On Friday evening at 20:30 (UTC+8), the United States will release its first non-farm employment data since the outbreak of the trade war. AICoin (aicoin.com) data shows that the market generally expects the number of new non-farm jobs added to sharply decline from 228,000 in March to 135,000, marking a new low in nearly five months; the unemployment rate is expected to remain at 4.2%. This data is not only the first empirical signal to test the consequences of Trump's tariff policy but may also become a key turning point for the Federal Reserve's monetary policy and financial market trends. Expectations for interest rate cuts, stagflation risks, and asset flight to safety all hang in the balance.

Although current employment data has not fully reflected the impact of tariff policies, economists widely warn that the "lagging effect" is approaching. Greg Daco from Oxford Economics predicts that Trump's tariff plan could reduce U.S. GDP growth by 1.5 percentage points and lead to a "stagflation" scenario—a vicious combination of economic stagnation and rising inflation.

Goldman Sachs warns that the unemployment rate is often one of the most sensitive signals of economic slowdown, typically worsening within just a month after the economy enters a recession. In other words, if the unemployment rate unexpectedly rises this time, the recession warning lights will flash again.

Meanwhile, Federal Reserve Governor Waller stated that if the job market begins to show significant weakness, the Fed may have to accelerate the pace of interest rate cuts.

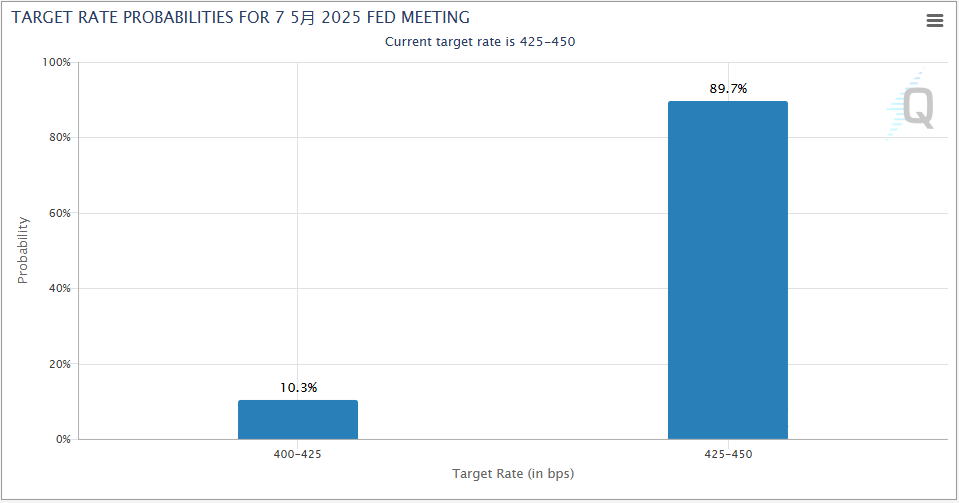

From the market pricing perspective, as of April 29, interest rate futures indicate a 89.7% probability that the Fed will hold steady in May, but the probability of a rate cut in June has risen to 54.5%, reflecting deepening market concerns about the economic outlook.

Potential Chain Reactions from Non-Farm Data

1. Impact on Federal Reserve Policy

(1) Rising Expectations for Rate Cuts

If the number of new jobs added declines significantly (below 150,000) or the unemployment rate exceeds 4.2%, combined with price pressures from tariffs, the market may bet that the Fed will expand its rate cuts for the year to over 100 basis points. Previously, due to resilient data, traders had just pushed back the first rate cut expectation from June to July.

(2) Rising Concerns of Stagflation

If job growth slows but wage growth remains strong, the Fed will find itself in a dilemma—should it continue to combat inflation or shift to stimulate the economy? This "catch-22" could easily trigger market concerns about a stagflation environment.

2. Impact on Financial Markets

(1) Strengthened Direction in the Stock Market

Strong data: Cyclical stocks (financials, industrials) are expected to rebound, improving market risk appetite.

Weak data: Risk aversion increases, defensive sectors (utilities, consumer staples) may outperform the broader market.

(2) Trends in Cryptocurrency and Gold

Weak data: Strengthened expectations for rate cuts may lead Bitcoin to rebound (previously, tariff fears had dragged Bitcoin below $8,000).

Gold: As a preferred safe haven, gold prices may replicate the sharp rise seen after weak non-farm data in 2019.

(3) U.S. Dollar and Bond Market

U.S. Dollar: Weak data combined with rising expectations for rate cuts puts downward pressure on the dollar; if data exceeds expectations, the dollar may briefly rebound.

Bond Market: Weak data may push up Treasury prices, but concerns over expanding fiscal deficits could also suppress gains. Weak data will exacerbate bond market volatility since April.

3. Long-term Policy and Political Impacts

If non-farm data clearly indicates job losses, the Trump administration may face greater political pressure—especially from lawsuits and voter skepticism in key swing states. At that point, the White House may be forced to adjust its tariff strategy, such as exempting certain industries or countries in an attempt to mitigate the impact, similar to previous actions regarding the Canadian and Mexican auto industries.

Conclusion:

This non-farm data is not just a report card for the job market but the first answer sheet to assess the economic costs of the trade war. Whether it’s economic growth, monetary policy, or financial markets, everything will be reshuffled based on the data's direction. The real challenge is that even if the data remains temporarily strong, the lagging effects may still slowly erode the resilience of the U.S. economy in the coming months.

This Friday, a battle between "resilience" and "recession" is about to unfold.

The content is for sharing only and does not constitute any investment advice. For more insights, feel free to join our community discussions:

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

Please recognize AiCoin's only official website: aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。