Ethereum's Internal and External Troubles: A Midfield Battle of Its Own

Author: 0Alice0

This is not the last time Ethereum has faced criticism.

Compared to the clamor surrounding Solana, Ethereum's autumn has been somewhat bleak: Layer2 performance has been underwhelming, the ecosystem lacks innovation, and the price trend has been sluggish.

Discussions about Vitalik's personal life even became a hot topic in the Chinese community:

“Is it true that V God is dumping foundation coins to support his girlfriend?”

For a long time, Ethereum was the innovation center of the blockchain industry, where developers gathered the latest ideas to showcase to users. Ethereum's strong community foundation also provided these projects with opportunities to shine— the rise of DeFi, the explosion of NFTs, and the social practices of DAOs all attest to this.

However, almost all the hot battlegrounds of this bull market have shifted away from Ethereum, moving instead to the Bitcoin ecosystem and new ecosystems like Solana and Sui.

Amidst internal and external troubles, Ethereum has also entered its own midfield battle.

The "Mother" Being Sucked Dry by Layer2s

It is no exaggeration to say that the Layer2 strategy has brought a golden age to Ethereum—Layer2 addresses scalability issues in technology and market share, acting as a buffer against the continuous emergence of "Ethereum killers"; Ethereum itself, through years of accumulated technology and influence, provides various forms of support to Layer2s exploring different directions.

The emergence of projects like Arbitrum and Optimism has successfully addressed the long-criticized high gas fees of the main chain, offering a lower-cost, more efficient trading experience, and has staved off attacks on the Ethereum ecosystem from public chains like Avalanche and Near.

However, the fate of many Layer2s is one of obscurity—there are currently 112 Layer2s listed on L2beat, but most public chains are not well-known, and they do not fit the early definition of Layer2, where the DA (data availability) layer is placed on Ethereum, with TVL and interaction volumes nearly at zero.

In the brutal Layer2 battle, the winner takes all has become the only truth.

The Layer2s at the bottom have almost zero TVL.

The definition of Layer2 is also becoming increasingly blurred.

Despite the Ethereum Foundation and Vitalik himself providing "guidance" on the definition of Layer2 multiple times through Twitter and blogs, this concept continues to be misused.

New public chain projects are all claiming to be "Layer2," leveraging Ethereum's momentum to attract investors and users, without needing to redesign their technical features or architectural designs. They simply need to click a button to launch a chain, paired with a polished PPT and grand project expectations, to find a slew of eager investors.

Vitalik himself has expressed his concerns in his blog: “…some currently independent Layer1 projects are seeking to align with the Ethereum ecosystem and may become Layer2. These projects likely hope for a gradual transition—an immediate transformation would lead to a decline in usability, as the technology is not yet ready to put everything on Rollup. A future transformation could sacrifice momentum, becoming too late to have substantive meaning…”

But at least at the time of writing this, V God still shows a very optimistic attitude towards the prospects of Ethereum's Layer2 system: the EVM Rollup ecosystem represented by Arbitrum, Optimism, and Taiko is developing rapidly; Polygon is also building its own Rollup; independent Layer1s like Celo are beginning to pivot towards Ethereum; and there are new attempts like Linea, Zeth, and Starknet.

At least at this moment, saying "all heroes enter my net" is not an exaggeration for Vitalik.

However, the development of events has not gone as hoped.

Overvalued Layer2 tokens plummeted on their first day of trading on exchanges, with profit-seeking VCs and airdrop hunters quickly selling off their holdings—of course, there are also the so-called "mouse warehouses."

Meanwhile, the prosperity of various Layer2 ecosystems is far from sufficient to support the expectations set by the market. Developers flit between various hackathons but do not actually build complete projects on the sponsoring public chains, adhering to a "grab and go" strategy.

The TVLs that came rushing in also scattered after the airdrops were distributed: staking ETH for airdrop rewards far exceeding traditional DeFi yields led large holders to "run from one dark forest to another dark forest."

Established ecological projects also have their own ulterior motives: just last month, the most classic DEX project in the Ethereum ecosystem, Uniswap, announced the launch of UniChain, built on the Op Stack foundation.

Like all OP chains joining the super chain (Base, Zora, etc.), Unichain will return 2.5% of chain profits or 15% of chain revenue (whichever is greater) to the Optimism collective. The situation of "only knowing OP and not ETH" is unfolding—despite the unbreakable "parent-child relationship" between Optimism and Ethereum, the emergence of modular narratives still leaves room for division within the Ethereum ecosystem.

Ethereum's internal troubles are now evident: the Foundation's "hands-off governance" and excessive emphasis on competitive pressure have led them to adopt a more "survival of the fittest" attitude towards project development within the ecosystem—established projects occupy the high ground, while developers can only seek survival space on other chains. Meanwhile, Layer2 foundations wield their substantial wallets to employ financial tactics on developers, providing various services from incubation to promotion, ultimately becoming the de facto new Layer1 in the growth process.

The market's attitude towards Layer2 has gradually shifted from excitement to fatigue, with the price of the new king coin listed on Binance plummeting uncontrollably, while Ethereum itself is teetering on the brink amidst continuous bloodsucking.

