With the correct time perspective, proper investment portfolio management, and enough patience, the likelihood of messing up will be very low.

Written by: Raoul Pal

Translated by: DeepTechFlow

Regarding the "banana zone" (referring to the price turning upward after a turning point, resembling a banana with a curved bottom and a vertical top), there have been some misunderstandings that I would like to clarify.

The summer and autumn of the macroeconomy are driven by the global liquidity cycle. Since 2008, the global liquidity cycle has shown clear periodicity. Why choose to analyze from 2008? In that year, multiple countries reset their interest payments to zero and adjusted the debt maturity to 3 to 4 years, creating a perfect macro cycle.

In the Institute for Supply Management (ISM) index, we can observe the perfect periodicity of the business cycle, which is one of the best indicators for studying the macroeconomic cycle.

All of this is part of "The Everything Code," where the business cycle almost perfectly repeats as liquidity rises to devalue currencies to cope with debt rollovers. Without this mechanism, yields would completely lose their anchor, leading to a debt spiral (which is to be avoided at all costs).

Note: The author's "The Everything Code" is a macro theory describing the mechanism of global economic operation, particularly focusing on how business cycles and debt management are influenced through monetary policy, especially currency devaluation.

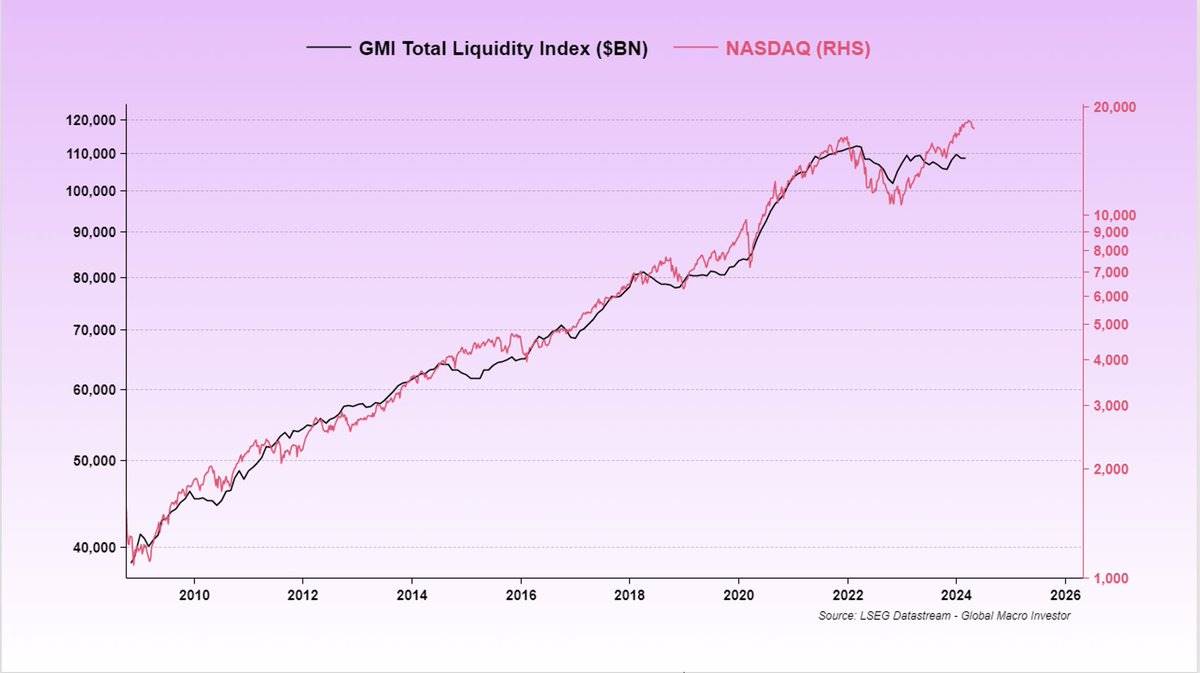

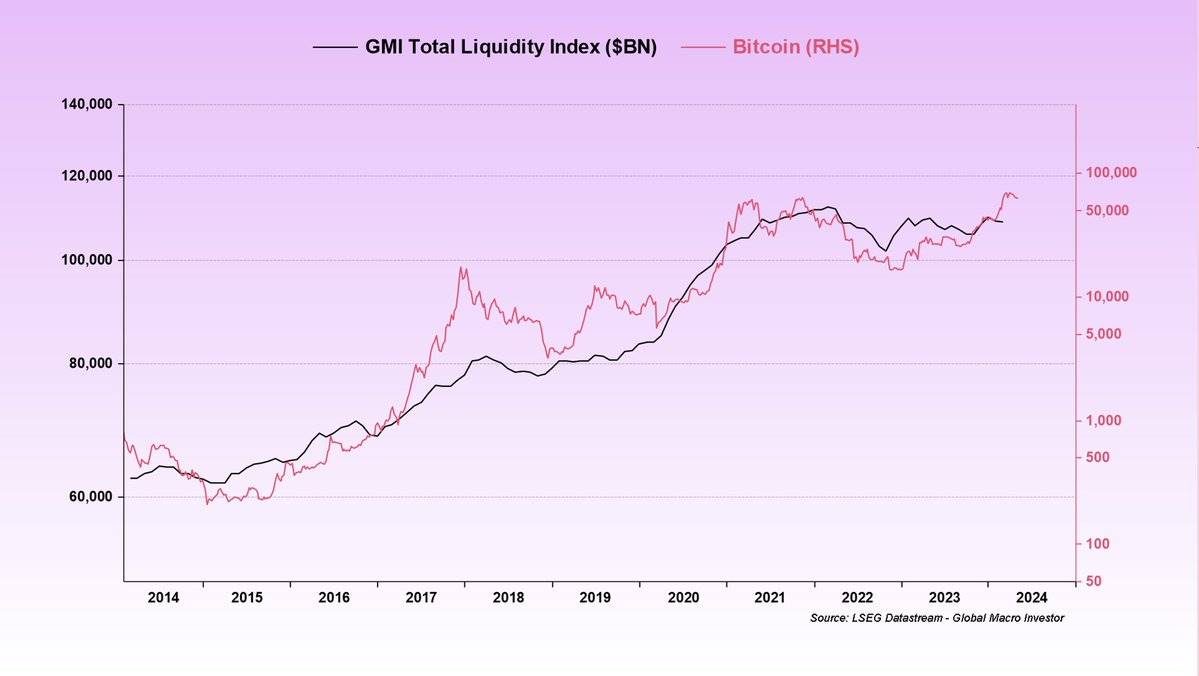

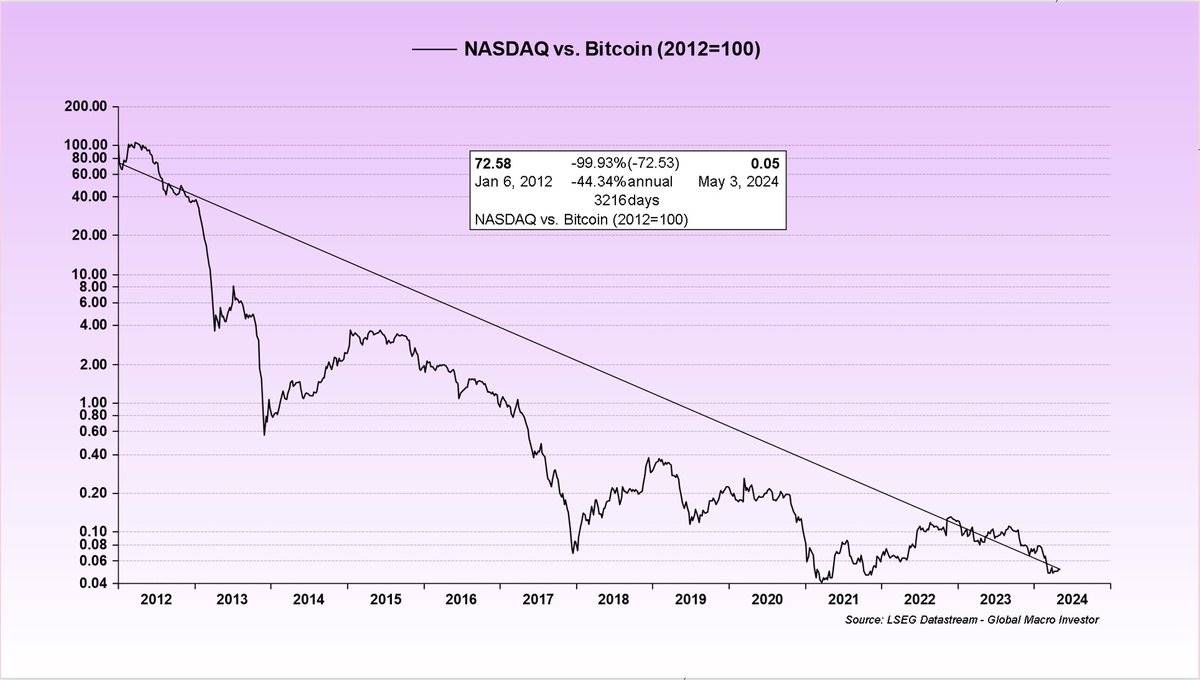

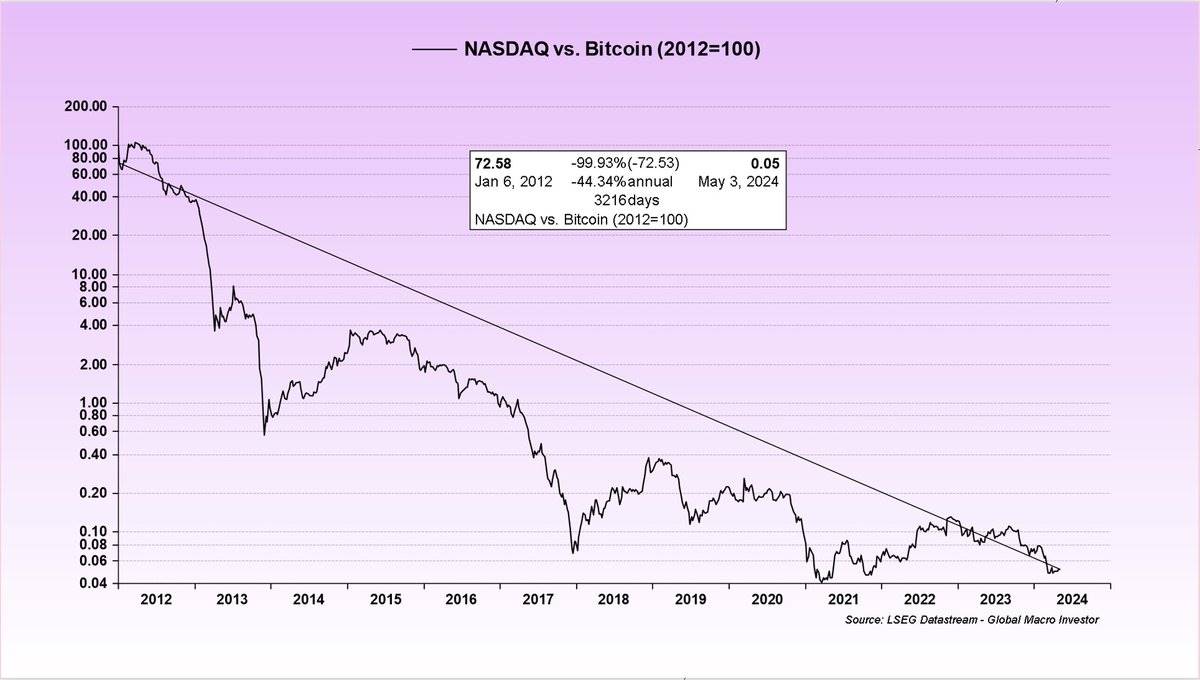

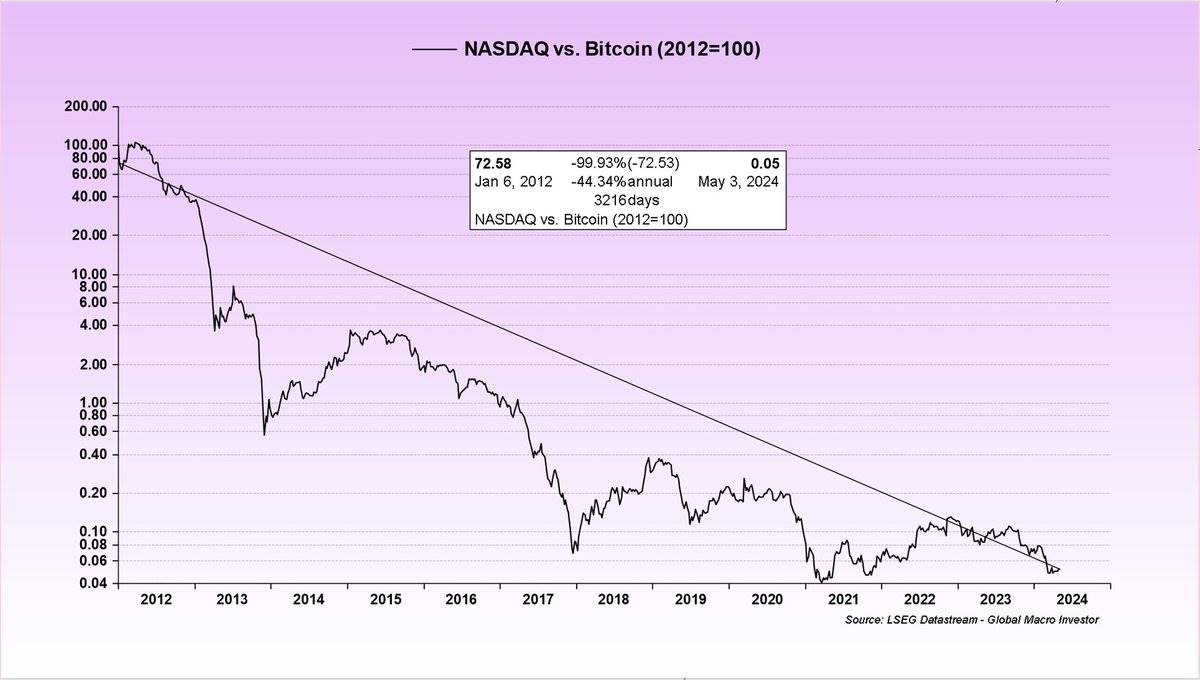

The effect of currency devaluation is to lower the denominator (fiat currency), making asset prices visually appear to appreciate. Here is the performance of the Nasdaq Index (NDX) and Bitcoin (BTC):

