《The Harvest》 — — Camille Pissarro

导语:

美联储主席鲍威尔暗示短期内不太可能加息,全球风险资产市场出现普涨行情。另外,随着美国非农数据低于预期,或让美联储降息道路从漫步转为冲刺,将促使股市、加密货币和债券大涨,美元、黄金和原油走弱。

1、投融资观察

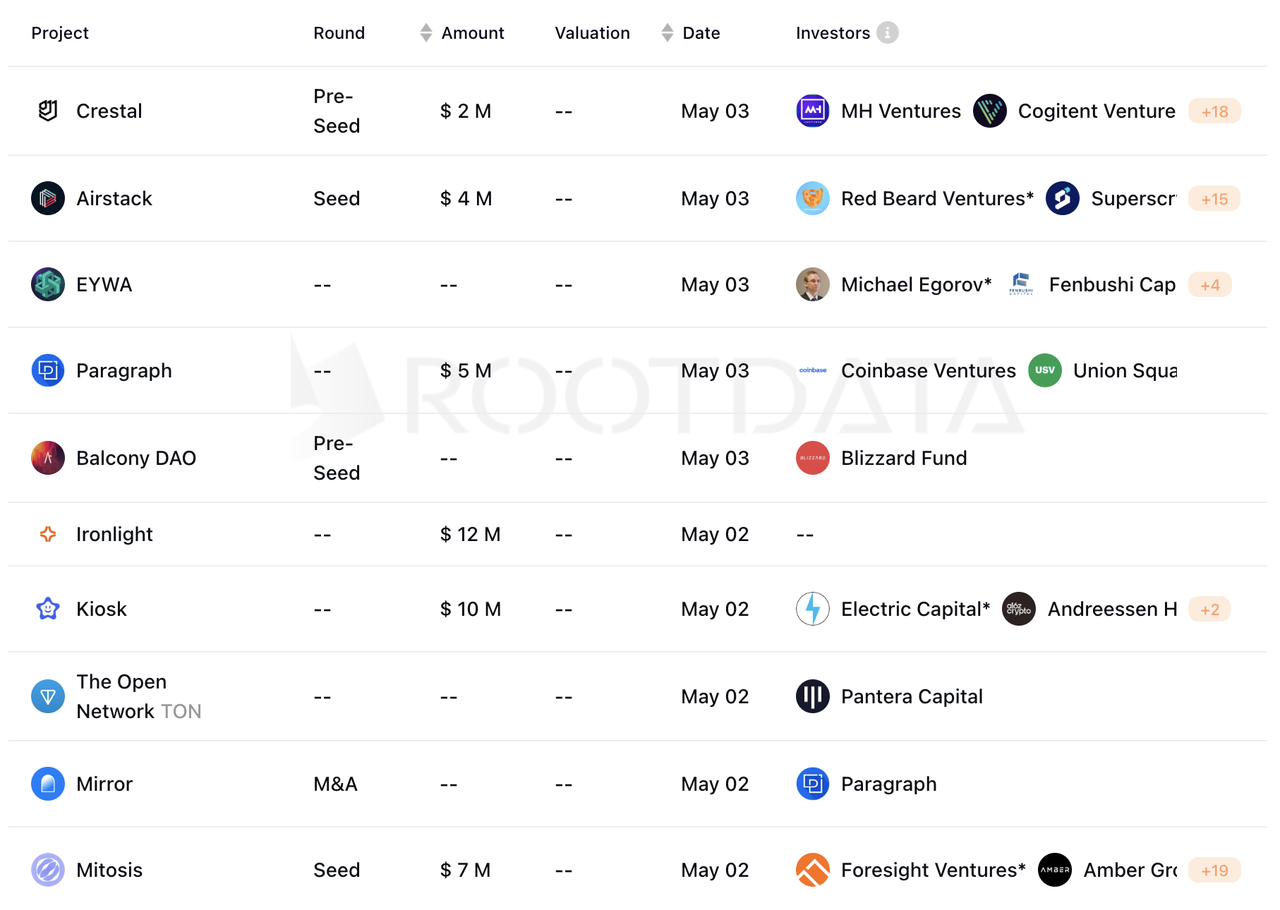

上周,加密市场共发生32笔投融资事件,环比上升10.34%,资金总规模1.5亿美元,环比下降27.18%:

