Amid ongoing trade negotiations and deepening investor unease over President Donald Trump’s tariff agenda, U.S. equity indexes declined on Wednesday, reacting to fresh data showing a contraction in gross domestic product (GDP). The Federal Reserve’s Board of Governors is slated to convene on May 7—exactly one week from now—to determine the course of the benchmark interest rate.

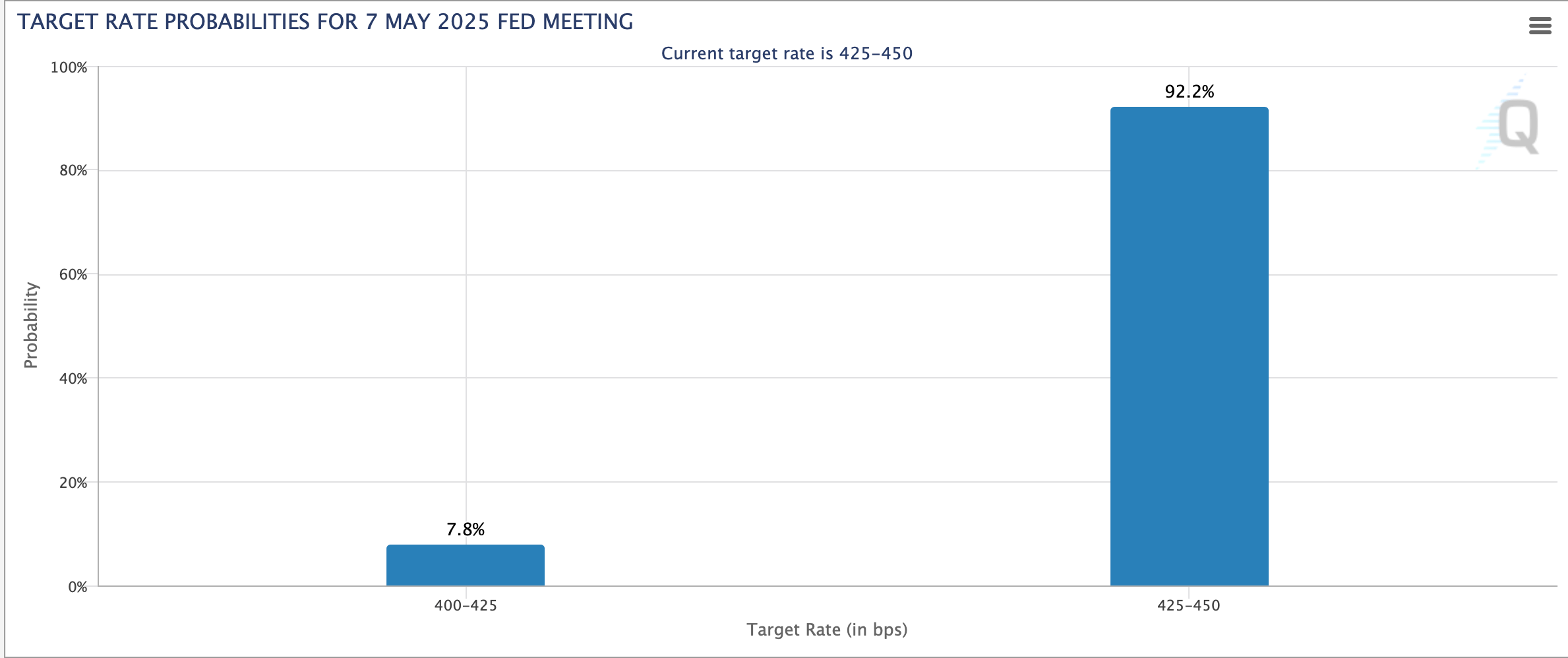

CME Fedwatch tool on April 30, 2025.

Trump’s stance on Federal Reserve Chair Jerome Powell has evolved with notable volatility. Initially, he criticized Powell for being slow to the ball and even suggested his removal was overdue. Yet, Trump later walked back that rhetoric, stating he had no plans to dismiss the Fed chair. Speaking Tuesday at a rally in Michigan, Trump claimed superior expertise in monetary matters. “I have a Fed person who is not really doing a good job,” he declared.

Trump added:

I want to be very nice and respectful to the Fed.

Based on projections from the CME Fedwatch tool, the likelihood of a cut to the benchmark interest rate appears minimal, with markets heavily favoring the status quo. While a modest 7.8% probability still lingers for a 25 basis point reduction, the prevailing expectation—at 92.2%—leans firmly toward no adjustment. The Fedwatch tool gauges these odds by interpreting fed funds futures prices, offering a dynamic readout of real-time market expectations.

