If you believe that the long-term value of ETH lies in the network equity as a widely used protocol, then it is necessary to achieve value accumulation.

Author: Doug Colkitt

Translation: Deep Tide TechFlow

Here is a very good analysis of Data Availability (DA) and the most reasonable bullish speculation on DA. However, I believe that DA cannot approach 50% of L2 costs. Because from an economic perspective, the value accumulation of sorting always far exceeds DA.

The core business of blockchain is the sale of block space. Because block space is difficult to exchange between different chains, they have almost formed a monopoly.

However, not all monopolies can obtain excess profits. The key is whether consumers can be price-discriminated.

If price discrimination cannot be carried out, monopoly profits are almost no different from ordinary goods. Think about how airlines differentiate between business travelers who do not care about prices and budget-conscious ordinary consumers, or the same SUV sold at drastically different prices under the Volkswagen, Audi, and Lamborghini brands.

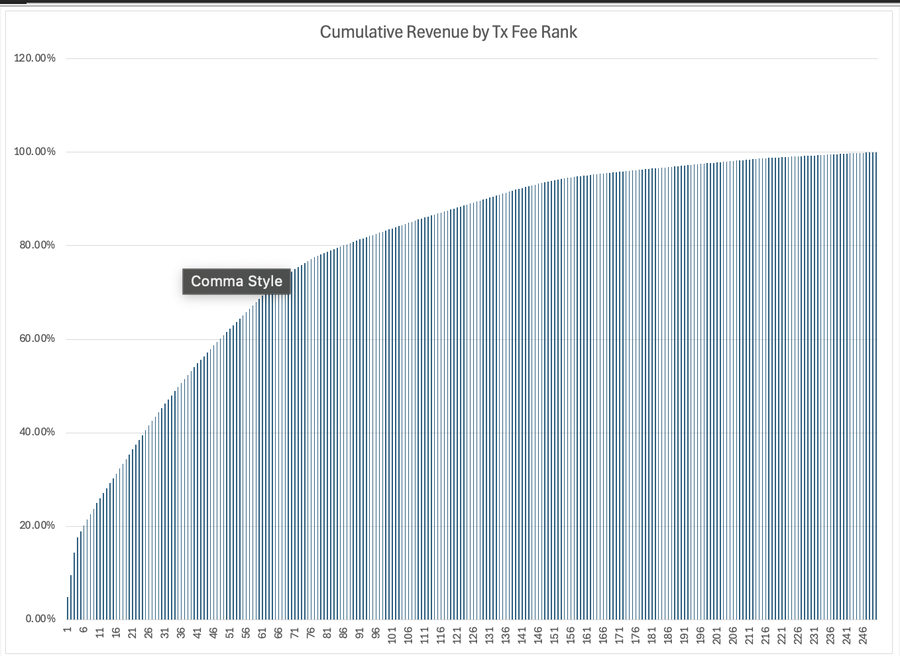

Priority fees are an extremely effective price discrimination mechanism in blockchain. The fees paid by transactions with the highest priority far exceed the median.

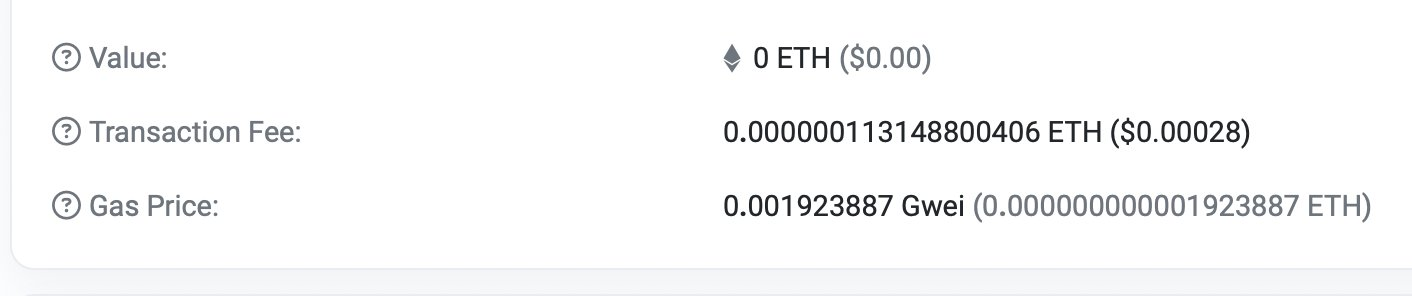

L2 and Solana achieve high throughput and high income by using the priority of the sorter for price discrimination. The fees for marginal transactions are very low, supporting high TPS, while transactions insensitive to prices pay most of the network income.

Below are the transaction distributions of 5 randomly selected blocks from Base L2. This presents a clear Pareto distribution, making price discrimination extremely effective. The top 10% of transactions paid 30% of the income, while the bottom 10% of transactions paid less than 1%.

The problem is that although the sorter can profit from it, the DA layer cannot participate because it lacks the ability to price discriminate. Whether it is high-value arbitrage transactions or 1 wei of junk transactions, the fees paid on the Ethereum DA are the same because they settle in the same batch.

Since the value of marginal transactions is very low, high TPS can only be achieved when median transactions can be settled on-chain at near-zero cost. But at the DA layer, basically every transaction pays the same fee. The DA layer can either have high throughput or high income, but not both at the same time.

This makes it almost impossible for rollups to scale without affecting Ethereum's network income. The roadmap centered on rollups is fundamentally flawed because it abandons the valuable part of the network (sorting) and mistakenly believes that it can be compensated by the worthless part (DA).

I was initially optimistic about the roadmap centered on rollups because I believed that rational people would recognize the economics of price discrimination and that it could develop in parallel with L1 expansion.

High-value users who are insensitive to prices will choose L1 because it has persistence, security, and finality, while L2 will focus on marginal low-value users excluded due to high L1 costs. Therefore, Ethereum can still obtain considerable sorter rent.

However, Ethereum's leadership has repeatedly emphasized that L1 as an application layer is no longer important and will not scale. As a result, users and developers have made rational responses, leading to the gradual decline of the L1 application ecosystem and a decrease in Ethereum's network income.

If you believe that the long-term value of ETH lies in being a currency asset, then this may still be feasible. By getting more people to hold ETH, making it a persistent form of currency. Subsidizing L2 rather than accumulating value at the base layer may promote this.

But if you believe that the long-term value of ETH lies in the network equity as a widely used protocol (which I think is more likely than ETH as a currency), then it is necessary to achieve value accumulation. Obviously, we have made mistakes at this point due to incorrect economic assumptions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。