DeFi方面公布9起投融资,其中RWA公司 Securitize 宣布成功完成4700万美元战略融资,贝莱德领投;Ironlight 则完成1200万美元融资,大部分投资则来自于华尔街背景的个人投资者;

CeFi领域公布1起融资,散户合约交易平台 LazyBear宣布完成400万枚USDT战略融资,参与的投资者和战略合作伙伴包括 Gogeko Labs、DWF Labs等;

GameFi赛道公布6起投融资,其中瑞典游戏工作室 Patriots Division为Web3 游戏Shadow War筹集500万美元;

基础设施与工具赛道公布5起投融资,其中模块化流动性协议 Mitosis 宣布完成700万美元融资,Amber Group与Foresight Ventures领投;

AI相关领域公布1起投融资,Web3 开发者平台 Airstack 完成 400 万美元种子轮融资,Red Beard Ventures 领投;

其他Web3/加密应用公布7起融资,其中Web3 内容发布平台 Paragraph 完成 500 万美元融资,USV、Coinbase Ventures 参投;

从环比数据看,上周加密货币市场投融笔数有所上升,但资金总规模显著下滑,市场热度押注 RWA、GameFi 和 Web3 领域;在VC中,本周明显活跃机构为贝莱德、Electric Capital,主要聚焦资管和 SocialFi 领域。

另据Rootdata数据,4月份加密市场总融资额为10.25亿美元,3月的10.94亿美元环比下降6.3%,融资数量环比下降10.5%。以赛道融资总额来看,前三的赛道分别是CeFi、DeFi和工具&信息服务。

关于Securitize

Securitize 本身是一家数字资产证券公司,其使命是为股东提供投资和交易另类投资的机会,并为公司筹集资金、管理股东并为股东提供潜在的流动性。 Securitize 开创了一个完全数字化的一体化RWA平台,用于发行、管理和交易数字资产证券,符合美国现有的监管框架,拥有超过 120 万投资者和 3,000 家企业的社区。

关于Ironlight

Ironlight 由 Rob McGrath 和 Matt Celebuski 创立,旨在将房地产、自然资源、美术、公共基础设施和私募股权等通常缺乏流动性的私人证券代币化,其目标是成为一个受美 SEC 监管的代币化RWA市场。

关于Kiosk

SocialFi 项目 Kiosk 是一个 Farcaster 客户端,可以帮助创作者能够在应用内建立一个从0到1的社区。创作者们可以与社交图谱分享媒体丰富的想法,使其可作为 NFT 铸造,在渠道中聚集志同道合的收藏家和合作者,建立自定义渠道经济,例如小费和分销,并与社区他们聊天 — — 所有这些都在Kiosk应用程序中完成。

