Original Author: Delphi Digital

Original Compilation: Luffy, Foresight News

The DeFi lending industry has been in a slump, mainly due to complex multi-asset lending pools and governance-driven project decisions. Our latest report explores the potential of a new type of lending product - modular lending, revealing its characteristics, design, and impact.

Current Status of DeFi Lending

DeFi lending protocols have become active again, with borrowing volume increasing by nearly 250%, from $3.3 billion in the first quarter of 2023 to $11.5 billion in the first quarter of 2024.

At the same time, there is an increasing demand to include more long-tail assets in the collateral whitelist. However, adding new assets significantly increases the risk of the asset pool, hindering lending protocols from supporting more collateral assets.

To manage additional risk, lending protocols need to adopt risk management tools such as deposit/borrowing limits, conservative loan-to-value (LTV) ratios, and high liquidation penalties. Meanwhile, isolated lending pools provide flexibility in asset selection but suffer from liquidity dispersion and low capital efficiency.

DeFi lending is reviving from innovation, shifting from pure "permissionless" lending to "modular" lending. "Modular" lending caters to a broader asset base demand and allows for customized risk exposure.

The core of a modular lending platform includes:

- Base layer handling functionality and logic

- Abstraction and aggregation layers ensuring user-friendly access to protocol functionality without adding complexity

The goal of a modular lending platform is to have base layer primitives with a modular architecture, emphasizing flexibility, adaptability, and encouraging user-centric product innovation.

In the process of transitioning to modular lending, there are two main protocols worth noting: Morpho Labs and Euler Finance.

The unique features of these two protocols will be highlighted below. We delve into the trade-offs, unique features, improvements, and conditions that modular lending needs beyond DeFi money markets.

Morpho

Morpho was initially introduced as an enhancer of lending protocols and has successfully become the third-largest lending platform on Ethereum, with deposits exceeding $1 billion.

Morpho has developed a modular lending market solution consisting of two independent products: Morpho Blue and Meta Morpho.

Amplifying Liquidity with Morpho

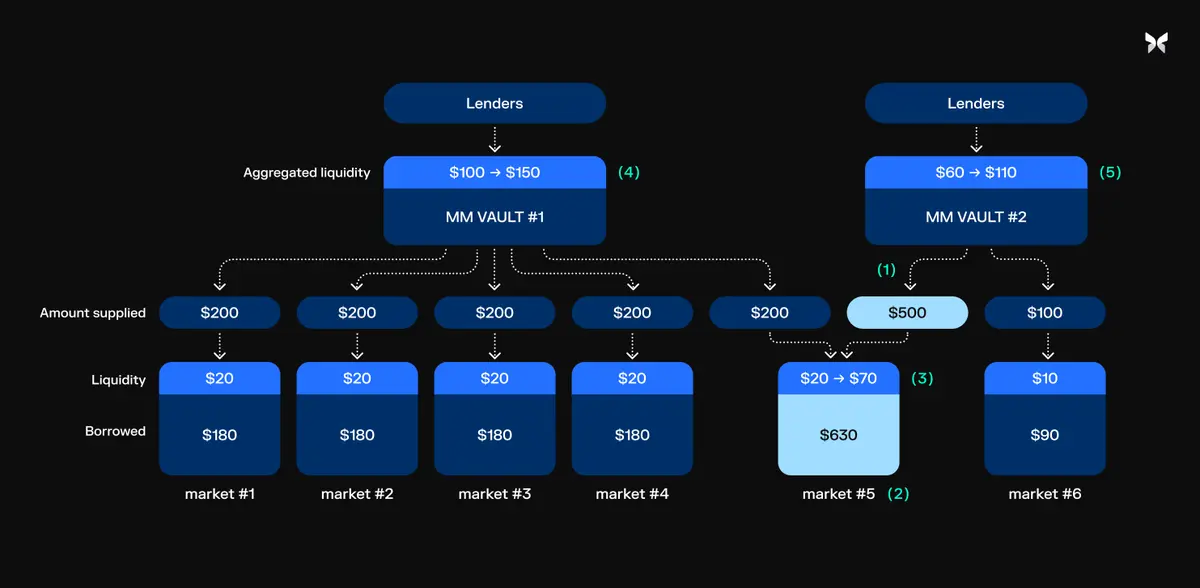

Before Morpho Blue, liquidity dispersion was a major drawback of isolated lending markets. However, the Morpho team addressed this challenge through aggregation at two levels: lending pools and insurance vaults.

Re-aggregating Liquidity

Lending to isolated markets is avoided through the MetaMorpho insurance vault, preventing liquidity dispersion. Liquidity for each market is aggregated at the insurance vault level, providing users with withdrawal liquidity comparable to a multi-asset lending pool while maintaining market independence.

Shared mode expands liquidity beyond lending pools

The Meta Morpho insurance vault enhances the liquidity position of lenders, surpassing that of a single lending pool. Liquidity from each vault is concentrated on Morpho Blue, benefiting anyone lending to the same market.

The insurance vault significantly enhances the liquidity of lenders. As deposits aggregate on Blue, subsequent users depositing funds into the same market increase the withdrawal funds for users and their insurance vaults, releasing additional liquidity.

Euler

Euler V1 changed DeFi lending by supporting non-mainstream tokens and permissionless platforms. However, it was phased out due to losses exceeding $195 million from a flash loan attack in 2023.

Euler V2 is a more adaptable modular lending primitive, including:

(1) Euler Vault Kit (EVK): Allows for permissionless deployment and customization of lending insurance vaults.

(2) Ethereum Vault Connector (EVC): Enables insurance vaults to connect and interact, enhancing flexibility and functionality.

Euler V2 is set to be launched this year, and we are curious how long it will take for it to establish a foothold in the competitive DeFi lending market.

Below is an overview of use cases for Euler V2, focusing on the unique DeFi products that can be achieved with its modular architecture.

Morpho vs. Euler

Comparing Morpho and Euler reveals their main differences, which are the result of different design choices. Both projects have designed mechanisms to achieve similar end goals, such as lower liquidation penalties, easier reward distribution, and bad debt accounting.

Morpho's solution is limited to isolated lending markets, a single liquidation mechanism, and is primarily used for ERC-20 token lending.

In contrast, Euler V2 supports lending with multi-asset pools, allows for custom liquidation logic, and aims to be the base layer for lending all types of fungible and non-fungible tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。