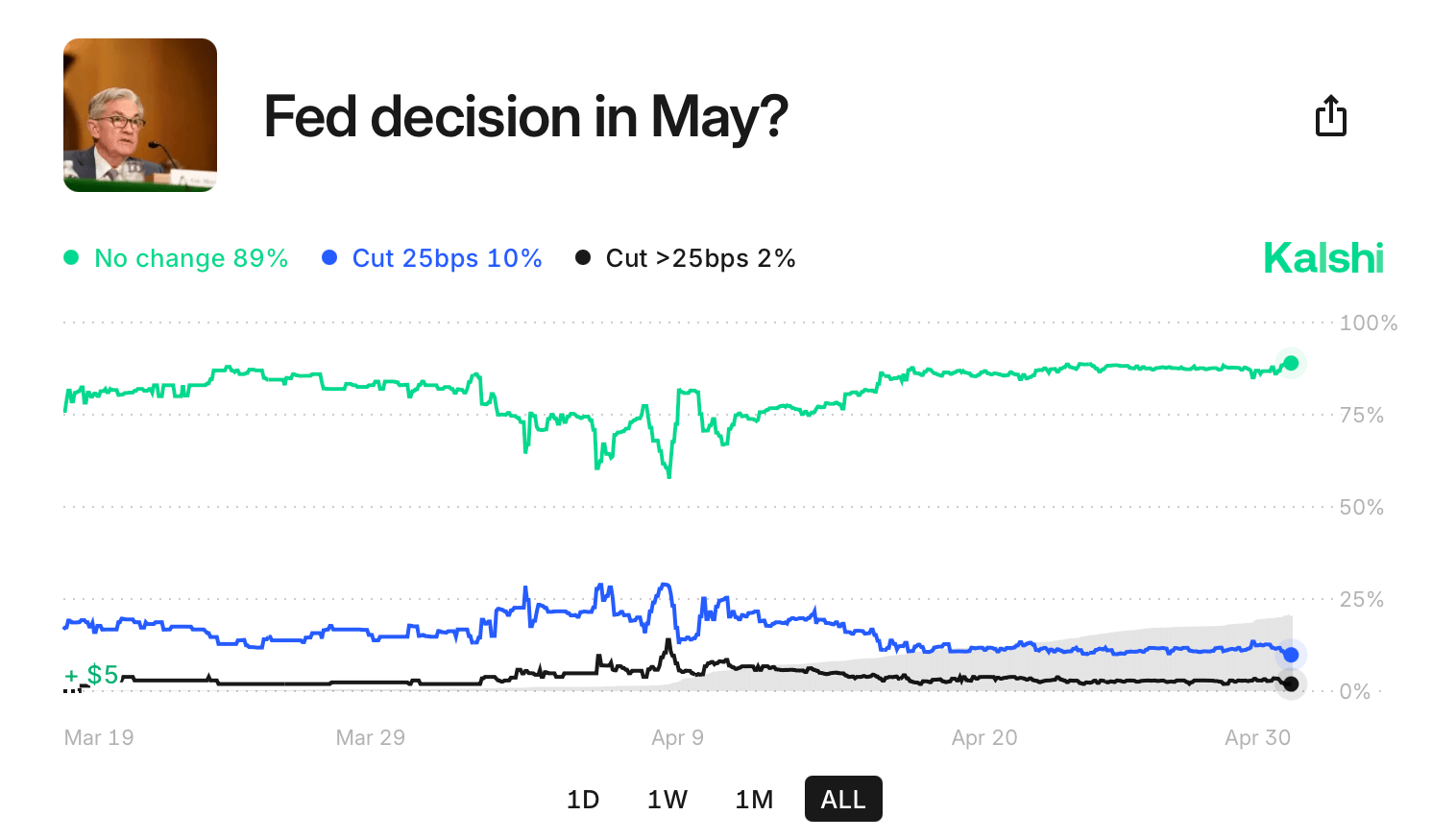

A 2025 study published on SSRN credits the Fedwatch tool with an 88% accuracy rate in forecasting Federal Reserve decisions. Meanwhile, Polymarket’s prediction market—where $32 million in wagers have been placed—puts the odds of no rate change at 93%, and a cut at 7%, as of 2:30 p.m. Eastern on April 30. Over on Kalshi, another forecasting venue, the probability of a quarter-point trim ticks slightly higher to 10%.

Kalshi wager on April 30, 2025.

As traders lean heavily toward no rate changes, the prevailing market sentiment suggests confidence in the Fed’s restraint during the May FOMC meeting, even amid political pressure from Trump and economic jitters from tariffs. The gap between sentiment and speculation reveals how decisively priced-in expectations have become.

Whether the central bank adheres strictly to data or bends to broader narratives may soon become a defining moment for monetary credibility. Of course, there’s still a week left—plenty of time for FOMC members to change their minds twice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。