“Why buy memes on ETH?”

The market's earliest impression of Solana came from SBF's classic line, "Sell me all your Sol right now"—after the FTX collapse, this high-performance public chain once found itself in a dire situation.

However, early accumulation has given Solana the capital to make a comeback. The successful launch of the Hacker House Series, the introduction of USDT/C that was already confirmed during the SBF era, the early influence of old projects like Stepn, and the Foundation's strong support for ecological projects helped Solana weather the toughest times and ultimately ushered in an ecological explosion.

The development of Ethereum's ecosystem resembles a planned economy: the Ethereum Foundation and Vitalik first propose directions, followed by responses from various Layer2s, and finally developers follow suit. But this strategy also implies a certain abandonment of alternative possibilities—no one wants to lose the so-called orthodoxy, so no one wants to fall behind voluntarily.

Solana has no burden of orthodoxy.

Unlike the idealistic developer environment of Ethereum and Bitcoin ecosystems, Solana's atmosphere is closer to the "backstabbing" of the BSC chain—Degen culture, which is more easily understood by Western players, has been woven throughout the entire public chain from the start, lacking a sense of harmony and leaning more towards PVP. Users also find that they do not have to pay gas fees that can easily reach dozens of dollars, and instead of waiting for chain congestion to end, interactions that are completed in seconds make engagement more frequent.

The instant smooth feedback brought by high TPS and a well-developed infrastructure has made the thrill of the "on-chain casino" stronger than ever. The emergence of meme coins like PEPE and BOME not only creates wealth effects but also siphons users from other ecosystems.

Then Pump.fun was born.

Pump.fun, which solved the "last mile" problem for meme coins, completely drove the market into madness—traditional crypto narratives require painstaking searches, a year of brewing, and half a year of explosion, ultimately reaching a peak in reports from outsiders. But on Pump.fun, anyone from famous singers to billionaires and even unknown individuals can create their own narratives anytime and anywhere; expectations, price increases, calls, and dumps become the only four things to care about.

Ethereum's ecosystem also has its own casino in this round—odds on Polymarket regarding the U.S. elections once became an important indicator for judging the final winner. However, compared to the simple and crude on-chain slot machines of Pump.fun, the feedback experience of betting feels somewhat lengthy, losing more excitement for those placing bets.

Slot machines may not be in Macau or Las Vegas, but they can be on any touchscreen you can access, and the rewards are higher than any machine you've encountered before—this is the most intuitive experience brought by Pump.fun. After all, most players participating in the crypto space still harbor dreams of overnight wealth.

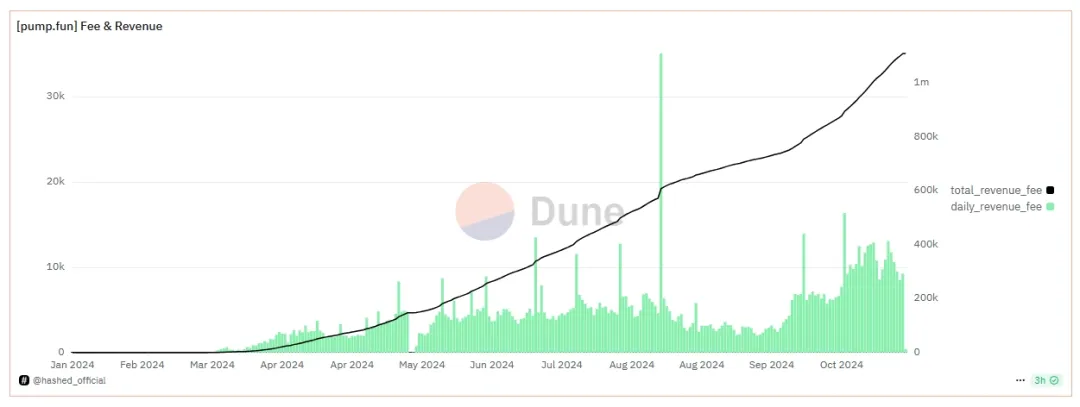

The other side of the coin is madness. As of the time of writing, the number of token projects deployed on Pump.fun has approached 2.95 million, and the total revenue of the projects has exceeded 1.1 million SOL (approximately $160 million), with an average daily income reaching 10,000 SOL.

Pump.fun's total revenue and daily average income are continuously growing.

Small Circles and Inertia

The practice of "entrepreneurship for Vitalik" has a long history—due to the non-profit nature of the Ethereum Foundation and Vitalik's prominence, gaining Vitalik's support and "clinging to his leg" to better secure investment and attention for their projects has become the only concern for some entrepreneurs for a long time.

