 虽然未担任 Movement 的正式职务,但长期以 “非正式顾问” 身份参与核心事务,其在此次事件中的具体影响力也成为项目内部审计关注的重点之一。

先拒后签,Movement 绕过审慎机制接受高风险协议,治理结构遭质疑

尽管最初曾否决与 Rentech 之间存在重大风险的做市协议,Movement 最终仍签署了一份结构近似的修订版协议,而协议的核心依赖,则是来自一个几乎没有公开履历的中间方的口头保证。

这一决策背后,凸显了当前加密行业的治理结构短板。根据常见实践,为规避证券监管风险,加密项目通常将运作拆分为两个实体:一个由非营利性质的基金会负责代币管理与社区资源配置,另一个为营利性的开发公司,负责底层技术开发。Movement Labs 即为该项目的开发实体,而 Movement Foundation 则负责代币事务。

但 CoinDesk 审阅的内部通信材料显示,原本应独立运作的结构在 Movement 案例中实际失效。联合创始人 Rushi Manche 虽名义上为 Movement Labs 员工,却在非营利基金会的关键事务中发挥了主导作用。这种职能重叠现象,令本应防范合规风险的双实体机制失去了其应有的制衡功能。

2025 年 3 月 28 日,联合创始人 Rushi Manche 通过 Telegram 消息向 Movement Foundation 发送了一份做市协议草案,并表示该合同 “需要尽快签署”。

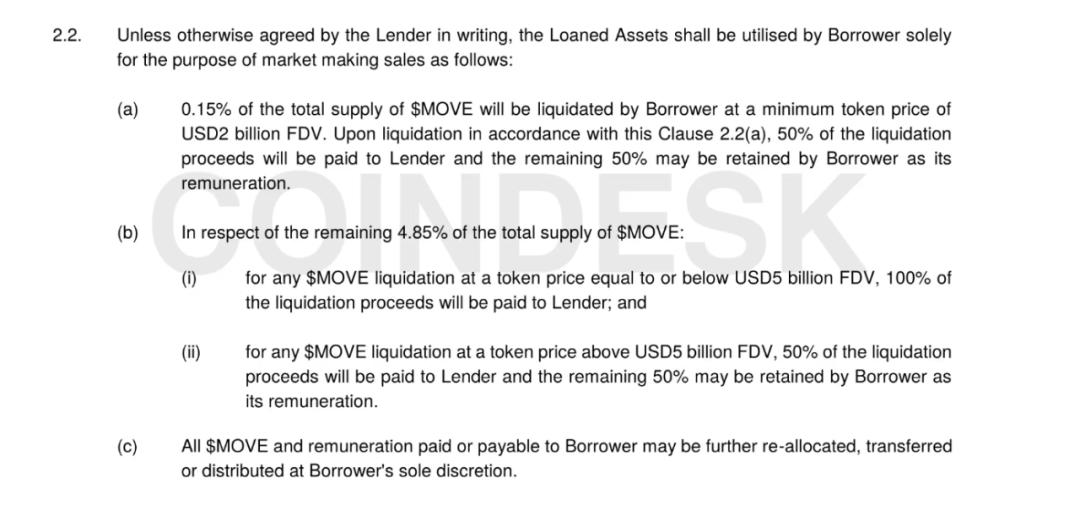

2025 年 11 月 27 日,Rentech 向 Movement 提出一份做市协议草案,内容包括将高达 5% 总量的 MOVE 代币借出予 Rentech。根据合同内容,Rentech 为借款方,Movement 为出借方。然而,这份协议最终未获签署。

Rentech 作为一家几乎无任何公开背景与链上记录的公司,其大额代币借贷请求立即引发基金会内部警觉。Movement Foundation 法律顾问 YK Pek 在邮件中直言,该文件 “可能是我见过最糟糕的协议”。他在另一份备忘录中进一步指出,协议若执行,等同于将 MOVE 市场的实质控制权交予一个身份模糊的外部实体。

