M2与比特币:历史规律的启示

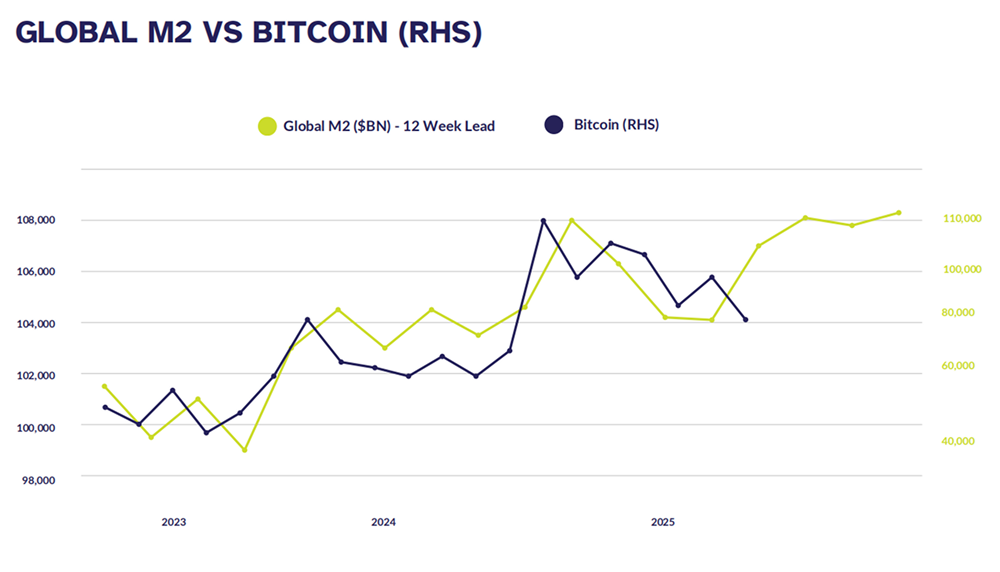

全球M2货币供应量——即现金、存款及短期流动资产的总和——是衡量全球流动性的核心指标。历史数据表明,M2的扩张与收缩往往领先于比特币价格的重大拐点。2024年底,全球M2短暂收缩,比特币价格随之从11万美元高位骤跌至7.8万美元,跌幅近30%。类似的情景也曾在2022年出现,当时M2增速放缓导致比特币从6.9万美元跌至1.6万美元的低谷。反过来,2023年M2的回升则助推了比特币从2万美元反弹至4万美元的修复行情。这些案例揭示了一个规律:M2的增长通常为比特币价格提供“顺风”,而收缩则带来“逆风”。

2025年4月的数据进一步验证了这一相关性。X上有分析指出,比特币价格与全球M2之间存在60至108天的滞后效应。例如,@ColinTCrypto在4月22日的帖子中提到,全球M2自2025年初持续创下新高,当前涨势已延续三个月,预计将持续至8月。这与比特币近期在8.8万美元附近的企稳表现相呼应。更重要的是,M2的增长不仅影响比特币,还与黄金等抗通胀资产的走势高度相关,强化了其作为宏观趋势指标的可信度。

