Author: Rooter, Founder of Solend

Translation: Felix, PANews

Recently, controversy arose in the crypto community due to the "centralization" of Renzo's token economics, leading to a large-scale sell-off of Renzo LRT token ezETH, causing it to become unanchored. Rooter, the founder of Solend, addressed this issue on the X platform and made a statement about the event. The following is the full content:

This is not a black swan event, nor is it a tail event. In this regard, it is common for LST to become unanchored, and it happens almost every few weeks. The following will introduce the ins and outs of this event, why good trades can turn bad, and how to deal with LST risks.

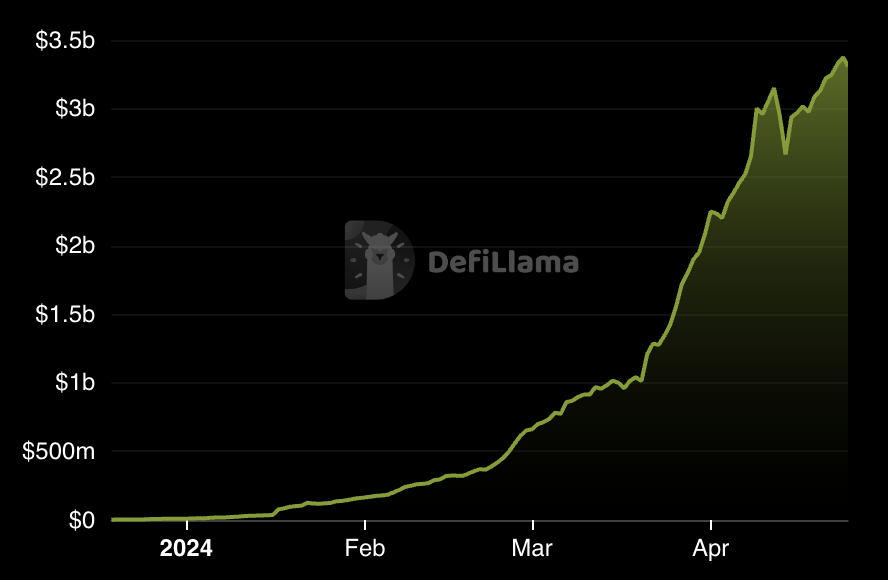

ezETH is the liquidity re-collateralization token (LRT) of Renzo Protocol and also acts as a "magnet" for rewards, allowing miners to accumulate rewards. Within just 4 months, Renzo's TVL has grown from 0 to 30 billion USD.

