Bonding Curve is the art of integrating growth curves and token economics, but it seems that we are abandoning the essentials for the sake of trivial matters.

By: Pzai, Foresight News

The core of iteration in the cryptocurrency market lies in the innovation of token economics, and algorithmic innovation based on smart contracts has played a crucial role in the iterations over the past decade. The early tokenization based on Bitcoin was relatively limited, and the relative lack of technology and narrative became a certain constraint on token issuance at that time. As the smart contract ecosystem represented by Ethereum was still in its infancy, some people began to consider how to combine smart contracts with token issuance models. As one of the early algorithmic innovations on the chain, Bonding Curve has had a profound impact on token economics and token engineering. Therefore, this article aims to explore the core of Bonding Curve through tracing its origins and to deeply consider its significance from multiple practical cases.

From fixed supply to dynamic supply

Early token issuance was filled with centralization and disorder. The establishment process of a project had no regularity, and it only required a plain white paper and a deck to appear in numerous roadshows, attracting countless token inflows. But what happened after the inflow? Centralized token models ultimately led to the collapse of token prices, and the lack of effective regulation in the market competition ultimately led to its demise.

In reflecting on these issuance models, a mainstream view believes that the characteristics of the issuance at that time limited the expansiveness of the market, including the following points:

- Centralization—In addition to the centralization of the issuance itself, most of the trading process also took place in centralized exchanges.

- Single asset—The ecological connectivity was poor, and a single chain basically corresponded to the circulation of a single asset (except for the circulation of USDT based on the Bitcoin OMNI architecture at that time).

- Liquidity restrictions—The widespread use of the PoW architecture at that time led to long block confirmation times, and the restriction of on-chain transfers led to a decrease in overall liquidity.

- Fixed supply issuance—For tokens with a fixed supply, the project could only distribute them through the consensus layer or initial allocation. The fixed token economics itself did not adapt to changes in the market environment, and the large space for manipulation by the project side led to a certain exaggeration and misleading of the token value, which was also the reason why the market did not achieve sustained development at that time.

Simon de la Rouviere, a former social engineer at Consensys, envisioned a "curated market" in 2017, which aimed to build a system that "allows groups to coordinate around common goals (and interests) and benefit from the value they co-create." This system was built on the Ethereum smart contract framework and added interoperability between protocols at the underlying architecture. The core of this concept lies in "automated coordination," that is, how to allow people to automatically create a market on the chain when they are interested in the marketization of something. In terms of mechanism design, a model for user participation without intermediaries needs to be built. Thus, the continuous token model based on Bonding Curve was born.

Simon defined several characteristics of a simple continuous token model:

- Using ETH and other tokens to mint tokens based on a hardcoded algorithm (function)

- The cost of tokens depends on the quantity of tokens in circulation (e.g., unit token price = token supply²)

- The purpose of the tokens is to "destroy" operations/services in the network. The use of services reduces the token supply, while also reducing the minting cost, making the use case of the tokens not limited to distribution.

Based on this model, we can see that compared to previous issuance models, the Bonding Curve itself provides a new issuance model for various applications with decentralized supply. Next, we will explore some implemented use cases, delve into the role of algorithms from the perspective of token engineering, and discuss the potential landing directions of future Bonding Curve.

Curation

As Simon initially envisioned, one major use case of Bonding Curve is curation. In the previous curation process, there were often organizational problems, such as insufficient organizational coordination and lack of information richness. Here, the author selected two projects for analysis.

Ocean Protocol

Ocean Protocol is a decentralized data sharing protocol designed to facilitate the open sharing of AI data. In this process, the purpose of the token economic design is to maximize the supply of relevant data and services. In traditional curation markets, the main behavior of participants is a signal-like entry and exit. Ocean combined these transaction behaviors with the actual work of providing services, creating a Curated Proofs Market.

In this market, each individual data set represents a corresponding "drop" staking curve. On this curve, users can choose to receive block rewards (by staking a specific data set and giving it availability) and unstake, and the staking of "drops" can serve as a measure of user attention.

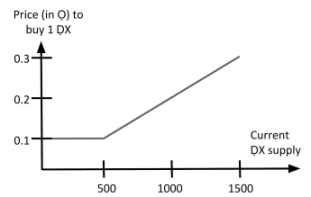

From the project narrative to the token economic model, we can see that the project needs stable inflows in the early stage to ensure that data sets can build equal initial consensus in curation. Subsequently, the availability of data sets adds barriers to later participants in curation, increasing the cost of subsequent participation while avoiding excessive concentration of consensus on a single data set. Therefore, its Bonding Curve model is as shown in the following figure. After 500 "drops," the overall minting cost shows a linear increase.

