作者:Ecoinometrics

编译:深潮TechFlow

今天的话题包括:

-

比特币创下历史新高的推动力

-

十月份比特币表现超出预期

-

小幅降息

每个主题都附带简要说明和一张详细图表。让我们一探究竟。

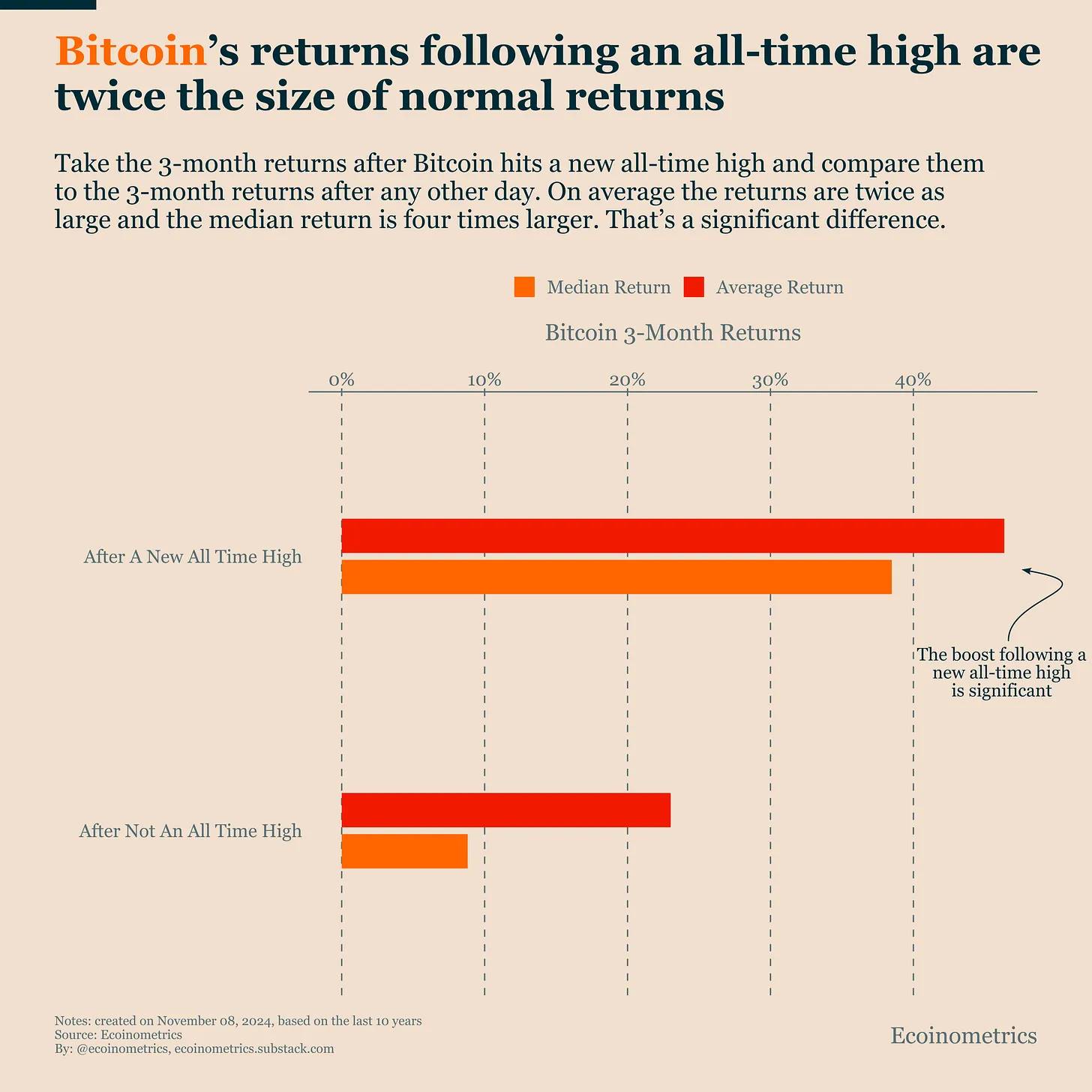

比特币创下历史新高的推动力

比特币在美国大选期间表现出色。不仅成功突破了 65,000 美元的关口,而且正在冲击新的历史高点。这种良好的势头将会自我强化。

根据历史数据,我们可以进行预测:在创下新高后的三个月内,比特币的平均回报率为 46%,中位数为 39%。

这意味着,如果比特币的回报率达到平均水平,那么在 2025 年第一季度,比特币可能会接近 100,000 美元的价位。

要实现这一目标,比特币只需从 ETF 中获得足够的资金流入。目前的趋势非常乐观,因此我们需要密切关注这一动态。