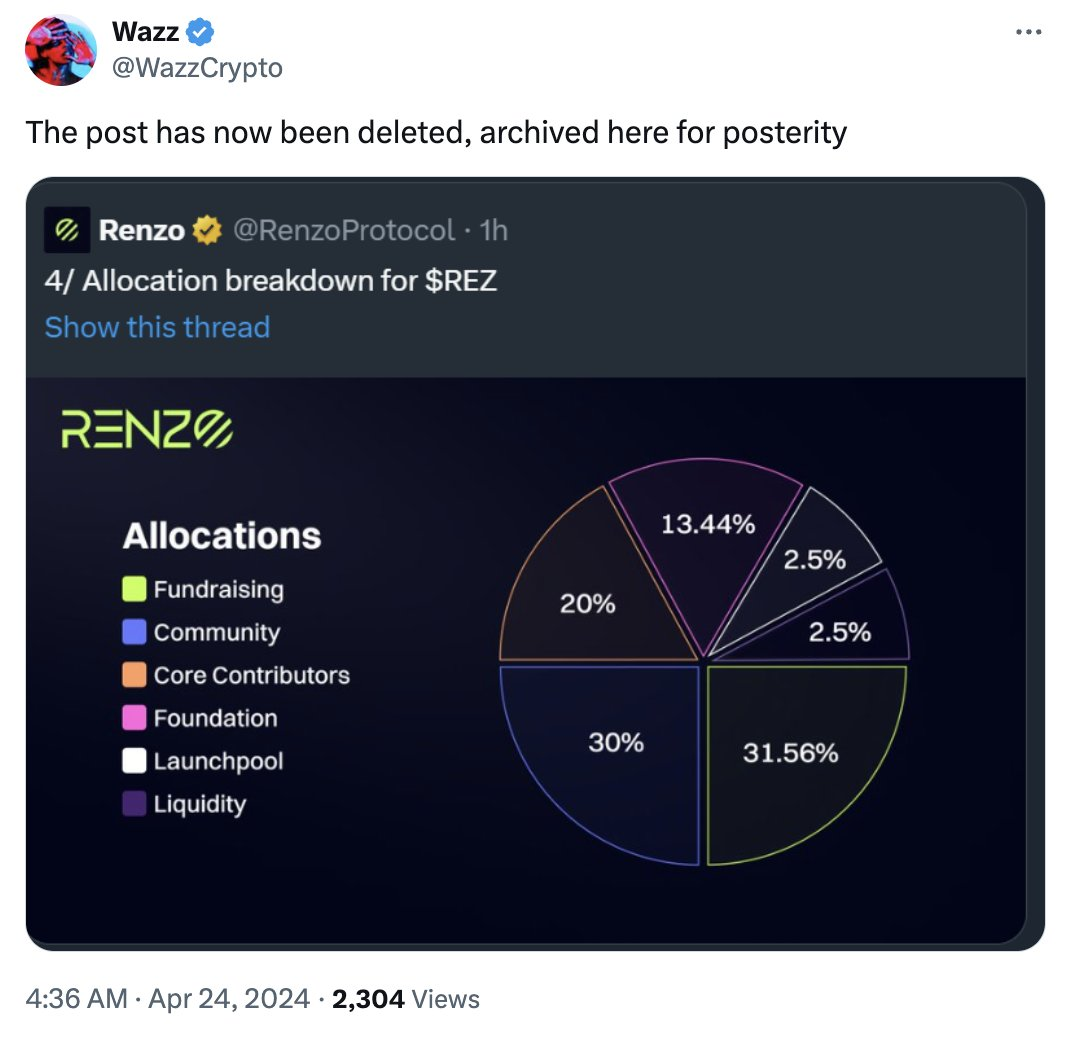

Due to strong doubts in the market about its token economics, ezETH became unpegged. Since ezETH cannot be redeemed yet, low-risk arbitrage cannot be used to restore the peg.