2、行业数据

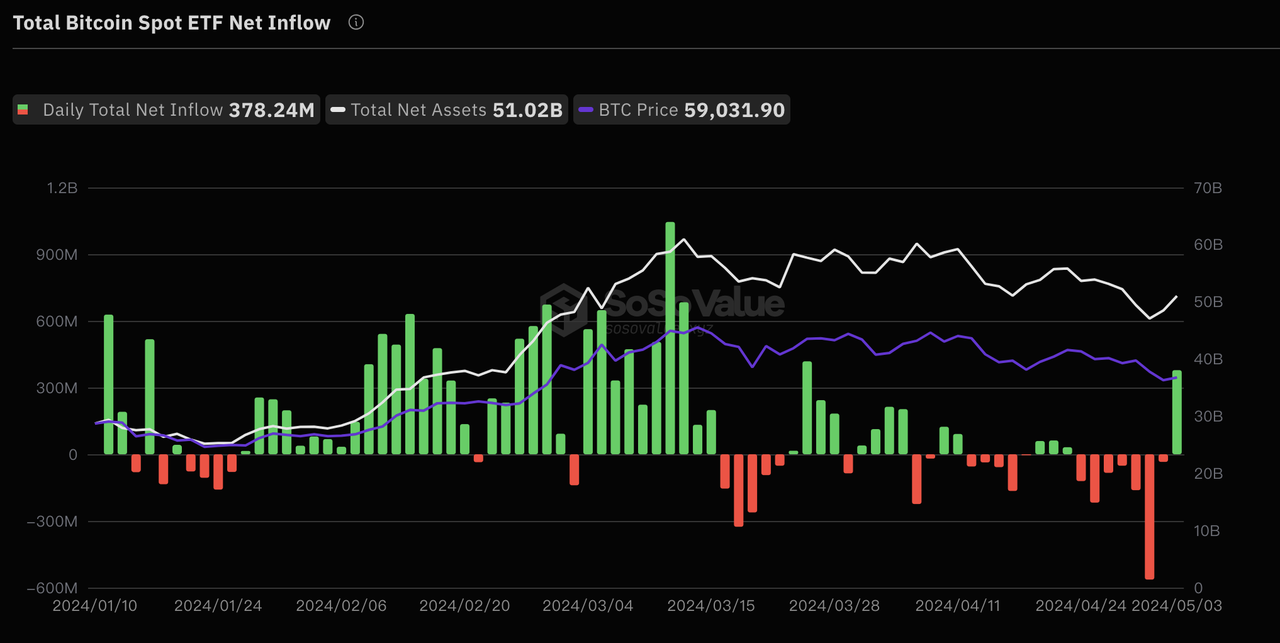

连续7日净流出后,美国BTC现货ETF首次净流入

SoSoValue 数据:美国东部时间 5月3日,BTC现货ETF总净流入 3.78 亿美元,为过去7日净流出后首次净流入,其中,富达(Fidelity) FBTC,单日净流入最高,为 1.03 亿美元,目前 FBTC历史总净流入达 80.30 亿美元。

美国BTC现货ETF上市后,其趋势一直与行情动态正相关,随着ETF正向净流入,近几日的行情趋势也开始出现小幅反弹回升。另外,后续一周ETF净流入趋势大概率加强,但GBTC净流入数值依然不高,继续流入规模可能不大。

目前,BTC 现货 ETF 总资产净值为 510.21 亿美元,ETF 净资产比率(市值较比特币总市值占比)达 4.12%,历史累计净流入已达 115.61 亿美元。

香港ETF资管规模超20亿港元,但不及预期

香港交易所官方数据:截至5月3日收市,华夏、嘉实、博时HashKey三家香港现货虚拟资产ETF上市首周资管规模达到了21.3069亿港元(约2.55亿美元),是虚拟资产期货ETF约11.92亿港元资产管理规模的近两倍,其中:

- BTC现货ETF总交易额2,751万美元,BTC现货持有总量4,220枚BTC,总净资产2.5亿美元;

- ETH现货ETF总交易额492万美元,ETH现货持有总量16,280枚ETF,总净资产4,852万美元;

这一数据与香港ETF获批后的市场预期有明显偏差,但对比加拿大ETF和英国ETN等数据则显得相对合理,我们需要更理性的看待和评估香港的市场规模和影响力,并持续关注其政策动态。

香港现货ETF数据:

博时HashKey比特币ETF资管规模为4.4722亿港元,以太币ETF资管规模为9082万港元;

嘉实比特币ETF资管规模为4.4939亿港元,以太币ETF资管规模为 8987万港元;

华夏比特币ETF资管规模为 9.0449亿港元,以太币ETF资管规模为1.489亿港元,总额已超过10亿港元;

香港期货ETF数据:

三星BTC期货ETF资管规模约为1.3512亿港元;

南方东英比特币ETF约为8.489亿港元;

南方东英方以太币ETF约为2.0806亿港元;

