Title: Article: TardFiWhale.eth

Compiled by: Frank, Foresight News

First of all, the idea of tokenizing the funding fees of perpetual contracts for CEX (and possibly DEX in the future) by Ethena is very interesting, and I support it.

In addition, considering the transparency of Ethena and the time it takes to bring down Ethena, those who are currently attacking Ethena due to negative funding rates are obviously misleading - although negative funding rates do pose some risks, they may not be significant compared to the undisclosed risks that Ethena currently faces.

In short, after conducting due diligence (a foreign concept for most cryptocurrency investors), I first disclosed on March 15th that Ethena has a critical vulnerability that will inevitably lead to its overall collapse, causing significant losses to investors due to undisclosed risks.

Furthermore, by adding BTC perpetual contract trading pairs in early April, Ethena significantly increased the complexity of the protocol. How do they decide which assets to deliver when creating/redeeming? How do they manage risks and balance returns between these different products? Many questions still remain unanswered.

I suspect I may be the only one who knows about this critical vulnerability, although Ethena's market makers may also be aware. However, at present, they hold shares in Ethena (such as Wintermute, Selini, etc.), for example, Evgeny's statement about how they short UST/LUNA but are still "partners" with Terra/Do Kwon.

It should be clarified that I am not saying that these market makers have done anything wrong, after all, they are just pursuing profit maximization, so what else can we expect?

Now, I will show you how Ethena misleads the public by promoting itself as a synthetic dollar (also known as a stablecoin) - the purpose is actually just to boost the price of their tokens, driven by the high demand for decentralized stablecoins in the market.

Ethena: Structured Investment Products Priced in Dollars

In fact, Ethena is a structured investment product (SIP) priced in dollars, consisting of two tiers, let's analyze in detail:

- Subordinated sUSDe, which can proportionally share the earnings from SIP and has a 7-day unlocking period, and can be exchanged for the higher-level USDe;

- Priority USDe, which can be instantly exchanged at a 1:1 ratio for dollars (for simplicity, I have ignored the intermediary role of market makers and asset exchanges, there are other issues in this regard, I can write several pages on this), but USDe cannot earn SIP income, these earnings flow into Ethena's treasury;

Therefore, if you hold USDe, you actually hold a priority debt of SIP that does not generate any income, with no upside potential, only downside risk.

Have you heard of anyone buying non-income-generating corporate bonds in traditional finance? Users hold USDe only because Ethena incentivizes through ENA token rewards, essentially selling ENA tokens in the background, and then promoting it as protocol revenue.

Now, Ethena is following Do Kwon's routine, boasting about how it has withstood the "stress test" to gain public trust, and they have also attracted 6 billion DAI from MakerDAO, with more funds to come.

It should be noted that MakerDAO decision-makers have not disclosed whether they have personal interests in Ethena (which is likely), and they no longer pretend to be decentralized.

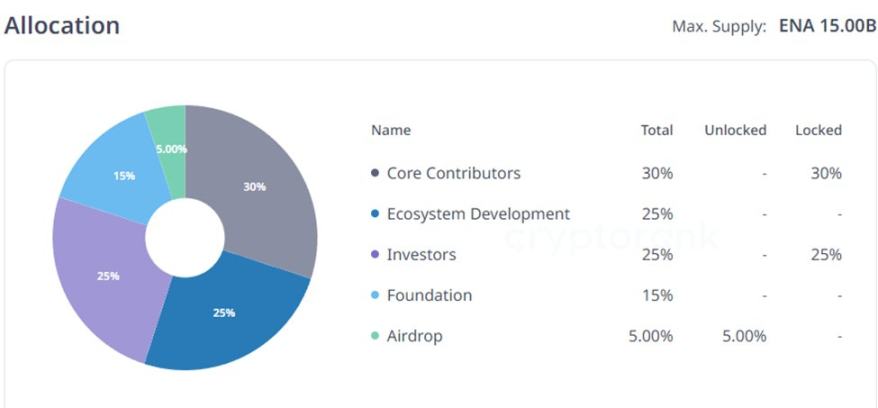

At the same time, Ethena itself is far from decentralized: 55% of the tokens are allocated to founders and investors, not including the foundation and ecosystem development parts controlled and decided by the team.

With a fully diluted market value of 13 billion dollars, they will continue to try to raise the total locked value (TVL) after the 1-year lock-up period ends, and then profit by selling tokens.