In simple terms, if a user discovers the value of a data set early, they can buy in through the Bonding Curve and profit in the future, thereby engaging in curation. However, this curve is still relatively rough for the curation process, as the purchase and sale of these tokens have a certain latency with the data sets used by AI and may not guarantee the availability of these data sets, requiring further mechanisms for screening.

Angel Protocol

The well-known research institution Delphi Digital has built a token economic model based on Bonding Curve for the Angel Protocol, a charity donation protocol built on Terra. There are three roles in the protocol: donors, charitable organizations, and charitable supporters (HALO protocol token stakers, curating in the charity market). The goal of the protocol is to combine donations with Bonding Curve to enhance the sustainability of charitable causes.

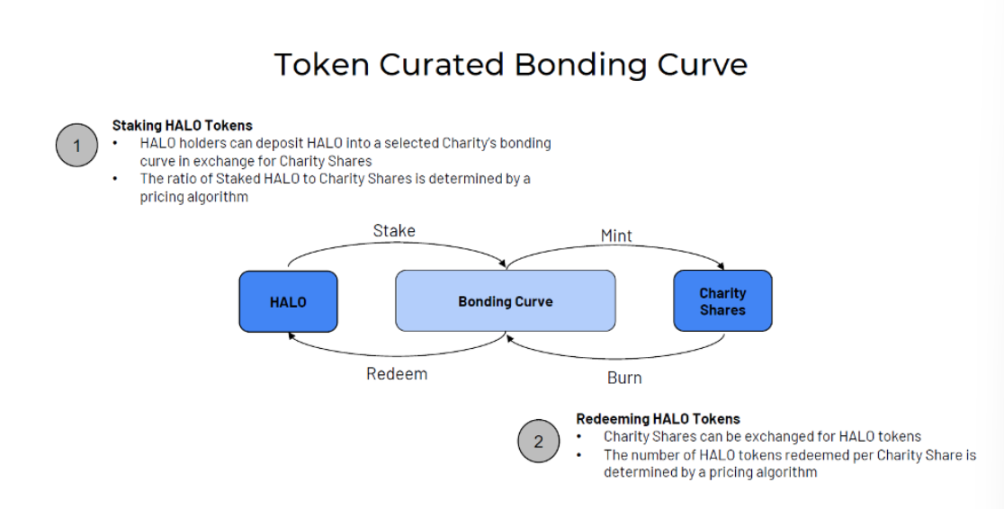

Based on the above use cases, its token economics needs to incentivize actions related to curation, donations, and governance, and over time, encourage stakeholders to participate. Therefore, Delphi proposed a token curation registry based on Bonding Curve, based on the concept of The Graph (which also curates through Bonding Curve, but is omitted from this article due to length). This model allows users to participate in staking pools and interact with the curve of specific institutions to mint charitable shares. The curve determines the exchange rate between HALO and shares, and rational curators will seek to maximize the returns for charitable organizations, while the Bonding Curve design can distribute returns between token transactions, and these gains can be distributed or destroyed.

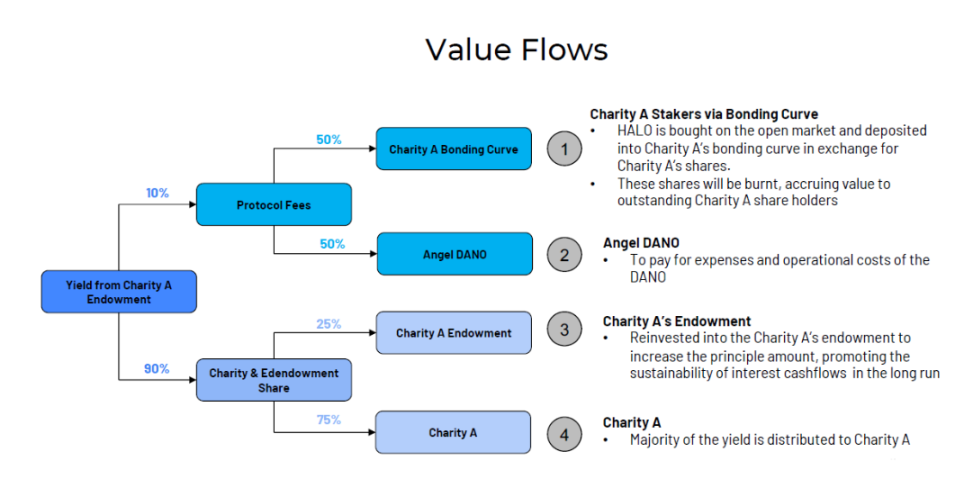

From the perspective of value flow, the returns generated from the charitable donation fund are divided into share distribution (90%) and protocol fees (10%). In terms of share distribution, 75% of the distribution goes to charitable organizations, and 25% is used for investment in the donation fund, thereby promoting the long-term sustainability of cash flow. The protocol fees are allocated to DANO (the protocol's governance organization) and HALO stakers.