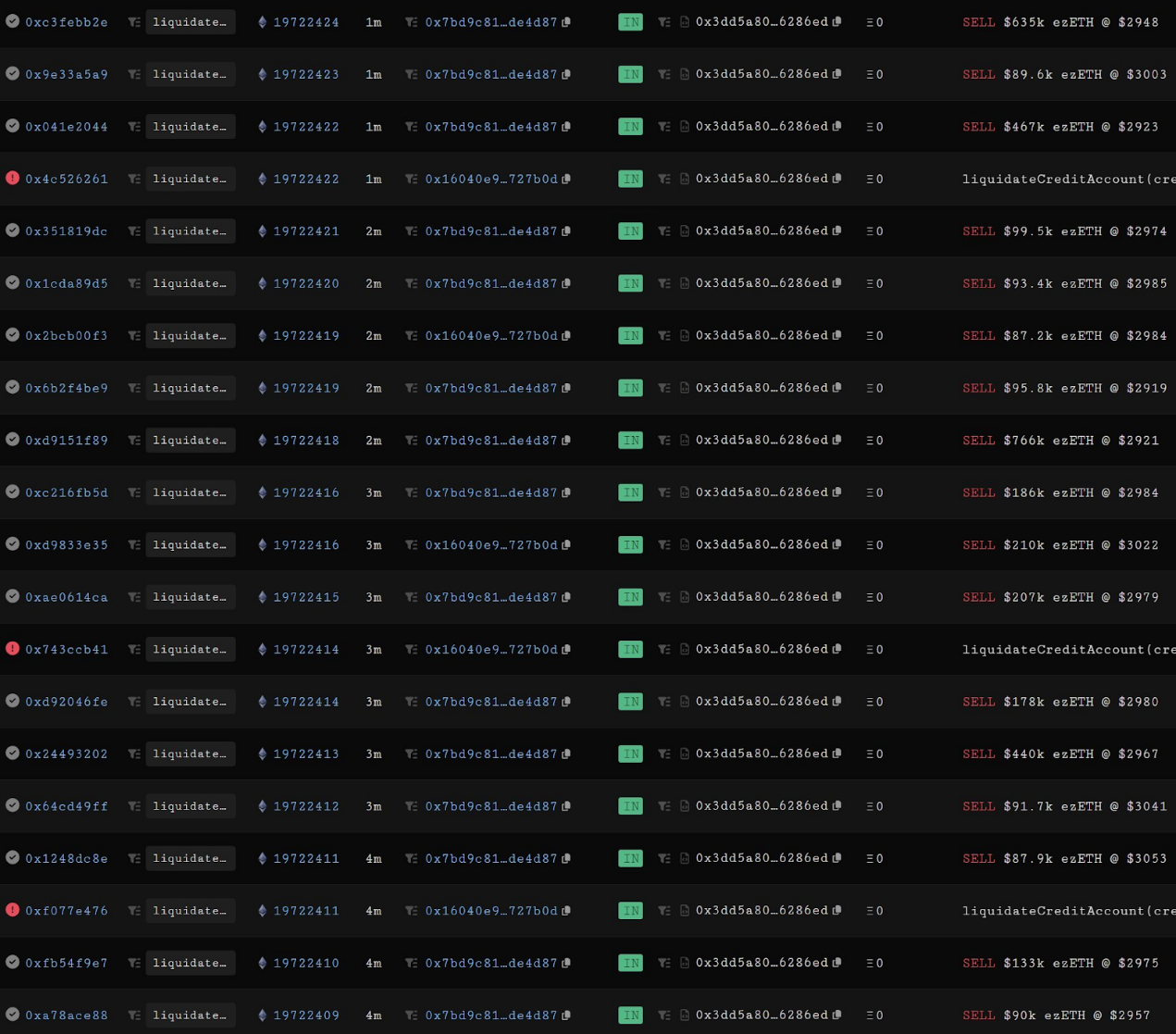

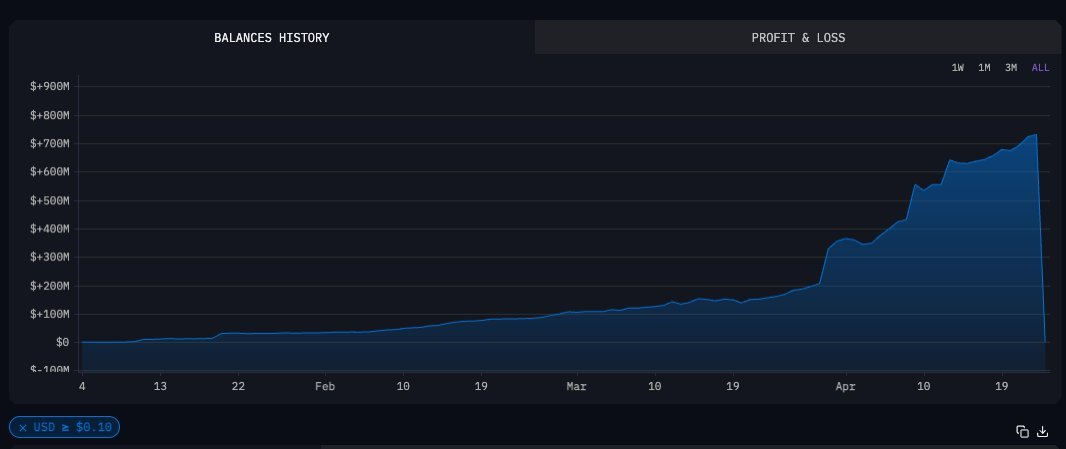

The value of ezETH, worth tens of millions of USD, was sold off, leading to a large-scale liquidation. The following image shows the liquidation on Gearbox and the sharp decline in TVL of ezETH on Morpho Labs.