当前趋势:全球M2的“新高”信号

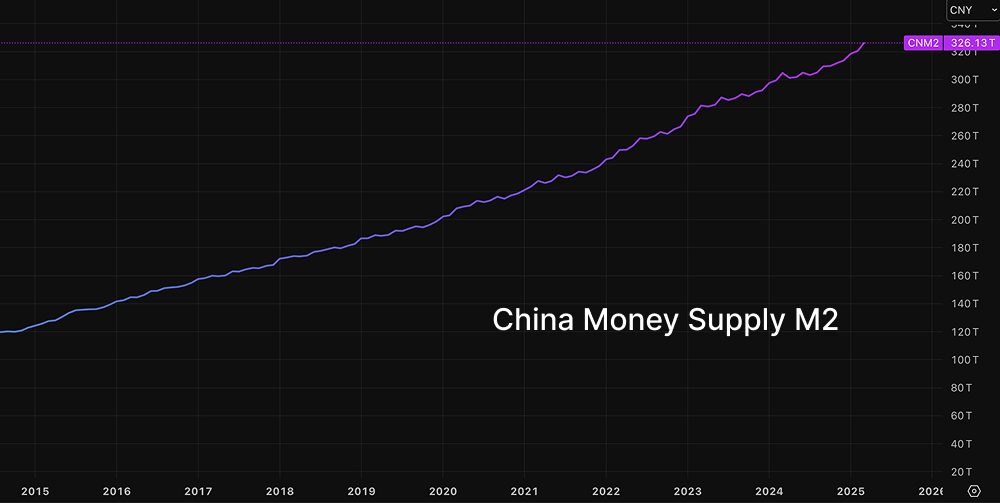

根据最新数据,截至2025年4月,全球M2已达到108万亿美元,较2024年底增长约5%。其中,中国M2突破326万亿元(约46万亿美元),成为全球流动性扩张的重要推手。 市场预期,未来数季度,全球M2有望进一步增至127万亿美元,增速可能达到15%以上。这一预测的背景是各国央行的政策转向:美联储降息窗口临近,日本与欧洲央行维持宽松基调,新兴市场国家也在加大货币投放以应对经济压力。

对于比特币而言,M2的持续扩张意味着什么?比特币的固定供应量(2100万个)使其在流动性过剩的环境中具备天然优势。通胀预期升温时,机构投资者倾向将比特币视为“数字黄金”,以对冲货币贬值风险。X上的分析师@biteshizhe指出,当前M2增速与比特币价格走势的重合度再度升高,历史上这一指标多次准确预示了比特币的中期趋势。 结合2025年4月28日的市场快讯,比特币在全球风险情绪回暖的背景下已开始小幅回升,反映了流动性扩张的初步影响。

央行政策与ETF监管的叠加效应

各国央行的流动性政策是M2增长的直接推手。2025年4月以来,美联储的降息预期不断升温,市场预计最早在6月启动降息周期。与此同时,日本央行继续维持超宽松货币政策,欧洲央行也在低利率环境中释放流动性。这些政策共同驱动了全球M2的上涨,为比特币等高风险资产提供了资金流入的土壤。

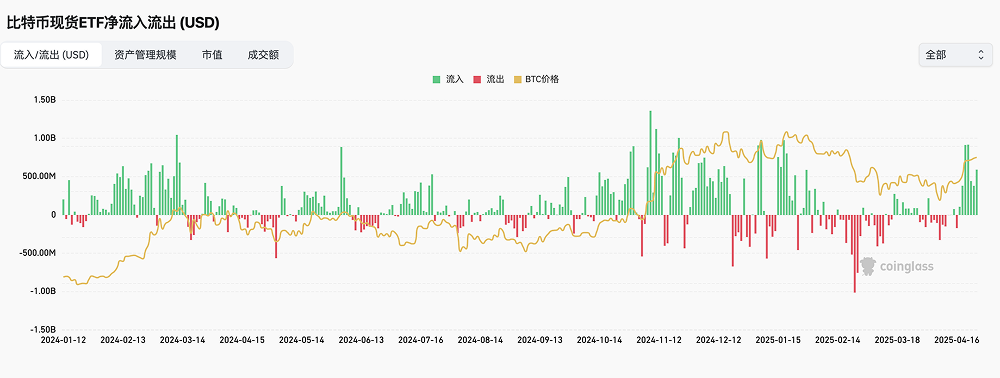

此外,ETF监管的松绑进一步放大了流动性的传导效应。2025年3月28日,美国联邦存款保险公司(FDIC)发布新规,允许受监管银行在无需事先批准的情况下开展加密资产相关活动。这一政策被视为银行入场加密市场的“倒计时”信号,可能吸引更多机构资金流入比特币ETF。

风险与展望:反弹的确定性与不确定性

尽管M2的扩张为比特币提供了结构性利好,但风险不容忽视。首先,全球经济的不确定性可能干扰流动性传导。2025年4月的数据显示,地缘政治紧张与关税政策的不明朗正在加剧市场波动,可能导致短期资金流向避险资产而非比特币。 其次,比特币价格的滞后反应意味着M2的当前增长可能在未来2至3个月内逐步显现效果,投资者需保持耐心。

综合来看,全球M2的持续扩张为比特币的中期反弹提供了坚实基础。预计2025年第三季度,随着流动性进一步释放,比特币有望挑战10万美元关口,甚至重返11万美元高位。然而,短期波动仍将受ETF资金、监管动态及KOL情绪的影响。投资者应密切关注M2增速、央行政策动向以及机构资金的配置节奏,以把握这一轮流动性浪潮中的机会。

本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区讨论该事件

官方电报(Telegram)社群:t.me/aicoincn

聊天室:致富群

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。