It is not difficult to see that the intervention of Bonding Curve provides diversified sources of income for token stakers (natural participation, protocol revenue, and early governance rights), and also provides a mechanism for selecting the best in the fundamental use case of charity. Curators can ensure that only the most needed charitable organizations appear in the charity market, and based on marketization, it has also created a sustainable economic source for them.

Summary

Through the above analysis, we can abstract the role of Bonding Curve in the curation field:

- Natural sorting based on token games: The token price indicators generated by the free market allow us to abstractly understand the preferences of users within the system and the status of corresponding things.

- Natural early incentives: Market incentives brought about by dynamic supply can provide early users with an advantageous position in future protocol use cases through real-time pricing on the curve.

- Healthy Value Flow: Each purchase corresponds to real asset storage, and the organic appreciation and potential distribution of assets bring substantial positive cash flow to the protocol.

Overall, the market environment provided by Bonding Curve offers a good environment for curation applications and integrates as the core of the protocol's growth curve.

Algorithmic Regulation

As a mechanism innovation on the chain, Bonding Curve exists as a core part of the algorithm in multiple protocols. Here, the author analyzes two examples, covering the fields of on-chain insurance and stablecoins.

Nexus Mutual

As one of the pioneers of on-chain insurance protocols, Nexus Mutual pioneered a mutual aid type of insurance alternative, providing purchasing and underwriting services to members within the protocol. Members can provide funds to the mutual aid fund and receive NXM tokens, stake NXM to assess underwriting risks, and receive rewards.

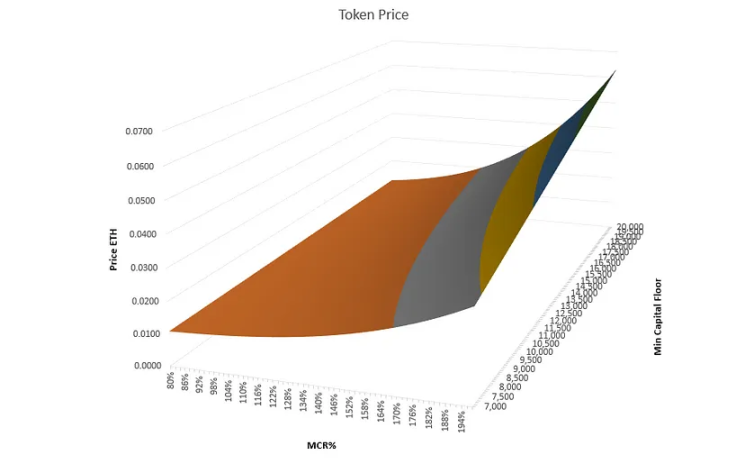

An important parameter introduced within the protocol is the Minimum Capital Floor (MCF), which corresponds to a ratio generated by the existing funds within the protocol, generally referred to as MCR%. For the sustainable development of on-chain mutual aid insurance protocols, there needs to be a corresponding relationship between the equity token (corresponding to NXM within the protocol) and the total equity of the protocol, thereby achieving organic scale growth of the protocol. Originally, MCF was determined through governance within the protocol. In November 2019, the community governance decided to automate the regulation of MCF. On days when the MCR% value is greater than 130%, MCF will increase slightly by 1%.

They modeled this change, and it was found that when MCF was fixed, the overall curve growth was relatively slow, but after MCF began to grow linearly, the overall growth rate increased. This is the charm of the Compound Bonding Curve—multiple protocol indicators can directly drive token growth.

Fei

FEI was a popular algorithmic stablecoin at the time, integrating the lessons learned from previous experiences into on-chain mechanism innovation. When users buy and sell FEI on-chain, the algorithm anchors the token through regulation.