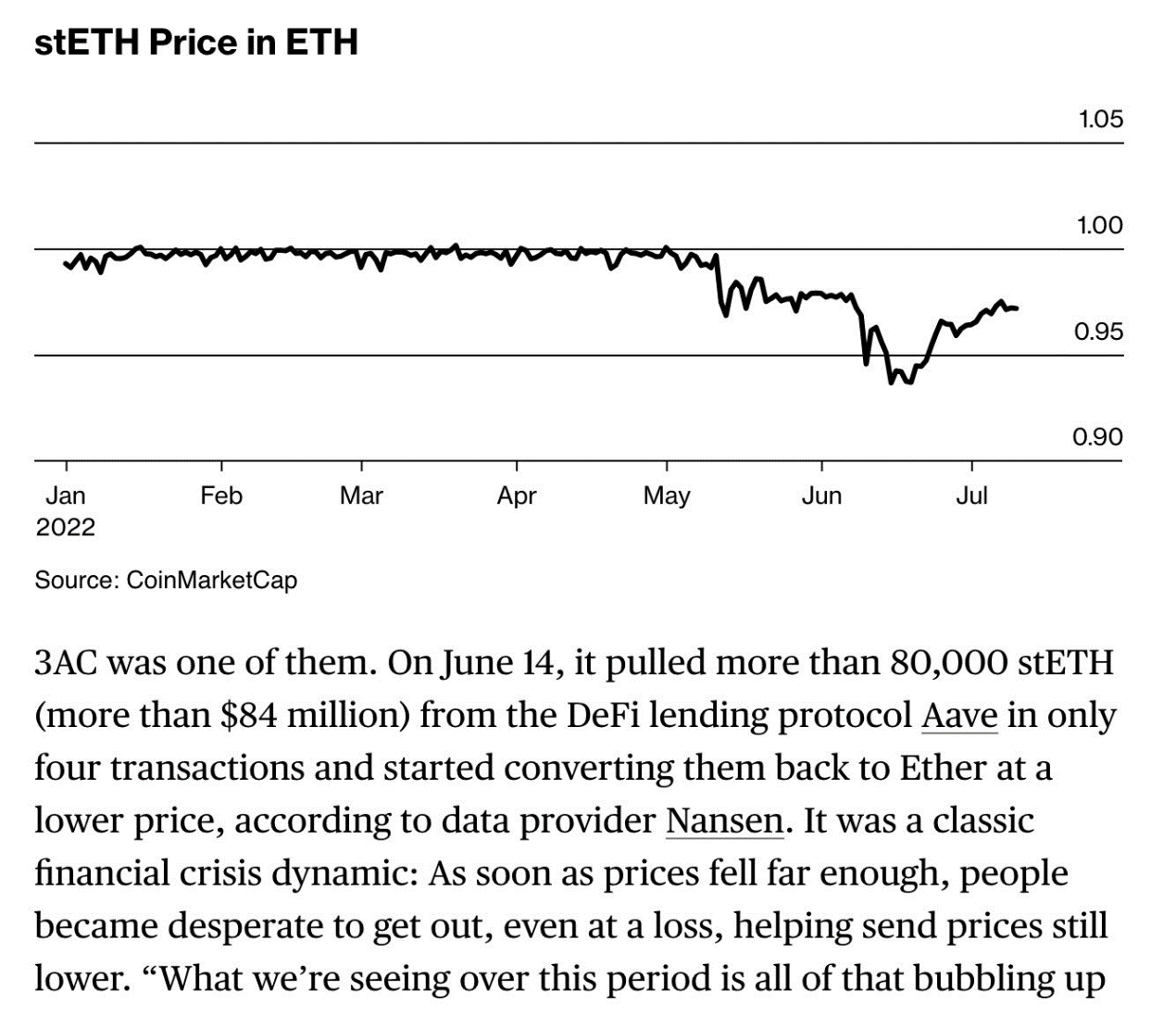

But there is nothing new under the sun, and history always repeats itself. A similar event occurred with stETH in 2022, leading to the collapse of 3AC and triggering a domino effect that completely reshaped the crypto market landscape.