此外,基金会在英属维京群岛注册的董事 Marc Piano 也拒绝在该协议上签字。上述种种反对意见显示,Movement 内部对该协议的风险认知其实极为明确,却仍在后续流程中未能阻止协议以变体形式落地,进一步暴露出治理失效问题。

该合同中一项尤为引人注目的条款规定:一旦 MOVE 代币的完全稀释估值(Fully Diluted Valuation, FDV)超过 50 亿美元,Rentech 便可开始清算其所持代币,并与 Movement Foundation 按 50:50 比例分成由此产生的利润。

加密行业资深人士 Zaki Manian 指出,这种结构实质上制造了 “扭曲的激励机制”,鼓励做市方人为推高 MOVE 价格,以便在估值虚高时集中抛售其巨额持仓,套取利润。该设计不仅背离了做市本应服务于价格稳定的初衷,更可能直接损害散户投资者利益。

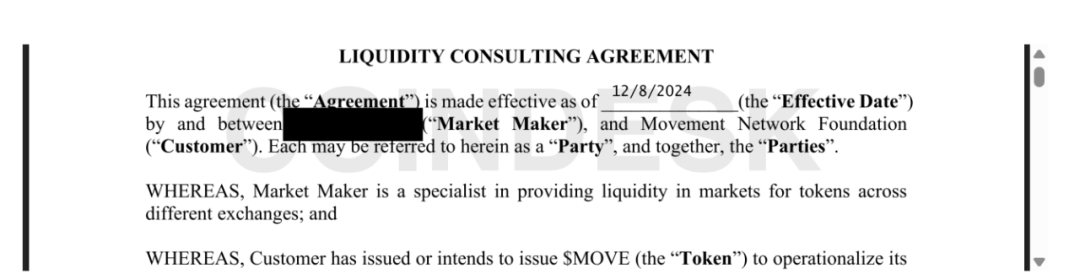

尽管 Movement Foundation 最初拒绝签署高风险的做市协议,但其与 Rentech 的谈判并未中止。根据 CoinDesk 采访的三位知情人士及所审阅的法律文件显示,Rentech 随后向基金会宣称其为中国做市机构 Web3Port 的子公司,并主动提出愿意提供 6000 万美元的抵押资金,从而提高了协议的吸引力。

在上述条件推动下,Movement Foundation 于 2025 年 12 月 8 日接受了一份修订版的协议。该版本在部分关键条款上做出修改,删除了原先最受争议的内容之一 — — 若 MOVE 代币未能在某一特定交易所上线,Web3Port 可起诉 Movement Foundation 要求赔偿的权利。

尽管协议在形式上有所调整,但这一妥协决定表明,基金会在多方压力与诱因面前仍放松了风险防范立场,最终为后续事件埋下隐患。

2025 年 12 月 8 日,Movement Foundation 与 Rentech 正式签署了修订版做市协议。尽管协议中 Rentech 被明确标注为 “Web3Port”(名称在部分文件中已打码处理),实质上其作为借款方的身份未变,而基金会依旧为出借方。

令人关注的是,该协议的主要起草人正是此前曾明确反对初版协议的基金会法律顾问 YK Pek。尽管修订后删除了部分最具争议的条款,但核心结构依然保持不变:Web3Port 仍可借用 MOVE 代币总供应量的 5%,并通过一定方式进行抛售以实现盈利。

进一步的技术信息揭示了协议背后操作的刻意性 — — 注册在 Rentech 董事邮箱名下的域名 “web3portrentech.io”,正是在协议签署当天才完成注册。

协议早已 “先斩后奏”?Web3Port 与 “Movement” 曾秘密签约,基金会事后才知情

据三位接近事件的知情人士透露,Movement Foundation 在 2025 年 12 月 8 日签署正式协议时,并未意识到 Web3Port 早在数周前,便已与名义上的 “Movement” 签订过一份内容类似的合作协议。