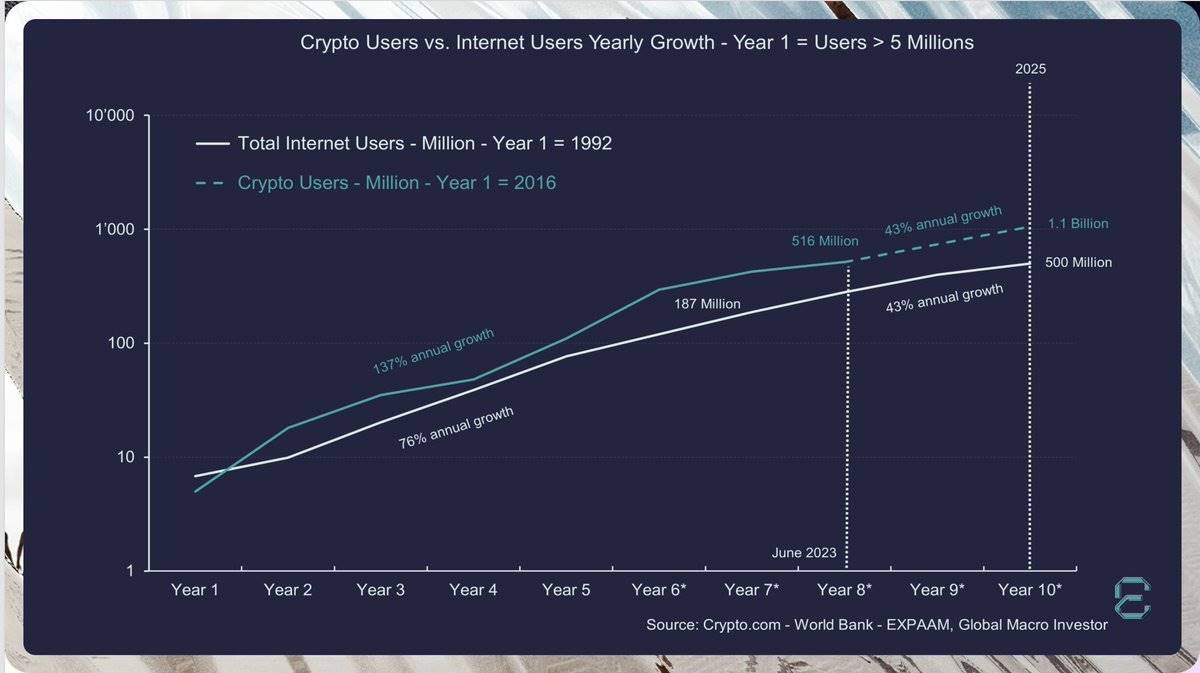

Growth assets (technology and cryptocurrencies) perform the best because they are in a secular trend based on adoption (Metcalfes Law).

Growth assets (technology and cryptocurrencies) perform the best because they are in a long-term trend based on adoption (Metcalfes Law).

This is twice the speed of internet application adoption (comparing active wallets to IP addresses, although not perfect, it is a comparable measure).

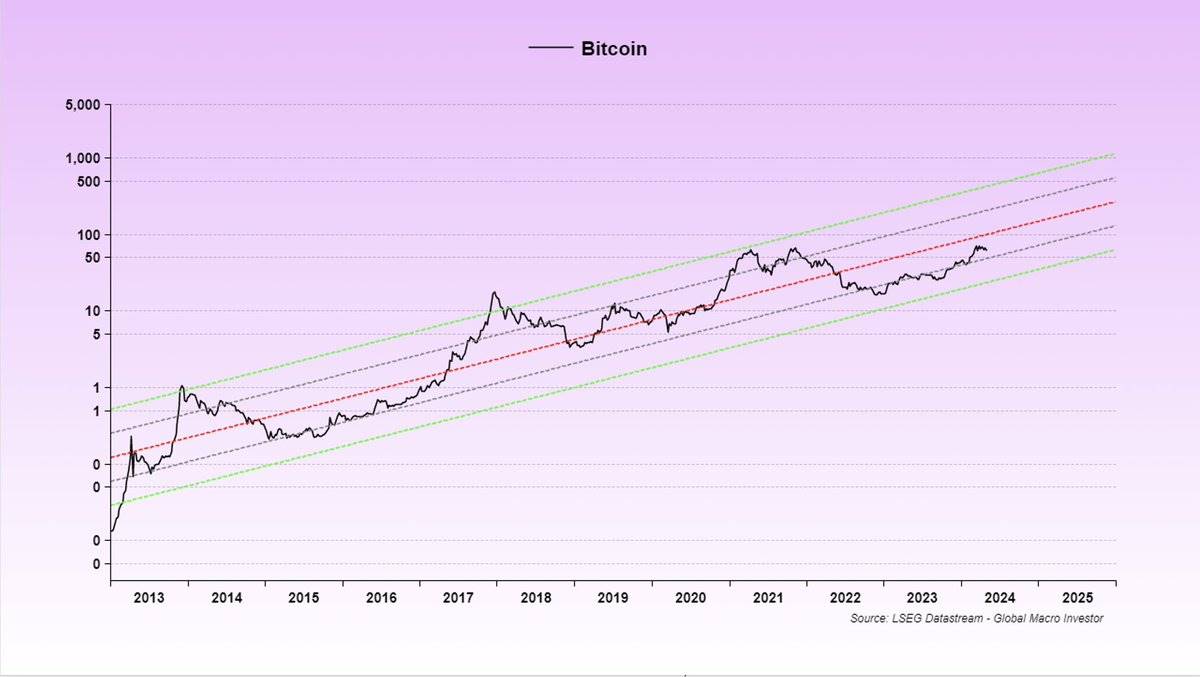

In the long run, it looks like this. I believe this is the adoption curve that has led the cryptocurrency market cap to grow from $250 billion to $1 trillion.