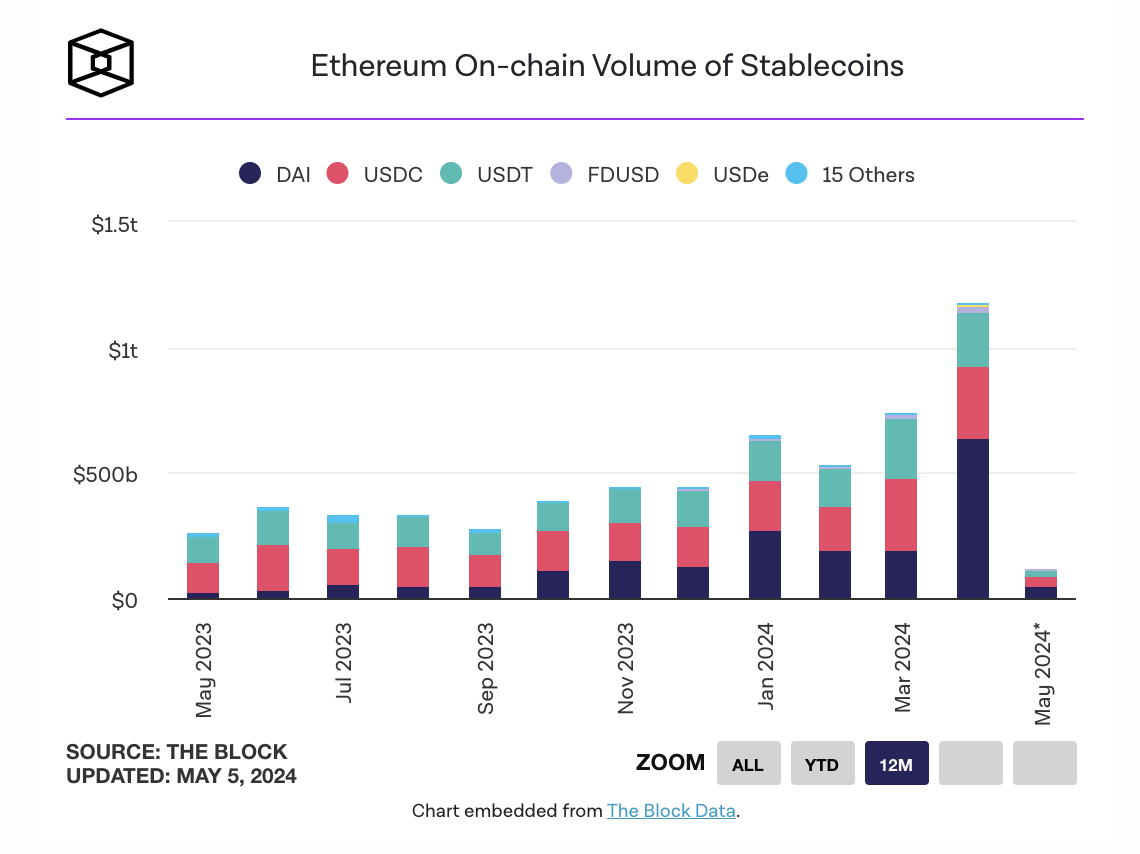

ETH稳定币交易量打破月度纪录

据The Block报道:过去3个月,ETH上稳定币的月交易量持续增长,并在4月份创月度交易量新高。其中,FDUSD更是创下最佳月度记录。

事实上,这一数据的贡献很多来自于DAI在MEV交易中的闪贷使用,大量DAI在单次交易中铸造并返还,大大拉升了DAI的交易量数据,但即便排除闪贷,稳定币交易量仍表现出色,侧面说明了ETH生态应用的活跃正在稳步上升。

关于DAI的交易数据:

根据The Block的数据,DAI在四月份的交易量高达6360亿美元,占以太坊稳定币总链上交易量的主要部分,当月总交易量接近1.2万亿美元。与三月份相比,DAI在四月份的交易量增长了三倍多。

同时,DAI的供应量也自3月7日起增长约10亿美元,使当前总供应量达到54.4亿。尽管其他稳定币交易量也有所增加,但DAI在总稳定币供应量中的份额在此期间略有上升。