这一 “先行协议” 不仅未经过基金会正式流程,更是绕过了应有的合规审查与治理机制。

根据 CoinDesk 获取的一份日期为 2025 年 11 月 25 日的合同,Web3Port 早在 Movement Foundation 正式签约前,便已与 Rentech 签署了一份高度相似的做市协议。该协议中,Rentech 被标注为出借方,Web3Port 为借款方,且 Rentech 在文件中被直接称作 “Movement” 的代表。

这一 “影子协议” 几乎复刻了基金会随后否决的原始提案内容,说明部分关键安排早已在非正式渠道中落地,并未经基金会审批流程。该发现印证了项目内部存在多条 “权力通道”。

这份 11 月 25 日签署的早期协议在结构上与 11 月 27 日被否决的合同高度一致,核心条款依旧明确允许做市商在 MOVE 代币价格达到特定阈值时进行清算操作。

这一设定被业内人士如 Zaki Manian 视为 “极具操纵风险” 的核心机制 — — 即通过人为推动价格达标后集中抛售,从中提取利润。这表明,即使在表面修改后的后续版本中,该项目背后部分关键利益方始终在推动一套内置套利激励的操作路径,未对根本风险进行实质性剔除。

“影子联合创始人”?幕后推手浮出水面,Zebec 创始人被指深度参与协议结构设计

多位接近 Movement 项目的消息人士向 CoinDesk 透露,围绕 Rentech 协议的真正策划者仍存诸多猜测。而这份被认为直接导致 MOVE 代币 12 月大规模抛售及舆论风暴的协议,其初始版本正是由联合创始人 Rushi Manche 在内部流转,并由他推动纳入决策流程。

据 Blockworks 报道,Manche 因涉事协议已于上周被短暂停职。Manche 本人回应称,在选择做市商的过程中,MVMT Labs 始终依赖基金会团队与多位顾问提供建议与协助,“但目前看来,至少有一位基金会成员同时代表了协议双方的利益,这已成为我们当前调查的重点”。

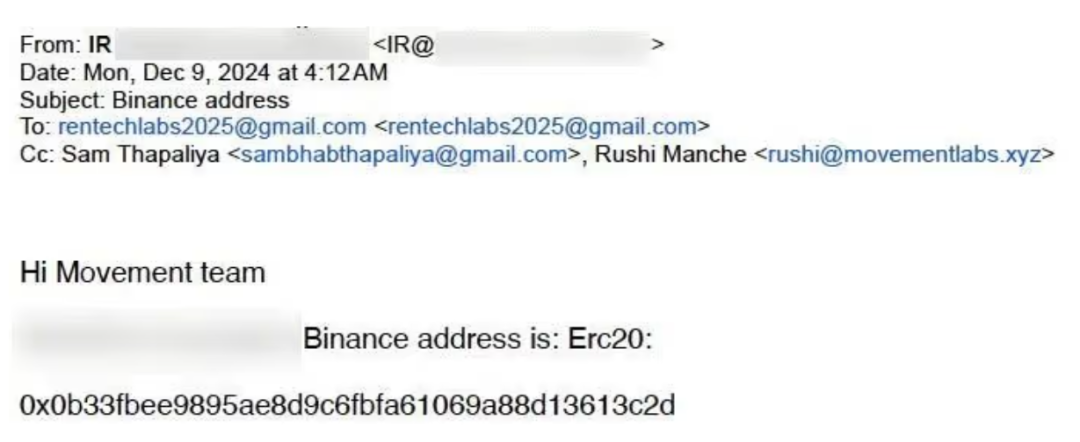

与此同时,另一关键人物 Sam Thapaliya 也引发高度关注。Thapaliya 是加密支付协议 Zebec 的创始人,同时是 Manche 与联合创始人 Scanlon 的长期顾问。他在 Web3Port 与 Movement 之间往来的多封邮件中均被抄送,与 Rentech、Manche 一同出现在重要沟通环节中。

这一线索强化了外界对于 Thapaliya 可能在 Rentech 结构设计中发挥 “幕后操盘” 角色的怀疑 — — 他或许并非单纯顾问,而是主导协议架构并深度干预决策的 “影子联合创始人”。