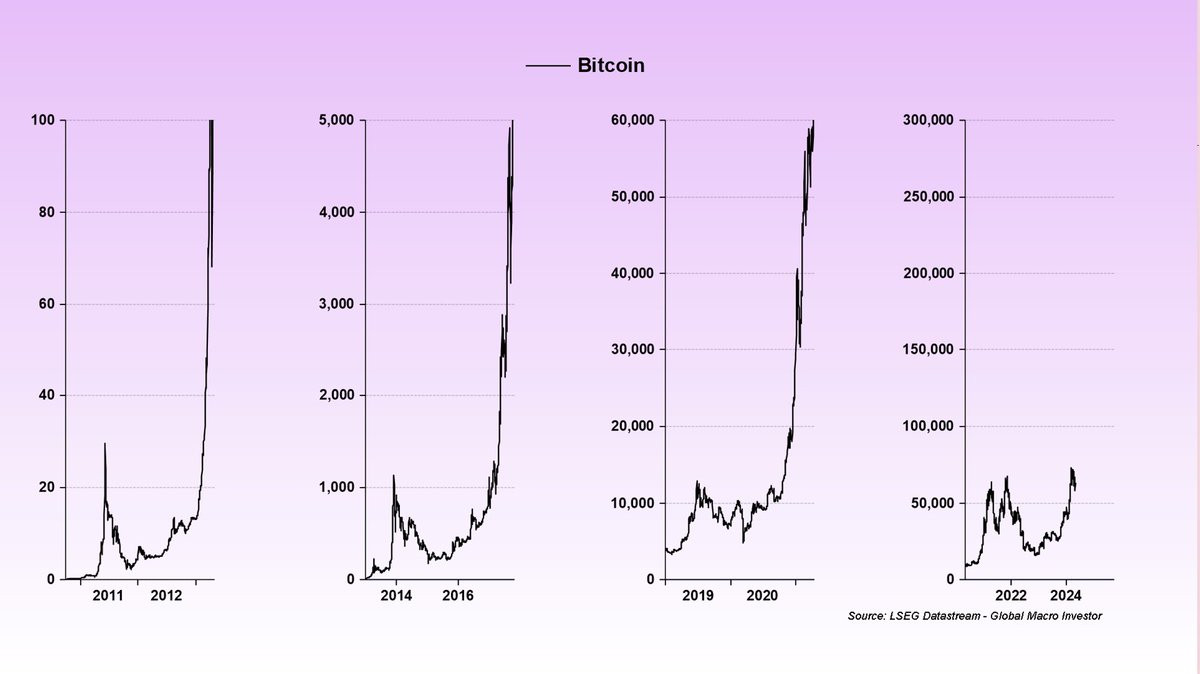

Returning to the banana zone, in the macro summer and autumn, tech stocks perform very well, having their own small banana zone, with autumn being the most significant.

But because cryptocurrencies have outperformed tech stocks, the banana zone is more significant in cryptocurrencies.

Due to the repetitive cycle, the transition to the macro summer is relatively predictable, once again emphasizing "The Everything Code."

This guides the growth of liquidity.

At the same time, the growth of liquidity also tends to create new banana zones in the cryptocurrency market.

Due to current debt rollovers, elections, and global issues such as China, the likelihood of significant changes in this situation is low. However, nothing is perfect, and we cannot determine the structure or nature of the last part of autumn, whether it will be an explosive rise or a stagnant period.

Ah, the mystery of the market… You can't always get what you want. But "The Everything Code" is the best framework for understanding all of this, and I believe it has a fairly high probability. But there will also be surprises along the way (sharp corrections, long periods of sideways markets, and so on).

The mystery of the market is that you can't always get what you want. But "The Everything Code" is the best framework for understanding all of this, and I believe it has a fairly high probability. But there will also be surprises along the way (sharp corrections, long periods of sideways markets, and so on).

However, if you have the correct time perspective, proper investment portfolio management, and enough patience, the likelihood of messing up will be very low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。