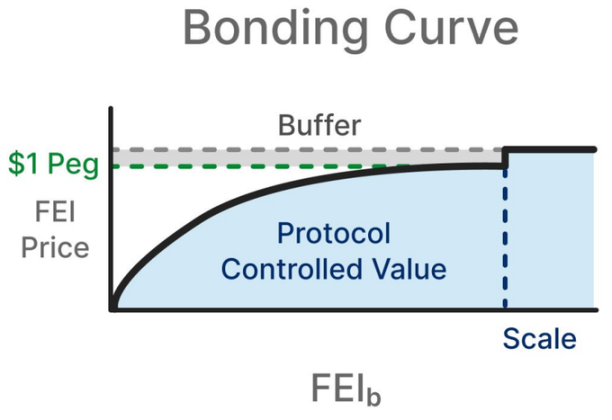

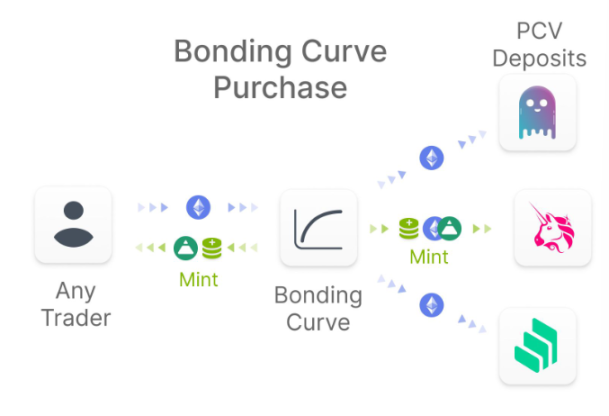

To create Protocol Controlled Value (PCV) and meet new demand, the Bonding Curve became an excellent solution, and it has mathematical fairness. Specifically, prices outside the buffer zone can be balanced by minting on the Bonding Curve, which is a one-way buy curve. In addition, for the general financing and deployment of PCV, these funds can be obtained through additional Bonding Curves priced in other tokens and directly deployed to various protocols on-chain. For example, the protocol initially established a unique curve based on the Uniswap ETH-FEI liquidity pool at launch, and later added liquidity from multiple DeFi protocols. Each Bonding Curve corresponds to the "anchoring" (liquidity) of a single protocol, and the flexible design allows PCV to be creatively deployed and integrated with potential new DeFi protocols in the future.

Unfortunately, due to the limited use case of the stablecoin itself, its unique mechanism and the user's entrapment in the "liquidity trap" led to its eventual demise, followed by a merger with Rari Capital and a theft incident. However, before this, Fei collaborated with Ondo Finance to launch Liquidity as a Service (LaaS), partially realizing the above vision. As a major contributor to PCV construction, the Bonding Curve also added fuel to the development of DeFi at that time.

Conclusion

One of the major advantages of Bonding Curve is that it allows users to benefit directly from early growth, and when the curve is integrated with other protocol indicators, it can achieve gains greater than the sum of its parts. In Nexus Mutual, as the staking value increases, it corresponds to superlinear growth of the token, while in FEI, it can achieve synergistic development with other DeFi protocols as stable protocol inflows. In addition, the "pure on-chain governance" introduced by Bonding Curve itself is a very sustainable feature, as the contract itself will not rug itself.

Buying equals growth… does it?

As the subtitle suggests, does buying equal growth? Take a look at Friend.tech and pump.fun, they have indeed mastered the use of Bonding Curve, but in the end? One is used for social purposes, and the other for MEME, achieving great success in their respective fields, but sustainability and externalities seem to have disappeared, and it seems that we are repeating the mistakes of the past.

Why? Let's look back at the characteristics of projects that use Bonding Curve as a pure token issuance tool:

- Disorder in issuance: Open curve markets have actually become the culprit of decentralized consensus, as everyone wants to be the initial issuer of the curve, just look at the success rate of pump.fun's launch.

- Lack of Value Flow: For projects that only use token issuance as a use case, any discussion about Value Flow is meaningless.

Let's go back to an age-old question: the crypto space has always been pursuing the next 1 billion users, but the discovery of real use cases always seems to have some stumbling blocks. The essence of putting the cart before the horse lies in the fact that we are once again falling into the trap of issuance models from the past. Ironically, the birth of token economics was originally meant to break free from this trap.

If we list the advantages of crypto, we can find that token economics is definitely the most important part, and serving real use cases is the breakthrough point of token economics.

Here are a few potential use cases:

- Fairer (natural) governance: Direct buying and selling of governance indicators may be more intuitive compared to direct voting (similar to the logic of prediction markets).

- Decentralized asset backing: For NFTs or other tokens, Bonding Curve can ensure the underlying asset backing, decentralized distribution avoids inaction by the project side (because there is no project side), and can automate the distribution of generated value. If this logic is applied to RWA, it can ensure a certain collateralization ratio.

- Protocol growth: What would happen if TVL, yield, or points were combined with Bonding Curve? The growth on the curve will inevitably drive the flywheel of indicators.

Of course, the imagination of token economics is not limited to these, and I hope to see more innovative use cases in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。