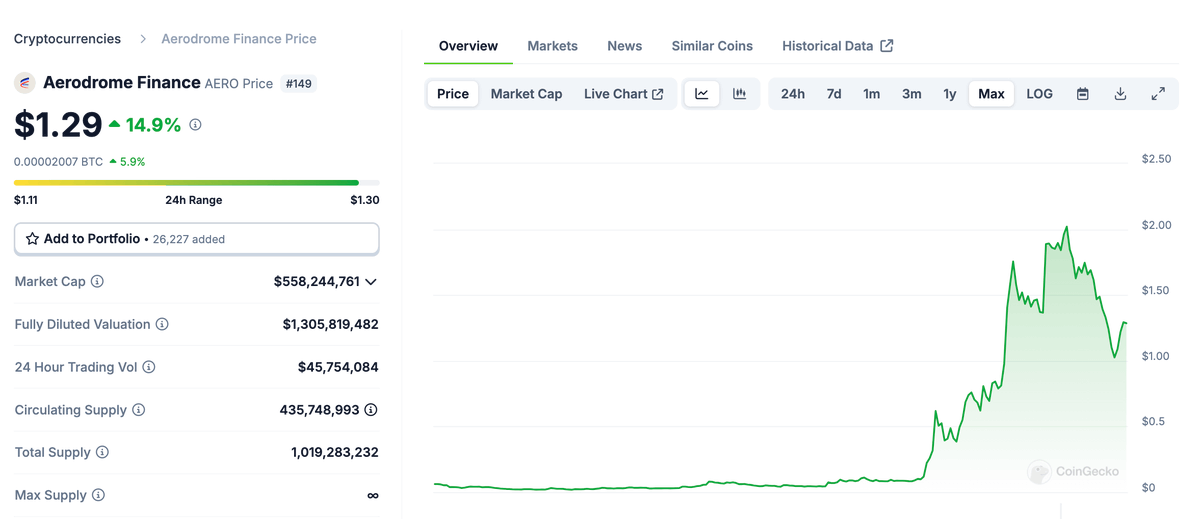

Aerdrome 价格走过一轮,Base 一己之力扶持起巅峰 1B Mcap, 2B FDV 的百倍币,秀出了肌肉,其所带来的正外部性也进一步盘活了 Base 生态

反观 BSC 本轮哪怕靴子落地依然没个响,差距在哪里?本 Thread 将以此为切入点探讨锐评本轮两个 CEX 在链上体现出的差距

Coinbase 拉 Aero 的原因非常简单,如下图所示,以往项目激励 DeFi 矿工,是直接激励,比如价值为 $2 的项目代币,矿工可能额外从 DEX 交易费里面再拿 $1, 一共获得 $3

而在 Aero 这种 Ve(3,3) DEX 体系下,这 $3 被用于向 veAero 贿赂,veAERO 投票分配 $Aero 代币 ( 价值更高,比如 $9) 给矿工

最后项目方还是付出 $3,veAero (Aero 锁仓)获得了 $3 的真实收益,矿工拿到了 $9 的激励,激励也翻倍了

Aero 价格越高发出去的激励价值越高,Base 生态项目所能享受的激励也就越高,生态项目基本面随之也增强,能拿出来给 Aero 的贿赂代币价值也越高,Aero 收入也越高价格也更看好形成飞轮

此外如果 Base 直接激励链上项目,一方面容易变成链下搞关系,另一方面也不好公开激励那些土狗和 Meme 项目,而这些项目有流量,通过扶持 Aero,就是对链上生态实现 permissionless 激励,因为任何项目都可以通过 Aero 来进一步放大激励效果,这种搞法给普通开发者带来的收益是官方激励不能比拟的

回头来看 BSC,有没有类似的产品,不但有,并且开发者和产品层面上都可以说比 Base 强了一档

Thena 算的上是 Aerodrome 加强版,支持 V3 集中流动性

Pancake + Cakepie 双轮驱动更是可以发挥更强的飞轮效应,天花板更高

虽然当年我们吐槽了 Cake War 组织远不如 Pendle War ( 涉嫌自吹自擂 ),后续 Pancake 的迭代也比较慢迟迟让飞轮没有搭建完毕,加上不学先进的 ve(3,3) 交易费给 voter 反而去拿了一小半投票权在团队手里手动干预(权力的滋味,谁又舍得放手)

但是横向比较下,比上虽不足但比下却绰绰有余了,比如 ARB 扛把子 Camelot ,都喊了一年还是没上 voting gauge 投票分配激励

Cakepie/Magpie 团队能力在 BSC 十分罕见, 在其他链上 subDAO 也很成功。Thena 这边虽然还没在其他链证明自己,但从产品上看,也比 Velo/Aero 系也更快更好

既然 BSC 上这块产品和开发者底子更好,为什么完全没有拿到 Base 类似的结果?甚至这一轮 Mantle 的 ve(3,3) DEX Moe 都能搞出点水花 BSC 都不能?

只要你稍加研究,就会惊奇的发现,币安对这块的支持不是零而是负的... 是负的...

是的,一方面上述项目没有得到 Aero 这样的投资和上币的相关支持,另一方面明牌被标记为币安的地址和另一个疑似币安的地址(Cake 社区推断)共计锁定了 26% 的 veCAKE,直接与生态项目争利。毕竟每轮的分红和激励是有限的,币安手里的多了生态项目手里的就少了

投票权 Pancake 团队拿一小半,剩下币安又来拿一小半,效果一下子就大打折扣。 一般做这个都是注入到生态项目给扶持,到这里既不扶持生态还直接去跟生态抢钱,币安应该不缺这点 Pancake 的收入分红吧...

ve(3,3) 难于理解吗,但上一轮无论是 AC 创立的 Yearn 和 Convex 之间的 Curve War,还是 Terra/Luna 买入 CVX 控制 Curve 治理以扶持 UST,都是焦点战役,这个对于资深 Web3 玩家来说可以说是基本常识

本轮的百倍币 Pendle 和 Aero,也都采用了这个模式,就连 Cake 也靠这个才止跌反弹

币安在 BSC 上投入的资源是不是去了更好的项目? NFP/ Cyber/ID/ Hook 这些获得投资 + 上币加持的 BSC 项目跟 Aero 相比有什么差距?

抛开早被吐槽烂的项目质量不谈,这些项目缺乏正外部性,较为孤立,CB 给 Aero 一分钱变三分生态激励,币安十分钱直接打水漂,还容易对开发者形成逆向筛选

实际上逆向筛选已经在运转了,开发者已经开始跳船

Thena 团队重点放在了 Base 的新项目 IntentX 上, Magpie 新 subDAO 重点也在 ETH 系,虽然 subDAO 最终大块收益将回流到 BSC 上的 MGP 上,但主 DAO 怎么可能长期呆在一个和其他新 subDAO 缺乏协同效应的链上呢?(12/n)

综上所述,主要的差距在于

- Coinbase 将资源重点投入了对 Base 生态有正外部性的项目上,一分钱花出三分效果,资源花在优质开发者上继续吸引优质开发者加入

- 币安将资源投在无正外部性的 BSC 项目上,十分钱打水漂,对于有正外部性的生态项目反而去帮倒忙,显得不懂 web3,导致优质开发者纷纷跳船

本文只是以 ve(3,3) DEX 这一小块为例进行切入说明,但一叶知秋,反应出来的问题是有代表性的

Base 没有单独发币,BNB 靠着频繁上币最近走势也强于大盘,但是这行币价上涨还是得靠想象力,如果能够让链上灵活一点,BNB 的上涨空间才能进一步打开,后续的变化我们会继续评估和观察

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。