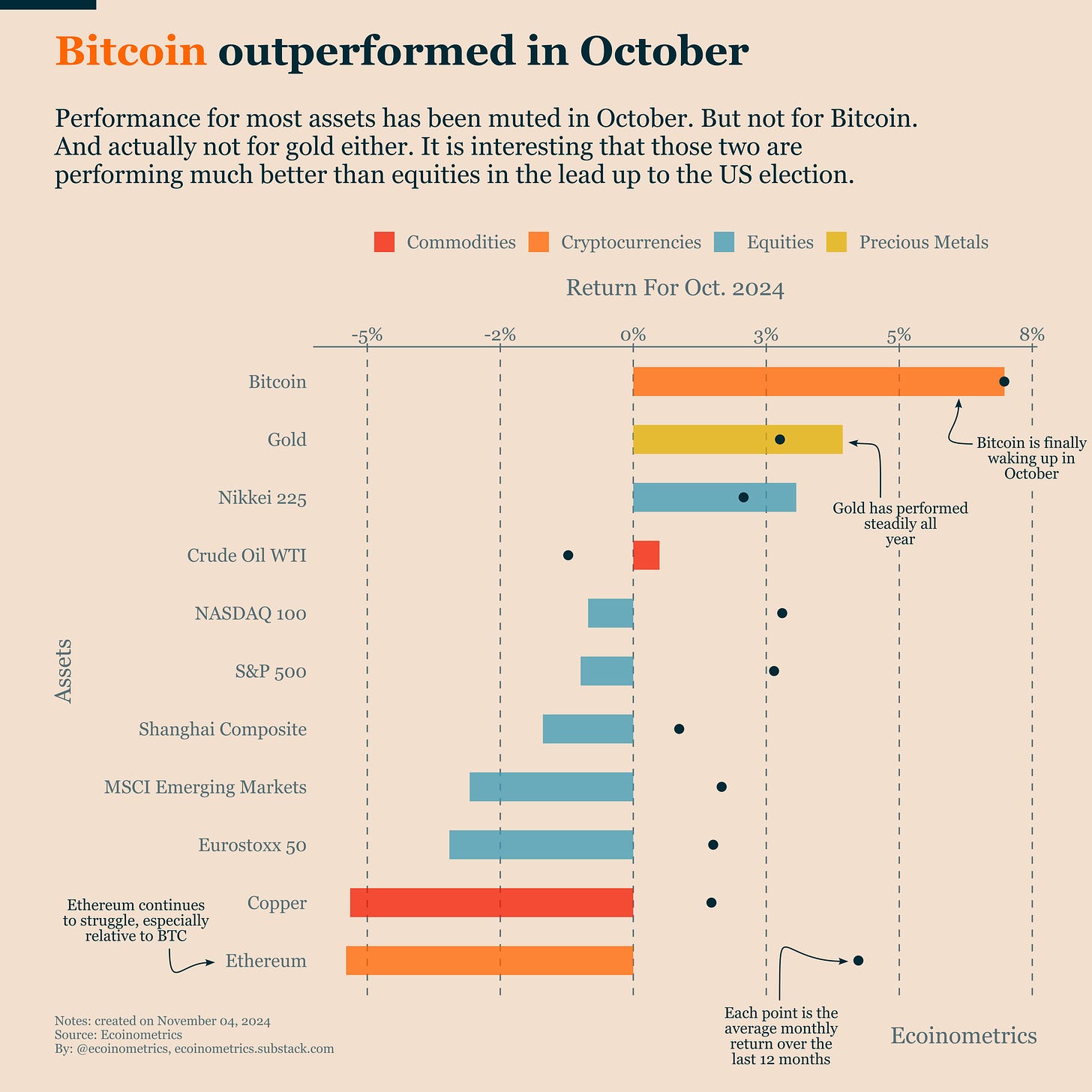

比特币在十月表现出色

事实上,即便是在美国总统大选之前,比特币的表现已经相当出色。

在十月份,它是少数几个实现正回报的全球资产之一,另一个是黄金。这并不是我们第一次谈论这一点。

比特币和黄金在过去 12 个月中的良好表现表明,全球宏观投资者对于美元贬值的威胁持有严肃态度。

除非联邦政府突然采取财政责任措施,否则美国债务将面临不可持续的趋势。当达到某个临界点时,这些债务将不得不通过美联储进行货币化。

这并不是“是否”的问题,而是“何时”的问题。

在投资组合中至少保留一部分比特币作为对冲手段,是您不可忽视的策略。

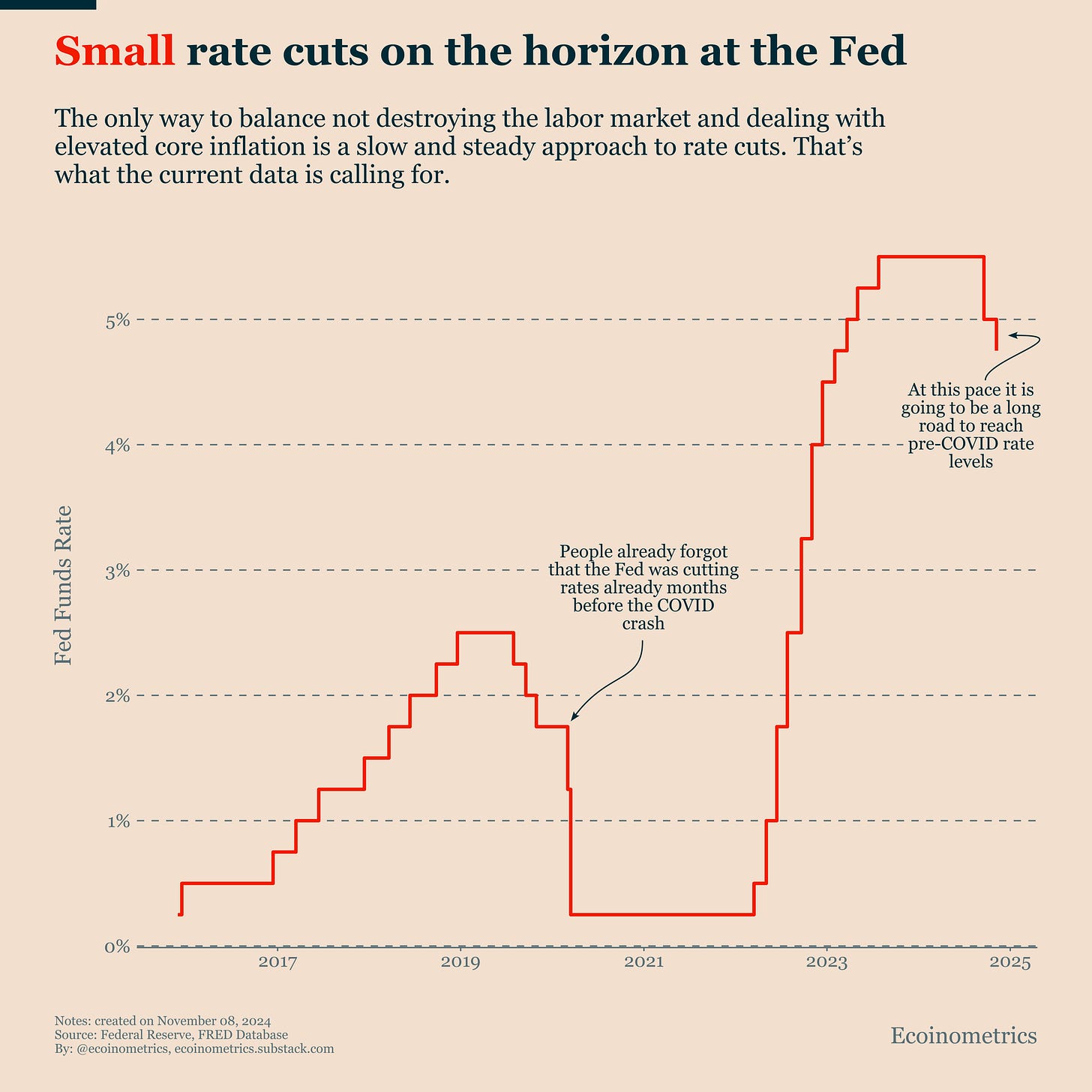

小幅降息

关于债务货币化,美联储目前尚未采取行动。

美联储当前面临的更紧迫问题是,在不破坏美国经济的情况下,确保核心通胀保持在可控范围内。

正如我们多次讨论的,当前数据显示:

-

核心通胀没有出现下降趋势

-

劳动力市场稳定,失业率处于历史低位

这意味着,美联储在未来几个月内采取小幅降息的缓慢策略是唯一合理的选择。

这正是本周 FOMC 会议的讨论重点。同时,美联储的资产负债表规模仍在缩减。

这种货币政策不会导致货币供应的快速增长,但对比特币来说并不完全是负面的。

因此,只要比特币的上涨势头存在,只要 ETF 的资金流入持续,美联储的举措在短期内不应对其产生影响。

今天的内容就到这里。希望您喜欢。下周我们将带来更多精彩的图表分析。

祝好。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。