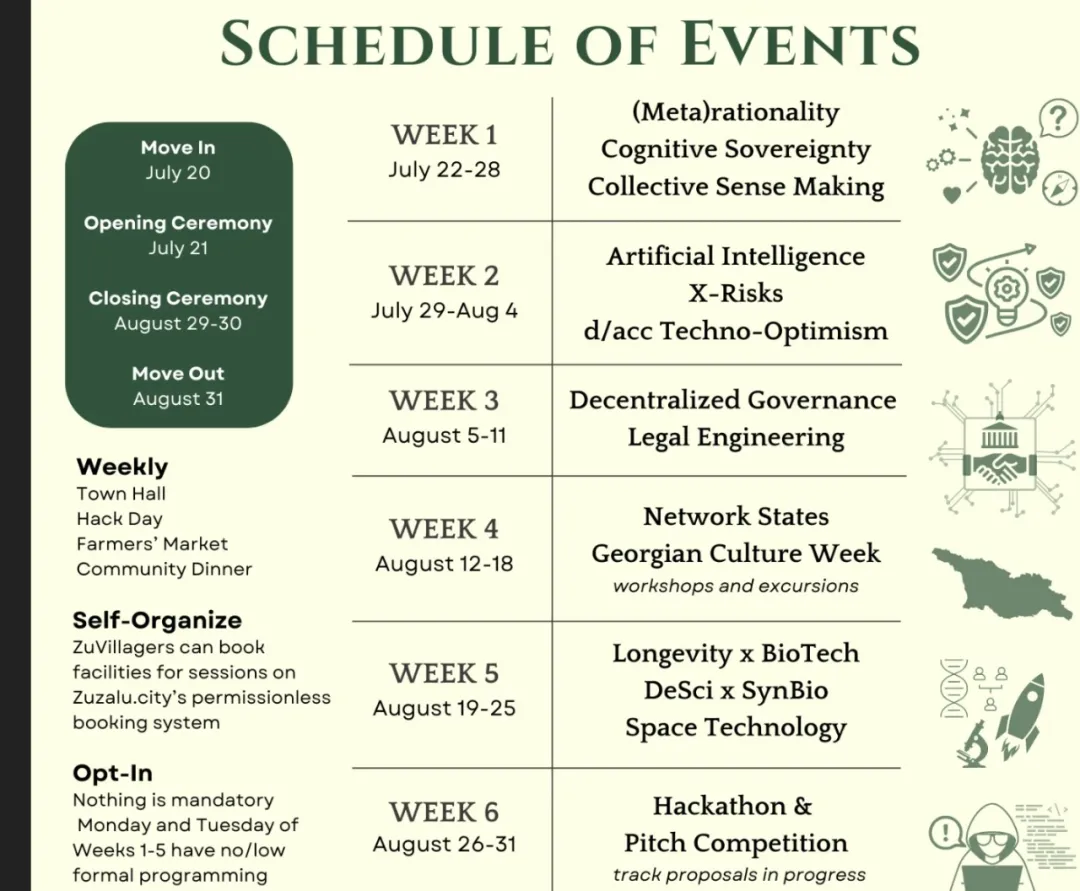

However, achieving financial success too early has gradually distanced Vitalik from the community, which he finds to be filled with the smell of copper, leading him to form small groups based on his own ideals. As a result, the barrier between Vitalik and the outside world has become increasingly severe: he rejected a photo request in Montenegro with "No Chinese," discussing cognitive sovereignty and irrationality with members, fearing that his photo would be used for hype, yet he never hesitates to cheer for the members of his small group—whether the projects of the small group are sincere or merely flattering him.

Discussion topic list on Zuzalu.

Ethereum Foundation researchers live a different kind of life; the technical staff quietly drive technological innovation, but what they can gain is far less than what they contribute. This is why projects like Eigenlayer can take advantage of the situation—researchers exchange their platform with almost no loss for project tokens, forming a different kind of collusion of interests.

Objectively speaking, Vitalik and the Ethereum Foundation have never placed the responsibility for ecosystem profitability on themselves: the former has always played the role of advancing technology and research, while the specific commercialization has been handled by companies closely related to the interests of the Ethereum ecosystem, such as Wanxiang and Consensys, in previous cycles. However, the tremendous commercial success of these companies has led them to lose interest in further commercializing the Ethereum ecosystem, turning instead to seek more lucrative avenues.

The rapidly emerging crypto VCs in the industry also do not bear the burden of commercialization.

The most telling example is the priority list listed on the official website when applying for grants: financial projects, NFTs, and projects preparing to issue tokens are "valuable but not eligible for funding"—this inertia has persisted since the day Ethereum was founded, ensuring the absolute neutrality of the Ethereum Foundation in financial investments.

However, the Ethereum Foundation cannot prevent individual preferences.

Conclusion

Naval typed this on Twitter: “Most crypto projects will fail because the founding teams become wealthy too early, and this problem cannot be solved by hiring new talent.”

Will Ethereum ultimately fail? Or are all the issues mentioned above merely growing pains that can be adjusted to get back on track? We do not yet know.

But this is not the first time, nor will it be the last, that Ethereum has faced criticism—this experiment born in 2015 has traversed a long journey of nine years, experiencing various ups and downs, and has garnered countless praises and criticisms. Whether in love or hate, it is an unavoidable part of blockchain history.

However, after a period of intense competition, Ethereum has ultimately encountered its unavoidable midlife crisis.

Without the exciting competition for market share, the surge of ICOs, and the vibrant atmosphere, long-term ecosystem building appears more tedious and bland, but this is also what Ethereum must do to survive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。