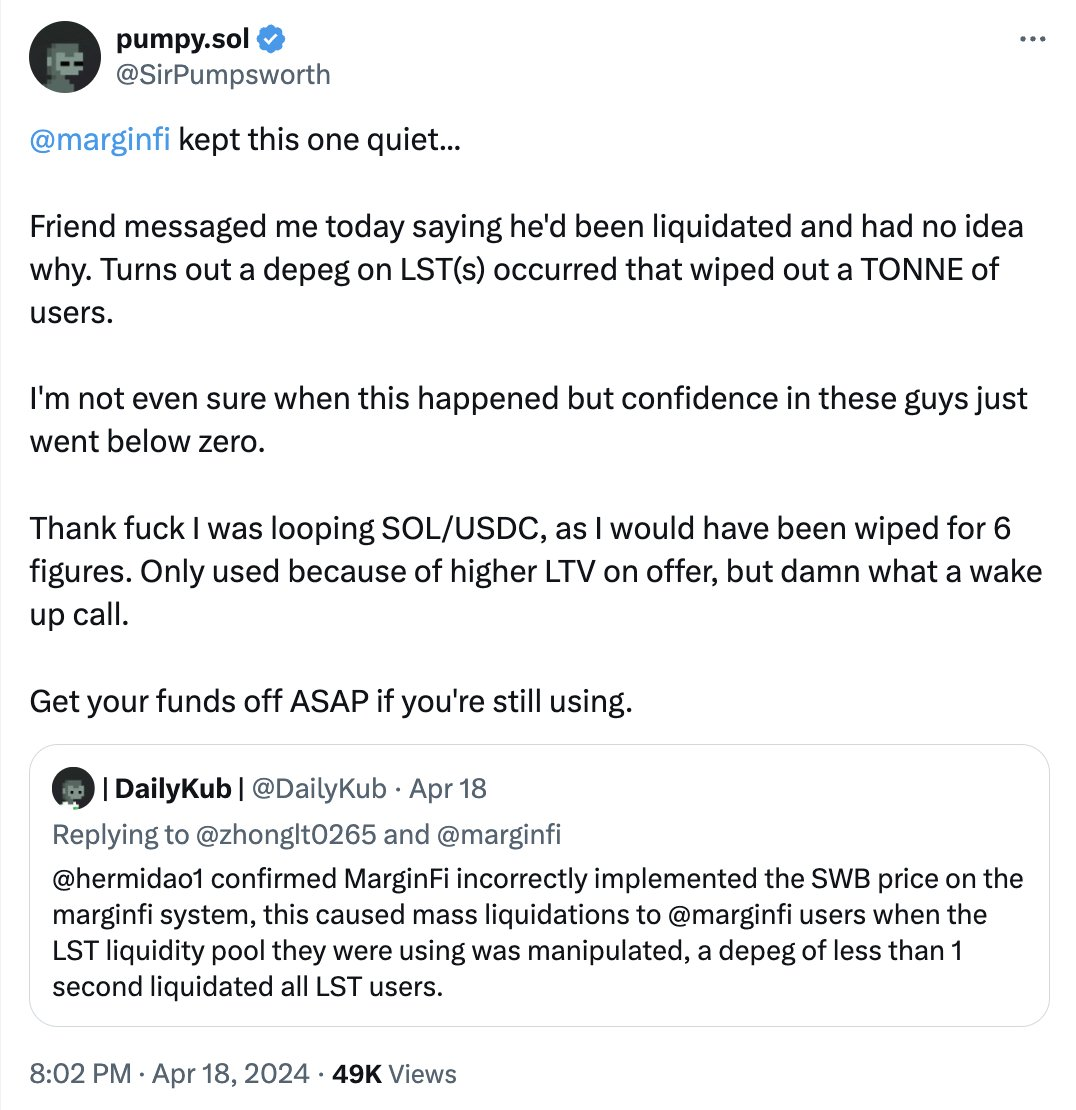

This kind of situation has also occurred many times on Solana (albeit on a much smaller scale). In December 2023, a whale selling mSOL worth 8 million USD caused mSOL to become unanchored. Just last week, multiple LSTs became unanchored, leading to erroneous liquidations and bad debts on marginfi.

Solend's pricing method for LSTs can avoid most of these issues. However, marginfi had harshly criticized Solend's method, but after the storm, marginfi was the first to suffer. However, this method only applies to SOL LSTs. It may take several months for ezETH to be redeemed, so it is difficult to determine whether the unpegging is a reasonable devaluation or simply the result of a volatile market.

There is no perfect way to completely eliminate risks, ultimately it comes down to setting secure parameters and using secure leverage. It is indeed terrible to hand over market share to competitors, but ensuring the safety of funds is more important.

Related reading: Renzo token economics sparks controversy, "dissatisfied" parties angrily dump ezETH causing unanchoring

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。