Ethena's Smoke and Mirrors?

How did they achieve a TVL of 24 billion dollars? To a large extent, it was achieved through deceptive marketing and incentivizing KOLs to recommend their products.

For those who think they can avoid the U.S. judicial system when Ethena collapses in the future, please refer to Do Kwon's recent conviction case, and please note that the U.S. is not the only country that can take action against those who cause investors to suffer huge losses through deception and misleading advertisements.

Throughout the entire cryptocurrency bull market, my intuition has been on high alert as various fraudulent activities have occurred. When Martin Shkreli does his best to imitate ZachXBT, it means that scammers are now rampant in the cryptocurrency field, and Ethena is currently at the top of the list of projects that are about to cause the most severe losses to investors.

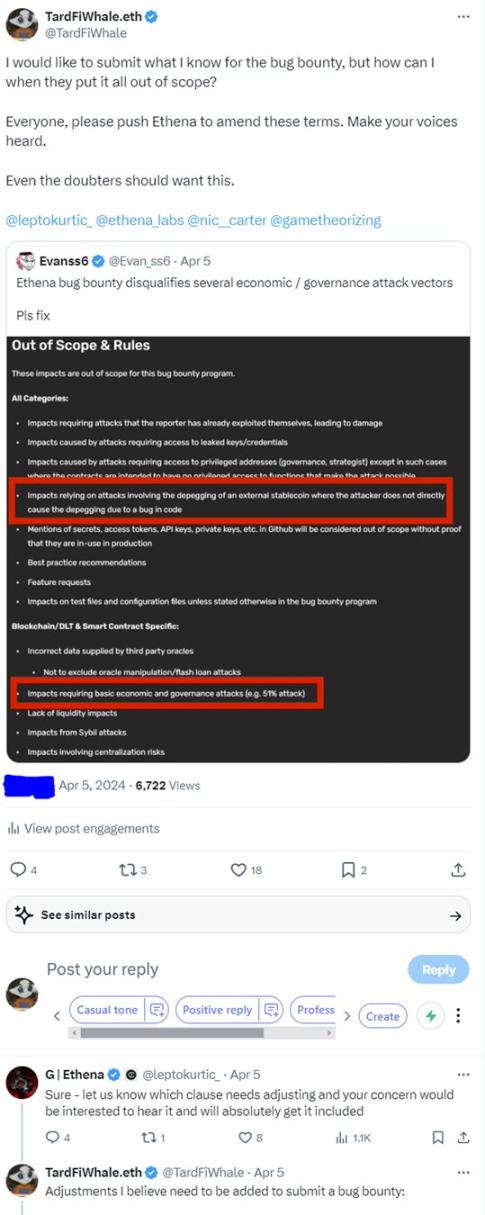

It is worth noting that after the token generation event (TGE), Ethena launched a bug bounty program with a maximum reward of 3 million dollars. However, they have restricted the wording very narrowly to exclude what I have said, and their founder Guy responded that they would adjust the wording weeks ago, but has since remained silent.

When the TVL reaches 13 billion dollars and insiders hold 55% of the tokens, they have ample motivation to maintain this scam. Can you imagine someone with a six-figure salary from a hedge fund turning into a billionaire? I don't believe the Ethena team has any intention of modifying the bug bounty terms, their motive is simple, to cash out and profit.

The bug bounty program is just a huge smokescreen, so I will make things simpler by publicly disclosing all of this and holding Ethena accountable for all of you.

$1 Million Bug Bounty Offer

I will fully disclose Ethena's fatal flaw and its fix (yes, it can be fixed), but on the condition that at least 1 million dollars is donated to the following known non-sanctioned entities, including:

- 50% to the Ethereum core developer organization Protocol Guild;

- 25% to on-chain detective ZachXBT;

- 25% to Roman S and Alexey Pertsev who support legal defense for crypto cases or DeFi Education Fund;

I will not handle any funds, all donations can be made after evaluating my disclosure, I just need public confirmation from Ethena or its founder @leptokurtic_ that I am willing to disclose to the Ethena team privately first.

I will give them a week before publicly disclosing, but will also respect any reasonable request for an extension to negotiate and resolve the issue. If my information is important, I suggest the public urge them to reward according to the bug bounty program's 3 million dollar reward.

Once Ethena's TVL exceeds 30 billion dollars, my offer will be void, I will not give them unlimited free choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。