撰文:博文,白露会客厅

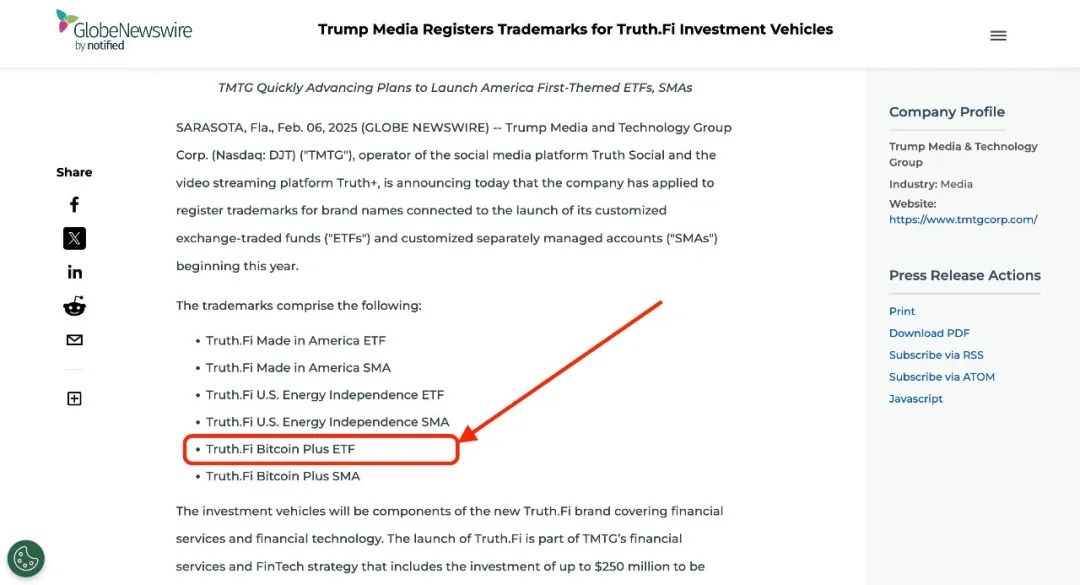

2025 年 2 月 5 日,据 GblobeNewswire 报道,特朗普媒体和技术集团公司,英文名称 Trump Media and Technology Group Corp.(以下简称 TMTG)宣布,公司已经申请注册与其 ETF 和 SMA 相关的品牌名称,计划从今年开始推出这些产品。

商标名称中包括 Truth.Fi Bitcoin Plus ETF、Truth.Fi Bitcoin Plus SMA,特朗普将成为首位发行比特币 ETF 的美国总统。

01 TMTG

TMTG 成立于 2021 年,旨在挑战大科技公司对言论自由的压制,推动自由表达和开放互联网。公司运营社交媒体平台 Truth Social,电视流媒体服务 Truth+,以及涵盖金融服务和金融科技领域的 Truth.Fi。

特朗普家族是 TMTG 的实际控制人,唐纳德·特朗普本人作为主要股东和决策者,在公司发展中扮演重要角色。此前爆火的 $TRUMP 币就是在媒体平台 Truth Social 发布的第一手信息。

详情可参考:美国总统特朗普发币暴涨 1250%,比特币全球合法的虚拟经济新时代

根据公告,TMTG 本次申请的注册商标包括:

-

Truth.Fi Made in America ETF

-

Truth.Fi Made in America SMA

-

Truth.Fi US Energy Independence ETF

-

Truth.Fi US Energy Independence SMA

-

Truth.Fi Bitcoin Plus ETF

-

Truth.Fi Bitcoin Plus SMA

02 Yorkville 担任注册投资顾问

TMTG 已与总部位于新泽西的 Yorkville Advisors 的关联公司签署了一项服务协议和一项许可协议。在获得必要批准的情况下,Yorkville 将担任新金融工具的注册投资顾问,负责产品构建并引导其完成监管流程。拟议中的 Truth.Fi 基金将进行最高达 2.5 亿美元的初始投资,托管方为 Charles Schwab。

TMTG 首席执行官兼董事会主席 Devin Nunes 表示:「我们的目标是为投资者提供投资于美国能源、制造业及其他企业的途径,这些企业能够与市场上普遍存在的『觉醒基金』和去银行化问题形成竞争性替代。

我们正在探索多种方式来区分我们的产品,包括与比特币相关的策略。我们将继续优化我们计划推出的产品系列,以打造最符合‘美国优先’原则的投资选择。」

Yorkville 总裁 Mark Angelo 表示:「Yorkville 很高兴与 TMTG 一起迈出这关键的一步,共同开发‘美国优先’投资工具。我们高度重视作为 TMTG 战略金融合作伙伴的地位,并自豪地加入 Truth.Fi 的创新行动。」

彭博行业研究高级 ETF 分析师 Eric Balchunas 表示,TMTG 的比特币 ETF 可能不会获得与贝莱德等公司同样的吸引力,但仍然具有重要意义。

「尽管有特朗普的品牌,但与 IBIT、FBTC 等相比,这些项目在资产聚集方面可能微不足道。话虽如此,他们推出这个项目的事实本身就为主流化叙事增添了内容,这很重要。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。