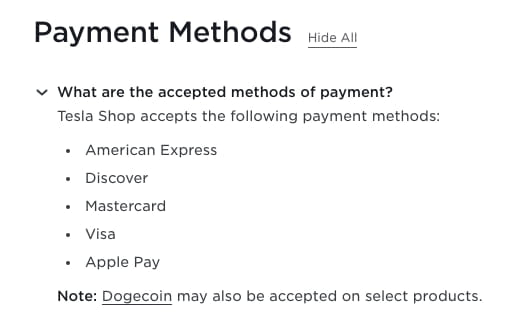

特斯拉新增DOGE支付,DOGE涨幅超20%

特斯拉网站信息:其部分产品支持使用Dogecoin支付,此类产品将在订单按钮旁边显示Dogecoin符号,买家只需Dogecoin转移到特斯拉Dogecoin钱包并付款即可。此消息传出后,据CoinGecko数据,DOGE飙升超过 20%,突破了 0.168 美元的水平,目前报价$0.162。

虽然特斯拉开放Dogecoin支付筹备已久,但这次落地实施依然代表了加密行业与传统市场的进一步融合,通过特斯拉的全球影响力,让更多人开始感知并接触到加密资产。

据Wayback Machine回溯,该特斯拉官网“付款、结账和定价”页面最近一次快照发生在今年2月28日,而Dogecoin常见问题解答页面在2022年1月便已经存在。

另外,特斯拉官网目前支持使用Dogecoin购买的商品并不包含特斯拉汽车,而主要是服饰、玩具等小型周边产品,比如儿童电动四轮车、帽子、不锈钢口哨和纪念款皮带扣等,且这些商品都没有在中国官方渠道销售。