据 Movement 多位员工透露,Zebec 创始人 Sam Thapaliya 或在项目内部扮演远超其顾问身份的实际角色。有人称其为 “Rushi(Manche)的亲密顾问,某种意义上的影子第三联合创始人”,并指出:“Rushi 一直对这层关系讳莫如深,我们通常只是偶尔听到他的名字。”

另一位员工则表示:“很多时候我们已就某项事务达成一致,但最后时刻总会出现变动,而这种时候我们通常知道,那可能是 Sam 的意见。”

据三位目击者证实,Thapaliya 曾在 MOVE 代币面向公众上线当天,现身 Movement 位于旧金山的办公现场。CoinDesk 还审阅了多张 Telegram 截图,显示联合创始人 Scanlon 曾委托 Thapaliya 协助筛选 MOVE 空投名单 — — 这是该项目社区代币派发机制中高度敏感的一环。

此类安排进一步加深了部分团队成员的印象:Thapaliya 在项目中的实际影响力,远比公开身份所示更深、更隐蔽。对此,Thapaliya 在回应 CoinDesk 时表示,他早年在大学期间结识了 Manche 和 Scanlon,并自此作为外部顾问参与项目,但他 “在 Movement Labs 不持股,也未从 Movement Foundation 获得代币,更不具备任何决策权”。

Rentech 是谁?神秘中间机构背后纠葛重重,创始人与项目法律顾问互相指责

处于本次 MOVE 代币争议核心的 Rentech,由 Galen Law-Kun 创立 — — 他是 Zebec 创始人 Sam Thapaliya 的商业伙伴。Law-Kun 向 CoinDesk 表示,Rentech 是他在新加坡注册的金融服务公司 Autonomy 的子公司,旨在为加密项目与亚洲家族办公室搭建融资桥梁。

Law-Kun 声称,Movement Foundation 的总法律顾问 YK Pek 不仅曾协助设立 Autonomy SG,还是该公司(或其关联公司)Rentech 的法律总顾问。他还表示,尽管 Pek 在内部强烈反对 Rentech 协议,但他本人实际上曾协助设计 Rentech 的结构,并参与起草最初版本的做市协议,“其内容几乎与他后来为基金会正式起草的合同版本一致”。

不过,CoinDesk 的调查并未发现 Pek 在 Autonomy 任职、或以该身份起草任何与 Rentech 相关合同的直接证据。

对此,Pek 回应称:“我从未,也从不是 Galen 或其任何实体的法律总顾问。” 他解释说,自己共同创立的一家企业秘书服务公司,确实为 Galen 旗下的两家公司提供过秘书服务,但这两家公司并非 Rentech,且它们在 2025 年年审中均申报 “无资产”。

Pek 进一步表示,他曾在 2024 年抽出两个小时审阅了 Galen 与某项目的顾问协议,此外仅在 FTX 案件截止日与 NDA 文书上给予过免费建议。“我完全不理解 Galen 为何会声称我是他的总顾问,这让我感到困惑且不安。”

Pek 还指出,Movement Foundation 和 Movement Labs 的法律团队是经由联合创始人 Rushi Manche 介绍,才得知 Rentech 所聘的律师 GS Legal。

而在 Galen 的说法中,Pek 曾以 “Autonomy 法律顾问” 的身份被介绍给 10 个不同项目,从未否认这一称谓;至于 GS Legal 的介入,“只是应 Movement 要求而形式性地完成的流程”。

事件爆发后,Movement Labs 联合创始人 Cooper Scanlon 在 Slack 内部通告中强调,公司已聘请外部审计机构 Groom Lake,对近期做市安排中的异常情况展开第三方独立调查。他再次强调:“Movement 在此事件中是受害者。”

这一连串相互否认与指控,暴露出 Rentech 背后错综复杂的人际与法律关系,也将 MOVE 风波进一步从市场事件推向信任危机与治理断层的核心漩涡。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。