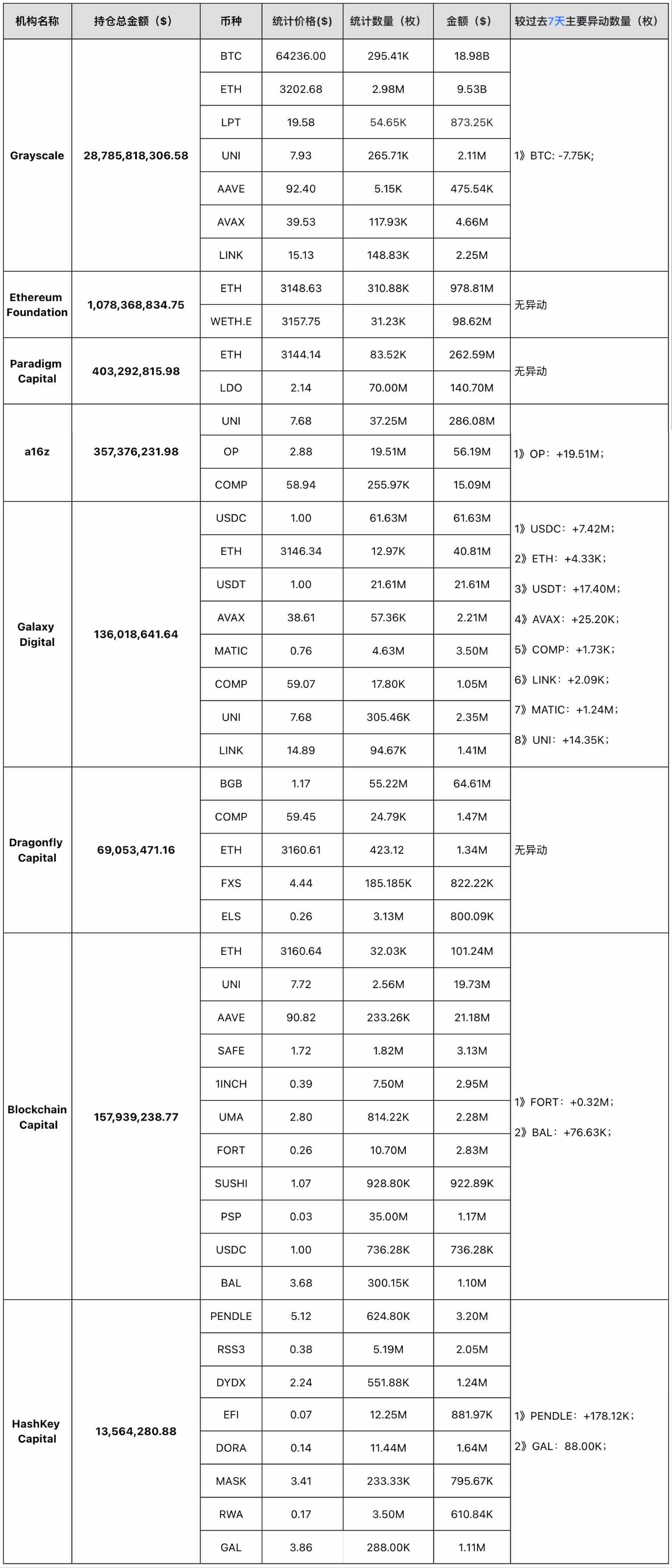

3、VC持仓

备注:以上数据来源https://platform.arkhamintelligence.com/,统计时间:2024年05月06日18:00(UTC+8)。

4、本周关注

5月7日

- FOMC票委、里奇蒙德联储主席巴尔金就经济前景发表讲话;

- FOMC永久票委、纽约联储主席威廉姆斯发表讲话;

- 基于 OP Stack 构建的 L2 网络Mode推出治理代币 MODE,总供应量为 100 亿枚;

- 由TRON 联合 HTX DAO、BitTorrent Chain 和 JustLend DAO 举办的黑客松提交阶段持续至5月7日;

- UTXO Management 主办的 Bitcoin Devcon 于5月7日至8日在香港科技园举办;

5月8日

- 美国当周EIA原油库存数据;

- 美联储副主席杰斐逊就经济发表讲话;

- FT Crypto & Digital Assets Summit 峰会;

5月9日

- 美国当周申请失业金人数;

- 英国央行利率调整决定公布;

- 比特币峰会 (Bitcoin Asia) 于 5 月 9 日至 10 日在香港举办;

5月10日

- 美国一年期通胀率预期;

- 美国密歇根大学消费者信心指数;

- 美联储理事鲍曼就金融稳定风险发表讲话;

- EigenLayer 拟于5月10日开启代币申领,根据 2024年3月15日活动快照,发放 5% 代币供应量;

- Biconomy向BICO质押者空投ARB,申领将于本日截止;

- Kraken 将在爱尔兰和比利时市场下架隐私币 Monero(XMR),5月10日起停止接受存款;

5月11日

- 美联储理事巴尔发表讲话;

- 中国4月CPI年率公布;

- Moonbeam(GLMR)将解锁约 304 万枚代币,价值约 92 万美元,占流通量的 0.35%;

5月12日

- 去中心化GPU云基础设施 Aethir 空投活动 Aethir Cloud Drop 持续至 5 月 12 日结束;

- Jupiter LFG Launchpad 第二期项目 UpRock 拟于5月12日启动声望证明及TGE事件;

5、结语

上周,加密市场虽然出现局部震荡,但投融资活动的增加则显示出行业内部的活力和长期增长潜力,尤其投资者对于RWA、GameFi和Web3领域的关注增强,让这些领域有可能成为新的市场增长点;同时,BTC和ETH的ETF表现,以及特斯拉支持DOGE支付,都说明了加密资产在更广泛的金融和消费市场中,正在被越来越多的感知和接受。

本周,美国EIA原油库存数据和一年期通胀率预期,英国央行利率调整决定,以及中国CPI年率数据价格陆续公布,它们有可能对后续市场行情走向产生较大影响;而随着美联储减缓缩表速度,虽然通胀隐忧仍在,市场流动性的改善将会逐渐呈现,如果没有极端利空的时间出现,预计整个市场将进入估值修复阶段。

当前的市场,仍然面临许多不确定因素,但长期来看,随着宏观面的改善和利好趋向,以及主流市场接受度的提升,加密市场的潜力将会进一步释放,开启新一轮的行情。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。